NHS Pay Calculator

Monthly Take-Home Pay

Gross Annual Salary

Gross Monthly Salary

Income Tax (monthly)

National Insurance (monthly)

NHS Pension (monthly)

Net Annual Salary

Your Details

If you work in the NHS, understanding your pay can sometimes feel like solving a puzzle. Tax codes, pension deductions, National Insurance, student loans, overtime rates, and London weighting all play a part in what finally lands in your bank account. That’s exactly why we’ve built the NHS Pay Calculator, a simple, accurate tool that helps you figure out your real take-home pay in seconds. Whether you’re a newly qualified Band 5 nurse, a Band 3 healthcare assistant, or a consultant planning your retirement contributions, this calculator gives you a clear, no-nonsense breakdown of your pay. You’ll instantly see your gross salary, deductions (tax, NI, pension), and your net salary, the amount you get to take home.

Why Does This Calculator Matter?

Every NHS role is tied to the Agenda for Change (AfC) pay scales, which means bands and spine points determine your salary. But what those official figures don’t show is how much you’ll lose to tax, how pension contributions reduce your take-home, or how enhancements like unsocial hours and London weighting increase your income. That’s where our NHS Pay Calculator steps in.

By using it, you’ll:

- Quickly check your after-tax salary for your band and region.

- See how pension contributions and National Insurance affect your pay.

- Compare overtime, on-call, and unsocial hours enhancements.

- Understand the real impact of pay rises, back pay, or student loan deductions.

Want to explore how our tool compares to others? Read our full review of the Best Online NHS Salary Calculators.

Who Is It For?

The calculator has been designed for all NHS staff under Agenda for Change contracts, including:

- Nurses, midwives, and healthcare assistants (Bands 2–7).

- Allied health professionals like physiotherapists and occupational therapists.

- Admin and clerical staff across Bands 2–5.

- Senior staff and consultants.

- Staff in England, Scotland, Wales, and Northern Ireland, with adjustments for regional tax and allowances.

Whether you’re considering a new job, planning a relocation, or just checking how a pay rise affects your take-home, this tool gives you instant clarity.

How the NHS Pay Calculator Works

Understanding NHS pay can be tricky because it’s not just about your annual salary figure. Your actual take-home pay depends on a range of factors, including the Agenda for Change pay scales, pension contributions, income tax, National Insurance, student loan deductions, and regional supplements. The NHS Pay Calculator takes all of these into account to give you an accurate breakdown. Alongside calculators, payroll software also plays a big role in staff payments see our review of the Top 5 Payroll Tools for NHS Employees for 2025.

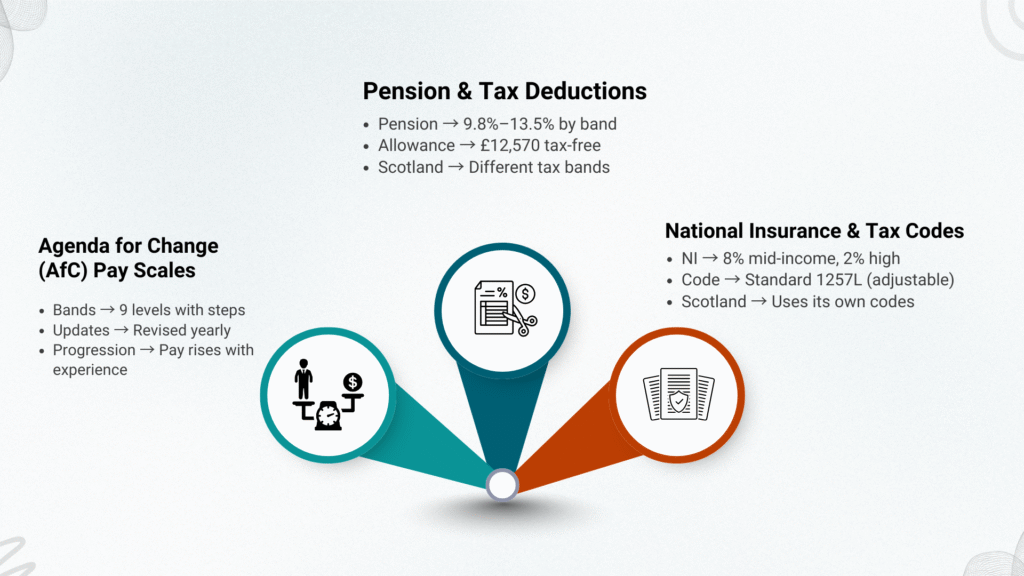

Agenda for Change (AfC) Pay Scales Explained

The NHS Pay Calculator is built around the Agenda for Change (AfC) framework, the pay system that covers more than a million NHS staff in England, Wales, Scotland, and Northern Ireland.

