The Most Accurate Shared Ownership Calculator

Your Share Value

Mortgage Amount

Monthly Mortgage

Monthly Rent

For many people, buying a home feels out of reach because saving for a large deposit or affording high monthly mortgage payments can be overwhelming. That’s why shared ownership has become such a popular option; it allows you to buy a portion of a property (typically between 25% and 75%) and pay rent on the rest, making homeownership far more affordable. But while the idea sounds simple, the actual numbers often confuse buyers. How much deposit will you need? How much will your mortgage repayments be? And how much rent will you owe on the share you don’t own?

This is where the FinCalc Shared Ownership Calculator steps in. Instead of juggling estimates or relying on housing association brochures, our tool gives you a clear, accurate breakdown of your costs in seconds. By entering the property value, the share you want to buy, and your deposit percentage, you can instantly see the deposit required, your monthly mortgage, the rent on the remaining share, and your total monthly cost. The Ownership Calculator turns uncertainty into clarity, helping you budget smarter and make confident decisions on your journey to homeownership. Sense-check overall affordability first with the FinCalc Mortgage Affordability Calculator before choosing a share.

What is a Shared Ownership Calculator?

A Shared Ownership Calculator is a tool designed to help buyers understand the costs of purchasing a home through a shared ownership scheme. Shared ownership is an affordable housing option where you buy a percentage of a property, usually between 25% and 75%, and pay rent on the remaining share owned by a housing association or developer. While the concept is straightforward, the financial details can be confusing. That’s why the calculator is so valuable: it breaks everything down into clear, easy-to-understand numbers.

Here’s how it works: you enter the property price, the percentage share you want to buy, and the deposit amount you can afford. The Ownership Calculator then shows you:

- The size of the deposit required for your chosen share.

- The mortgage amount you’ll need to borrow.

- The rent you’ll pay on the portion of the property you don’t own.

- Your estimated total monthly cost (mortgage + rent).

For example, let’s say you’re looking at a £200,000 property with a 50% share:

- You’d purchase a £100,000 share.

- With a 10% deposit, you’d need £10,000 upfront.

- You’d take out a mortgage on the remaining £90,000.

- You’d also pay rent on the unsold £100,000 portion, typically at around 2.75% of its value per year.

Instead of struggling with complex percentages and rent formulas, the calculator handles all the details instantly. It allows buyers to compare different share levels, like 25% vs 50%, and see how deposit, mortgage, and rent change accordingly. In short, the Shared Ownership Calculator is more than just a number-cruncher. It’s a decision-making tool that shows you the reality of shared ownership costs, helping you budget confidently and decide whether this path to homeownership is right for you. Break down the mortgage part separately with the FinCalc Mortgage Repayment Calculator to see the principal-and-interest component clearly.

