The Best Regular Monthly Savings Calculator UK

Total Contributions

Interest Earned

Total Savings Value

Details

Everyone wants to save money, but the hardest part is knowing how much your monthly savings will actually grow into. Putting aside £200 or £500 each month sounds disciplined, but without a clear picture, you’re left guessing whether those efforts will be enough for your goals. Will it cover a wedding in three years? A house deposit in five? Or retirement in twenty? That’s exactly where the FinCalc Regular Monthly Savings Calculator makes a difference. Instead of vague guesses, this tool shows you the real outcome of consistent saving. Enter your monthly contribution, timeline, current balance, and optional interest rate, and you’ll instantly see how your money adds up over time.

For example, saving £300 per month for 5 years results in £18,000 without interest, or nearly £19,500 with a modest 3% return. Suddenly, the power of steady savings becomes visible, motivating you to stay consistent. Whether you’re building a short-term fund or preparing for long-term goals, the Monthly Savings Calculator gives you the clarity you need. Small amounts saved regularly can snowball into life-changing results, and this tool proves it.

What is a Regular Monthly Savings Calculator?

A Regular Monthly Savings Calculator is a financial tool that shows you how much money you can build by saving a fixed amount every month. Instead of just guessing where your money might end up, it uses your contributions, time horizon, and interest rate to give you a clear picture of the total savings you’ll have in the future.

Here’s how it works: you enter your monthly saving amount, how long you want to save for, and (optionally) the interest or return rate your account offers. Working backward from a target? Use the Savings Goal Calculator to compute the exact monthly amount you need. The calculator then shows you two key outcomes:

- Total Contributions → the sum of all the money you’ve put in over time.

- Final Balance → your contributions plus any growth from interest or compounding.

For example, saving £300/month for 5 years gives you £18,000 in pure contributions. If you earn 3% annual interest, your balance could grow to nearly £19,500, a difference of £1,500 gained just from compounding.

In short, this calculator transforms the abstract idea of “saving regularly” into concrete numbers, giving you motivation and clarity about what your future savings will actually look like.

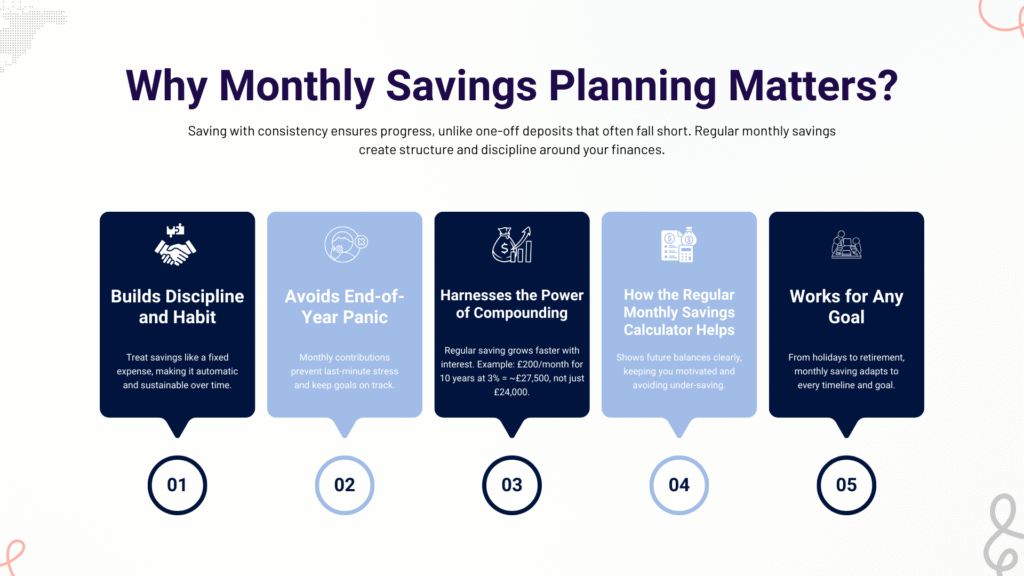

Why Monthly Savings Planning Matters?

