The Most Accurate Lifetime ISA Bonus Calculator

Total Contributions

Government Bonus

Interest Earned

Projected Total

Saving for your first home or retirement can feel overwhelming, but the UK government’s Lifetime ISA (LISA) makes it easier by offering a 25% bonus on what you save. The problem is, most people don’t realise how much that bonus adds up to or how it could transform their savings over time. That’s where the FinCalc Lifetime ISA Bonus Calculator comes in.

This simple, powerful tool shows you exactly how much extra money you’ll receive from the government, based on your contributions. Whether you’re putting away £100 a month, contributing a lump sum, or maxing out the annual £4,000 allowance, the calculator instantly reveals your total savings plus the government bonus, no spreadsheets, no guesswork, just clear numbers that make planning easier.

What is a Lifetime ISA Bonus Calculator?

A Lifetime ISA Bonus Calculator is a tool designed to show you exactly how much extra money you can receive from the government when saving into a Lifetime ISA (LISA). The LISA is a special savings product available to people aged 18 to 39, created to help first-time buyers and retirement savers. You can put away up to £4,000 each year, and the government will add a 25% bonus on top. That means if you save the maximum amount, you could receive an extra £1,000 per year absolutely free.

The challenge for many savers is understanding how this bonus works in practice. Is it paid monthly or yearly? How does it affect your total balance? What happens if you contribute less than the maximum allowance? These are the questions the Lifetime ISA Bonus Calculator answers in seconds. Instead of trying to run the numbers manually, you simply enter the amount you plan to contribute, either as a lump sum or regular monthly payments, and the calculator instantly shows you:

- Your personal contributions.

- The government’s 25% bonus.

- The combined total of your savings and the bonus.

For example, if you enter £3,000, the calculator adds £750, giving you a total of £3,750. If you enter the full £4,000, the calculator automatically adds £1,000, showing a total of £5,000.

This tool is valuable because it not only shows you the immediate effect of the bonus but also helps you plan. First-time buyers can see how quickly their house deposit grows with government support, while retirement savers can calculate how much their savings will be boosted year after year. In short, the Lifetime ISA Bonus Calculator takes what can seem like complicated financial rules and turns them into clear, easy-to-understand numbers. It ensures you never underestimate the value of your contributions and helps you make smarter choices about how and when to save.

Want to project the full pot with compounding over the years? Run the same inputs in the ISA Calculator to model tax-free growth beyond the annual bonus view.

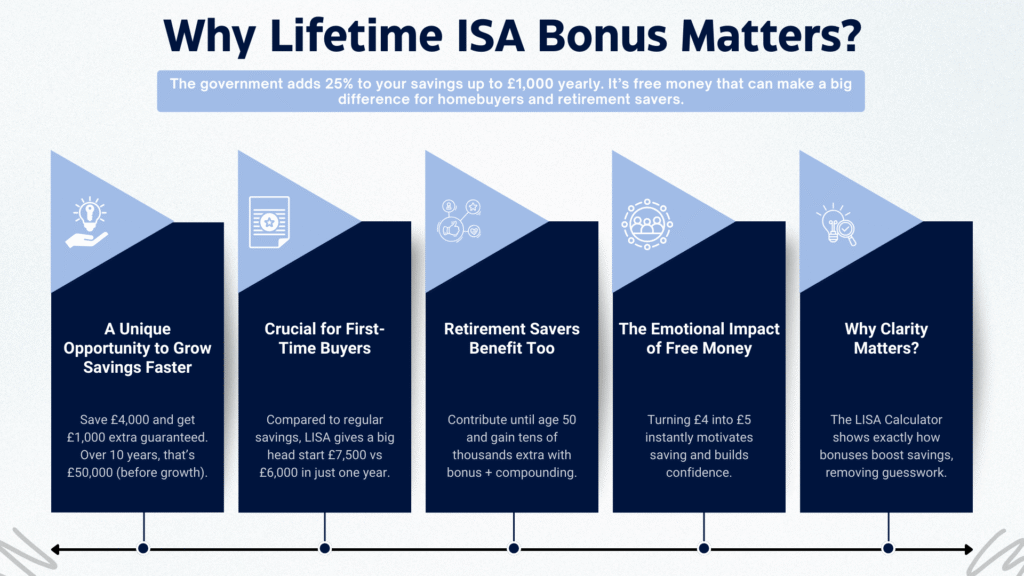

Why Lifetime ISA Bonus Matters?