Here’s how it works:

- Bands and Spine Points: NHS staff salaries are grouped into nine bands. Within each band are “spine points,” which reflect years of experience and progression.

- Annual Updates: Pay scales are revised each year following national negotiations. In 2025, new deals have updated most bands with percentage increases and additional back pay in some cases.

- Automatic Progression: Staff usually move up spine points each year until they reach the top of their band, which means gradual increases in gross pay.

➡ ️ The calculator uses the latest 2025 AfC pay scales and spine points to calculate your gross salary before deductions.

NHS Pension Contributions and Tax Deductions

NHS staff are automatically enrolled into the NHS Pension Scheme, which is one of the most generous in the UK public sector. But it also means a chunk of your salary goes into contributions before you even see it.

- Pension contributions are tiered depending on your pay band. For example, staff earning around Band 5 levels contribute ~9.8%, while higher earners in Bands 8–9 contribute up to 13.5%.

- These contributions reduce your take-home pay now but increase your long-term retirement benefits.

Alongside the pension, income tax is deducted based on HMRC tax codes. For 2025, the standard tax-free personal allowance is £12,570 in England, Wales, and Northern Ireland, while Scotland has different tax bands.

The calculator factors in:

- Your pension tier (based on band and income).

- Standard tax deductions using the 1257L code (or Scotland’s S codes).

- Regional adjustments to allowances and tax rates.

How National Insurance and Tax Codes Affect NHS Pay

National Insurance (NI) is another key deduction. All NHS employees pay Class 1 NI contributions, which vary depending on your salary and whether you’re over the state pension age.

- For most staff: 8% NI on income between £12,570 and £50,270, then 2% on anything above.

- Tax Codes: Most NHS employees have the standard tax code 1257L, but adjustments can be made for student loans, benefits, or regional differences.

- Scotland: Employees in Scotland are subject to different income tax bands introduced by the Scottish Government.

The NHS Pay Calculator integrates both NI thresholds and HMRC tax codes to ensure your net pay reflects what you’ll receive in your bank account. To understand how tax code updates affect your deductions, see our guide on NHS Tax Code Changes in 2025.

NHS Pay Bands 2–9 Salary and Net Pay Breakdown

The NHS Pay Calculator works by applying the official 2025 Agenda for Change (AfC) pay scales to each band and then subtracting tax, National Insurance, pension contributions, and (if relevant) student loans. This gives NHS staff a realistic take-home pay figure. Below, we break down the salaries for Bands 2 through 9. Each example shows the annual gross salary, deductions, and estimated net pay for a full-time employee on standard tax code 1257L (England & Wales rates). If debt is part of the picture, build a fast payoff plan around your new net with the Debt Snowball Calculator, quick wins first, momentum all the way.

NHS Band 2 Salary After Tax

- Typical roles: healthcare assistants, domestic support workers, porters.

- Gross salary (2025): ~£23,000 at entry level.

- Deductions:

- Income tax: ~£1,200

- National Insurance: ~£1,300

- Pension (tiered ~5–7%) ~£1,200

Net pay (take-home): £19,300 per year (£1,610/month).

NHS Band 3 Salary and Hourly Rate

- Typical roles: clinical support workers, therapy assistants, and admin staff.

- Gross salary (2025): ~£25,500 at entry level.

- Deductions:

- Tax: ~£1,600

- NI: ~£1,600

- Pension: ~£2,000

- Net pay: £20,300 per year (£1,690/month).

- Hourly rate: ~£11.85/hour after deductions.

NHS Band 4 Salary After Tax

- Typical roles: assistant practitioners, senior admin staff, medical secretaries.

- Gross salary: ~£28,000

- Net pay: ~£22,000 after standard deductions.

NHS Band 5 Net Pay (Newly Qualified Nurse)

- Typical roles: staff nurses, midwives, paramedics, radiographers.

- Gross salary: ~£32,500 (entry).