Saving isn’t just about putting money aside; it’s about doing it with consistency and purpose. Many people wait until the end of the year to see what’s left in their account, but that often means saving too little, too late. Regular monthly savings planning fixes this problem by creating structure and discipline around your finances.

Builds Discipline and Habit

Treating savings like a non-negotiable monthly expense makes it automatic, just like rent or utilities. Over time, this habit builds consistency that one-off deposits can’t match.

Avoids End-of-Year Panic

Many savers realise too late that they haven’t put enough aside. By saving monthly, you avoid the stress of scrambling for lump sums at the last minute, and your goals stay on track.

Harnesses the Power of Compounding

When you save regularly, your contributions start earning interest month after month. Even small amounts snowball into big totals. For example, £200/month for 10 years at 3% interest grows to nearly £27,500, not just £24,000 in contributions. Compare “save-only” vs “save-and-invest” paths in the Investment Return Calculator to see the compounding lift.

How the Regular Monthly Savings Calculator Helps

The Regular Monthly Savings Calculator shows exactly how your monthly efforts add up. By projecting future balances with clarity, it keeps you motivated and prevents under-saving, no matter your goal.

Works for Any Goal

Whether it’s a holiday fund, a house deposit, or retirement, monthly savings adapts to every timeline. Small amounts over short terms cover smaller goals, while bigger or longer commitments prepare you for life’s biggest milestones.

How the Calculator Works Step-by-Step + Example

The Regular Monthly Savings Calculator converts your consistency into concrete numbers. You tell it what you’ll save each month, for how long, and (optionally) the interest/APY you expect. It returns the final balance and a clean split between your contributions and growth. No spreadsheets, no mental math.

Step 1: Enter Your Monthly Contribution

This is the fixed amount you’ll deposit each month (e.g., £200, £500, £1,000). Consistency is the engine; this figure is the fuel.

Step 2: Add Current Savings (Optional)

If you already have a pot (say £2,000), include it so the tool can project how that balance compounds alongside your monthly deposits.

Step 3: Pick Your Time Horizon

Select months/years (e.g., 36 months, 5 years, 10 years). Time is leverage; the longer the runway, the bigger the snowball.

Step 4: Add Interest/APY (Optional)

If your savings earn interest, add an annual rate (e.g., 3% or 5%). The calculator assumes monthly compounding to keep projections realistic.

Step 5: See the Results

You’ll get:

- Final balance at the end of the period.

- Total contributions (what you paid in).

- Growth/interest earned from compounding.

Use the what-if controls to nudge the monthly amount, timeframe, or APY and see instant impact.

The (simple) math behind it

For monthly deposits P, monthly rate i = (APY/12), and number of months n:

- Future value of deposits = P×(1+i)n−1iP \times \frac{(1+i)^n – 1}{i}P×i(1+i)n−1 (or P×nP \times nP×n if APY = 0)

- Future value of current savings B₀ = B0×(1+i)nB₀ \times (1+i)^nB0×(1+i)n

- Final balance = deposits FV + B₀ FV

Sense-check purchasing power with the Inflation Impact on Savings Calculator to view your projected balance in real terms.

(You don’t have to calculate this; the tool does. But it’s here to show the logic is solid.)

Worked Examples

Example 1: £200/month for 3 years

- @ 0% APY: Final balance = £7,200 (pure contributions)

- @ 3% APY: Final balance ≈ £7,524 → £324 growth from interest

Takeaway: Even modest rates add meaningful lift over multi-year periods.

Example 2: £500/month for 5 years

- @ 0% APY: Final balance = £30,000

- @ 3% APY: Final balance ≈ £32,323 → ~£2,323 growth

Takeaway: Compounding + consistency = visible acceleration.

Example 3: £1,000/month for 10 years

- @ 0% APY: Final balance = £120,000

- @ 5% APY: Final balance ≈ £155,282 → ~£35,282 growth

Takeaway: Longer timelines supercharge compounding even at reasonable rates.