When it comes to saving money, very few opportunities offer such a direct, guaranteed boost as the government’s Lifetime ISA (LISA) bonus. At its core, it’s free money, a 25% top-up added to your own savings, up to £1,000 every year. For anyone trying to save for a home or retirement, that’s not just helpful; it can be life-changing. Yet many people underestimate the power of this incentive simply because they don’t see the numbers clearly. That’s where the Lifetime ISA Bonus Calculator steps in, showing exactly why this bonus matters.

A Unique Opportunity to Grow Savings Faster

Unlike investment returns, which depend on markets, the LISA bonus is guaranteed. If you contribute £4,000, you get £1,000 on top, no risk, no waiting. Over a decade of saving the maximum, that’s £40,000 of your own contributions and £10,000 of government bonuses, giving you £50,000 before any investment growth or interest. That bonus alone could mean a bigger house deposit or a stronger retirement fund.

Crucial for First-Time Buyers

For those saving toward their first property, the LISA bonus can be the difference between getting on the housing ladder sooner or waiting years. Imagine two people, both saving £500 a month: one in a standard savings account and the other in a LISA. After 12 months, the regular saver has £6,000, while the LISA saver has £6,000 plus a £1,500 government bonus, £7,500 in total. That’s a major head start toward a deposit. The Lifetime ISA Bonus Calculator makes these comparisons visible in secondsBuying your first place? Use the First-Time Buyer Mortgage Calculator to translate your LISA-boosted deposit into realistic borrowing and monthly repayments.

Retirement Savers Benefit Too

Even if you already own a home, the LISA bonus plays a huge role in building long-term security. Saving into a LISA until age 50 with the government topping up 25% every year could result in tens of thousands extra by retirement. That money compounds alongside investment returns, making your savings go further than they would in a standard account.

The Emotional Impact of Free Money

Beyond the numbers, there’s an emotional side to the LISA bonus. It creates motivation. Knowing that every £4 you save turns into £5 instantly makes saving feel more rewarding and less like a sacrifice. It builds confidence in your financial planning, reduces the stress of “am I saving enough?”, and encourages people to stick with their goals. For first-time buyers, it brings peace of mind that they’re maximising every pound toward their dream home. For retirement savers, it creates a sense of security about the future.

Why Clarity Matters?

The problem is that without clear tools, most savers underestimate how powerful the LISA bonus really is. They may contribute small amounts without realising how quickly the bonus accelerates growth, or they may think the maximum allowance isn’t worth aiming for. The Lifetime ISA Bonus Calculator cuts through the confusion, showing exactly how much extra money you’ll have at any contribution level.

How the Calculator Works Step-by-Step?

Here’s exactly how the Lifetime ISA Bonus Calculator works, step by step, with clear examples and built-in guardrails so your results mirror real LISA rules.

Step 1: Tell us how you’ll save

Choose whether you’re contributing monthly or as a one-off lump sum. You can switch between the two at any time to compare scenarios (e.g., £250/month vs a £4,000 lump in April).

Step 2: Enter your contribution amount(s)

Type the amount you plan to save. For monthly savings, the calculator totals your payments across the tax year (6 April–5 April). For lump sums, it treats the whole payment as made in the month you select.

Step 3: Add timing/eligibility basics (light checks)

Confirm your age (LISA can be opened 18–39; contributions allowed until age 50). This doesn’t change the maths, but it ensures the plan is within LISA rules. If you’re saving for a first home, you can optionally tag the goal so we display the relevant withdrawal rules alongside your numbers.

Step 4: We apply the 25% government bonus automatically

The calculator multiplies eligible contributions by 25% and caps the bonus at £1,000 per tax year (because contributions are capped at £4,000 per person per tax year). If you contribute less than £4,000, you’ll see the exact bonus you’ve earned and how much allowance remains.

Step 5: See the full breakdown, instantly

You’ll get:

- Your contributions (monthly total or lump-sum value)

- Government bonus (25%) with the annual cap applied

- Combined total (your money + the bonus)

- Allowance remaining to hit the £4,000 ceiling this tax year

- Optional simple growth view (if you toggle a projected rate) for illustration only

Step 6: Understand payout timing

By default, results assume the bonus is credited monthly after each contribution (as providers typically do). You’ll see an estimated credit month, so expectations match reality.

Step 7: Optional “what if” switches

- Partial-year saving: enter fewer months to see the bonus you’ll still earn.

- Top-ups later: test adding money near tax year-end to maximise the £1,000 cap.

- Couple planning: run the calculator twice (one per person) to see combined bonuses.

Worked examples

- Monthly saver

You set £300/month from May to April (12 months).

