The Most Accurate ISA Calculator UK

Total Contributions

Interest Earned

Total Value

Your Details

Saving into an ISA is one of the smartest ways to grow your money in the UK, thanks to generous tax-free allowances. But while many people know ISAs exist, few understand how powerful they can be over time, or how to maximise them. Questions like “How much will I actually save?”, “What happens if I invest the full allowance?” or “How does interest affect my ISA?” often stop people from taking full advantage. That’s why we created the FinCalc ISA Calculator.

With just a few inputs, deposit amount, contributions, interest rate, and time, it instantly shows how your ISA will grow, tax-free. Whether you’re using a Cash ISA, Stocks & Shares ISA, or Lifetime ISA, this tool gives you clarity and confidence. No spreadsheets, no complicated maths, just clear results you can trust. Plan smarter, invest consistently, and make the most of your ISA allowance with FinCalc.

What is an ISA Calculator?

An ISA (Individual Savings Account) is one of the most popular ways to save and invest in the UK because all the growth inside it is tax-free. But while most people know ISAs are useful, few actually understand how much of a difference they can make over time, a nd that’s where an ISA Calculator comes in. mAt its core, an ISA Calculator is a simple tool that helps you project how your savings or investments will grow within the ISA allowance. You enter your deposit amount, any monthly or yearly contributions, the interest rate (for a Cash ISA) or expected growth rate (for a Stocks & Shares ISA), and the number of years you plan to save. The calculator then shows you how your money builds up tax-free.

The benefit of using an ISA Calculator is that it doesn’t just give you a final balance, it shows the full breakdown of:

- Your contributions (how much you’ve put in)

- The tax-free growth or interest earned

- The total balance at the end of your chosen time period

For example, let’s say you deposit £10,000 into a Cash ISA earning 3% interest. Over 10 years, your balance would grow to more than £13,400 without paying any tax. Now imagine you max out the £20,000 allowance each year in a Stocks & Shares ISA with an average return of 6%. After 10 years, your balance could be over £275,000, completely tax-free. These scenarios are exactly what the ISA Calculator helps you visualise.

Another major advantage of the ISA Calculator is flexibility. You can test different savings strategies and see how small changes affect your results. What if you increase your monthly contribution by £100? What if you keep saving for 20 years instead of 10? What if your investments grow faster than expected? Instead of guessing, the calculator gives you instant clarity. In short, an ISA Calculator takes the complexity out of ISA planning. It turns abstract rules and tax allowances into clear, personalised projections, helping you plan smarter, save consistently, and make the most of your tax-free savings.

Want to model Lifetime ISA specifics? Use the Lifetime ISA Bonus Calculator to factor the 25% government bonus, limits, and withdrawal rules before you commit.

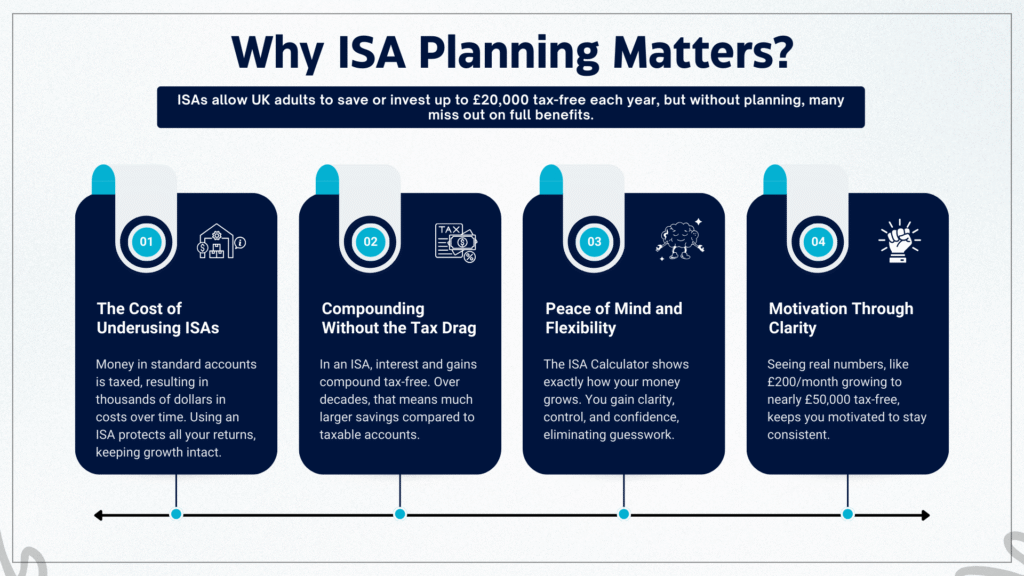

Why ISA Planning Matters?

