Mortgage Term Calculator Free Online Tool: FinCalc

Estimated Term

Total Interest

Total Repayment

Monthly Interest

For most people, a mortgage is the single largest financial commitment they will ever take on. It can span 20, 25, or even 30 years, tying up your finances for decades. While most homeowners focus on interest rates and monthly repayments, the actual length of your mortgage term is just as important. The term not only determines how long you’ll be paying, but also how much total interest you’ll end up paying over the life of the loan. The challenge? Few people truly understand how changes in monthly payments or interest rates can affect their mortgage term.

Paying a little more each month could shave years off your repayment schedule, while extending your term might lower monthly costs but significantly increase total interest. That’s where the FinCalc Mortgage Term Calculator comes in. This simple yet powerful tool shows you, instantly, how long it will take to clear your mortgage based on your current balance, interest rate, and monthly payments. It also lets you test different scenarios, from increasing payments to adding lump sums, so you can make informed, confident decisions.

What is a Mortgage Term Calculator?

A mortgage term is simply how long it will take to repay your home loan in full, usually 15, 20, 25, or 30 years. It dictates two things that matter most to homeowners: the size of your monthly payment and the total interest you’ll pay across the life of the loan. The Mortgage Term Calculator translates those moving parts, loan balance, interest rate, and monthly payment into one clear output: how many months (and years) until you’re mortgage-free.

Here’s the big win: instead of guessing, you can model reality. Enter your remaining balance, your annual interest rate, and what you actually pay each month (including any regular overpayment). Instantly, the calculator projects your payoff timeline. If you tweak the payment, say you add £75 more per month, it recomputes the term and shows how much time you shave off and how much interest you avoid. That’s operational clarity you can act on today.

- Your projected payoff date and total months remaining.

- The interest you’re on track to pay versus what you’d pay if you increase contributions.

- The impact of a one-off lump sum versus a small, recurring overpayment.

- How different interest rates (e.g., after a remortgage) change your finish line.

Think of it as an interactive “what-if” machine. Want to see how a new fixed rate at 4.25% affects your timeline? Update the rate. Curious whether £50 extra per month beats a one-time £1,000 overpayment? Test both and compare. Planning a remortgage next year with a shorter term and slightly higher payment? Model it now and avoid surprises later.

Now increase the monthly payment to £1,220 (just £100 more). You could trim well over a year off the term and save thousands in interest without any risky financial gymnastics. Prefer a lump sum? Drop £3,000 against the balance, and the Mortgage Term Calculator will show an immediate reduction in months remaining, plus the interest you’ll no longer pay on that chunk. Want the exact monthly payment for a specific term? Run it in the Mortgage Repayment Calculator.

Why Mortgage Term Planning Matters?

Taking on a mortgage isn’t just about securing the loan and making the monthly payments. It’s about understanding how long you’ll be tied to that loan, how much interest you’ll pay, and how those choices impact your wider financial life. This is where term planning comes into play, and why using a tool like the Mortgage Term Calculator is so important.

The Length of Your Term Changes Everything

A shorter mortgage term means higher monthly payments, but it also means clearing your debt sooner and paying significantly less interest overall. A longer term reduces monthly payments, making them more affordable in the short term, but it also stretches repayments across decades and can add tens of thousands to your total cost. This calculator helps you visualise both sides of this trade-off.

The True Cost of Interest

Interest is where most homeowners underestimate the impact of term length. For example, on a £200,000 mortgage at 4% over 30 years, you could pay around £143,000 in interest.

Over 20 years, that interest drops to about £91,000.

That’s a difference of more than £50,000, just by reducing the term. Without planning, many people unknowingly commit to paying far more than necessary. If you’re considering a shorter term on a new deal, compare it side-by-side in the FinCalc Remortgage Calculator.

Avoiding Financial Stress

A mortgage that feels affordable at the start can become a burden later if it runs too long or if repayments aren’t managed carefully. By planning, you avoid the “payment trap” of low monthly instalments but huge long-term costs. The Mortgage Term Calculator lets you find the right balance between monthly affordability and long-term savings.

