The Most Accurate Mortgage Overpayment Calculator UK

Normal Term

Reduced Term

Interest Saved

Total Paid

For most homeowners, a mortgage is the largest financial commitment they’ll ever take on. It stretches across decades, and while making regular monthly payments keeps you on track, many people wonder: What if I could pay it off sooner? The truth is, even small extra payments toward your mortgage can save you years of repayments and thousands in interest. The challenge, however, is knowing exactly how much of a difference those overpayments will make. That’s where the FinCalc Mortgage Overpayment Calculator comes in.

This simple yet powerful tool shows you, in seconds, how much interest you’ll save and how many years you can shave off your mortgage by making regular or one-off overpayments. By entering your current balance, interest rate, and repayment term, you’ll instantly see the impact of paying a little extra each month or putting down a lump sum. Whether you’re a first-time buyer eager to clear your loan faster, a family planning for long-term financial security, or someone looking for the peace of mind that comes with being debt-free, the Overpayment Calculator gives you clarity, control, and confidence.

What is a Mortgage Overpayment Calculator?

A Mortgage Overpayment Calculator is a financial tool that helps homeowners see the impact of paying more than their required monthly mortgage repayment. Mortgages are structured so that interest is calculated on the outstanding balance. By paying extra, either regularly each month or through occasional lump sums, you directly reduce the balance faster. This means less interest is charged over time and, ultimately, you pay off your mortgage sooner.

But while the principle is simple, the actual numbers can be tricky. How much will an extra £50, £100, or £200 a month save in interest? How many years could you cut off your term if you paid a lump sum now instead of later? Without a calculator, you’re left guessing. The Overpayment Calculator removes this uncertainty by giving you clear, instant answers tailored to your loan. Here’s what it typically shows:

- New Mortgage End Date: How much sooner will you clear the loan?

- Total Interest Saved: the money you no longer pay the bank.

- Revised Monthly Payments (if applicable): depending on whether you keep the same term or shorten it.

For example, if you have a £200,000 mortgage at 4% interest with 20 years remaining, paying an extra £100 a month could save you nearly £15,000 in interest and cut years off your term. A lump sum of £10,000 could bring even bigger savings. This tool is particularly useful because most lenders allow limited overpayments (often up to 10% of the outstanding balance per year without penalty). The calculator helps you model different strategies within those limits, so you can decide whether to make steady monthly overpayments or occasional one-off payments.

In short, the Mortgage Overpayment Calculator is not just about crunching numbers; it’s about giving you control. It shows you the hidden power of small extra payments, turns vague ideas into concrete plans, and helps you take a smarter, faster path toward financial freedom.

Why Overpayment Planning Matters

Making mortgage overpayments can be one of the smartest financial moves a homeowner makes. Even small extra payments can reduce your total interest bill and bring you closer to living mortgage-free. But without proper planning, many people either underestimate the power of overpayments or, worse, overstretch themselves financially. The Mortgage Overpayment Calculator solves this by showing exactly what’s possible and helping you avoid costly mistakes.

The Power of Small Extras

Most homeowners don’t realise that even an extra £50 or £100 a month can cut years off their mortgage. Interest compounds on your outstanding balance, so the faster you reduce that balance, the less interest builds up. Proper planning shows you how these “small” amounts can add up to tens of thousands in long-term savings.

Balancing Overpayments with Daily Life

While overpaying is beneficial, it’s important to strike a balance. Putting too much toward your mortgage without considering other expenses could leave you short in emergencies. Planning ensures your overpayments are realistic and sustainable. The calculator helps you test different amounts until you find the sweet spot between saving money and keeping financial flexibility.

Avoiding Guesswork

Too many buyers assume overpayments only make a tiny difference, or they believe you need huge lump sums to make an impact. This misconception stops people from acting. The Mortgage Overpayment Calculator proves otherwise, with clear, personalised results. Seeing the actual interest savings and reduced mortgage term motivates you to stay consistent.

Considering Penalties and Limits

Most lenders allow overpayments of up to 10% of the outstanding balance each year without penalty. Going beyond this may trigger early repayment charges. Planning with the calculator ensures your strategy stays within the rules, helping you maximise benefits without incurring unnecessary fees. If you’re worried about fees, the Early Mortgage Repayment Penalty Calculator shows whether your lender charges for paying off your loan faster.

Peace of Mind and Financial Freedom

There’s also an emotional side to overpayments. Knowing you’re on track to clear your mortgage years earlier reduces long-term stress and gives you peace of mind. For many, this means reaching retirement mortgage-free or freeing up income for other life goals like travel, investments, or supporting family.

How the Calculator Works Step-by-Step and Example

The Mortgage Overpayment Calculator is designed to take the mystery out of overpayments and show you, in simple terms, how much time and money you can save. By entering just a few details, you can instantly see the long-term impact of paying extra toward your mortgage. Here’s how it works.

