First-Time Buyer Mortgage Calculator UK

Loan Amount

Monthly Repayment

Total Repayment

Total Interest

Buying your very first home can feel both exciting and overwhelming. Between browsing listings, arranging viewings, and dealing with lenders, the financial side often feels like a maze. That’s why we built the First-Time Buyer Mortgage Calculator at FinCalc, to take the guesswork out of your biggest decision. Instead of struggling with spreadsheets or relying on vague bank estimates, this tool gives you clear, realistic numbers so you know exactly what you can afford.

It factors in your deposit, loan amount, interest rates, and repayment terms to create a picture tailored to your situation. Whether you’re saving for your starter home or already exploring offers from lenders, our calculator arms you with the knowledge to plan confidently. At FinCalc, our mission is simple: turn financial confusion into clarity, giving first-time buyers the confidence to take their first big step onto the property ladder. Want a lender-style cap on borrowing before you view properties? Use the FinCalc Mortgage Affordability Calculator to set a realistic price range.

What is a First-Time Buyer Mortgage Calculator?

A First-Time Buyer Mortgage Calculator is a financial planning tool designed to help people purchasing their very first home estimate how much they can borrow, what their monthly repayments will look like, and how the interest adds up over the life of the loan. Unlike generic mortgage calculators, this one is tailored to the unique challenges first-time buyers face, such as smaller deposits, limited credit history, and higher upfront fees.

Instead of offering vague figures, the calculator gives a realistic breakdown based on your property price, deposit, term length, and interest rate. By entering a few simple details, you can instantly see whether your dream home fits within your budget or if you need to adjust your expectations. For first-time buyers, this clarity is invaluable. It takes away guesswork, helps avoid over-borrowing mistakes, and builds the confidence to approach banks and brokers with a clear understanding of affordability.

Why First-Time Buyer Mortgage Planning Matters

For many first-time buyers, the excitement of owning a home often overshadows the reality of long-term financial commitments. Without careful planning, it’s easy to underestimate costs or overestimate how much you can comfortably borrow. A mortgage might seem manageable at first glance, but interest rates, insurance, and maintenance expenses can quickly stretch a budget thin.

Proper planning helps you:

- Avoid financial surprises: Stamp duty, solicitor fees, surveys, and moving costs often add thousands beyond the mortgage itself.

- Understand affordability: Knowing your repayment limits prevents you from falling into “house-poor” territory, where every penny goes toward your mortgage.

- Negotiate with confidence: Walking into a lender meeting armed with realistic figures strengthens your position.

- Think long-term: Planning doesn’t just secure the home, it ensures you can enjoy living in it without constant financial strain.

For first-time buyers, this preparation is the difference between comfortably stepping onto the property ladder and struggling to hold on. Compare deals side-by-side—use the FinCalc Interest Rate Comparison Calculator to see the cost impact before you choose a product.