Flexibility for Life Changes

Life rarely goes exactly as planned. Career moves, family changes, or retirement goals all affect how much you can or should pay toward your mortgage. A calculator lets you test scenarios, like adding £100 a month or making a one-off overpayment, so you can adapt your term planning to real-life changes.

Peace of Mind and Financial Freedom

There’s also an emotional side to term planning. Knowing you’ll be mortgage-free by a specific age, perhaps before retirement or before your children start university, provides peace of mind. The Mortgage Calculator helps turn vague hopes into concrete timelines, giving you confidence in your financial future.

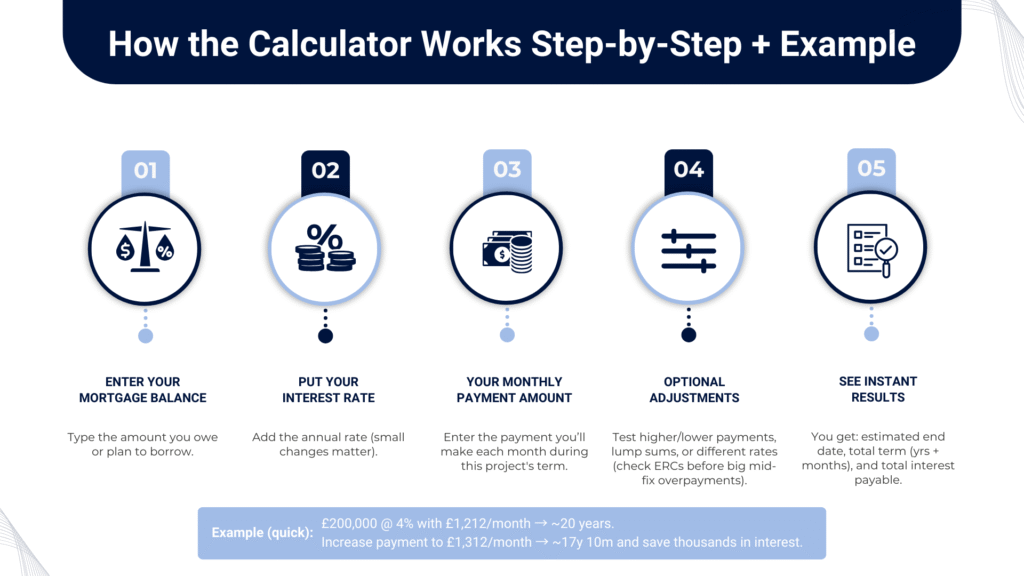

How the Calculator Works Step-by-Step + Example

The Mortgage Term Calculator takes the complexity out of mortgage maths and turns it into a simple, actionable result. Instead of guessing how long you’ll be repaying or relying on vague lender estimates, you can see the exact impact of your payments on your mortgage term. Here’s how it works.

Step 1:Enter Your Mortgage Balance

Start with the amount you currently owe or plan to borrow. This forms the base for the calculation.

Step 2: Put Your Interest Rate

Add your mortgage’s annual interest rate. Even small changes in the rate significantly affect how long it takes to pay off your loan.

Step 3, E: Your Monthly Payment Amount

This is where planning becomes powerful. The calculator uses your monthly repayment to project how long it will take to clear your balance at the given interest rate.

Step 4, Optional Adjustments

You can test scenarios by adjusting monthly payments, making lump sum contributions, or changing interest rates. This shows how flexible strategies can reduce the length of your term.Making a big overpayment mid-fix? Check any potential ERC first with the Early Mortgage Repayment Penalty Calculator.

Step 5: See Instant Results

The Mortgage Term Calculator then provides:

- The estimated mortgage end date.

- The total term length (in years and months).

- The total interest payable over the term.

How much faster could you finish by increasing payments?

Worked Example

Imagine you have a £180,000 mortgage at 4.5% interest.