Example 4: Add a starting balance.

- Current savings £2,000 + £500/month for 5 years @ 3% APY

- Final balance ≈ £34,647 (vs £32,323 with no starting pot).

Takeaway: A head start compounds into extra thousands over the term.

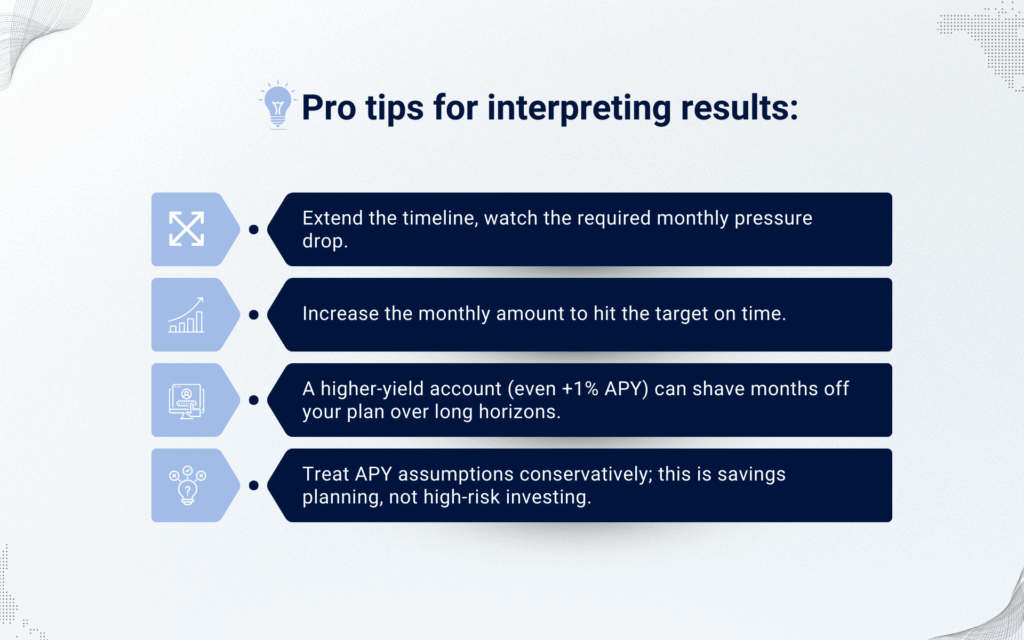

Pro tips for interpreting results:

- Extend the timeline; watch the required monthly pressure drop.

- Increase the monthly amount to hit the target on time.

- A higher-yield account (even +1% APY) can shave months off your plan over long horizons.

- Treat APY assumptions conservatively; this is savings planning, not high-risk investing.

Benefits of Using FinCalc’s Regular Monthly Savings Calculator

Saving money sounds simple: put aside a bit every month and watch it grow. But in reality, most people give up halfway because they don’t see results quickly enough, or worse, they don’t know if they’re even saving enough. That’s why the FinCalc Regular Monthly Savings Calculator isn’t just a tool; it’s a mindset shift. It makes savings tangible, motivating, and realistic by showing you exactly what your consistency will create in the future. Here’s how it transforms your approach to saving:

Clarity on Future Value

The number one question most savers ask is: “If I save £X every month, what will I actually have in 3, 5, or 10 years?” Without a clear answer, savings feel vague and unmotivating. The calculator provides instant clarity. For example, saving £400/month for 5 years adds up to £24,000 in contributions. But with 3% interest, your final balance becomes £25,887, that’s almost £1,900 extra earned without lifting a finger. This distinction between “what I put in” and “what I’ll end up with” gives you a powerful mental picture of your progress. Clarity is also about accountability. If your goal is a £15,000 wedding fund in 3 years, the calculator shows exactly what you’ll have, and whether that’s enough. No more vague guesswork, just straightforward numbers.

Motivation to Stay Consistent

Consistency is the hardest part of saving. Most people start with energy but lose steam because results seem too far away. The Regular Monthly Savings Calculator solves this by showing the cumulative effect of small monthly deposits.