- Deductions:

- Tax: ~£3,100

- NI: ~£2,400

- Pension (9.8%): ~£3,100

Net pay: £23,900 (£1,990/month).

NHS Band 6 Salary After Tax

- Typical roles: senior nurses, paramedics, health visitors, team leaders.

- Gross salary: ~£41,500

Net pay: £29,500 (£2,450/month).

NHS Band 7 Salary After Tax

- Typical roles: ward managers, advanced practitioners, specialist nurses.

- Gross salary: ~£50,000

- Net pay: £35,000 (£2,915/month).

NHS Band 8A / 8B / 8C Salary After Tax

- Band 8a: ~£55,000 gross → ~£38,000 net

- Band 8b: ~£65,000 gross → ~£44,500 net

- Band 8c: ~£75,000 gross → ~£50,800 net

- Higher bands see heavier pension and tax deductions, but net income is still substantial.

NHS Band 9 Salary After Tax

- Senior management and executive-level roles.

- Gross salary: ~£95,000

- Net pay: ~£62,500 after deductions.

Extra Insight

- Progression within bands (spine points) can add £1,000–£3,000 per year as you gain experience.

- Regional variations (Scotland tax bands, London weighting) can shift net pay by several hundred pounds annually.

- The NHS Pay Calculator automatically accounts for these factors when generating results.

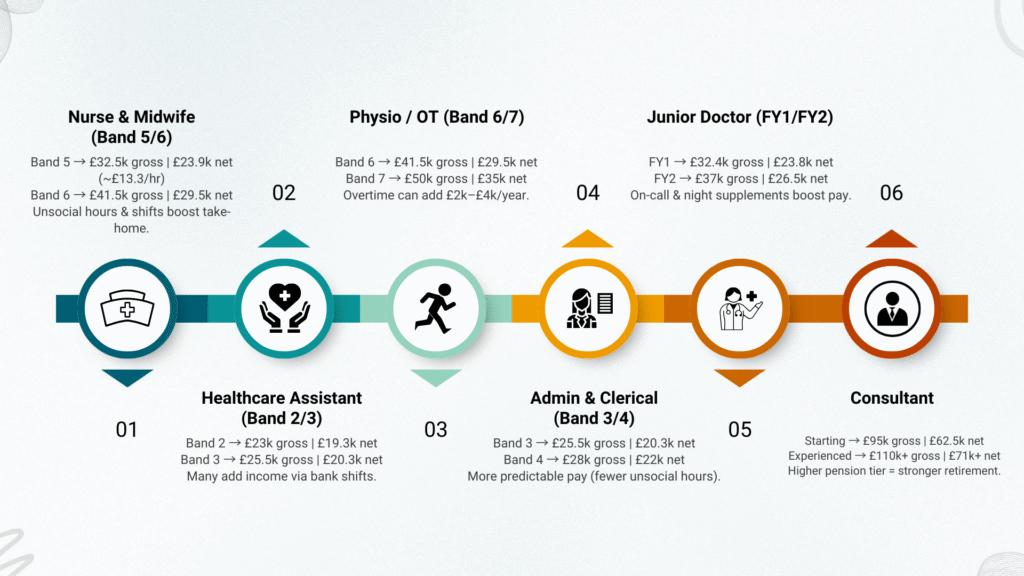

Role-Based NHS Salary Calculations

Not every NHS employee searches by “band number.” Most staff think in terms of their job role: nurse, healthcare assistant, midwife, physiotherapist, admin, or doctor. The NHS Pay Calculator is designed to match both: you can filter by band, or directly by role.Here’s how different NHS job roles translate into bands and what that means for net pay in 2025.

Nurse Salary Calculator (Band 5/6)

1. Newly Qualified Staff Nurse (Band 5):

- Gross salary: ~£32,500

- Net pay: ~£23,900 after tax, NI, and 9.8% pension contribution.

- Hourly rate (net): ~£13.30/hour.

2. Senior Nurse (Band 6):

- Gross salary: ~£41,500

- Net pay: £29,500 (£2,450/month).

Nurses also receive enhancements for unsociable hours (night shifts, weekends, bank holidays), which can increase annual take-home by several thousand pounds. Carry a student loan? The Student Loan Repayment Calculator mirrors HMRC thresholds by plan, so your deductions and take-home pay match reality.

Healthcare Assistant (HCA) Salary Calculator (Band 2/3)

1. Band 2 HCA:

-

- Gross salary: ~£23,000

- Net pay: £19,300 per year (£1,610/month).