- If you pay £950/month:

- Mortgage term: ~28 years

- Total interest: ~£124,000

- If you pay £1,150/month:

- Mortgage term: ~22 years

- Total interest: ~£100,000

- If you add a £200 lump sum annually:

- The term is reduced by ~2 years.

- Interest savings: ~£12,000

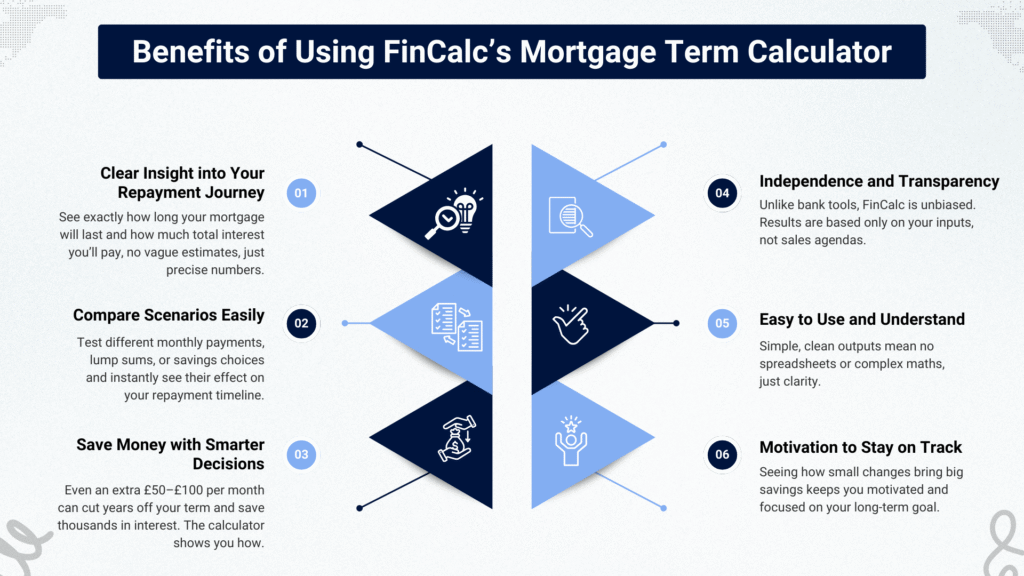

Benefits of Using FinCalc’s Mortgage Term Calculator

Choosing the right mortgage and repayment plan isn’t just about securing a loan; it’s about understanding how long you’ll be paying it back and how much it will truly cost you. Many borrowers underestimate the importance of the term length, or they rely on vague lender figures that don’t tell the full story. The FinCalc Mortgage Term Calculator changes that by giving you clarity, flexibility, and confidence.

Clear Insight into Your Repayment Journey

Instead of guessing or relying on generic mortgage brochures, the calculator shows you exactly how long your loan will last at your current repayment level. You’ll see the total years and months, plus the total interest payable, information that can transform your financial planning.

Compare Scenarios Easily

Should you keep paying £950 a month, or stretch to £1,100? Should you make a one-off lump sum now, or keep money in savings? The Mortgage Calculator lets you test these choices instantly, showing how they affect your repayment timeline and long-term costs.

Save Money with Smarter Decisions

Small changes can make a huge impact. By showing you how even an extra £50–£100 per month shortens your term, the calculator helps you save thousands in interest. It turns “what if” scenarios into concrete savings strategies.

Independence and Transparency

Unlike bank calculators that often push you toward their products, FinCalc is independent and unbiased. The Mortgage Term Calculator provides accurate results based solely on your numbers, without hidden agendas or sales pitches.

Easy to Use and Understand

Spreadsheets and financial tables can be intimidating. FinCalc simplifies the process, delivering results in a clean, easy-to-read format. You don’t need to be a maths expert to understand your mortgage; the calculator does the heavy lifting for you.

Motivation to Stay on Track

When you can clearly see that an extra £100 a month will save you five years of repayments, it’s far easier to stay motivated. The calculator helps turn abstract financial goals into visible progress, keeping you focused on the bigger picture.

