Most Accurate Mortgage Affordability Calculator UK

Max Mortgage

Total Home Price

Monthly Repayment

Income Multiple

Buying a home is one of life’s most exciting milestones, but it’s also one of the most overwhelming. With property prices climbing and lending rules becoming stricter, the biggest question for most buyers is simple: how much can I actually afford? Too many people either overestimate their budget, leading to financial stress later, or underestimate it, missing out on properties they could have bought comfortably. That’s why having a clear view of your affordability is so important.

The FinCalc Mortgage Affordability Calculator is designed to give you instant answers. By taking into account your income, deposit, expenses, interest rates, and loan term, it shows exactly how much you can borrow and what your repayments might look like. Instead of guesswork or relying solely on banks, you get an independent, transparent view of your financial limits.

Whether you’re a first-time buyer, a family upgrading to a bigger home, or an investor testing affordability, this calculator makes the process simple, accurate, and stress-free.

What is a Mortgage Affordability Calculator?

A Mortgage Affordability Calculator is a financial tool that helps you understand how much you can realistically borrow for a mortgage based on your personal circumstances. Unlike a simple loan calculator that only looks at property price and interest rates, an affordability calculator factors in your income, deposit, expenses, and other commitments to give you a more accurate picture of what you can afford.

When you apply for a mortgage, lenders don’t just look at the property price; they look closely at your finances. They want to know your income level, your monthly spending, and whether you have any existing debts or financial responsibilities. A Mortgage Calculator mimics this process, helping you get a clear estimate before you approach a lender. This means you can avoid wasting time on properties outside your budget and focus on homes you can truly afford.

Here’s how it typically works:

- Input your income (single or joint).

- Add your monthly expenses such as bills, loans, and credit commitments.

- Enter your deposit amount and select a mortgage term.

- Adjust the interest rate to see how it affects your repayments.

The calculator then provides an estimated maximum loan amount and the monthly repayment required. For example, if you earn £40,000 annually, contribute a £15,000 deposit, and select a 25-year mortgage term at 5% interest, the calculator might show you an affordability of around £175,000–£190,000. This gives you a realistic expectation of your budget before you even start house-hunting. Need to see how a bigger deposit boosts your budget? Use the Savings Goal Calculator to plan the exact amount and timeline.

The value of a Mortgage Affordability Calculator lies in its ability to bring clarity. Instead of guessing or relying only on bank projections, you get an independent, unbiased view of your financial limits. It doesn’t guarantee what lenders will approve; each lender has its own criteria, but it gives you a strong starting point and the confidence to plan your property journey more effectively.

Why Mortgage Affordability Matters?