- Gross salary: ~£23,000

2. Band 3 HCA (experienced):

- Gross salary: ~£25,500

- Net pay: £20,300 (£1,690/month).

HCAs form the backbone of hospital care, and many supplement earnings with bank shifts or unsocial hours enhancements.

Midwife Salary After Tax (Band 5/6)

1. Entry-Level Midwife (Band 5):

-

- Gross salary: ~£32,500

- Net pay: ~£23,900.

- Gross salary: ~£32,500

2. Experienced Midwife (Band 6):

-

-

- Gross salary: ~£41,500

- Net pay: ~£29,500.

- Gross salary: ~£41,500

-

Enhancements are common due to 24/7 service provision, which means night/weekend shifts boost actual take-home.

Physiotherapist / Occupational Therapist Salary (Band 6/7)

1. Band 6 Physio/OT:

-

- Gross salary: ~£41,500

- Net pay: ~£29,500.

- Gross salary: ~£41,500

2. Band 7 Specialist Physio/OT:

- Gross salary: ~£50,000

- Net pay: ~£35,000.

With overtime or bank work, many allied health professionals add ~£2,000–£4,000 extra per year.

Admin & Clerical NHS Pay (Band 3/4)

1. Band 3 Admin/Clerical Staff:

-

- Gross salary: ~£25,500

- Net pay: ~£20,300.

- Gross salary: ~£25,500

2. Band 4 Medical Secretary/Admin Officer:

-

-

- Gross salary: ~£28,000

- Net pay: ~£22,000.

- Gross salary: ~£28,000

-

Clerical roles often include less unsociable hours work, so take-home pay is more predictable than in clinical roles.

Junior Doctor and Foundation Year Pay (FY1/FY2)

1. Foundation Year 1 (FY1):

-

- Gross salary: ~£32,400

- Net pay: ~£23,800 after deductions.

- Gross salary: ~£32,400

2. Foundation Year 2 (FY2):

-

-

- Gross salary: ~£37,000

- Net pay: ~£26,500.

- Gross salary: ~£37,000

-

Junior doctors also earn supplements for on-call, night shifts, and additional duties, which significantly increase earnings.

Consultant Salary After Tax

1. Starting Consultant (typical):

-

- Gross salary: ~£95,000

- Net pay: ~£62,500.

- Gross salary: ~£95,000

2. Experienced Consultant (with additional clinical excellence awards):

-

-

- Gross salary: £110,000+

- Net pay: £71,000+.

- Gross salary: £110,000+

-

Consultants also contribute to the highest NHS pension tiers, so deductions are heavier but retirement benefits are stronger.

Extra Note:Every role can be filtered in the NHS Pay Calculator, which means whether you search by “Band 5 nurse” or “junior doctor,” you’ll get a precise after-tax figure adjusted for region, pension tier, and deductions.

Junior Doctor and Foundation Year Pay (FY1/FY2)

1. Foundation Year 1 (FY1):

-

- Gross salary: ~£32,400

- Net pay: ~£23,800 after deductions.

- Gross salary: ~£32,400

2. Foundation Year 2 (FY2):

-

-

- Gross salary: ~£37,000

- Net pay: ~£26,500.

- Gross salary: ~£37,000

-

Junior doctors also earn supplements for on-call, night shifts, and additional duties, which significantly increase earnings.