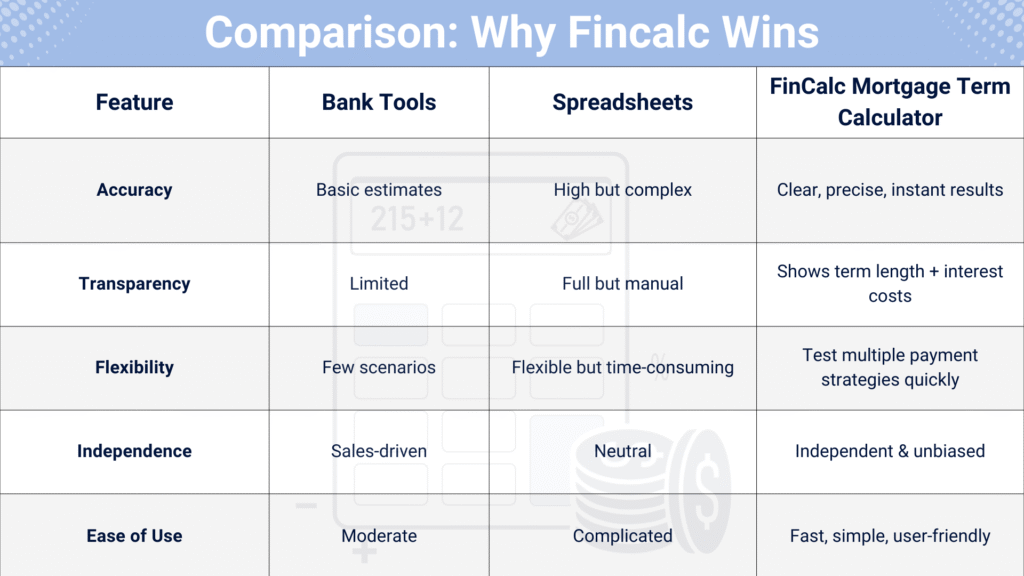

Comparison: Why FinCalc Wins

Feature | Bank Tools | Spreadsheets | FinCalc Mortgage Term Calculator |

Accuracy | Basic estimates | High but complex | Clear, precise, instant results |

Transparency | Limited | Full but manual | Shows term length + interest costs |

Flexibility | Few scenarios | Flexible but time-consuming | Test multiple payment strategies quickly |

Independence | Sales-driven | Neutral | Independent & unbiased |

Ease of Use | Moderate | Complicated | Fast, simple, user-friendly |

Big savings goals can feel overwhelming when you only look at the final figure. A £20,000 wedding or a £40,000 house deposit sounds intimidating, but when broken down into smaller chunks, it suddenly becomes achievable. That’s exactly what the Savings Goal Calculator does: it translates your big target into monthly actions you can actually follow.

Breaking Down Your Goal Into Monthly Targets

Every savings plan comes down to one formula: Total Goal ÷ Time = Monthly Contribution. For example, a £12,000 car over 3 years is £333/month. If you already have £2,000 saved, that drops to £278/month. The calculator handles this math instantly, showing you both the total and the monthly breakdown.

Short-Term vs Long-Term Savings

- Short-term (under 1 year): Goals like holidays require larger monthly amounts, but they’re achievable if you’re disciplined.

- Medium-term (2–5 years): House deposits or weddings fit here. Regular monthly saving builds momentum without overwhelming your budget.

- Long-term (5+ years): Education or retirement goals require patience, smaller contributions, and often benefit from compounding.If a short-term loan is tempting to bridge a gap, sanity-check the total cost with the Payday Loan Interest Calculator first.

Worked Example 1: Holiday Fund (Short-Term)

- Goal: £3,600, Timeline: 12 months, Current: £600

- Result: £250/month required.

- Lesson: Even modest savings add up quickly when spread over time.

Worked Example 2: Wedding

- Goal: £20,000, Timeline: 24 months, Current: £2,000

- Result: ≈ £750/month.