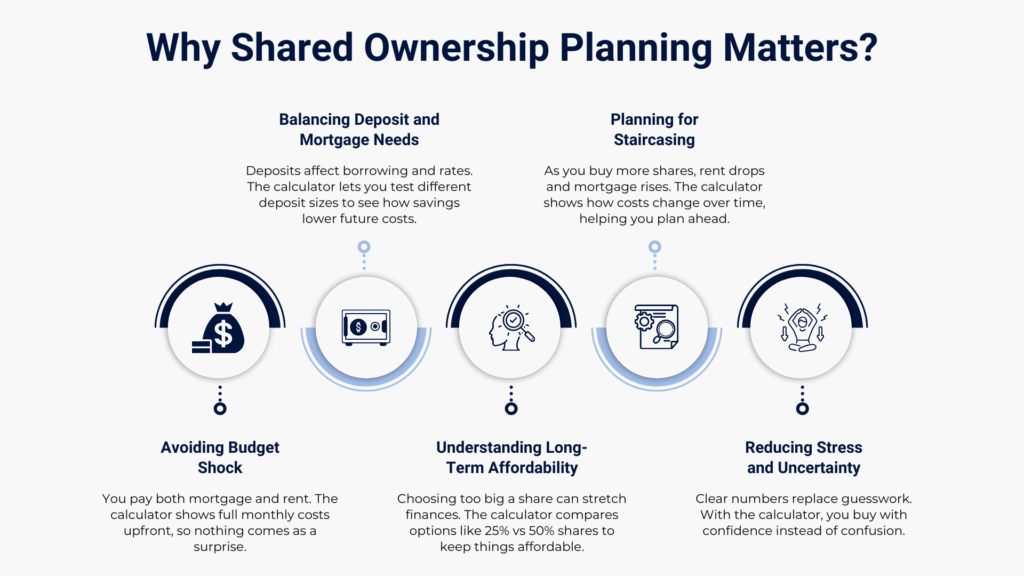

Why Shared Ownership Planning Matters?

Shared ownership is designed to make homeownership more accessible, but without proper planning, it can quickly become overwhelming. Many buyers focus only on the share they’re buying and forget about the rent on the unsold portion, the deposit requirements, and other costs like service charges. This lack of clarity can lead to financial strain or even delays in the buying process. That’s why careful planning with the help of a Shared Ownership Calculator is essential.

Avoiding Budget Shock

One of the most common mistakes buyers make is underestimating their monthly outgoings. With shared ownership, you don’t just have a mortgage; you also have to pay rent on the part you don’t own. Without planning, it’s easy to misjudge affordability and feel blindsided when the first payment is due. Using the calculator ensures you understand your total monthly costs before you commit.

Balancing Deposit and Mortgage Needs

For first-time buyers, especially, deposits are often the biggest hurdle. The size of your deposit directly affects your mortgage borrowing and interest rates. An Ownership Calculator helps you experiment with different deposit percentages, showing how even a small increase in your savings can reduce your monthly costs over time.

Understanding Long-Term Affordability

Shared ownership isn’t just about getting on the ladder; it’s about staying on it comfortably. Without proper planning, buyers risk choosing a share that stretches their finances too thin. The calculator makes it easy to compare scenarios, such as buying a 25% share vs 50%, so you can decide what’s sustainable in the long run.

Planning for Staircasing

Many people using shared ownership aim to buy more of their property over time, a process called staircasing. But every increase in ownership means adjusting your mortgage and reducing your rent. Planning with a calculator helps you see how your costs might change as you increase your share, giving you a roadmap for the future.

Reducing Stress and Uncertainty

Buying a home is stressful enough without confusing financial jargon and hidden costs. By using the Shared Ownership Calculator early, you eliminate uncertainty, reduce anxiety, and enter the process with confidence. It turns guesswork into clear numbers, so you always know where you stand.

How the Calculator Works Step-by-Step and Example

The Shared Ownership Calculator turns a lot of moving parts—share percentages, deposits, rent, interest rates, and service charges—into one clean picture of affordability. Follow this flow to get numbers you can trust.

Step 1: Enter the full property price

Start with the market value (e.g., £200,000, £240,000, £300,000). Everything else keys off this figure.

Step2: Choose the share you want to buy

Select 25%, 40%, 50%, 60%, 75% (or a custom value where available). The calculator immediately splits the home into:

- Your owned portion (the part you’ll mortgage)

- The unsold portion (the part you’ll pay rent on)

Step 3: Add your deposit

Input a deposit percentage or cash amount. Remember: in shared ownership, your deposit is usually based on the value of the share you’re buying, not the full property price. The tool then shows your required deposit and mortgage needed (owned share minus deposit). Plan your deposit precisely with the FinCalc House Deposit Calculator to set realistic saving targets.

Step 4: Set mortgage assumptions

Enter (or use defaults for) interest rate and term (e.g., 25 years). The calculator uses standard repayment formulas to estimate your monthly mortgage payment on the owned share.

Step 5: Enter the rent assumption on the unsold share

Most schemes set initial rent as a % of the unsold share’s value per year (commonly ~2.5%–3.0%). The calculator converts that to a monthly rent, so you see the ongoing cost clearly.