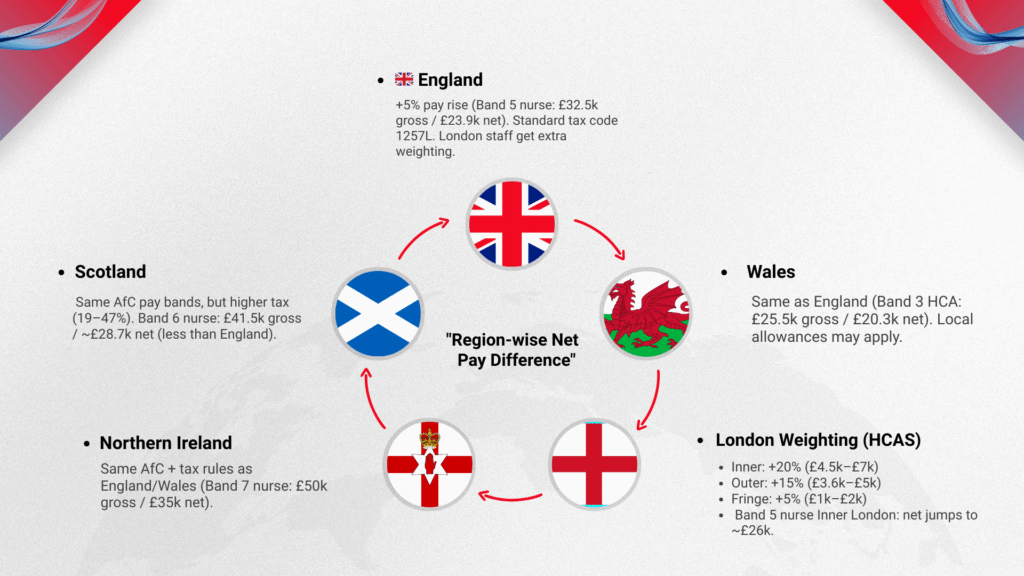

NHS Pay Calculator by Region

One of the biggest challenges with NHS salaries is that take-home pay isn’t the same across the UK. While the gross salary bands are set nationally through Agenda for Change (AfC), different tax bands, National Insurance rates, and supplements like London weighting make a big difference.The NHS Pay Calculator adjusts automatically for regional variations so you can see your actual after-tax salary based on where you work.

NHS Pay Calculator England 2025

In England, the 2025 pay deal increased salaries across all bands by ~5%. Tax is based on UK-wide HMRC thresholds with the standard 1257L tax code for most employees.

Example (Band 5 nurse in England):

-

- Gross: £32,500

- Net: ~£23,900

- Pension deduction: ~9.8%

- Gross: £32,500

England is also where London weighting supplements apply, making a noticeable difference for NHS staff in the capital.

NHS Pay Calculator Scotland After Tax

Scotland operates under the same AfC pay bands, but with different income tax bands set by the Scottish Government.

1. Scottish income tax 2025:

- Starter rate: 19% (up to £2,300 above allowance)

- Basic rate: 20%

- Intermediate: 21%

- Higher: 42%

- Top: 47%

- Starter rate: 19% (up to £2,300 above allowance)

Because of these higher tax rates, Scottish NHS staff often take home slightly less than their English counterparts on the same gross salary. Example (Band 6 nurse in Scotland):

- Gross: £41,500

Net: ~£28,700 (slightly lower than England).

NHS Pay Calculator Wales

Wales follows the same pay scales and tax codes as England, so take-home pay is generally identical. Example (Band 3 HCA in Wales):

- Gross: £25,500

- Net: ~£20,300

The main difference lies in local allowances or health board enhancements, but the base deductions remain the same.

NHS Pay Calculator Northern Ireland

Northern Ireland also uses the AfC framework with the same tax codes as England and Wales. Example (Band 7 Specialist Nurse in NI):

- Gross: £50,000

- Net: ~£35,000

Pay progression and deductions are aligned with HMRC thresholds.

London Weighting and High Cost Area Supplements (HCAS)

For NHS staff in London and surrounding areas, extra pay is added to account for the high cost of living. These are called High Cost Area Supplements (HCAS).

- Inner London: +20% of basic salary (minimum £4,500, maximum £7,000).

- Outer London: +15% (minimum £3,600, maximum £5,000).

- Fringe areas: +5% (minimum £1,000, maximum £2,000).

Example:

- A Band 5 nurse in Inner London could see their net pay rise from ~£23,900 to ~£26,000 once weighting is applied. Planning rent or a mortgage in London? Check your affordability with the Debt-to-Income Ratio Calculator before locking in new commitments.

Extra Insight:

- Staff in London and Scotland see the biggest differences in take-home pay.

- The NHS Pay Calculator automatically adjusts for tax codes, regional bands, and HCAS supplements, giving the most accurate after-tax salary for your specific location.

NHS Pay Components & Deductions

The gross salary you see on NHS pay scales isn’t what ends up in your bank account. Every NHS payslip includes a set of deductions, pension contributions, tax, National Insurance (NI), and sometimes student loans. On the other side, enhancements like overtime, unsocial hours, and on-call payments can increase your final take-home pay.The NHS Pay Calculator considers all of these to give a realistic, after-tax salary figure.

NHS Pension Contributions (2015 Scheme Tiers)

The NHS Pension Scheme (2015) is a defined benefit scheme, meaning your retirement income is linked to your salary and length of service.

