The Best Interest Rate Comparison Calculator UK

Future Value (Rate 1)

Future Value (Rate 2)

Difference

Details

Interest rates might look like just numbers on paper, but in reality, they decide how much you’ll pay, or earn, over time. A difference of just 1% can mean thousands of pounds saved on a loan, or thousands gained on a savings account. The problem is, most people don’t have the time or tools to manually crunch the numbers and compare options side by side. That’s where the Interest Rate Comparison Calculator changes the game. Instead of guessing whether a 5% or 6% loan is better, or whether your savings grow more at 2% or 3%, this tool gives you instant clarity. Simply enter your amount, time period, and different interest rates, and the calculator shows you the exact outcome.

Whether you’re borrowing or saving, you’ll see the total cost, growth, and real financial impact in seconds. By turning complex interest calculations into clear, actionable results, the Interest Rate Calculator empowers you to make smarter financial choices. From students considering a loan to families planning a mortgage or savers choosing the best bank account, this tool ensures you don’t leave money on the table.

What is an Interest Rate Comparison Calculator?

An Interest Rate Comparison Calculator is a financial tool that helps you evaluate different loan or savings options side by side. Instead of doing complex calculations manually, it shows you the real impact of small differences in rates, whether you’re borrowing or investing. You enter the principal amount, time period, and different interest rates. The calculator then compares outcomes like total repayment, total interest paid, or growth of savings. Comparing savings growth across rates? Use the Compound Interest Calculator to see how compounding shifts the outcome. For example:

- £10,000 loan at 5% for 5 years = ~£11,322 total repayment.

- £10,000 loan at 6% for 5 years = ~£11,616.

A 1% difference adds nearly £300 extra cost, visible instantly with this tool.

Without a structured tool, people often underestimate how much interest affects their finances. The Interest Rate Comparison Calculator makes it easy to test multiple scenarios, compare borrowing vs saving, and see which option saves (or earns) you the most money. Interest isn’t always calculated the same way. Simple interest applies only to the principal, while compound interest applies to both principal and accumulated interest. This tool adjusts automatically, so you don’t get confused by different financial products.

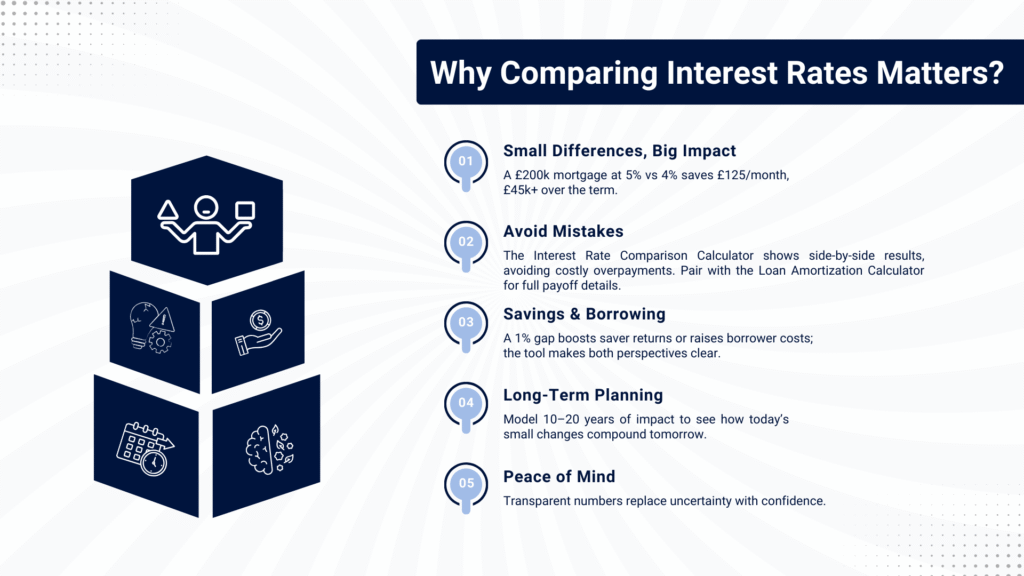

Why Comparing Interest Rates Matters?

On the surface, a 1% difference in interest rates doesn’t seem like much. But over the years, that “tiny” difference can cost, or save, you thousands. Whether you’re borrowing for a loan or investing in savings, comparing rates is critical for smart financial planning.

Small Differences, Big Impact

Consider a £200,000 mortgage:

- At 5% → monthly repayment ~£1,170

- At 4% → monthly repayment ~£1,045

That’s £125 saved every month, adding up to over £45,000 across the loan term. This shows why comparing rates is never optional.