Step, Add service charges (optional but smart)

If your development includes service charges/ground rent, add a monthly estimate. The calculator then rolls everything into a single monthly total.

Step 7: Review your results.

You’ll see a tidy summary:

- Deposit required

- Mortgage amount (on your owned share)

- Monthly mortgage + monthly rent (+ optional service charges)

- Total monthly cost

- Helpful context like LTV on your share and quick stress-tests for rate rises.

Step, Test scenarios

Nudge the share (e.g., 40% → 50%), tweak the deposit (10% → 15%), or stress-test interest rates (+1%). The Shared Ownership Calculator updates in real time, so you can find your sweet spot for affordability and plans (including staircasing).

Worked Example

Property price: £240,000

Scenario A: Buy 40% with a 10% deposit on your share

- Your share value: £96,000

Deposit (10% of £96,000): £9,600

Mortgage required: £86,400

Mortgage payment (5.5%, 25y): ~£531/month

Unsold share value (60%): £144,000

Rent at 2.75% p.a.: ~£330/month

Service charge (example): £120/month

Total monthly: £531 + £330 + £120 = £981

Stress-test: If the mortgage rate rises from 5.5% → 6.5%, the mortgage payment would move to ~£583/month, taking the total to ~£1,033 (rent & service charge unchanged).

Scenario B: Buy 50% with a 10% deposit on your share

- Your share value: £120,000

Deposit (10%): £12,000

Mortgage required: £108,000

Mortgage payment (5.5%, 25y): ~£663/month

Unsold share value (50%): £120,000

Rent at 2.75% p.a.: ~£275/month

Service charge (example): £120/month

Total monthly: £663 + £275 + £120 = £1,058

Insight: owning more increases your mortgage payment but reduces rent. Scenario A has a lower total monthly cost today (~£981 vs ~£1,058), while Scenario B builds more equity and reduces exposure to rent inflation. If you increased the deposit to 15% in Scenario A, the mortgage payment drops to ~£501/month, trimming your total further.

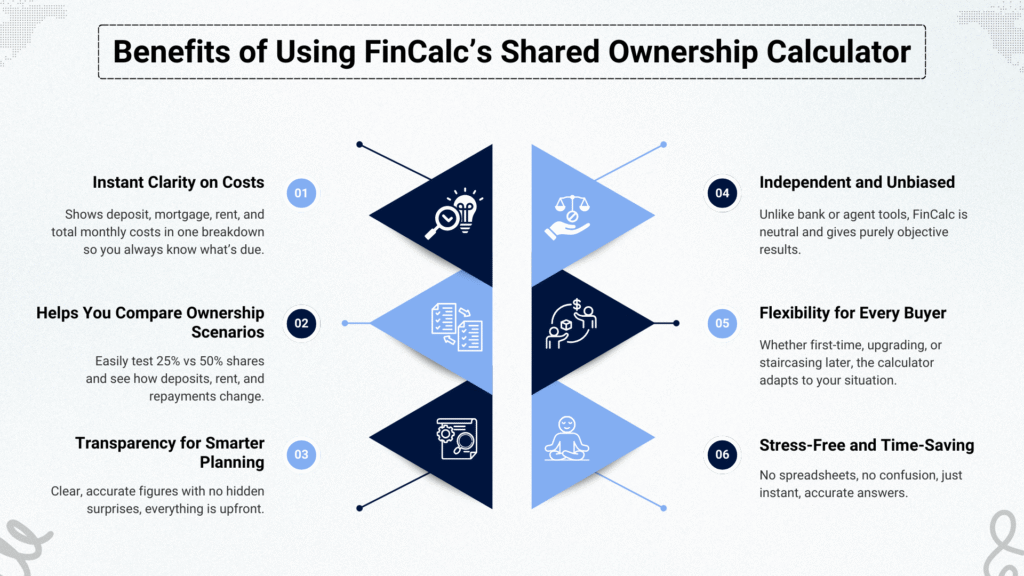

Benefits of Using FinCalc’s Shared Ownership Calculator

Shared ownership can be a fantastic route to homeownership, but only if you fully understand the financial commitments. Too often, buyers underestimate deposits, miscalculate rent, or fail to consider how monthly costs add up. The FinCalc Shared Ownership Calculator eliminates this uncertainty, giving you clear, accurate insights in seconds. Here’s why it’s the smarter choice.