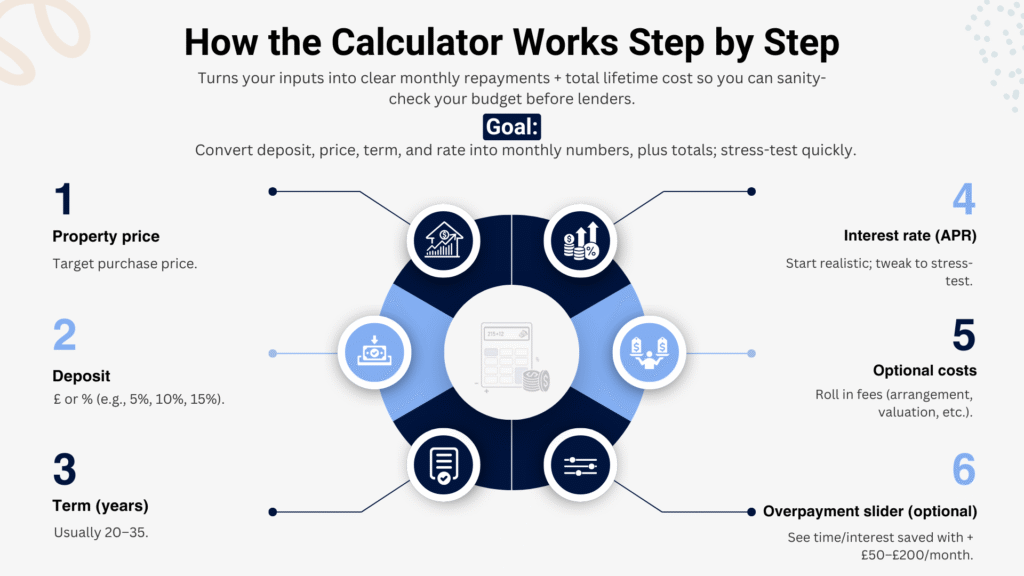

How the Calculator Works Step by Step

Goal: turn your deposit, property price, term, and rate into clean monthly numbers, plus lifetime costs, so you can sanity-check your budget before talking to lenders.

Inputs you’ll enter:

- Property price – The place you’re eyeing.

- Deposit – Either a £ amount or a % (e.g., 5%, 10%, 15%).

- Term (years) – Typical ranges: 20–35 years.

- Interest rate (APR) – Start with a realistic market rate; adjust to stress-test.

- Optional costs – Fees you want included in the repayment (arrangement, valuation, etc.).

- Overpayment slider (optional) – See savings if you add £50–£200/month.

What the calculator returns:

- Monthly repayment (principal + interest)

- Total interest over the term

- Total repaid (loan + interest)

- Loan-to-Value (LTV) estimate (helps you gauge rate tiers)Check how your deposit shifts rate tiers with the FinCalc Loan to Value Calculator UK.

- Sensitivity panel (what happens if rates move ±1%)

Step-by-step flow (do this once, then tweak):

- Enter your property price (e.g., £250,000).

- Add your deposit (e.g., 10% = £25,000).

- Pick a term (25 years if unsure; you can compare 20 vs 30 later).

- Set an APR (start with today’s realistic fixed rate, then test +1% for risk).

- Hit Calculate → review monthly repayment, total interest, and LTV.

- Iterate: Change deposit, term, or rate until the monthly payment sits comfortably below your “safe spend” threshold.

Worked examples

- Example A (baseline):

£250,000 price • 10% deposit • £225,000 loan • 5.25% APR • 25 years

→ Monthly ~ £1,348.31

→ Total interest ~ £179,492 (lifetime)

→ Total repaid ~ £404,492 - Example B (larger price, better rate):

£300,000 price • 15% deposit • £255,000 loan • 4.50% APR • 30 years

→ Monthly ~ £1,292.05

→ Total interest ~ £210,137

→ Total repaid ~ £465,137 - Example C (same as A, but 20% deposit):

£250,000 price • 20% deposit • £200,000 loan • 5.25% APR • 25 years

→ Monthly ~ £1,198.50

→ Total interest ~ £159,549

Impact vs Example A: ~£149.81 lower per month and ~£19,944 less interest lifetime.

How to interpret the results

- Affordability guardrail: Keep the mortgage around 25–30% of net monthly income (not a rule, just a pragmatic benchmark).

- Rate shock test: Add +1% APR; if you still sleep at night, you’re in the green zone.

- Term trade-off: Longer term = lower monthly, more interest; shorter term = higher monthly, less interest.

Pro tips for first-time buyers

- Deposit bumps (even +5%) can unlock better LTV brackets and rates.

- Overpay early: Even £50–£100/month from year one meaningfully reduces lifetime interest.

- Compare scenarios side-by-side: 25 vs 30 years, 5% vs 10% deposit, 5.25% vs 4.75% APR.

Notes & assumptions

- Calculations assume fixed-rate, level-payment amortization with monthly compounding.