- Lesson: Medium-term goals balance ambition with feasibility, and realistic planning avoids last-minute loans.

Worked Example 3: House Deposit

- Goal: £40,000, Timeline: 60 months, Current: £5,000

- Result: ≈ £583/month.

- Lesson: Breaking big dreams into smaller monthly goals makes them realistic and less intimidating.

Why Realistic Targets Matter

Many people either under-save (“I’ll just put away £100 a month”) and fall short, or over-save (“I’ll try £1,500 a month”) and burn out within weeks. The calculator ensures your plan is balanced, ambitious enough to reach your goal, but achievable enough to stick with consistently.

Real-Life Use Cases

Every homeowner has different financial goals, but one thing is constant: understanding your mortgage term is critical to long-term planning. The Mortgage Term Calculator helps people in very different situations make smarter, more confident choices. Here are some real-life scenarios where the tool proves invaluable.

First-Time Buyer Seeking Clarity

Sarah, a 27-year-old first-time buyer, took out a £180,000 mortgage with a 25-year term. She worried about how long she’d be paying and whether increasing her repayments would really make a difference. By using the Mortgage Calculator, she discovered that adding just £75 extra a month would cut her term by over 3 years and save her nearly £14,000 in interest. That insight gave her the motivation to start overpaying early.

Family Moving to a Larger Home

The Khan family upgraded to a £280,000 home with a 30-year mortgage. Concerned about stretching repayments too far, they used the calculator to compare terms:

- £1,050/month → 30 years to repay.

- £1,250/month → term reduced to ~24 years.

- One £5,000 lump sum → cut 18 months off their mortgage.

Seeing the numbers laid out clearly helped them choose a repayment plan that balanced affordability today with savings tomorrow.

Professional Planning Aggressive Repayment

David, a 35-year-old lawyer, wanted to retire mortgage-free by age 50. His £220,000 mortgage had 22 years left, but the calculator showed that by paying £400 extra each month, he could reduce his term to just 13 years. The Mortgage Term Calculator allowed him to build a strategy that matched his high income with his financial ambitions.

Retiree Downsizing with Confidence

Linda, 60, downsized into a smaller home with a £120,000 mortgage. She wanted the peace of mind of clearing it before retirement. Using the calculator, she tested paying £1,100/month instead of £950. The results showed she’d be mortgage-free 4 years sooner, giving her confidence that she could enter retirement debt-free.

Investor Managing Multiple Properties

James, a property investor with several buy-to-let mortgages, needed to decide which loan to overpay first. The calculator let him compare the term lengths and total interest across each mortgage. By targeting the one with the highest interest rate, he maximised savings and improved his cash flow for future investments.

Understanding the Numbers

Mortgages can feel complicated, but at their core, they follow simple maths: the amount you borrow, the interest rate, and the repayment term determine how much you’ll pay back in total. The Mortgage Calculator helps you make sense of these numbers so you can see how every decision affects your long-term costs.

How Amortisation Works?

Mortgages are typically repaid through amortisation, a process where each monthly payment covers both interest and principal. In the early years, most of your payment goes toward interest. As the balance decreases, more of your payment is applied to the principal. Over time, the scales shift, but the term you choose directly influences how quickly this process happens.

The Power of Overpayments

Even if you’re locked into a standard term, overpayments can dramatically shorten your mortgage. For instance, paying just £100 extra per month on that same £200,000 mortgage (30 years at 4%) could reduce the term by more than 4 years and save over £25,000 in interest. The Mortgage Term Calculator makes these scenarios easy to visualise.

Lump Sum vs Monthly Adjustments

The timing of payments also matters. A lump sum early in the mortgage can cut years off your term because it immediately reduces the balance on which interest is charged. Regular monthly overpayments build discipline and still deliver impressive savings. The calculator lets you compare both approaches side by side.