Instant Clarity on Costs

The calculator doesn’t just give you one figure; it provides a complete breakdown of the deposit required, mortgage repayments, rent, and total monthly costs. This level of detail means you always know where your money is going.

Helps You Compare Ownership Scenarios

Wondering whether to buy 25% or 50% of a property? The calculator lets you test both options instantly. By toggling between different share percentages, you can see how your mortgage, deposit, and rent change, empowering you to choose the option that best fits your budget..

Transparency for Smarter Planning

Unlike some housing association tools that only show rough figures, FinCalc’s calculator provides accurate numbers with clear assumptions. You won’t be caught off guard by hidden costs because everything is laid out up front

Independent and Unbiased

Many calculators are tied to estate agents, banks, or housing associations, which can make the numbers feel more like sales pitches. FinCalc is completely independent. Our Ownership Calculator gives objective results, free from marketing spin.

Flexibility for Every Buyer

Whether you’re a first-time buyer, a family upgrading, or someone planning to staircase (buy a larger share later), the calculator adapts to your needs. You can adjust property values, deposit percentages, and share levels to see what works best for your circumstances.

Stress-Free and Time-Saving

No more fiddling with spreadsheets or second-guessing estate agent estimates. The Shared Ownership Calculator gives you instant, accurate answers, saving hours of stress and helping you move forward with confidence.

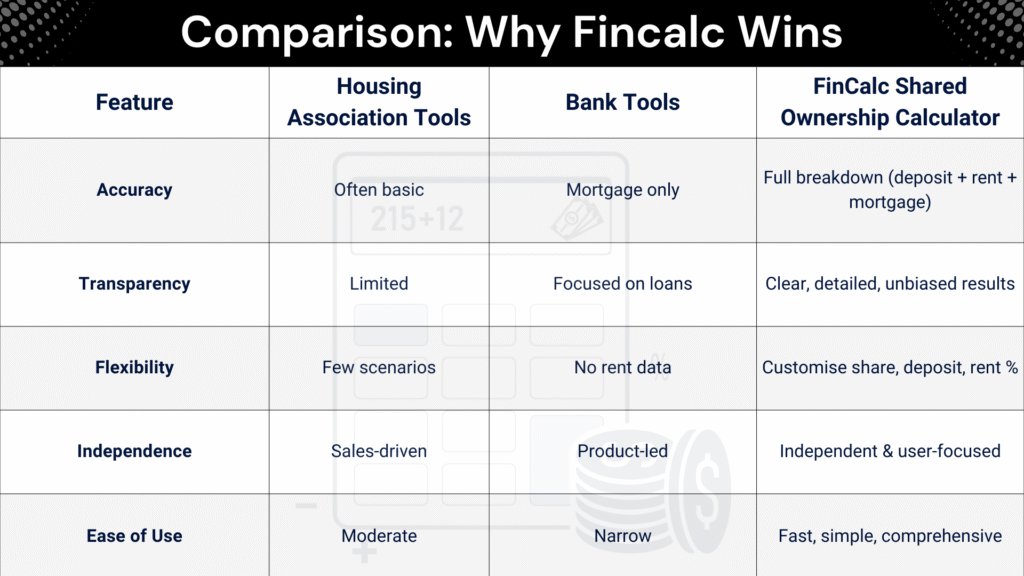

Comparison: Why FinCalc Wins

Real-Life Use Cases

Shared ownership is not one-size-fits-all. Different buyers enter the scheme with different goals, budgets, and long-term plans. The Shared Ownership Calculator helps each of them understand their costs clearly and plan with confidence. Here are some real-world scenarios where the calculator makes a real difference.