Imagine this: you’re saving £250/month. After one year, it feels like only £3,000, hardly exciting. But the calculator projects that in 10 years, you’ll have £34,000 with 3% interest. That bigger future picture motivates you to keep going when the short-term feels underwhelming.

It’s like fitness tracking: you don’t go to the gym once and see results, but tracking your long-term progress keeps you coming back. FinCalc gives you that same long-term vision for your money.

Helps Balance Goals vs Budget

Not everyone can save £500/month, and that’s okay. The calculator helps you balance ambition with reality. By adjusting amounts and timelines, you can find a savings plan that fits your budget instead of breaking it.

For example, if your house deposit goal is £30,000:

At £500/month → 5 years.

At £350/month → closer to 7 years.

At £300/month with 3% APY → 7.5 years, but still achievable.

This flexibility prevents disappointment. Instead of quitting because your original target was too ambitious, you can adjust and stay on track. It’s about creating a realistic roadmap rather than a fantasy.

Scenario Testing in Seconds

Life changes, income goes up, expenses go down, or inflation bites harder. The calculator lets you adapt instantly by testing “what-if” scenarios.

What if you add £100 more per month?

What if you shorten your timeline from 10 years to 7?

What if you find an account paying 4% instead of 2%?

For example:

£400/month for 10 years at 2% = £52,482.

£400/month for 10 years at 4% = £58,374.

That’s almost £6,000 difference simply by earning 2% more interest. Seeing this comparison in seconds empowers you to make smarter choices today, instead of regretting them later.

Independent and Unbiased

Most savings tools come from banks or apps that have an agenda. They’ll subtly suggest “open our savings account” or “invest in our product.” FinCalc is different; it’s independent and unbiased. Its only job is to give you transparent numbers.

This matters because when you’re planning your financial future, you don’t want marketing spin; you want facts. Whether the results show that you’re on track or falling short, the calculator tells you the truth. That independence is what makes it trustworthy.

Works for All Goals

Everyone has different goals, and the calculator adapts to them all:

Short-term: £200/month for 18 months builds a holiday fund of £3,600.

Medium-term: £500/month for 5 years creates a house deposit of £30,000+.

Long-term: £1,000/month for 20 years with 4% APY grows into nearly £370,000.

The same tool works whether you’re a student saving for a trip, a couple planning a wedding, or a professional building retirement wealth. This universality means you don’t need 5 different calculators; FinCalc covers it all.

Reduces Stress and Brings Confidence

Money stress usually comes from uncertainty. Without numbers, you’re left asking: “Am I saving enough? Will this be enough for my goal?” The Regular Monthly Savings Calculator turns uncertainty into confidence. If you see that your current plan won’t hit your target, you can adjust immediately. If you’re already on track, you’ll feel reassured. Either way, you stop worrying in the dark and start planning in the light.

For example, knowing you’ll hit £50,000 in 7 years at £600/month is far more reassuring than hoping you’re saving “enough.” That certainty reduces stress and helps you stay committed.

Builds Financial Awareness

This tool isn’t just about calculating, it’s about teaching. Many users learn, for the first time, how contributions + interest + time interact. By running different scenarios, you see firsthand why compounding matters and why consistency beats occasional lump sums.

This awareness is empowering. It changes how you think about spending and saving, making financial discipline more natural and less forced.