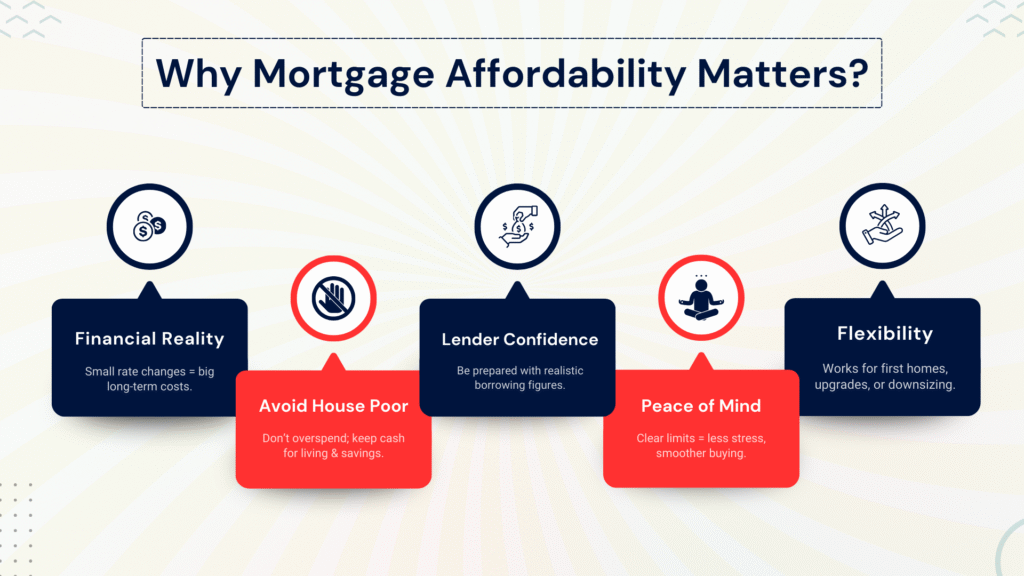

Buying a home is one of the biggest financial steps you will ever take. While property ownership is exciting, it also comes with long-term financial responsibility. This is why understanding affordability is crucial before committing to a mortgage. A Mortgage Affordability Calculator is not just about numbers; it’s about peace of mind, smart planning, and protecting your financial future.

The Financial Reality

Mortgages often stretch over 20–35 years, which means even a small difference in borrowing or interest rates can have a massive impact over time. For example, taking on a loan slightly beyond your means may feel manageable at first, but when rates rise or unexpected expenses appear, monthly repayments can quickly become a burden. Careful affordability planning ensures that your mortgage fits comfortably into your lifestyle, not the other way around.

Avoiding the Trap of “House Poor”

Many people dream of stretching their budget to buy a larger home, but overcommitting can leave you “house poor”, spending so much on your mortgage that little is left for daily living, savings, or emergencies. A Mortgage Calculator helps prevent this by showing the upper limits of what you can borrow, balanced against realistic monthly expenses. That way, you secure a home you love without sacrificing financial security. Protect your monthly comfort—use the FinCalc Regular Monthly Savings Calculator to build a buffer alongside your mortgage.

Confidence When Dealing with Lenders

Banks and lenders assess affordability rigorously. They don’t just consider your salary; they also examine your spending habits, debts, and dependents. By using a calculator first, you can walk into lender meetings prepared. You’ll already have a good idea of your borrowing range, making you more confident in negotiations and less likely to be caught off guard by a rejection.

Emotional Peace of Mind

Home-buying is emotional; it’s about family security, lifestyle, and future stability. But when you’re uncertain about affordability, the process quickly turns stressful. Knowing exactly what you can afford removes much of this anxiety. With a Mortgage Affordability Calculator, you gain clarity on your financial boundaries, making the entire experience more enjoyable and less overwhelming.

Flexibility for Different Life Stages

Affordability planning isn’t just for first-time buyers. Families moving to larger homes, investors considering buy-to-let properties, or retirees downsizing all benefit from understanding their financial limits. A calculator gives you the flexibility to test different scenarios, joint incomes, shorter or longer terms, higher or lower deposits, so you can adapt your mortgage to your life stage and goals.

How the Calculator Works (Step-by-Step + Example)

The Mortgage Affordability Calculator is built to mirror how lenders think, so you get realistic numbers before you apply. Here’s the exact flow it follows, and what each input changes in your results.

Step 1: Choose applicant type

Select single or joint application. For joint, you’ll enter both incomes so the calculator can assess total earnings and shared affordability.

Step 2: Enter income details

Add your gross annual income (and partner’s, if joint). If you receive regular bonuses, overtime, or commission, you can add a conservative proportion (e.g., 50–60%), similar to how many lenders assess variable pay.

Step 3: Add monthly commitments

Enter typical outgoings: rent (if applicable), loans, credit card payments, childcare, car finance, student loan, and insurance. These reduce the disposable income available for mortgage repayments and directly affect the borrowing limit.

Step 4: Set your deposit

Input the cash deposit you expect to have. The calculator uses this to work out the target property price by adding your maximum mortgage to your deposit, and computes your loan-to-value (LTV), a key driver of the rate you’ll qualify for.

Step 5: Choose term and interest rate

Pick a mortgage term (e.g., 20, 25, 30, 35 years) and an assumed interest rate. Longer terms reduce monthly payments (raising headline affordability) but increase total interest over time. You can test multiple rates to see sensitivity. Compare repayments at different rates with the Interest Rate Comparison Calculator before you lock a deal.