Step 1: Enter Your Mortgage Balance

Start with the amount you still owe on your mortgage. This is the foundation for all the calculations.

Step 2: Add Your Interest Rate

Input the interest rate your lender charges. Even small differences in rates dramatically affect how much you can save with overpayments.

Step 3: Enter the Remaining Term

Add the number of years left on your mortgage. This helps the calculator estimate how long you’d otherwise be paying if you only made the standard repayments.

Step 4: Choose Your Overpayment Amount

Decide whether you want to model regular monthly overpayments, a one-off lump sum, or both. The calculator allows you to test each scenario instantly.

Step 5: See Instant Results

Once your details are entered, the Mortgage Overpayment Calculator shows you:

- The new mortgage end date (how much sooner you’ll be debt-free).

- The interest savings from paying more.

- The reduction in total term length (in months or years).

Step 6: Test Multiple Scenarios

The real power lies in testing options. You can adjust overpayments to see how much difference £50, £100, or £200 a month makes, or compare a £5,000 lump sum vs. £10,000. This flexibility helps you find a strategy that fits your budget.

Worked Example

Mortgage Balance: £200,000

Interest Rate: 4%

Term Remaining: 20 years

- Without overpayment:

- Monthly repayment: ~£1,212

- Total interest paid: ~£91,000

- Mortgage ends in 20 years

.

- Monthly repayment: ~£1,212

- With £100 monthly overpayment:

- Mortgage repaid in ~17 years, 10 months.

- Interest saved: ~£13,500

- Mortgage repaid in ~17 years, 10 months.

- With £200 monthly overpayment:

- Mortgage repaid in ~16 years, 4 months.

- Interest saved: ~£24,000

- Mortgage repaid in ~16 years, 4 months.

- With a £10,000 lump sum now:

- Mortgage repaid in ~18 years, 3 months.

- Interest saved: ~£16,500

- Mortgage repaid in ~18 years, 3 months.

Benefits of Using FinCalc’s Mortgage Overpayment Calculator

Many homeowners want to pay down their mortgage faster, but most struggle to understand the exact impact of overpaying. Bank statements show only minimum repayments, lender tools often oversimplify, and spreadsheets can feel overwhelming. That’s where the FinCalc Mortgage Overpayment Calculator stands out. It provides clarity, independence, and motivation to help you take control of your mortgage.

Instant Clarity on Savings

Instead of guessing, you get hard numbers. The calculator shows you exactly how much interest you’ll save and how many months or years you’ll cut from your term by overpaying. Seeing this in real time makes the benefits tangible and motivating.

Compare Different Overpayment Strategies

Should you add an extra £50 a month, or save for a lump sum of £5,000? The Mortgage Overpayment Calculator lets you test both approaches and see which gives the biggest payoff. This flexibility means you can match your overpayment strategy to your personal financial situation.

Transparency and Control

Unlike many bank calculators that gloss over assumptions, FinCalc’s tool is transparent. You see the full breakdown: your deposit, outstanding balance, term reduction, interest saved, and new end date. No vague estimates, just clear, unbiased numbers.

Independent and Unbiased

Bank and lender calculators are often designed to steer you toward specific mortgage products. FinCalc is completely independent. The Mortgage Overpayment Calculator gives you results without hidden sales pitches, so you know the decisions you make are based on facts, not marketing.

Motivation to Stay Consistent

One of the hardest parts of overpaying is sticking with it month after month. By showing you exactly how your extra payments reduce years off your term, the calculator turns discipline into motivation. It’s easier to commit when you can clearly see the long-term reward.

Saves Time and Reduces Stress

Forget building complex spreadsheets or calling your lender for estimates. The Mortgage Overpayment Calculator does all the heavy lifting in seconds. That means you spend less time calculating and more time acting.

Real-Life Use Cases

Every homeowner’s financial journey looks different, but the one thing they all share is a desire to reduce debt and gain freedom sooner. The Mortgage Overpayment Calculator helps turn that goal into a realistic plan. Here are some scenarios that show how different people use the tool to make smarter choices.

The Young Couple Cutting Years Off Their Loan

Emma and Jack bought their first home with a £200,000 mortgage at 4% over 25 years. They wanted to be mortgage-free before starting a family. By using the Mortgage Calculator, they discovered that by paying an extra £150 a month, they could shave nearly five years off their mortgage and save over £25,000 in interest. Seeing the numbers motivated them to budget carefully and commit to regular overpayments.

The Family Planning for Children’s Education

The Patel family had a £250,000 mortgage with 18 years left. Their priority was freeing up money for university costs. The calculator showed that making a lump sum overpayment of £10,000 from savings would shorten their term by 2 years and save nearly £18,000 in interest. This insight gave them peace of mind, knowing they could redirect funds toward their children’s future.