Contributions are tiered by salary:

- ~5% for Band 2/3 staff.

- 9.8% for most Band 5/6 nurses and midwives.

- 12.5–13.5% for senior staff in Bands 8/9.

- These deductions reduce your take-home pay today, but build one of the most valuable pensions in the UK public sector.

Example: A Band 6 nurse earning £41,500 will contribute ~£4,000 per year into their pension

NHS Tax & National Insurance (Class 1)

Income Tax: Based on UK tax bands (with Scotland using higher rates). Standard allowance: £12,570.

NI Contributions: Class 1 employee NI applies:

- 8% on earnings £12,570–£50,270.

- 2% on earnings above £50,270.

- 8% on earnings £12,570–£50,270.

Example:

- A Band 5 nurse (~£32,500 gross) will pay ~£3,100 income tax and ~£2,400 NI per year.

NHS Student Loan Deductions

Many NHS staff, especially newly qualified nurses, midwives, and physios, have outstanding student loans. These repayments are automatically deducted from pay:

- Plan 2: 9% of income above £27,295.

- Plan 4 (Scotland): 9% above £25,000.

- Postgraduate Loans: 6% above £21,000.

Example: A Band 5 nurse earning £32,500 under Plan 2 pays ~£470/year in student loan deductions.

NHS Overtime Calculator

NHS overtime is usually paid at time-and-a-half or double time, depending on shifts.

- Example: A Band 6 nurse earning £20/hour gross could receive £30/hour for overtime shifts.

- Overtime can add several thousand pounds per year, especially in high-pressure units.

The NHS Pay Calculator includes an overtime input option, so staff can estimate the effect of extra shifts.

NHS Unsocial Hours & Enhancements

NHS staff receive enhancements for working nights, weekends, and bank holidays under Agenda for Change terms.

- Nights (8 pm–6 am): +30%

- Saturdays: +30%

- Sundays & Bank Holidays: +60%

Example: A Band 5 nurse working 4 Sunday shifts per month can add £3,000–£4,000 annually.

NHS On-Call and Standby Pay Calculator

Some NHS roles (e.g., radiographers, senior nurses, anaesthetists) require on-call availability.

- On-call standby payments apply even if you’re not called in.

- Actual call-outs are usually paid at enhanced overtime rates.

This can make a meaningful difference to take-home pay for certain staff groups.

➡ Key Insight: By combining deductions (pension, tax, NI, student loan) with additions (overtime, unsocial hours, on-call), the NHS Pay Calculator provides a more accurate picture of take-home pay than just looking at the basic AfC salary.

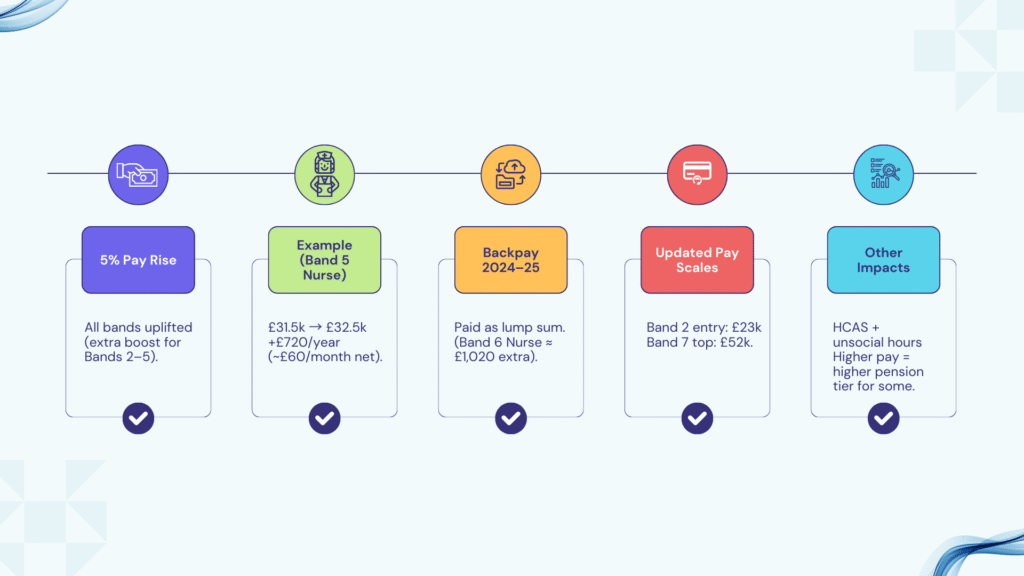

NHS Pay Rise 2025 and Backpay Explained

Every year, NHS staff look forward to updated salary scales under the Agenda for Change (AfC) framework. For 2025, a national pay deal was agreed, increasing salaries across all bands and introducing backpay for April 2024–March 2025. The NHS Pay Calculator includes these updated figures so staff can see their latest net pay, including any arrears due from backdated increases.