In the UK, ISAs (Individual Savings Accounts) are one of the most generous savings tools available. Every adult gets an annual ISA allowance, currently £20,000, that can be saved or invested tax-free. Yet despite how powerful this benefit is, millions of people underuse it each year. Why? Because without clear planning, it’s easy to underestimate the impact of tax-free compounding and overestimate how far casual saving will get you.

The Cost of Underusing ISAs

Many people leave their money in ordinary savings accounts where interest is taxable. Over the decades, this can mean thousands lost in unnecessary taxes. For example, someone who saves £200 a month into a standard account might lose hundreds a year to tax once their returns grow. Had they used an ISA, every penny of growth would have been protected. Planning with an ISA Calculator makes it obvious just how much money can be kept by staying within the allowance.

Compounding Without the Tax Drag

The real power of ISAs comes from compounding. Normally, reinvested interest or investment growth can be eroded by taxes. But in an ISA, that growth rolls up tax-free, meaning your money compounds faster. For example, £20,000 invested at 6% annually for 20 years outside an ISA might lose 20% of its gains to tax. Inside an ISA, those gains stay intact. An ISA Calculator demonstrates this difference instantly, making the long-term benefit crystal clear.

Peace of Mind and Flexibility

Financial stress often comes from uncertainty. “Am I saving enough? Will this cover my retirement? Will my child’s Junior ISA be big enough for university?” The calculator removes that uncertainty. By showing exactly how contributions and timeframes add up, it provides peace of mind and the flexibility to adjust your plan. You don’t need to guess; you can make informed decisions based on numbers tailored to your situation.

Motivation Through Clarity

One of the biggest challenges in saving is staying consistent. Without seeing results, motivation fades. The ISA Calculator makes progress visible. It’s easier to save £200 a month when you know that over 15 years, it could grow to nearly £50,000 tax-free. Seeing the goal in hard numbers provides motivation and accountability, helping you stick to the plan.

How the ISA Calculator Works (Step-by-Step + Example)

One of the biggest frustrations with ISAs (Individual Savings Accounts) is figuring out how much your money could grow over time. Different contribution levels, interest rates, and timeframes can make manual calculations confusing. That’s where the ISA Calculator takes over; it applies the rules instantly, giving you clear answers in seconds. Here’s exactly how it works:

Step 1: Enter Your Initial Deposit

Start by entering the lump sum you’re planning to put into your ISA. This could be a one-off contribution or your opening balance.

Step 2: Add Your Monthly or Annual Contributions

Most people top up their ISAs regularly. Enter how much you plan to contribute each month or year, and the calculator will factor it in automatically.

Step 3: Choose Your Interest Rate or Growth Rate

Enter the annual interest rate (for cash ISAs) or an expected growth rate (for stocks & shares ISAs). The calculator compounds the returns over time to show how much your savings could grow.

Step 4: Select Your Investment Term

Decide how long you’ll be saving or investing, five years, ten years, or even longer. The ISA Calculator then applies your chosen timeframe to project future values.

Step 5: Apply the ISA Allowance

The calculator automatically factors in the current ISA allowance (£20,000 per tax year). This ensures your plan stays realistic, showing how much you can contribute without breaching HMRC rules.

Step 6: Get Instant Results

With one click, you’ll see:

- Your total contributions.

- Your interest or investment growth.

- Your final ISA balance after the chosen term.

- A clear breakdown of how much came from your money vs how much was generated by growth.

Worked Example: £10,000 Lump Sum + £200/Month Contributions

- Initial deposit: £10,000

- Monthly contributions: £200

- Annual growth rate: 5%

- Investment term: 10 years

Result:

- Total contributions: £34,000 (£10,000 + £24,000 from monthly payments)

- Growth added: ~£9,300

- Final ISA value after 10 years: £43,300

This means the ISA generated nearly £10,000 in growth on top of the money you put in, all sheltered from tax.

Why This Matters?

The difference between contributing blindly and planning with the ISA Calculator is huge. Instead of guessing, you see exactly what your savings could look like under different scenarios. That clarity helps you decide whether to increase contributions, adjust your timeline, or explore different ISA types.