The Professional with Annual Bonuses

David, a finance manager, received yearly bonuses but wasn’t sure how best to use them. By modelling different one-off payments in the Mortgage Calculator, he saw that paying £5,000 annually into his mortgage could clear it 7 years early, saving him nearly £40,000 in interest. The tool turned his bonuses into a long-term financial strategy.

The Retiree Seeking a Debt-Free Retirement

Linda, aged 60, had 10 years left on her mortgage and wanted to retire without debt. With £20,000 in savings, she tested the effect of a lump sum payment. The calculator showed her that applying it immediately would cut nearly three years off her term and save thousands in interest. That clarity helped her decide to act, securing her retirement plans.

The Property Investor Managing Cash Flow

James, who owned several rental properties, needed to balance cash flow while reducing debt. Using the calculator, he modelled overpayments across different mortgages and identified which one produced the greatest interest savings. By focusing on his highest-rate loan, he maximised returns without overstretching his portfolio.

Understanding the Numbers

Mortgages are often described as “the biggest loan you’ll ever take out,” and for good reason. They last decades and cost tens of thousands in interest. Overpayments are powerful because they target the way mortgages are structured. The Mortgage Overpayment Calculator makes this easy to see by breaking down the numbers behind your loan.

How Interest Works

Mortgage interest is usually calculated daily or monthly on the outstanding balance. The larger your balance, the more interest you’re charged. Overpayments reduce that balance faster, which means less interest accrues. Every pound you overpay is a pound that can no longer generate interest charges.

Impact of Monthly Overpayments

Consider a £200,000 mortgage at 4% interest with 20 years remaining:

Standard repayment: ~£1,212/month.

With £100 extra per month: Mortgage clears ~2 years earlier, saving ~£13,500 in interest.

With £200 extra per month: Mortgage clears ~3 years 8 months earlier, saving ~£24,000.

Even modest monthly overpayments deliver significant long-term results.

Extra payments reduce your balance and improve your ratio. Check your progress with the Loan to Value (LTV) Calculator to see how overpayments affect equity.

Impact of Lump Sum Payments

Lump sums also accelerate repayment. For example, with the same £200,000 mortgage:

Paying a one-off £10,000 now reduces the balance immediately.

This shortens the term by ~1 year 9 months and saves ~£16,000 in interest.

The earlier you make the lump sum, the bigger the savings, since more interest is prevented from compounding.

Planning to save a lump sum for overpayments? Use the House Deposit Calculator to see how much you could set aside for either your deposit or future mortgage top-ups.

Keeping the Same Term vs Shortening It

When you overpay, lenders may give you two options:

Keep the term the same, but reduce monthly payments.

Keep monthly payments the same, but shorten the term.

The Mortgage Overpayment Calculator shows how both options affect your costs, so you can choose whether lower monthly outgoings or faster repayment is more valuable.

The Effect of Interest Rates

The higher the rate, the more powerful overpayments become. For instance:

- At 3% interest, an extra £100/month saves ~£11,000.

- At 5% interest, the same £100/month saves ~£17,000.

The calculator highlights this, showing how even a small rise in rates makes overpayments even more impactful.

Don’t Forget Overpayment Limits

Most lenders allow penalty-free overpayments of up to 10% of the outstanding balance per year. Exceeding this may trigger early repayment charges. Understanding these limits ensures you save money without incurring extra fees.