First-Time Buyer Stepping Onto the Ladder

Sophie, a 26-year-old teacher, wanted to buy her first home but struggled to save a full deposit. She found a shared ownership flat priced at £180,000 with a 40% share available. By entering the numbers into the Shared Ownership Calculator, Sophie discovered:

- Her share value: £72,000.

- Deposit at 10%: £7,200.

- Mortgage required: £64,800.

- Rent on the remaining 60%: ~£247/month.

Seeing the full monthly cost, including mortgage and rent, gave Sophie confidence that the property was affordable and helped her secure her first home.First-time buyers can build a complete plan with the FinCalc First-Time Buyer Mortgage Calculator once their shared-ownership numbers check out.

Family Upsizing Without Overstretching

The Khans were living in a small flat and wanted to move into a £300,000 shared ownership house. Unsure whether they could afford 50% ownership, they used the calculator to compare:

- 40% share: £120,000 (deposit: £12,000, mortgage: £108,000, rent on 60%: £413/month).

- 50% share: £150,000 (deposit: £15,000, mortgage: £135,000, rent on 50%: £344/month).

By testing both options, the Khans decided to start with 40% ownership to keep monthly costs manageable while planning to staircase later.

Professional Comparing Rent vs Ownership

David, a 30-year-old software engineer, was renting a flat for £1,200/month. Curious about whether shared ownership was a better value, he used the Ownership Calculator for a £250,000 apartment at 50% share:

- Deposit: £12,500.

- Mortgage repayment: ~£690/month.

- Rent on 50%: ~£286/month.

- Service charge: £120/month.

- Total monthly cost: £1,096.

Not only was this cheaper than renting, but it also meant David was building equity through his mortgage. The calculator helped him make a confident decision to buy.

Retiree Downsizing with Peace of Mind

Linda, 62, was downsizing into a shared ownership bungalow worth £200,000. She wanted to keep some of her cash accessible in retirement. Using the calculator, she compared a 25% share vs a 50% share. While the 50% share increased her equity, it also raised her monthly costs by nearly £200. By seeing the trade-off clearly, she chose the 25% share, keeping her finances flexible.

Buyer Planning for Staircasing

Mark bought a 25% share in a £240,000 property when he was 24. Five years later, he wanted to increase it to 50%. Using the Shared Ownership Calculator, he modelled the new deposit, mortgage size, and reduced rent. The tool showed him exactly how his costs would change and gave him a roadmap for moving toward full ownership over time.

Understanding the Numbers

Shared ownership can feel complicated because you’re not just buying a property outright; you’re splitting costs between a mortgage on your share, rent on the unsold portion, and often service charges. The Shared Ownership Calculator is designed to simplify this, but it helps to understand the numbers behind it.

How Rent is Calculated

When you buy part of a shared ownership home, you pay rent on the share you don’t own. Rent is usually set at around 2.5%–3% of the unsold share’s value per year. For example, if you buy 50% of a £200,000 property, the remaining £100,000 is owned by the housing association:

Rent at 2.75% = £2,750 annually, or about £229/month.

This rent will often increase annually, usually linked to inflation.

How Deposits Work

Unlike traditional home buying, your deposit is based on the value of your share, not the full property. For example:

- Property price: £250,000

Buying 40% share (£100,000)

Deposit at 10% = £10,000

This makes deposits much smaller than on the open market, helping buyers with limited savings get on the ladder.

Mortgage on Your Share

The mortgage covers the portion of the property you own, minus your deposit. If you bought the same £100,000 share with a £10,000 deposit, you’d borrow £90,000. The calculator estimates monthly repayments based on your interest rate and term.