- Contributions: £300 × 12 = £3,600

- Bonus (25%): £900

- Total by year-end: £4,500

- Allowance remaining: £400 (you could add £400 more to reach £4,000 and lift the bonus to £1,000 total)

- Max in one go

You pay £4,000 in April.

- Contributions: £4,000

- Bonus (25%): £1,000 (cap reached)

- Total: £5,000

- Any extra you add this tax year won’t earn a bonus (the calculator shows “bonus capped” so there’s no confusion).

- Partial-year with a top-up

You save £150/month for 8 months = £1,200. In February, you add £2,000.

- Contributions: £1,200 + £2,000 = £3,200

- Bonus (25%): £800

- Total: £4,000

- You still have £800 of allowance left (and could earn up to £200 more bonus this year).

Targeting a number? The Savings Goal Calculator shows the monthly contribution needed to reach your deposit by a specific date.

Guardrails the calculator flags for you

- Allowance cap: Bonus stops at £1,000 per tax year.

- Age rules: Open 18–39; contribute until 50.

- Eligible uses: First home (≤£450,000, after 12 months of account opening) or retirement (withdrawals from age 60).

- Early withdrawal penalty: Non-qualifying withdrawals incur 25% of the whole amount withdrawn (the calculator surfaces a heads-up so you understand the effective loss).

In short, the Lifetime ISA Bonus Calculator turns percentages and policy into plain numbers: how much you put in, the exact 25% you’ll get back, and the total you can plan on, whether you’re drip-feeding monthly or going for the full allowance in one shot.

Benefits of Using FinCalc’s Lifetime ISA Bonus Calculator

Saving into a Lifetime ISA is already a smart move, but understanding exactly how the government’s 25% bonus works makes it even more powerful. Unfortunately, most people either underestimate their potential bonus or get lost in the details of tax-year allowances, monthly contributions, and bonus caps. That’s where the FinCalc Lifetime ISA Bonus Calculator changes everything. It’s not just about doing the maths, it’s about giving you clarity, confidence, and control.

1. Transparent Breakdown of Your Savings

Many tools show you a single “total balance” without explaining how they got there. FinCalc breaks it down clearly:

- Your own contributions.

- The government’s 25% bonus.

- Your combined total savings.

- How much allowance do you still have left for the year?

This transparency means you don’t just know what you’ll have, you know why. That’s vital when planning deposits or retirement savings.

2. Instant, Accurate Results

No more spreadsheet formulas, guesswork, or double-checking numbers on paper. Enter your savings amount, and the calculator does the work in seconds. Whether you’re testing £50 a month or the full £4,000 in one go, you’ll see your bonus instantly and without confusion.

3. Flexibility to Test Scenarios

The Lifetime ISA Bonus Calculator isn’t a one-size-fits-all tool. You can compare:

- Monthly contributions vs lump sums.

- Different saving periods (e.g., saving for six months vs twelve).

- Individual vs couple scenarios (each partner using their own allowance).

This flexibility helps you plan smarter. For example, you may see that saving an extra £400 before the tax year ends will secure the full £1,000 bonus.

4. Independent and Unbiased

FinCalc is not tied to banks, ISA providers, or financial advisors. That independence means the calculator is purely about showing you the right numbers, no upselling, no jargon, and no hidden agendas.

5. Confidence in Your Financial Planning

When you know exactly what your savings and bonuses will look like, you can make better decisions. For first-time buyers, that means understanding how quickly you’ll reach a deposit. For retirement savers, it means seeing how consistent contributions build long-term wealth. The calculator takes away doubt and replaces it with confidence.

6. Always Up to Date

ISA rules can change, but FinCalc updates with the latest government guidance. That means you can trust the results to reflect current allowances, contribution limits, and bonus rules.