Step 6: Stress testing (built-in)

Behind the scenes, the Mortgage Affordability Calculator runs a lender-style stress test by checking affordability at a slightly higher “buffer” rate. This ensures your result isn’t fragile to modest rate rises and mirrors how banks assess risk.

Step 7: Income multiple cross-check

Most lenders cap borrowing at an income multiple (e.g., up to ~4.5× salary, sometimes higher for strong profiles). The calculator cross-checks your disposable-income result with a typical multiple and shows the lower of the two, giving a realistic ceiling.

Step 8: Results you’ll see, clearly broken down

- Estimated maximum mortgage (after stress tests and income multiple limits)

- Indicative property budget (deposit + max mortgage)

- Estimated monthly repayment at your chosen rate/term

- LTV band (e.g., 90%, 85%, 75%) with an info note on how LTV may influence rates

- Affordability buffer (rough headroom after fixed expenses + mortgage) so you can judge comfort, not just possibility

Step 9: “What-if” toggles for planning

- Adjust term (25 vs 30 years) to trade payment size vs. total interest

- Nudge the rate (±0.5%) to see stress-test resilience

- Change the deposit to watch LTV and repayments shift

- Toggle debts (e.g., clearing a loan) to see how much extra you could borrow

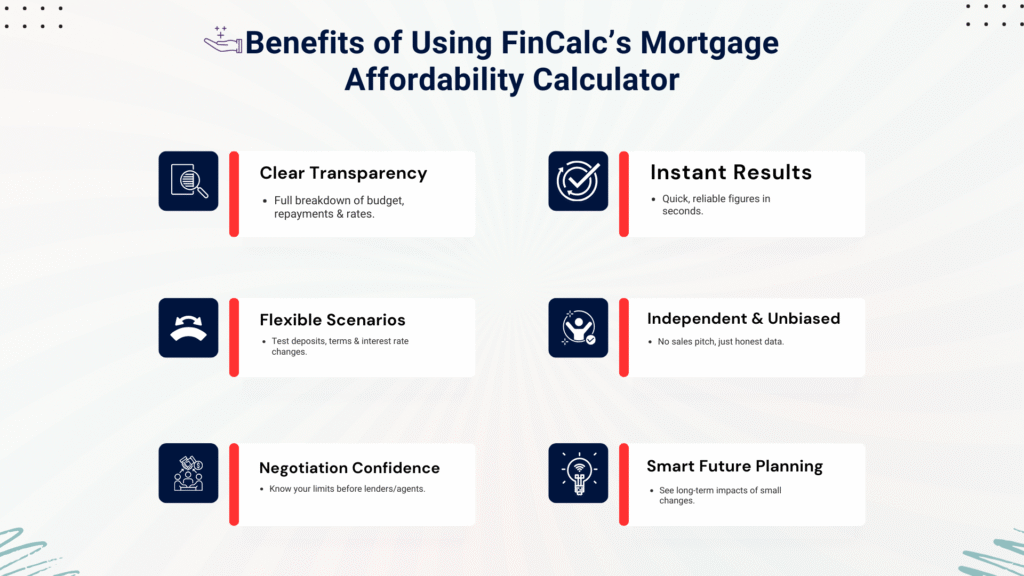

Benefits of Using FinCalc’s Mortgage Affordability Calculator

Buying a home should be exciting, not confusing. Yet for many, the biggest challenge is figuring out how much they can realistically afford before speaking to a bank. That’s why the Mortgage Affordability Calculator from FinCalc is designed to take away the guesswork and replace it with clear, actionable insights. Here’s why thousands of buyers would benefit from using it before making any property decision.

1. Clear Transparency

Unlike rough income multipliers or vague online estimates, the calculator gives a detailed breakdown. You see your maximum mortgage, estimated property budget, monthly repayments, and how changes in term, deposit, or rate affect your numbers. This transparency helps you understand exactly where every figure comes from.