Avoiding Costly Mistakes with the Interest Rate Comparison Calculator

Many borrowers accept the first rate offered by a bank without checking alternatives. The Interest Rate Comparison Calculator makes side-by-side comparisons effortless, helping you avoid overpaying and choose the best deal. Before accepting any loan quote, pull the full schedule in the Loan Amortization Calculator to see the total interest and payoff timeline.

Savings vs Borrowing Perspectives

For savers, a 2% vs 3% return changes how quickly wealth grows. For borrowers, the same difference increases total repayment costs. This comparison tool highlights both sides of the coin, ensuring you plan realistically.

Long-Term Financial Planning Using an Interest Rate Comparison Calculator

Planning for big goals, like retirement or paying off a mortgage, requires accurate projections. With the Interest Rate Comparison Calculator, you can model 10, 15, or 20 years of impact and see how small changes today compound into massive differences tomorrow.

Peace of Mind Through Clarity

Financial stress often comes from uncertainty. By showing exact numbers, the calculator replaces doubt with confidence, so you know whether you’re making the smartest financial choice.

Real-Life Use Cases

The true value of an interest comparison tool is seen when you apply it to real-life decisions. From loans to savings, here’s how the calculator helps different people make smarter financial choices.

Case 1: Student Comparing Loan Options with the Interest Rate Comparison Calculator

Amira, a university student, needed a £10,000 education loan. By using the Interest Rate Comparison Calculator, she compared 5% vs 6% interest.

- 5% loan → £188/month

- 6% loan → £193/month

It looked small monthly, but over 5 years, the higher rate cost her nearly £277 extra. The tool helped her pick the cheaper loan confidently.

Case 2: Family Planning a Mortgage

The Martinez family wanted a £200,000 mortgage. Using this tool, they compared 4% vs 4.5% rates.

- At 4% → ~£1,055/month

- At 4.5% → ~£1,111/month

That’s £55/month saved and over £16,000 less interest across the term. This clarity influenced their bank choice.

Case 3: Investor Maximising Savings Accounts

David had £50,000 to invest in fixed deposits. With the Interest Rate Comparison Calculator, he compared 2.5% vs 3.0% APY over 5 years.

- At 2.5% → ~£56,610

- At 3.0% → ~£57,963

That’s £1,353 more earned with the higher rate, without any extra effort.

Case 4: Freelancer Managing a Business Loan

Sara, a freelancer, needed £15,000 to expand her business. This calculator showed her that a 7% loan vs 8% loan would add nearly £600 extra interest over 4 years. She negotiated better terms with the data in hand.

Case 5: Couple Deciding on a Car Loan

James and Priya wanted a £20,000 car loan. The comparison tool revealed that a 6% vs 7% rate meant almost £1,100 more in total repayment. That insight helped them avoid overpaying.

Understanding the Numbers

Interest rates may look simple, but behind them are formulas that decide whether you’re saving money or losing it. The calculator simplifies these into clear results, but knowing the basics helps you trust the outcomes.

How is interest calculated?

- Simple Interest: Calculated only on the principal (Loan of £10,000 at 5% simple for 3 years = £1,500).

- Compound Interest: Interest on principal + accumulated interest. (£10,000 at 5% compounded annually for 3 years = £1,576).

This difference grows massively over longer terms.

APR vs APY:

- APR (Annual Percentage Rate): Used in loans, shows the yearly cost of borrowing but doesn’t account for compounding.

- APY (Annual Percentage Yield): Used in savings, reflects true annual growth including compounding.

The tool makes this distinction automatically, so you aren’t misled by marketing tricks.

Confused by APR vs APY labels? Convert one to the other with the APR vs APY Calculator for an apples-to-apples comparison.

Transparency in the Interest Rate Comparison Calculator

Many calculators only show the final figure, leaving you unsure how it was calculated. The Interest Rate Comparison Calculator breaks results into:

- Monthly payments

- Total repayment or total growth

- Interest portion vs contributions

This transparency ensures you understand where every pound goes.

The Role of Compounding

Compounding is the reason small rate differences have a huge long-term impact. For example:

- £5,000 for 10 years at 3% APY = ~£6,720

- £5,000 for 10 years at 4% APY = ~£7,401

That’s nearly £700 more earned with just 1% higher interest.

Real vs Nominal Costs Using an Interest Rate Comparison Calculator

Banks often advertise attractive rates but hide the real cost. With the Interest Rate Comparison Calculator, you see the nominal rate plus the actual financial impact, monthly, yearly, and total. This way you don’t fall for marketing tricks, and your decision is based on facts.