Big savings goals can feel overwhelming when you only look at the final figure. A £20,000 wedding or a £40,000 house deposit sounds intimidating, but when broken down into smaller chunks, it suddenly becomes achievable. That’s exactly what the Savings Goal Calculator does: it translates your big target into monthly actions you can actually follow.

Breaking Down Your Goal Into Monthly Targets

Every savings plan comes down to one formula: Total Goal ÷ Time = Monthly Contribution. For example, a £12,000 car over 3 years is £333/month. If you already have £2,000 saved, that drops to £278/month. The calculator handles this math instantly, showing you both the total and the monthly breakdown.

Short-Term vs Long-Term Savings

- Short-term (under 1 year): Goals like holidays require larger monthly amounts, but they’re achievable if you’re disciplined.

- Medium-term (2–5 years): House deposits or weddings fit here. Regular monthly saving builds momentum without overwhelming your budget.

- Long-term (5+ years): Education or retirement goals require patience, smaller contributions, and often benefit from compounding.If a short-term loan is tempting to bridge a gap, sanity-check the total cost with the Payday Loan Interest Calculator first.

Worked Example 1: Holiday Fund (Short-Term)

- Goal: £3,600, Timeline: 12 months, Current: £600

- Result: £250/month required.

- Lesson: Even modest savings add up quickly when spread over time.

Worked Example 2: Wedding

- Goal: £20,000, Timeline: 24 months, Current: £2,000

- Result: ≈ £750/month.

- Lesson: Medium-term goals balance ambition with feasibility, and realistic planning avoids last-minute loans.

Worked Example 3: House Deposit

- Goal: £40,000, Timeline: 60 months, Current: £5,000

- Result: ≈ £583/month.

- Lesson: Breaking big dreams into smaller monthly goals makes them realistic and less intimidating.

Why Realistic Targets Matter

Many people either under-save (“I’ll just put away £100 a month”) and fall short, or over-save (“I’ll try £1,500 a month”) and burn out within weeks. The calculator ensures your plan is balanced, ambitious enough to reach your goal, but achievable enough to stick with consistently.

NHS Pay Rise 2025 Calculator

Headline Increase: On average, NHS staff received a 5% uplift across bands in 2025. Who Benefits Most: Entry-level staff (Bands 2–5) received slightly higher percentage increases to improve recruitment and retention.

- Example (Band 5 nurse): Before you celebrate the headline uplift, run it through the Pay Rise Calculator to compare old vs new take-home by month.

- Old salary: £31,500 → New salary: £32,500.

- Net increase: £720/year take-home (£60/month).

Use the calculator to see exactly how much your pay has increased after tax and deductions.

NHS Backpay Calculator 2025

Because the 2025 deal was implemented after April, NHS staff are entitled to backdated pay from April 2024 onwards. This means a one-off lump sum in payslips.

- Example (Band 6 nurse):

- Monthly increase: ~£85/month.

- Backpay for 12 months: ~£1,020 lump sum.

This can be a welcome bonus, though subject to tax, NI, and pension deductions.

NHS Pay Scales 2025 / Agenda for Change Updates

- The updated 2025 AfC pay scales apply to all staff in England, Wales, Scotland, and Northern Ireland.

- Spine points were uplifted proportionally, meaning annual increments are also higher.

Example:

- Band 2 entry: ~£23,000 (previously ~£22,000).

- Band 7 top point: ~£52,000 (previously ~£50,000).

- Band 2 entry: ~£23,000 (previously ~£22,000).

Note: The calculator always uses the latest AfC rates and updates automatically when new pay deals are announced.

Extra Notes for Context

- London Weighting and HCAS also apply on top of these pay rises.

- Staff eligible for unsocial hours enhancements will see proportional increases.