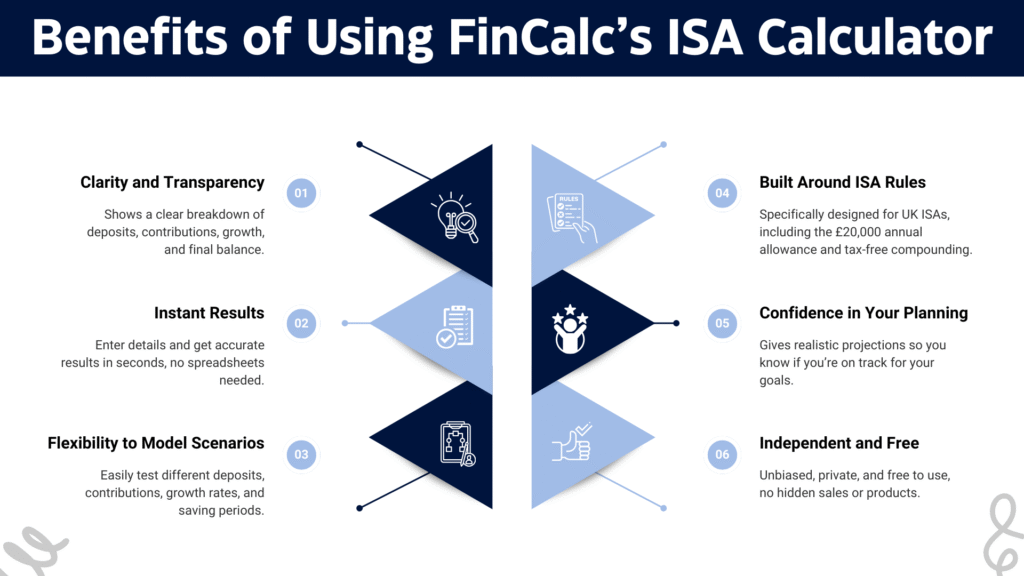

Benefits of Using FinCalc’s ISA Calculator

An ISA (Individual Savings Account) is one of the most powerful ways to grow your money tax-free in the UK. The problem? Most savers don’t really know how much their contributions could turn into over time. Some underestimate growth and under-save, while others overestimate and face disappointment later. That’s where the FinCalc ISA Calculator gives you a huge advantage. It transforms complexity into clarity, instantly.

1. Clarity and Transparency

Many calculators give you a lump-sum answer without showing how it was worked out. FinCalc is different. It provides a full breakdown of your:

- Initial deposit

- Ongoing contributions

- Interest or investment growth

- Final balance

By seeing the numbers side by side, you understand exactly how your ISA is building over time.

2. Instant Results

Why spend hours with spreadsheets or HMRC guidance notes when you can get answers in seconds? The ISA Calculator is designed for speed. You enter your details, click once, and immediately see the results. It’s quick enough to test multiple scenarios in minutes.

3. Flexibility to Model Scenarios

Not sure whether to contribute monthly or make a lump sum? Wondering how your ISA would look with a 3% interest rate vs 6%? The calculator lets you adjust assumptions instantly. You can test:

- Different deposit amounts

- Monthly vs annual contributions

- Growth rates (cash ISA vs stocks & shares ISA)

- Saving periods (short-term vs long-term)

This flexibility helps you make smarter financial decisions and avoid guesswork.

4. Built Around ISA Rules

Generic savings calculators often ignore key UK ISA rules, like the £20,000 annual contribution limit or the way compound interest builds tax-free. The FinCalc ISA Calculator is designed specifically for ISAs, so the numbers reflect reality, not wishful thinking.

5. Confidence in Your Planning

When you see the numbers clearly, planning becomes less stressful. The calculator helps you:

- Understand how much your ISA can realistically grow.

- Spot whether you’re on track to hit your goals.

- Decide if you should increase contributions or extend your saving horizon.

Instead of anxiety, you get confidence in your financial future.

6. Independent and Free

FinCalc is unbiased; it isn’t tied to banks, brokers, or product providers. That means the calculator has one job: to give you accurate, transparent results. It’s completely free to use, and your inputs remain private.