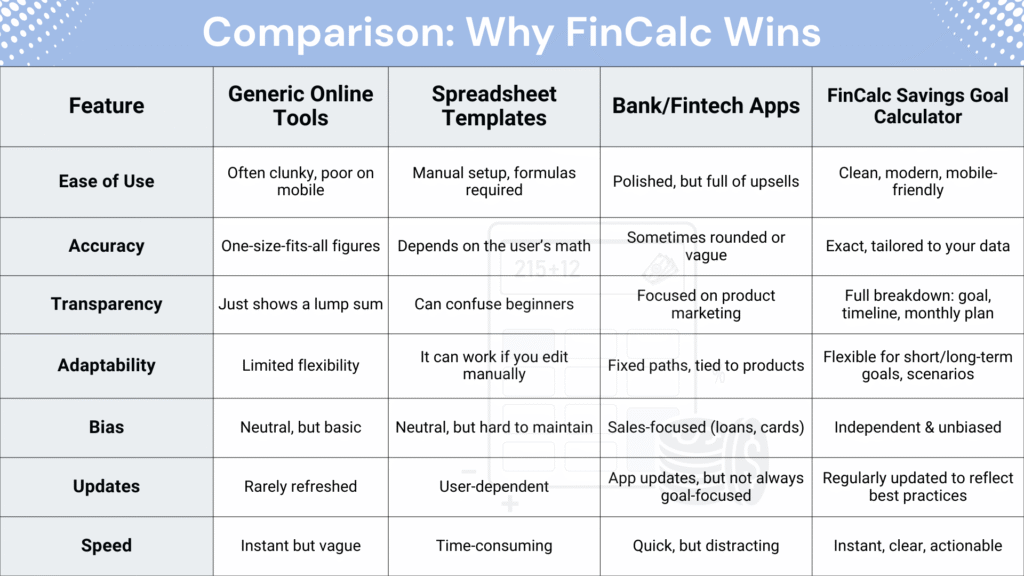

Comparison: Why FinCalc Wins

When it comes to savings calculators, there’s no shortage of options online. But here’s the catch: most of them either oversimplify, hide the details, or push you toward products you don’t need. The FinCalc Regular Monthly Savings Calculator is built with one goal: giving you clarity and independence.

Here’s how it compares:

Feature | Generic Online Tools | Spreadsheet Templates | Bank / Fintech Apps | FinCalc Regular Monthly Savings Calculator |

Ease of Use | Basic, often clunky; poor mobile usability | Requires manual formulas; not beginner-friendly | Polished, but cluttered with features | Clean, simple, mobile-friendly |

Accuracy | Gives rough totals, ignores interest/compounding | Accurate if set up properly (but error-prone) | Accurate, but sometimes vague | Precise: contributions + growth + compounding |

Transparency | Only shows the final figure | Breakdowns are possible, but complex | Often hides assumptions | Full breakdown: monthly, total, growth |

Adaptability | Limited inputs | Highly customizable but manual | Fixed to the bank’s products | Flexible for any goal, any timeline |

Bias | Neutral, but limited | Neutral, but too technical | Sales-driven (loans, accounts, cards) | 100% independent & unbiased |

Updates | Rarely refreshed | Depends on user effort | Updated for marketing, not planning | Regularly updated with realistic assumptions |

Speed | Instant but limited detail | Slow (manual setup) | Quick, but distracting | Instant, clear, actionable |

Why This Matters?

- Generic online tools: Good for rough estimates, but too shallow for serious planning.

- Spreadsheets: Powerful, but only if you’re Excel-savvy, and one wrong formula ruins everything.

- Bank apps: Slick design, but always pushing you toward their financial products, not your best interest.

Understanding the Numbers

Numbers don’t lie, but without the right breakdown, they can feel confusing. The Regular Monthly Savings Calculator makes saving simple by splitting results into what you contribute versus what you earn through growth or interest. This distinction helps you see the real power of consistency.

Contributions vs Growth

Your total balance has two parts:

- Contributions → the money you put in each month.

- Growth → the extra value created through compounding interest or returns.

For example, saving £400/month for 10 years: - Contributions = £48,000

- With 3% APY, Growth = ~£7,720

- Final Balance = ~£55,720

Short-Term vs Long-Term Impact

- Short-term (1–3 years): The difference between contributions and growth is small. £200/month for 3 years = £7,200 (without interest) or ~£7,524 at 3%.

- Medium-term (5–10 years): Growth becomes visible. £500/month for 7 years = £42,000 contributions; ~£45,600 with 3%.