2. Instant, Reliable Results

Mortgage planning can take days when done manually, gathering figures, checking affordability, and comparing scenarios. With FinCalc’s Mortgage Calculator, you get instant results in seconds. It’s accurate enough to mirror how lenders think, giving you confidence before applying.

3. Flexible Scenarios

Every buyer is different, and so are their finances. Whether you’re buying alone, as a couple, or as an investor, you can test multiple scenarios. Try different deposits, switch between terms, increase or decrease expenses, or stress-test higher interest rates. This flexibility ensures you’re not just seeing numbers, you’re exploring your options.

4. Independent and Unbiased

Bank tools often nudge you toward their own products. FinCalc is independent. That means no sales pitch, no bias, just data. The Mortgage Affordability Calculator is built solely to help you plan smarter, with no hidden agenda.

5. Confidence in Negotiation

When you know your real affordability, you can approach estate agents, lenders, or brokers with confidence. You’ll avoid overpromising, and you’ll know exactly what price range to focus on. This not only saves time but also makes the home-buying journey less stressful.

6. Better Long-Term Planning

Affordability isn’t just about getting a mortgage approved today; it’s about ensuring you can still manage payments comfortably in the future. The calculator highlights how even small changes in rate or term can affect your repayments. By planning this upfront, you protect yourself from future financial strain.

Comparison Table: Why FinCalc Wins

Feature | Manual Maths | Bank Tools | FinCalc Mortgage Affordability Calculator |

Accuracy | Error-prone | Varies, often simplified | High, realistic estimates |

Transparency | Limited | One or two figures only | Full breakdown |

Flexibility | Hard work | Restricted to bank’s rates | Any deposit, term, or rate |

Independence | N/A | Biased toward products | Completely unbiased |

Ease of Use | Time-consuming | Moderate | Instant + user-friendly |

Real-Life Use Cases

Numbers are useful, but they mean more when you see how they apply in real life. Here are some real-world examples of how people use the Mortgage Affordability Calculator to make confident property decisions.

1. The First-Time Buyer Finding a Starting Point

Sarah, 27, dreamed of buying her first flat but wasn’t sure what price range she could consider. With an income of £32,000 and a £20,000 deposit, she entered her details into the calculator. It estimated her maximum mortgage at around £145,000–£155,000, meaning she could look at properties around £165,000–£175,000. Instead of wasting time viewing homes beyond her reach, she focused on properties she could comfortably afford. The calculator gave her clarity and confidence to approach lenders without second-guessing herself.

2. The Growing Family Planning an Upgrade

James and Maria already owned a small starter home but were expecting their second child. They wanted to move to a bigger property but worried about higher repayments. Entering their joint income (£68,000), current commitments (£500/month), and a £40,000 deposit, the Mortgage Affordability Calculator showed they could borrow around £260,000–£275,000. Adding their deposit meant a budget of £300,000+. This reassured them that upgrading to a larger family home was within reach, without stretching their finances uncomfortably.

3. The Couple Comparing Different Terms

Amir and Ayesha, both 30, weren’t sure whether to choose a 25-year or 30-year mortgage term. Their combined income was £72,000, with a £30,000 deposit. The calculator showed that over 25 years, monthly repayments on their maximum affordability would be about £1,450. Stretching to 30 years reduced payments to around £1,300 but added tens of thousands in total interest. Seeing the side-by-side comparison helped them strike a balance: they chose the 25-year term, with plans to overpay slightly when possible.

4. The Investor Testing Buy-to-Let Potential

Mark, a 40-year-old professional, wanted to invest in a rental property. Using the Mortgage Affordability Calculator, he entered his £50,000 deposit and secondary income details. The tool showed his borrowing potential and helped him calculate monthly repayments. By comparing this with expected rental income, Mark quickly saw which properties would generate positive cash flow. The calculator didn’t just guide him on affordability; it became part of his investment strategy.

5. The Retiree Downsizing Smartly

Rachel, 59, was considering selling her large family home and downsizing to a smaller property with a partial mortgage. She wasn’t sure what borrowing power she still had so close to retirement. By entering her income, pension contributions, and modest deposit, the calculator showed a comfortable mortgage figure well within her means. This gave her peace of mind that she could downsize without financial strain, and still free up cash for retirement plans.