- Outputs are estimates; lenders use full affordability checks (income, credit, commitments).

- Fees, insurance, and taxes vary; add them for a real-world picture.

If the numbers above feel tight, don’t panic; that’s precisely why the First-Time Buyer Mortgage Calculator exists. Tweak the inputs, stress-test the plan, and aim for a payment that leaves room for real life, not just bricks and mortar.

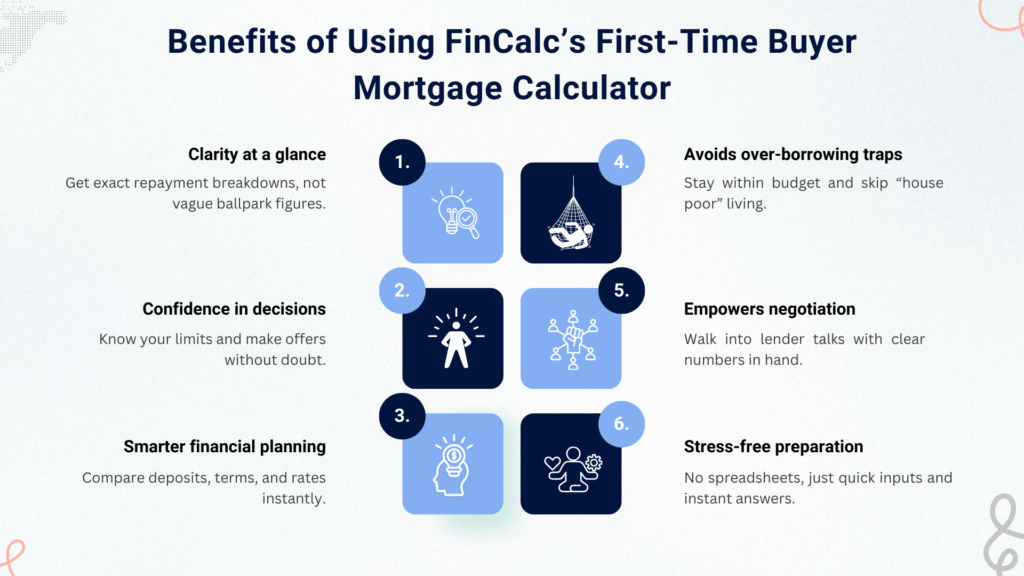

Benefits of Using FinCalc’s First-Time Buyer Mortgage Calculator

For first-time buyers, every decision feels weighty. The FinCalc calculator lightens that load by making complex mortgage math digestible and actionable. Here’s why it’s more than just another online tool:

- Clarity at a glance – Instead of vague ballpark figures, you get precise repayment breakdowns tailored to your inputs.

- Confidence in decisions – Knowing your limits means you can make offers with certainty instead of second-guessing.

- Smarter financial planning – You can compare scenarios (higher deposit vs longer term, fixed vs variable) instantly.

- Avoids over-borrowing traps – Prevents you from stretching beyond your comfort zone and risking “house poor” living.

- Empowers negotiation – When you walk into a lender’s office with clear figures, you shift from passive applicant to informed buyer.

- Stress-free preparation – No spreadsheets, no complex formulas, just simple inputs and clear answers in seconds.

At its core, this calculator doesn’t just crunch numbers; it gives peace of mind. And for someone taking their very first step onto the property ladder, that’s priceless.

Real-Life Use Cases

The First-Time Buyer Mortgage Calculator adapts to a variety of situations, giving tailored answers for different types of buyers:

Young Professional in London

Sarah is 27, renting in London, and looking to buy her first flat. With a modest deposit, she uses the calculator to test scenarios with 5%, 10%, and 15% deposits. She quickly sees how each step up in deposit size drops her monthly repayment and total interest.

Couple Buying Their First House in Manchester

James and Emma are upgrading from renting. They enter their combined salaries, set a realistic property price, and adjust the loan term. The calculator shows them that stretching to a 30-year term lowers their monthly payments, freeing up money for renovations.