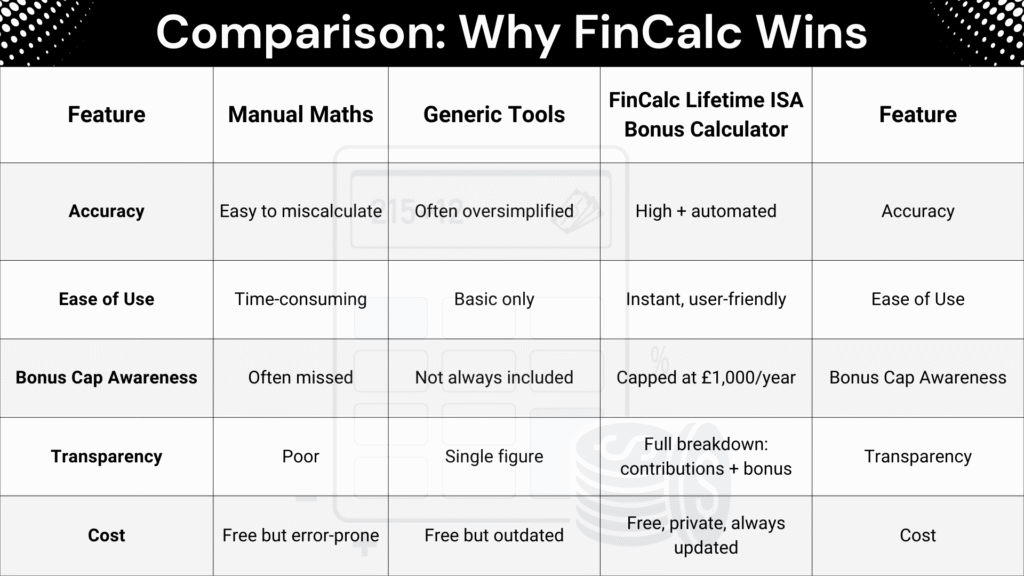

Comparison: Why FinCalc Wins

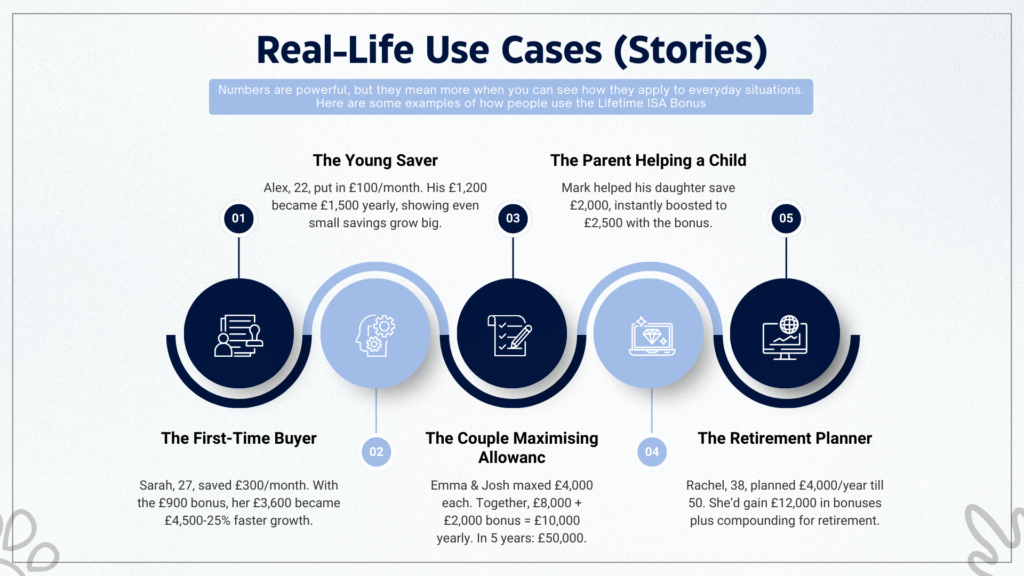

Real-Life Use Cases (Stories)

Numbers are powerful, but they mean more when you can see how they apply to everyday situations. Here are some examples of how people use the Lifetime ISA Bonus Calculator to plan, save, and stay motivated.

1. The First-Time Buyer Saving for a Deposit

Sarah, 27, wanted to know how quickly she could build her first house deposit. She entered £300 per month into the calculator. It showed her annual contributions of £3,600, plus a £900 government bonus, giving her £4,500 total. Seeing how her deposit could grow nearly 25% faster than in a standard account gave her confidence to stick with her savings plan and motivated her to save regularly.

2. The Young Saver Starting Small

Alex, 22, was nervous about starting with only £100 a month. Using the calculator, he saw that even small amounts added up: £1,200 in contributions a year plus £300 bonus = £1,500 total. The bonus showed him that every pound mattered; his £100 effectively became £125 each month. The calculator helped Alex stay motivated, knowing his small sacrifices were growing bigger thanks to the government’s support.

3. The Couple Maximising the Allowance

Emma and Josh, both 30, wanted to know what would happen if they each maxed out the £4,000 yearly allowance. Using the calculator separately, they saw that their £8,000 combined contributions would earn £2,000 in bonuses, giving them £10,000 a year together. Over just five years, they could save £50,000 with bonuses alone, enough to make a serious step onto the housing ladder.

4. The Parent Helping a Child Save

Mark, a dad of two, wanted to help his daughter save for her first home. He encouraged her to open a Lifetime ISA and used the calculator with her. When she entered a lump sum of £2,000, the calculator showed an instant £500 bonus. This clear, visual breakdown made it easier for her to understand why a LISA was such a smart option, and it gave Mark peace of mind that his daughter was maximising her savings.