Understanding the Numbers

Affordability may feel like a vague concept, but behind every mortgage offer is a set of clear calculations. Lenders use income multiples, debt-to-income ratios, and stress tests to decide how much they are willing to lend. The Mortgage Affordability Calculator applies these same principles so you can see what’s realistic before approaching a bank.

Income Multiples

Traditionally, lenders base affordability on a multiple of your gross annual income. In the UK, the standard is around 4 to 4.5 times your salary, though some lenders may stretch higher for applicants with strong profiles.

Example: A salary of £40,000 × 4.5 = £180,000 maximum mortgage.

For joint applicants, incomes are combined before the multiplier is applied.

Debt-to-Income Ratio (DTI)

Lenders also look at how much of your income already goes toward other debts. This ratio is key to ensuring you’re not overextended.

- Example: If your monthly income is £3,000 and you spend £600 on existing loans and credit cards, your DTI is 20%. The lower your DTI, the more comfortable lenders feel about approving a mortgage.

Stress Testing

Mortgages are long-term commitments, and interest rates can rise. To protect borrowers (and themselves), lenders “stress test” your affordability at a slightly higher interest rate. For instance, even if you’re applying for a 5% mortgage, they might test your repayments at 6% to ensure you could cope with a rise. The Mortgage Affordability Calculator mirrors this, showing how sensitive your repayments are to rate changes.

Impact of Deposit and Loan-to-Value (LTV)

Your deposit directly affects your affordability. A larger deposit reduces the loan amount, lowers the loan-to-value ratio, and often unlocks better rates.

- Example: On a £200,000 property, a £20,000 deposit gives you 90% LTV, while a £40,000 deposit drops that to 80% LTV, potentially saving thousands in interest across the term.

Credit Score and Other Factors

While the calculator focuses on the core financial numbers, lenders also check your credit history. A higher score improves your chances of borrowing closer to the maximum, while poor credit may reduce it. They’ll also consider age, job stability, and type of income (salary vs. self-employed).

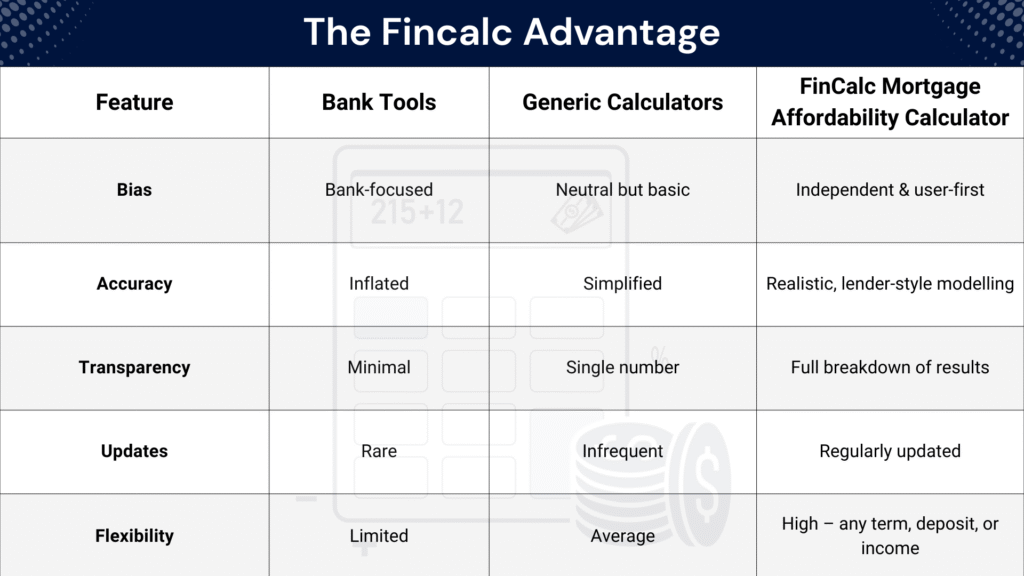

Why Choose FinCalc Over Others?