Graduate Balancing Student Loans

Daniel has just finished university and is considering a starter home outside Birmingham. He uses the tool to see how different APRs affect affordability, and how overpaying by £50 a month shortens his repayment term significantly, even with his student loan repayments.

Family Saving for a Forever Home

Ali and Ayesha, with two kids, are saving for their forever home. They use the calculator to plan three years, adjusting interest rate scenarios. This lets them see how much extra deposit they’ll need to comfortably manage repayments when rates fluctuate.

In every case, the calculator removes uncertainty and replaces it with clarity, allowing first-time buyers to focus on finding the right home, not fearing the math behind it.

Understanding the Numbers

A First-Time Buyer Mortgage Calculator isn’t just about monthly payments; it’s about the story the numbers tell. Here are the key concepts every buyer should grasp:

- Loan-to-Value (LTV)

LTV is the percentage of the property price that you borrow from the bank. Example: if you buy a £200,000 property with a £20,000 deposit, you’re borrowing £180,000, that’s 90% LTV. The higher your LTV, the riskier it looks to lenders, which usually means higher interest rates. Aiming for 80% or lower often unlocks better deals. - Fixed vs Variable Interest Rates

With a fixed rate, your monthly repayment stays the same for a set period (e.g., 2 or 5 years), giving stability. With a variable rate, your repayment can rise or fall depending on the market. First-time buyers often prefer fixed rates for budgeting peace of mind, but it’s worth running both scenarios in the calculator. - Mortgage Term Length

Choosing between 20, 25, or 30 years dramatically changes your monthly repayment. Longer terms lower the monthly cost but increase the total interest paid. For instance, borrowing £200,000 at 5% APR costs ~£1,170/month over 25 years, but ~£1,075/month over 30 years, that’s cheaper each month but adds tens of thousands in lifetime interest. - Deposit Size Impact

Even a small increase in deposit makes a big difference. Raising your deposit from 5% to 10% doesn’t just shrink the loan; it can shift you into a lower LTV bracket, cutting your interest rate and saving thousands over the term. - Hidden & One-Off Costs

Many first-time buyers focus only on monthly payments, forgetting extras like arrangement fees, solicitor costs, surveys, and moving expenses. The calculator highlights the mortgage part, but budgeting for these extras ensures no nasty surprises. - Interest vs Principal Split

In the early years, most of your repayment goes to interest, not the loan itself. Over time, more goes toward reducing the balance. The calculator’s breakdown shows this clearly, so you know how slow (or fast) your equity builds.

By understanding these numbers, first-time buyers move from guessing to strategising. The calculator becomes not just a tool for quick sums, but a way to model different futures and pick the one that feels secure.