- Pension contributions rise slightly for some bands because higher gross pay pushes staff into higher tiers.

Takeaway: The 2025 deal not only boosts salaries but also means backpay lump sums. For staff worried about deductions, the NHS Pay Calculator provides a clear breakdown so you can see your new salary + backpay after tax, NI, pension, and loans.

Conclusion

Working in the NHS comes with a structured pay system, but understanding your actual take-home pay can be complicated. Between tax, National Insurance, pension contributions, student loans, and enhancements like overtime or London weighting, the figure on your payslip can look very different from the official pay scale.

That’s why we built the NHS Pay Calculator, to give staff across all bands and roles an easy, accurate way to see their real pay. Whether you’re a newly qualified Band 5 nurse, a healthcare assistant, a midwife, or a consultant, the calculator adapts to your circumstances and shows your net salary after all deductions.

With the latest 2025 pay scales, backpay updates, and region-specific tax bands built in, you can trust the results to reflect your true earnings. And as new NHS pay deals are agreed, the calculator will always be updated.

Try the NHS Pay Calculator now, enter your band, role, and details, and instantly see what you’ll take home each month.This way, you can plan your finances with confidence, compare roles or regions, and make informed career decisions within the NHS.

Frequently Asked Questions

Q1: What is the NHS Pay Calculator?

The NHS Pay Calculator is an online tool that shows your real take-home pay after deductions. It uses the latest 2025 Agenda for Change pay scales, then factors in pension contributions, income tax, National Insurance, and optional elements like student loans and overtime.

Q2: How accurate is the NHS Pay Calculator?

It is highly accurate because it’s built on official NHS pay scales, HMRC tax codes, and NHS Pension tiers for 2025. While exact figures may vary slightly due to tax code changes or individual benefits, it gives a very close estimate of your net salary.

Q3: Does the NHS Pay Calculator include pension contributions?

Yes. NHS staff are automatically enrolled into the 2015 Pension Scheme, and contribution rates vary depending on your salary band. The calculator deducts these contributions, giving you a realistic figure for what you’ll take home each month.

Q4: Can I see my NHS pay after tax?

Absolutely. The calculator provides both your gross salary (before deductions) and your net pay after income tax, NI, and pension contributions. You’ll instantly see how much money goes to deductions and how much lands in your bank account.

Q5: What is the difference between NHS gross pay and net pay?

Gross pay is the salary published in NHS pay scales. Net pay is your salary after deductions such as tax, NI, pension, and loan repayments. For example, a Band 5 nurse’s gross may be ~£32,500, but the net pay is closer to £23,900 after deductions.

Q6: Does the NHS Pay Calculator include student loan deductions?

Yes. The calculator adjusts for all loan repayment plans, including Plan 1, Plan 2, Plan 4 (Scotland), and postgraduate loans. It automatically applies the 9% or 6% repayment thresholds, so you know exactly how much your student loan will reduce your take-home pay.

Q7: How often are NHS pay scales updated?

NHS pay scales are usually revised once a year under Agenda for Change negotiations. However, extra pay rises and backpay deals may occur mid-year, as seen with the 2025 uplift. The calculator updates as soon as new scales are published.

Q8: Can I calculate NHS overtime with this tool?

Yes. You can add extra hours to the calculator to estimate overtime pay. Overtime is normally paid at time-and-a-half or double time, so the tool shows how much these extra shifts could boost your monthly income.

Q9: Does it cover London weighting and HCAS?

Yes, the calculator includes High Cost Area Supplements (HCAS) for Inner London, Outer London, and Fringe zones. These can add between £1,000 and £7,000 per year to your basic pay, depending on your band and location.

Q10: Is the NHS Pay Calculator different in Scotland?

Yes. Scotland has its tax system with higher income tax rates, which means take-home pay is slightly lower compared to England, Wales, and Northern Ireland for the same gross salary. The calculator automatically adjusts for Scottish bands.

Q11: Does the NHS Pay Calculator work for junior doctors?

Yes. The calculator covers foundation doctors (FY1, FY2), registrars, and consultants. Junior doctors have different contracts from Agenda for Change staff, but their gross pay scales are included, so you can still calculate net pay.

Q12: Can I use it for 2025 backpay?

Yes. The 2025 pay deal included backdated increases from April 2024. The calculator allows you to see both your new monthly salary and the lump-sum backpay you can expect, adjusted for tax, NI, and pension.