- Long-term (15–20 years): Growth dominates. £1,000/month for 20 years = £240,000 contributions; nearly £320,000+ with 4% APY.

Why Compounding Matters?

Every pound saved earns interest, and that interest itself starts earning more interest. It’s a snowball effect. Even a small APY (like 2–3%) can add thousands over long horizons. The calculator shows this difference side by side so you understand how patience pays off.

Realistic Assumptions

It’s tempting to plug in high return rates, but being conservative ensures your plan is safe. Test different scenarios:

- At 2% APY vs 4% APY

- Saving £300 vs £400 per month

- 5 years vs 10 years

These comparisons reveal how small changes have a big impact on your future balance.

Why Choose FinCalc Over Others?

There are plenty of savings calculators online, but most either oversimplify the math, overload you with jargon, or push you toward financial products you don’t need. The Regular Monthly Savings Calculator from FinCalc is built differently; it’s designed to give you clarity, independence, and motivation, not a sales pitch.

Full Transparency

Generic tools usually show a single figure. FinCalc breaks it all down clearly:

- Monthly contributions

- Total contributions over time

- Growth/interest earned.

This transparency ensures you see how the final number is built, not just the total.

Flexible for Every Goal

From short-term holidays to long-term retirement, this tool adapts instantly. Whether you’re saving £100/month or £1,000/month, you’ll get a realistic projection tailored to your plan.

Independent and Unbiased

Bank apps often suggest products that benefit them, not you. The Regular Monthly Savings Calculator is completely independent. It doesn’t upsell loans or credit cards; it simply gives you honest numbers so you can make the right decision for your financial goals.

Regularly Updated and Reliable

Many free tools online are outdated or inaccurate. FinCalc stays current with realistic return assumptions and modern savings trends, so your plan reflects today’s conditions, not last decade’s.

Easy and User-Friendly

Spreadsheets can be intimidating, bank apps are cluttered, and online calculators often feel incomplete. FinCalc is different, clean design, mobile-friendly, and instant results. Just input your numbers and see your future balance right away.

Conclusion

Saving isn’t just about putting money aside; it’s about doing it with consistency, clarity, and confidence. Too many people start saving with enthusiasm but fall short because they don’t have a clear picture of where their money is heading. That’s where the Regular Monthly Savings Calculator makes all the difference.

By showing you exactly how your monthly contributions build up over time, whether it’s for a short-term goal like a holiday or a long-term plan like retirement, you get transparency that guesswork can’t provide. You’ll see the split between your contributions and growth, understand the role of compounding, and know immediately if your plan is realistic or needs adjusting. Most importantly, the calculator takes away financial uncertainty. Instead of worrying, “Am I saving enough?” you’ll know, “If I stick to this plan, I’ll have £X by my target date.”Saving inside an ISA? Model tax-free growth and access with the ISA Calculator before you choose an account. That clarity reduces stress, builds confidence, and keeps you motivated to stay consistent.

FAQs

What is a Regular Monthly Savings Calculator?

It’s a tool that shows how your fixed monthly contributions grow over time, with or without interest. It helps you see the future value of your savings clearly.

How does the calculator work?

You enter a monthly saving amount, time period, and interest rate. The tool then projects your total contributions, interest earned, and final balance.

Does it include compound interest?

Yes, the calculator can apply monthly compounding if you add an APY/interest rate. This shows how even small percentages add up over the years.

Can I add my existing savings?

Of course. If you already have a starting balance, just enter it and the tool will calculate how it compounds alongside your new contributions.

Is the Regular Monthly Savings Calculator free to use?

Yes. FinCalc offers this tool free of charge, with instant results and no sign-ups required.

Can I use it for short-term goals?

Definitely. Whether you’re saving for a holiday in 18 months or a deposit in 5 years, the tool adapts to any timeline.

How accurate are the results?

The results are accurate based on the inputs you provide. Since interest rates and inflation can change, it’s smart to re-check regularly.

What if I change my monthly contribution later?

You can adjust the numbers anytime. Increasing or reducing contributions instantly updates your savings projection.