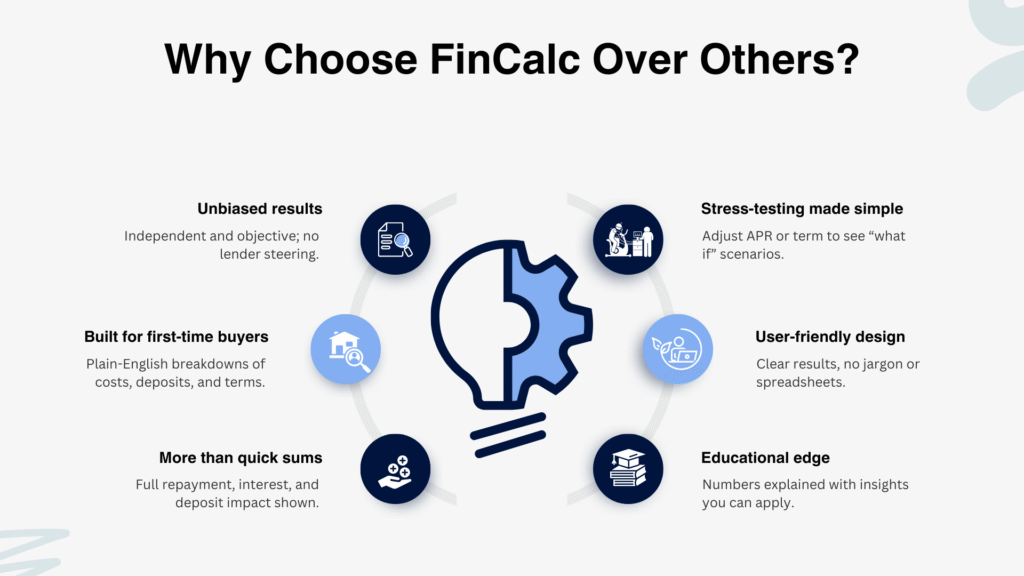

Why Choose FinCalc Over Others?

Unlike bank tools or comparison sites, the First-Time Buyer Mortgage Calculator at FinCalc is completely independent, transparent, and designed with real buyers in mind. Here’s why it makes a difference:

- Unbiased results – We don’t steer you toward a particular lender or mortgage product. The numbers you see are based solely on your inputs, giving you a clear, objective picture.

- Built for first-time buyers – Generic calculators assume you already know the game. Ours breaks down costs, deposits, and terms in plain English, tailored to people taking their very first step.

- More than quick sums – While most tools spit out a single repayment figure, FinCalc gives a full breakdown: monthly repayments, total interest, and the impact of different deposit sizes or rate changes.

- Stress-testing made simple – Easily adjust APR or loan term to see “what if” scenarios. This helps you plan for rate changes instead of being caught off guard.

- User-friendly design – No spreadsheets, no complex financial jargon. Just clean, clear results you can understand without a finance degree.

- Educational edge – Each result is paired with insights and explanations, so you’re not just seeing numbers, you’re learning what they mean.

At the end of the day, the FinCalc difference is simple: where others show you numbers, we show you a plan. That’s why first-time buyers trust us to guide one of the most important financial decisions of their lives.

Conclusion

Buying your first home is one of life’s biggest milestones, and one of its biggest financial decisions. The excitement of choosing a place to call your own often comes with the pressure of navigating mortgages, deposits, and repayments. That’s exactly why the First-Time Buyer Mortgage Calculator from FinCalc exists: to turn financial stress into clarity. With just a few details, you can see exactly what’s affordable, how much interest you’ll pay, and how different scenarios affect your future.

No guesswork, no confusing jargon, just straightforward answers that help you plan with confidence. At FinCalc, we believe that knowledge is power. The right numbers don’t just tell you what you can borrow, they give you the confidence to negotiate smarter, plan further, and step onto the property ladder without fear of hidden surprises. Your first home isn’t just a purchase; it’s the foundation of your financial journey. With FinCalc by your side, you’re not just buying a property, you’re building a future you can truly afford. For more first-home tools, guides, and calculators, start at FinCalc.

FAQs

Who should use the First-Time Buyer Mortgage Calculator?

Anyone buying their first home who wants to understand affordability, monthly repayments, and how different deposits or terms affect the loan.

Does the calculator guarantee mortgage approval?

No, it’s a planning tool. Lenders will still assess your income, credit history, and affordability before approval.

Can I compare different scenarios?

Yes. Adjust the deposit, interest rate, or mortgage term to instantly see how each change impacts repayments.

Does it include extra costs like legal fees or insurance?

The calculator focuses on mortgage repayments and interest. You’ll need to budget separately for solicitor fees, surveys, and insurance.

Is the calculator free to use?

Absolutely. FinCalc’s First-Time Buyer Mortgage Calculator is 100% free, with no hidden charges or commitments.

How accurate are the results?

They’re highly reliable estimates based on your inputs, but actual offers depend on lenders’ specific criteria and market rates.

Why is this better than my bank’s mortgage calculator?

Unlike bank tools that steer you toward their products, FinCalc provides unbiased, independent results, giving you a clearer picture of your options.