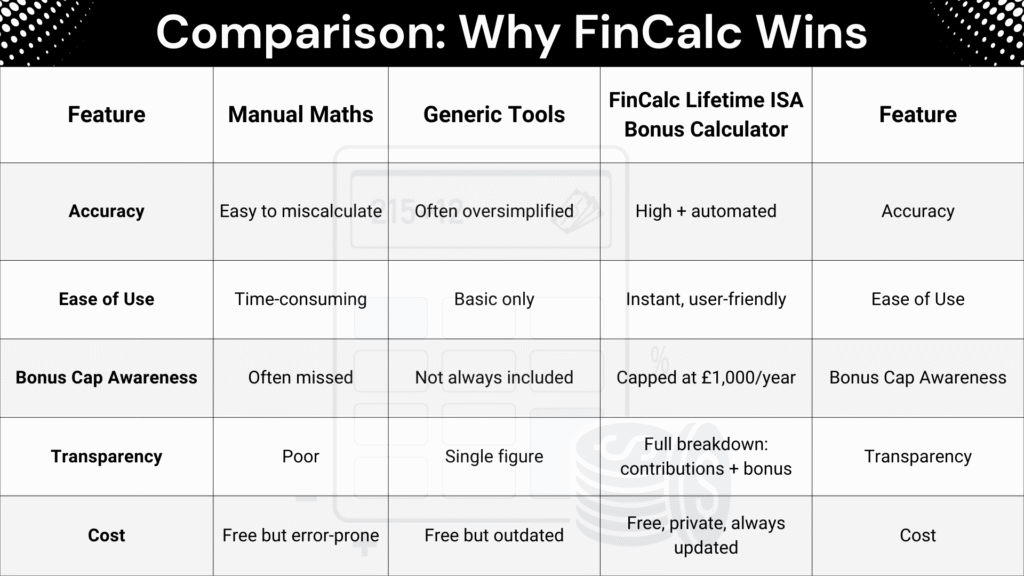

Comparison: Why FinCalc Wins:

Real-Life Use Cases

It’s one thing to talk about numbers. It’s another to see how those numbers affect real people. Here are some scenarios where the ISA Calculator turns uncertainty into clarity.

1. The Student Saver

Sophie, 21, opened her first Cash ISA with £1,000. She wanted to save £50/month from her part-time job but wasn’t sure if it would make a difference. Using the ISA Calculator, she saw that over 5 years at 3% interest, she could grow her account to nearly £4,300. That simple projection motivated her to stay consistent. What seemed like “small money” suddenly felt meaningful once she saw the long-term impact.

2. The Young Professional

James, 28, had £5,000 in savings and wanted to put it into a Stocks & Shares ISA. Unsure whether to add £200 or £300 each month, he tested both scenarios with the calculator. At 5% annual growth over 15 years, the difference was striking: £65,000 vs £92,000. Seeing the bigger picture helped James commit to the higher monthly contribution, knowing his future self would thank him.

3. The Family Saver

Priya and Daniel, in their late 30s, were saving for their children’s university costs. They deposited £10,000 into a Junior ISA and added £250/month. With the calculator set at 4% growth for 18 years, they saw the account could grow to £85,000+ by the time their child turned 18. Instead of guessing, they had a clear target nd reassurance that their savings plan was on track.

4. The Cautious Investor

Helen, 45, was nervous about investing after the last market dip. She wanted to see how a Cash ISA compares to a Stocks & Shares ISA. With the calculator, she modelled £20,000 at 2% vs 6% over 10 years. The Cash ISA grew to £24,000, while the Stocks & Shares ISA projection hit nearly £36,000. Seeing both outcomes side by side gave her perspective. She chose to split contributions, half safe, half growth, with confidence.

5. The Near-Retiree

Mark, 58, had a lump sum of £50,000 to invest. Unsure whether it would meaningfully boost his retirement income, he ran the numbers. At 5% growth over 7 years, the ISA Calculator showed his balance could reach £70,000+, an extra £20,000 without tax. That clarity helped him move forward without hesitation, knowing his savings would work harder for him before retirement.

The Human Takeaway

From students to retirees, the situations are different, but the challenge is the same: “Am I saving enough, and what will it become?” The ISA Calculator answers that question every time, turning vague guesses into confident plans.

Understanding the Numbers (Educational)

Let’s cut through the noise and get quant. The ISA allowance is £20,000 per tax year. What you park inside an ISA grows tax-free, no Income Tax on interest, no Dividend Tax, no Capital Gains Tax on profits. That shield is the whole game.

Cash ISA vs Stocks & Shares ISA, growth, not guesswork

- Cash ISA behaves like a high-interest savings account inside the ISA wrapper. Your capital is stable; your return equals the stated rate. If your Cash ISA pays ~3% and you contribute regularly, your pot compounds quietly and predictably.

- Stocks & Shares ISA holds funds/shares/bonds/ETFs. Returns are volatile year-to-year but historically higher over long horizons. The wrapper still kills the tax drag; the market introduces risk and reward.

Illustrative scenario (not advice): Start with £10,000 and add £300/month for 10 years.

- At 3% (Cash ISA-like), you end up around £55k.

At 6% (long-run equities-like), closer to £67k.

That’s ~£12k of delta purely from growth rate, before fees, and with the same contributions. Markets can underperform or outperform; the ISA wrapper simply ensures the growth you do achieve isn’t taxed.