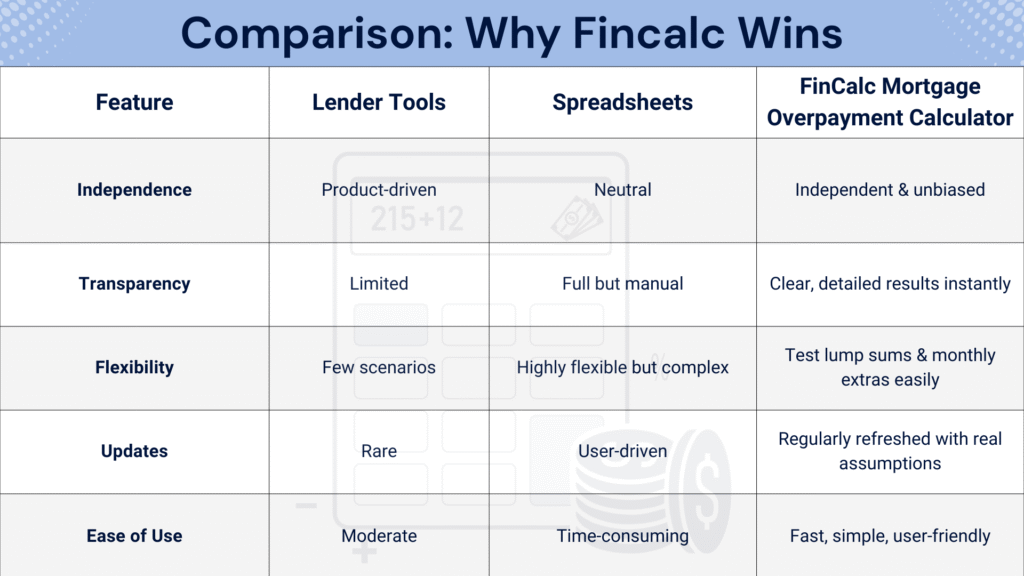

Why Choose FinCalc Over Others?

There’s no shortage of mortgage calculators online. Banks, lenders, and comparison sites all offer their own versions. But most of them are either too simplistic, biased toward selling a product, or not designed to answer the exact question homeowners ask: “How much faster can I pay off my mortgage by overpaying, and how much will I save?” That’s why the FinCalc Mortgage Overpayment Calculator stands apart.

Independent and Unbiased

Lender calculators are often designed to make their products look attractive. They may underestimate costs, gloss over assumptions, or guide you toward specific deals. FinCalc has no hidden agenda; our Mortgage Calculator is built to give you clear, honest results, free of marketing spin.

Transparency and Detail

Many calculators stop at rough figures. FinCalc goes deeper, showing:

- The exact interest savings.

The years and months are cut from your term. - The impact of monthly vs lump sum overpayments.

- Options to shorten your term or reduce monthly payments.

This transparency means you get answers you can trust, not vague estimates.

Flexibility to Test Scenarios

Should you add £50, £100, or £200 a month? Or is a £5,000 lump sum more effective? The Mortgage Overpayment Calculator lets you test them all instantly. This flexibility helps you create a repayment strategy tailored to your budget and goals.

Always Updated, Always Relevant

Some online tools sit untouched for years, leaving you with outdated assumptions. FinCalc is regularly updated to reflect real-world mortgage practices, interest rate trends, and lender rules, so your results are always accurate.

Designed for Ease of Use

Forget clunky spreadsheets or calculators buried in jargon. FinCalc’s tool is simple, intuitive, and fast. In less than a minute, you’ll see exactly how much time and money you can save.

Comparison: Why FinCalc Wins

Conclusion

A mortgage may be the biggest financial commitment you ever take on, but it doesn’t have to last the full 20 or 25 years. With smart planning, you can cut years off your loan and save thousands in interest. The challenge is knowing exactly how much difference your extra payments will make. That’s where the FinCalc Mortgage Overpayment Calculator becomes invaluable. This simple yet powerful tool takes the guesswork out of overpayments by showing you, in seconds, how much time and money you’ll save.

Whether you’re making small monthly top-ups, one-off lump sum payments, or testing a combination of both, the calculator provides a clear, unbiased breakdown of your results. For first-time buyers, growing families, professionals with irregular income, or retirees planning for a debt-free future, the Overpayment Calculator delivers the clarity and motivation you need to act with confidence.

FAQs

What is a mortgage overpayment?

A mortgage overpayment is any extra payment you make on top of your normal monthly repayment, either as a regular amount or a one-off lump sum.

How does the Mortgage Overpayment Calculator work?

You enter your balance, interest rate, term, and overpayment amount. The calculator shows how much sooner you’ll clear your loan and how much interest you’ll save.

How much difference does £50 or £100 extra a month make?

Even small overpayments can have a big impact. An extra £100 a month could save you tens of thousands in interest and cut years off your mortgage.

Is it better to overpay monthly or as a lump sum?

Both are effective. Monthly overpayments provide steady long-term savings, while lump sums create an immediate reduction in your balance. The calculator lets you compare both.

Will overpayments reduce my monthly payments?

That depends. Some lenders keep your monthly payments the same and shorten your term, while others reduce your monthly payments but keep the term unchanged.

Are there penalties for making overpayments?

Most lenders allow you to overpay up to 10% of your outstanding balance each year without fees. Overpaying beyond that may trigger early repayment charges.

Can I pause or stop overpayments if needed?

Yes, in most cases. Regular overpayments are voluntary, so you can adjust them as your financial situation changes.

Should I clear other debts before overpaying my mortgage?

If you have high-interest debts like credit cards, it’s usually smarter to pay those off first. The calculator helps you see the relative benefits.

Does the calculator account for changing interest rates?

It uses the rate you input. If rates rise or fall, you can re-run the numbers to see how your savings and term would be affected.

Can first-time buyers use the Mortgage Overpayment Calculator?

Yes. It’s designed for anyone with a mortgage who wants to see how extra payments change their repayment journey.