Why Numbers Matter for Planning

Without seeing the real figures, many people underestimate the cost of a long mortgage or overestimate the difficulty of paying it off faster. By turning abstract interest percentages into clear, digestible results, the Mortgage Calculator empowers you to make smarter financial decisions.Sense-check that the faster payment still fits your budget with the FinCalc Mortgage Affordability Calculator.

Why Choose FinCalc Over Others?

There are dozens of mortgage calculators online, from bank websites to comparison portals. But many of them are limited in scope, overly simplistic, or biased toward promoting financial products. The FinCalc Mortgage Term Calculator was designed with one goal: to give you clear, accurate, and independent results so you can plan your mortgage with confidence.

Independent and Unbiased

Most lender calculators are tied to sales objectives, nudging you toward specific mortgage deals or repayment terms. FinCalc is different. Our Mortgage Calculator is completely independent, offering transparent insights without hidden agendas.

Transparency and Detail

While many tools provide rough estimates, FinCalc goes further by breaking down:

- How long will it take to clear your mortgage?

- The total interest you’ll pay across the term.

- The effect of adjusting monthly payments or adding lump sums.

This level of detail ensures you get the full picture, not just a headline figure.

Flexibility to Test Real Scenarios

Should you add an extra £100 per month? Should you aim for a 20-year term instead of 25? The Mortgage Term Calculator lets you explore multiple repayment strategies quickly and easily, so you can find a plan that balances affordability today with savings tomorrow.

Regularly Updated and Reliable

Unlike static tools left outdated on bank websites, FinCalc is refreshed regularly to reflect real-world mortgage practices, interest rate changes, and lender rules. That means the numbers you see are always relevant.

Designed for Simplicity

You don’t need financial expertise to use the calculator. The design is intuitive, the results are clear, and you’ll know exactly how your choices affect your mortgage term within seconds.

Conclusion

Your mortgage isn’t just about the money you borrow; it’s about how long you’ll be repaying it and how much it will cost in the end. Too often, homeowners focus only on interest rates or monthly affordability, overlooking how the term shapes their financial future. A longer term may seem comfortable now, but it adds decades of debt and thousands in extra interest. A shorter term demands more each month, but it can save you a fortune and bring financial freedom much sooner.

The FinCalc Mortgage Term Calculator gives you the power to see these trade-offs clearly. By showing how your payments, interest rate, and overpayments affect your mortgage term, it transforms confusion into clarity. Whether you’re a first-time buyer, a family upgrading, or a homeowner looking to pay off early, this tool gives you control over one of life’s biggest commitments.

FAQs

What is a mortgage term?

A mortgage term is the length of time you have agreed to repay your loan. It’s usually between 15 and 35 years, depending on your lender and repayment plan.

How does the Mortgage Term Calculator work?

By entering your loan amount, interest rate, and monthly payments, the calculator shows how long your mortgage will take to repay and how much interest you’ll pay.

Why does the mortgage term matter?

Your term affects both monthly affordability and long-term costs. Shorter terms mean higher monthly payments but far less interest overall.

Can I change my mortgage term after taking out a loan?

Yes, many lenders allow term adjustments when you remortgage or renegotiate. The calculator helps you test how different terms affect repayments.

How does making overpayments affect my term?

Overpayments reduce your balance faster, which shortens your term and lowers interest. Even small extras can cut years off your mortgage.

Does the calculator include lump sum payments?

Yes, you can test how a one-off lump sum affects your term and interest savings, alongside your regular monthly repayments.

What is the average mortgage term in the UK?

Most mortgages are around 25 years, though younger buyers often stretch to 30–35 years, while some choose shorter terms to save on interest.

How much interest can I save with a shorter term?

It depends on your loan size and rate, but reducing from 30 years to 20 years can save tens of thousands of pounds in interest.

Is a longer mortgage term always bad?

Not necessarily. Longer terms mean smaller monthly payments, which can make homeownership affordable, but you’ll pay more in interest over time.

Can first-time buyers use the Mortgage Term Calculator?

Yes. It’s perfect for first-time buyers who want to see the true cost of their mortgage and how repayment terms affect affordability.