Compare wrappers side-by-side with the Cash ISA vs Stocks & Shares ISA Comparison Calculator to see long-run outcomes for the same contributions.

Why compounding + tax-free growth matters?

Tax is friction. Remove friction and compounding accelerates. Inside an ISA, every pound of interest, dividend, or gain stays in the flywheel, earning more in future periods. Outside an ISA, a chunk bleeds away annually, less fuel for compounding, smaller terminal value. Over multi-year horizons, that gap becomes material.

Inflation and real returns

Headline returns lie if you ignore inflation. If inflation averages ~2.5%, then:

- A 3% Cash ISA yield delivers ~0.5% real (your purchasing power creeps up).

A 6% Stocks & Shares ISA return delivers ~3.5% real (purchasing power climbs meaningfully, with volatility).

Using the example above, after ten years and adjusting for 2.5% inflation, the £55k feels like ~£43k in today’s money, while £67k feels like ~£53k. You’re playing a real-returns game; inflation is the silent competitor.

Test purchasing power directly with the Inflation Impact on Savings Calculator and compare nominal vs. inflation-adjusted projections.

Why Choose FinCalc Over Others?

Bank tools = biased and limited. Bank calculators are marketing assets first, planning tools second. They often hard-code rosy assumptions, hide fees, and steer you toward in-house products. Translation: vendor lock-in with a glossy UI.

Spreadsheets = complex. Spreadsheets can do anything until nobody in the team remembers the cell logic. One wrong reference and your ten-year plan is fiction. Version control? Good luck.

Generic calculators = vague. Most “free ISA calculators” are pretty charts masking rigid math: no visibility into assumptions, no inflation control, no contribution scheduling flexibility, and zero audit trail for stakeholders.

FinCalc advantage = independent, transparent, user-friendly.

- Assumption control: Edit growth rates (cash vs equity), fees, contribution timing (monthly/lump-sum), and inflation. We show inputs and math, not just outcomes.

- Tax realism: Built specifically for UK ISA logic £20k annual allowance guardrails, contribution pacing, and no-tax growth baked in.

- Scenario planning: Best-, base-, and worst-case bands, so teams can debate ranges, rather than just one magic number.

- Clarity over theatre: Clean interface, no ads, no dark patterns, no product push. Just defensible projections you can screenshot, export, and share.

- Team-ready outputs: Downloadable summaries and tidy charts designed for client decks and board packs.

- Privacy by design: We don’t need your bank login to model outcomes. Keep your data, use our engine.

If you want an independent calculator that’s transparent enough for professionals but intuitive sufficient for busy humans, FinCalc is the operationally excellent middle ground, no vendor bias, no spreadsheet spaghetti.

Conclusion:

Ready to plan with numbers you can defend? The ISA wrapper protects your growth; FinCalc makes the projections clear, realistic, and decision-ready. Compare Cash vs Stocks & Shares, stress-test inflation, pace contributions within the £20,000 annual allowance, and export clean visuals for clients or family buy-in. No sales funnels. No hidden assumptions. Just transparent math that respects your time and your goals.

Enter your starting balance, set monthly contributions, pick your growth and inflation assumptions, and run your scenarios. In two minutes, you’ll have a plan you can actually use to start your ISA projection in FinCalc now.

FAQs

What is an ISA Calculator?

A planning tool that estimates how your ISA could grow over time, factoring in contributions, growth rates, fees, and inflation, without tax drag.

How much can I save in an ISA?

Currently up to £20,000 per tax year across your ISAs (eligibility rules apply). FinCalc models within that limit.

What’s the difference between a Cash ISA and a Stocks & Shares ISA?

Cash ISA: stable interest, lower risk, lower expected return. Stocks & Shares ISA: market exposure, higher expected return, higher volatility. Both grow tax-free.

Does the calculator include ISA allowance limits?

Yes. We apply the £20k/year cap and show pacing so you can plan monthly or lump-sum contributions compliantly.

How does compound interest work in an ISA?

Your interest, dividends, and gains stay in the pot and earn more over time. No tax leakage means compounding has full power.

Can I use the ISA Calculator for a Junior ISA?

You can model growth similarly, but note different annual limits for JISAs. Adjust contributions accordingly.

What about Lifetime ISA planning?

You can approximate growth and contributions, but LISA has unique rules (age, withdrawal penalties, bonuses). Use prudent assumptions.

Can the calculator account for inflation?

Yes. Toggle inflation to see real (today’s money) outcomes versus nominal figures.

How accurate is it?

It’s a projection engine, not a crystal ball. Accuracy depends on assumptions (rates, fees, timing). We show ranges to manage uncertainty.