Service charges

Many shared ownership properties are leasehold flats or houses on estates with communal areas. Service charges cover maintenance and can range from £50 to £200+ per month. The Shared Ownership Calculator allows you to add these, so you get a full picture of costs.

Why Choose FinCalc Over Others?

When it comes to shared ownership, there are a handful of calculators available online, some from housing associations, others from banks. But most of these tools are either too simplistic, too biased toward selling a product, or not updated often enough to reflect real affordability. The FinCalc Shared Ownership Calculator was built to solve those problems. It’s independent, transparent, and designed solely to help you make better decisions.

Independent and Unbiased

Unlike calculators tied to lenders or housing associations, FinCalc has no hidden agenda. Our results aren’t designed to “sell” you a mortgage or make a property look more affordable than it is. You get honest, accurate numbers every time.

Clear and Transparent Results

Where many tools simply show you a rough rent estimate or deposit figure, FinCalc goes further. The Ownership Calculator provides:

- Exact deposit needed.

Mortgage amount on your share.

Rent on the remaining share.

Optional service charge estimates.

Your total monthly cost.

This level of detail ensures you know exactly what you’re committing to.

Flexibility for Every Scenario

Whether you’re considering a 25% starter share, comparing 40% vs 50% affordability, or modelling staircasing to 100% in future, the calculator adapts. You can test multiple property prices, deposit levels, and share percentages in seconds.

Regularly Updated and Reliable

Many calculators sit online for years without updates, giving misleading figures. FinCalc is regularly refreshed to align with current shared ownership rent assumptions, deposit rules, and mortgage trends, so your results stay relevant.

Designed for Ease of Use

While some tools require clunky inputs or confusing jargon, the Shared Ownership Calculator is built for speed and simplicity. Enter a few details, and you get an instant, easy-to-read breakdown.

Conclusion

Shared ownership can be one of the most affordable and practical ways to step onto the property ladder, but it often leaves buyers with more questions than answers. How much deposit do you need? How much rent will you pay? And what will your total monthly costs look like? These uncertainties can make the process stressful and even stop people from moving forward. The FinCalc Shared Ownership Calculator removes this confusion by giving you instant, accurate answers tailored to your situation.

Whether you’re a first-time buyer aiming for your first 25% share, a family considering a bigger portion of a home, or someone planning to staircase in the future, the calculator provides clarity at every step. By breaking down deposit, mortgage, rent, and optional service charges, it empowers you to plan realistically and avoid surprises. With this tool, you’re no longer guessing; you’re making informed, confident decisions about one of life’s biggest milestones.

FAQs

What is shared ownership?

Shared ownership lets you buy a portion of a property (usually 25–75%) and pay rent on the remaining share owned by a housing association.

How does the Shared Ownership Calculator work?

You enter the property price, share percentage, and deposit. The calculator shows your deposit, mortgage amount, rent, and total monthly cost.

What share can I buy through shared ownership?

Most schemes allow you to buy between 25% and 75% initially. You may be able to increase your share later through a process called staircasing.

Do I still need a deposit with shared ownership?

Yes. Deposits are based on the value of the share you buy, not the full property price, which usually makes them smaller and more affordable.

How is rent calculated?

Rent is typically set at 2.5%–3% of the unsold share’s value per year. The calculator applies this percentage to estimate your monthly rent.

Can I increase my share later on?

Yes. This is called staircasing. You can buy more shares over time until you eventually own 100% of the property.

Are service charges included in the calculator?

Yes, you can add an estimated service charge to see your full monthly cost alongside your rent and mortgage payments.

Is shared ownership cheaper than renting?

In many cases, yes. Your total monthly cost may be lower than renting, and you’re building equity in your share at the same time.

Can first-time buyers use shared ownership?

Yes, shared ownership was designed to help first-time buyers who can’t afford to buy outright. It’s also available to others who meet eligibility rules.

Does the calculator show mortgage rates?

Yes, the Shared Ownership Calculator estimates mortgage repayments based on the interest rate and term you enter, so you can test scenarios.