5. The Retirement Planner Building Long-Term Wealth

Rachel, 38, already owned her home but wanted to use the LISA for retirement savings. By inputting the maximum £4,000 per year, the calculator showed she’d receive £1,000 annually until age 50, a total of £12,000 in government bonuses if she contributed every year. Seeing how much this would add to her retirement fund, especially when combined with investment growth, convinced her to commit to maxing out her allowance.

Understanding the Numbers (Educational Section)

The Lifetime ISA (LISA) can feel complicated at first, but the maths behind it is simple once you see it laid out clearly. The Lifetime ISA Bonus Calculator takes these rules and applies them instantly, but it helps to understand what’s happening behind the scenes.

Contribution Rules

- You can save up to £4,000 per tax year into a LISA.

- The government then adds a 25% bonus on whatever you contribute.

- The maximum bonus is therefore £1,000 per year.

You can continue contributing until age 50, provided you opened the account between 18 and 39.

Bonus Structure

- Every £4 you save = £1 added by the government.

- Save £1,000 → £250 bonus.

- Save £2,500 → £625 bonus.

- Save £4,000 → £1,000 bonus (annual maximum).

The Lifetime ISA Bonus Calculator automatically applies these percentages and caps so you always know where you stand.

Withdrawal Rules

The LISA is designed for first homes and retirement. You can withdraw without penalty if:

- You’re buying your first home (up to £450,000, after 12 months of opening).

- You’re aged 60 or older.

For any other withdrawal, there’s a 25% penalty. That means you don’t just lose the bonus, you lose part of your own contributions too. For example, withdrawing £1,000 early could cost you £250, leaving you with only £750. The calculator highlights this so you don’t make costly mistakes.

Worked Examples

Example 1: Small Saver

- Contribution: £1,000

- Bonus: £250

- Total: £1,250

Example 2: Medium Saver

- Contribution: £2,500

- Bonus: £625

- Total: £3,125

Example 3: Max Saver

- Contribution: £4,000

- Bonus: £1,000

- Total: £5,000

Over 10 years of max contributions, that’s £40,000 saved + £10,000 in bonuses = £50,000 total, before interest or investment growth.

Why Understanding Matters?

The numbers are straightforward when explained, but they often surprise people. Many savers don’t realise they can earn up to £1,000 a year just from the bonus, or they overlook the early withdrawal penalty. The Lifetime ISA Bonus Calculator makes these rules visible in plain numbers, helping savers avoid mistakes and maximise their free money.

Conclusion

The Lifetime ISA is one of the most generous savings opportunities available, giving you a 25% government bonus worth up to £1,000 every year. That’s free money that can turn steady contributions into a powerful deposit or long-term retirement boost. But too often, savers underestimate its value or get lost in the rules, missing out on the true potential of their savings. The FinCalc Lifetime ISA Bonus Calculator solves that problem by showing you exactly how your contributions grow with the bonus, instantly, clearly, and without guesswork.

Whether you’re a first-time buyer calculating your deposit, a young saver starting small, or someone planning for retirement, this tool gives you transparency and confidence. You’ll see not just how much you’re saving, but how much the government is adding to your efforts. For more calculators, projections, and plain-English guides across money topics, start at FinCalc.

FAQs

What is the Lifetime ISA bonus?

It’s a 25% government top-up on your contributions to a Lifetime ISA. You can earn up to £1,000 per year if you save the maximum of £4,000.

How does the Lifetime ISA Bonus Calculator work?

You enter your contribution amount, and the calculator instantly shows your savings, the government bonus, and your total balance.

What’s the maximum bonus I can earn each year?

The maximum bonus is £1,000 annually, based on a £4,000 contribution. The calculator applies this cap automatically.

Can I use the calculator for monthly savings?

Yes. Simply enter your monthly contribution and timeframe, and the Lifetime ISA Bonus Calculator will show your total bonus and allowance remaining.

Who is eligible for a Lifetime ISA?

You must be aged 18–39 to open one, and you can keep contributing until age 50.

Does the bonus get paid monthly or yearly?

The bonus is usually paid monthly into your LISA account after each contribution. The calculator assumes this standard schedule.

Can couples both claim the bonus?

Yes. Each partner can open a Lifetime ISA and earn their own 25% bonus, doubling the benefit for couples saving together.

What happens if I withdraw money early?

Early withdrawals for non-eligible reasons face a 25% penalty, meaning you lose the bonus and some of your own savings.