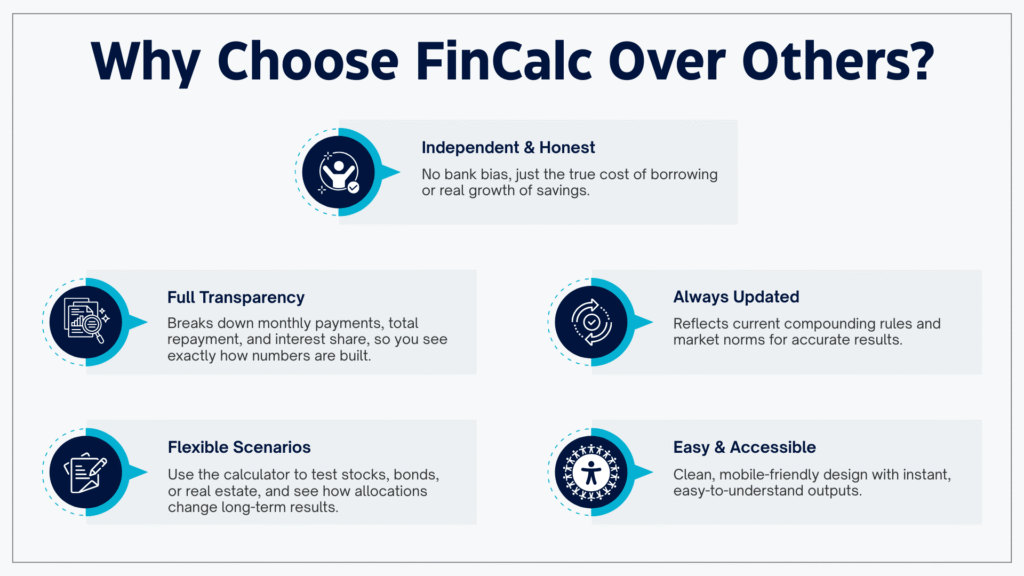

Why Choose FinCalc Over Others?

Not all calculators are created equal. Some are too basic, some are too complicated, and others are biased toward selling you products. The Interest Rate Comparison Calculator from FinCalc stands apart because it gives you transparent, independent, and reliable numbers, without the marketing spin.

Independent and Honest Results with the Interest Rate Comparison Calculator

Unlike bank apps that only highlight their own offers, the Interest Rate Comparison Calculator is 100% unbiased. It shows the true cost of borrowing or the real growth of savings, helping you make the best decision for your money, not the bank’s.

Full Transparency

FinCalc doesn’t just give you a single figure. It breaks down monthly payments, total repayment, interest portion, and growth, so you know exactly how the numbers are built. This level of transparency builds trust and keeps surprises away.

Flexible for All Scenarios

Whether you’re comparing mortgage rates, car loans, student loans, or savings accounts, this tool adapts instantly. You can enter multiple rates, adjust terms, and test scenarios until you find the perfect fit.

Regularly Updated

Generic calculators often rely on outdated assumptions. FinCalc’s tool is updated regularly to reflect realistic interest practices, compounding rules, and market norms, ensuring accuracy every time.

Easy and Accessible with an Interest Rate Comparison Calculator

You don’t need to be a financial expert. The Interest Rate Comparison Calculator is designed with simplicity in mind, a clean interface, a mobile-friendly design, and instant results that anyone can understand.

Conclusion:

Interest rates can quietly make or break your financial plans. A half-percent more on a mortgage or a slightly better APY on a savings account may look small on paper, but over the years it adds up to thousands. Most people realise this too late, after they’ve locked into a deal.The Interest Rate Comparison Calculator from FinCalc makes sure you’re never in the dark.

Showing side-by-side comparisons, total repayment costs, and future savings growth, it gives you the clarity that guessing or relying on sales-driven bank tools simply cannot. Whether you’re a student taking a loan, a family shopping for a mortgage, or an investor maximising savings, this tool empowers you to make confident, data-driven choices. Turning rate choices into a monthly plan? Plug your target into the Savings Goal Calculator to map contributions against time. Instead of second-guessing, you’ll know exactly what’s at stake before you commit.

FAQs

What is an Interest Rate Comparison Calculator?

It’s a tool that lets you compare different loan or savings rates side by side. The Interest Rate Comparison Calculator shows how even small changes in rates affect your total repayment or future growth.

Does it work for both loans and savings?

Yes. You can use this calculator to see repayment differences on loans, or to check how much more your savings will grow at different APYs.

Can I compare multiple rates at once?

Of course. Enter several rates, for example, 4%, 5%, and 6%, and the tool instantly shows which one saves or earns you the most money.

Does it include compound interest?

Yes. The tool adjusts for both simple and compound interest, giving you an accurate projection based on real-world scenarios.

How accurate are the results?

The results are accurate based on the inputs provided. Since interest rates and market conditions can change, it’s always best to re-check regularly.

Is the calculator free to use?

Yes. FinCalc’s tool is completely free and doesn’t require any registration or sign-up.

Can it help with mortgage planning?

Definitely. Mortgages are where small interest differences matter most. This calculator shows the long-term repayment impact instantly.