When it comes to figuring out how much you can borrow, there’s no shortage of mortgage calculators online. Banks provide their own versions, brokers offer tools to attract clients, and comparison websites give rough estimates. But here’s the truth: most of them are limited, biased, or outdated. That’s why the FinCalc Mortgage Affordability Calculator is different; it’s built to give you clarity, independence, and realistic results.

1. Independent and Unbiased

Bank calculators are designed with one goal in mind: to sell you their products. They often inflate affordability to make their mortgages look attractive. By contrast, FinCalc is completely independent. Our Mortgage Calculator exists to give you accurate information, not push you toward a particular lender.

2. Built Around Real Lender Criteria

Many generic tools use simple income multipliers and ignore real-life expenses or stress testing. FinCalc mirrors how lenders actually assess affordability. It factors in income, deposit, term length, monthly commitments, and even rate sensitivity, giving you a realistic range you can trust.

3. Always Up to Date

Mortgage rules and market conditions change quickly. Interest rates rise and fall, and lenders adjust their affordability models. Unlike static calculators that rarely update, FinCalc is refreshed in line with market trends, ensuring your results reflect today’s environment, not last year’s assumptions.

4. Transparent Results

Other calculators often throw out a single figure with no explanation. FinCalc goes deeper. You’ll see your estimated maximum mortgage, potential property budget, monthly repayments, loan-to-value band, and even how much allowance you have to adjust for different deposits or terms. Transparency means no surprises later.

5. Designed for All Buyers

Whether you’re a first-time buyer, a family upgrading, an investor, or a retiree downsizing, the tool adapts to your situation. It’s flexible enough to handle single or joint applications, small or large deposits, and short or long terms, giving you tailored results instead of a one-size-fits-all answer.

The FinCalc Advantage

Conclusion:

Buying a home is exciting, but it’s also one of the biggest financial commitments you’ll ever take on. Knowing how much you can borrow, and more importantly, how much you can comfortably afford, is the key to making smart property decisions. Guessing your budget or relying solely on a lender’s estimate can lead to disappointment or long-term financial strain. That’s where the FinCalc Mortgage Affordability Calculator makes the difference.

By combining your income, deposit, expenses, and mortgage terms, the calculator gives you instant, transparent results that mirror how lenders assess affordability. Instead of vague estimates, you get a clear breakdown of your maximum borrowing power, property budget, and monthly repayments. This allows you to shop for properties with confidence, avoid overcommitting, and negotiate with lenders from a position of strength. For more mortgage tools—affordability, LTV, deposit planning, and rate comparisons—start at FinCalc.Whether you’re a first-time buyer, a family upgrading, or an investor planning your next purchase, this tool ensures you stay in control of your financial future.

FAQs

What is a Mortgage Affordability Calculator?

It’s a tool that estimates how much you can borrow for a mortgage based on your income, deposit, expenses, and chosen loan term.

How accurate is the Mortgage Affordability Calculator?

It gives a strong estimate that mirrors how lenders assess affordability, though final approval depends on each lender’s specific criteria.

What factors affect mortgage affordability?

Key factors include income, deposit size, interest rates, loan term, credit score, and monthly commitments such as loans or childcare.

Can couples use the calculator together?

Yes. You can enter joint incomes and expenses to see combined affordability, giving couples a clearer picture of their budget.

Do lenders use the same method as the calculator?

Similarly,most lenders use income multiples, expense checks, and stress tests. The calculator gives you a realistic guide before applying.

What is the debt-to-income ratio (DTI) in mortgages?

It’s the percentage of your income that goes toward existing debts. A lower DTI usually means higher borrowing potential.

How much deposit do I need for a mortgage?

Typically, between 5–20% of the property value. A larger deposit reduces your loan-to-value ratio and often unlocks better rates.

Does credit score affect mortgage affordability?

Yes. A stronger credit score improves your chances of borrowing more and accessing lower interest rates.