The Best Fixed vs Variable Mortgage Calculator UK

Fixed Monthly Payment

Variable Monthly Payment

Total Fixed Cost

Total Variable Cost

When it comes to mortgages, one of the most important decisions you’ll ever make is choosing between a fixed-rate deal and a variable-rate deal. Both options come with their own benefits and risks. Fixed-rate mortgages give you security, locking in the same payment every month, while variable-rate mortgages can start cheaper but may rise (or fall) over time depending on the market. For many homeowners, this decision can feel like a gamble without the right information. That’s exactly where the FinCalc Fixed vs Variable Mortgage Calculator comes in.

This powerful tool allows you to compare both options side by side, giving you clear insight into how each mortgage type will affect your monthly repayments, total interest, and long-term financial stability. Instead of relying on guesswork or confusing lender projections, you can model real scenarios in seconds and see which option works best for your budget. Whether you’re a first-time buyer trying to get on the property ladder, a family looking for predictability, or an investor balancing costs and risks, the Fixed vs Variable Calculator gives you the clarity and confidence to make smarter mortgage decisions. Sense-check both options against your income with the FinCalc Mortgage Affordability Calculator.

What is a Fixed vs Variable Mortgage Calculator?

A Fixed vs Variable Mortgage Calculator is a financial tool that helps you compare two of the most common mortgage types side by side: fixed-rate mortgages and variable-rate mortgages. These two products work differently, and while lenders may present them with appealing terms, the long-term impact on your monthly budget and total repayment can be very different.

A fixed-rate mortgage locks in the same interest rate for a set number of years, often two, five, or ten. That means your monthly payments stay the same during the fixed term, regardless of whether interest rates in the wider market rise or fall. The main advantage is stability and predictability, which is why many first-time buyers and families choose fixed rates.

A variable-rate mortgage, on the other hand, changes with market conditions. Some are tied directly to the Bank of England base rate (tracker mortgages), while others are set at the lender’s discretion (standard variable rates). Variable mortgages often start with lower rates than fixed deals, but they come with the risk that payments could increase if interest rates rise. This Calculator works by taking your loan amount, interest rates for both options, and your chosen term. It then calculates:

- Your monthly repayments for both mortgage types.

- The total cost of the mortgage over the term.

- How much more (or less) you could end up paying if rates change.

For example, on a £200,000 mortgage over 25 years:

- A fixed rate of 4.5% may give you stable payments of ~£1,111 per month.

- A variable rate starting at 3.9% could begin at ~£1,045 per month, but if rates rise by just 1%, your payments may jump to ~£1,150.

This side-by-side view is what makes the tool so valuable. Instead of choosing blindly or trusting generic lender projections, the calculator allows you to test real-world scenarios. You can see how rising rates might affect a variable mortgage or how a fixed deal locks in certainty. In short, the Fixed vs Variable Calculator is about clarity. It’s not about telling you which mortgage is “better,” but showing you the numbers in a way that makes sense for your circumstances, so you can balance security against potential savings and make an informed choice. Drill into monthly and lifetime costs with the FinCalc Mortgage Repayment Calculator.

Why Mortgage Type Planning Matters?

Choosing a mortgage isn’t just about the amount you borrow; it’s about deciding how you’ll repay it and under what conditions. The difference between a fixed-rate and variable-rate mortgage can have a profound effect on your finances for decades. Without proper planning, you may lock yourself into a deal that either costs more than it should or exposes you to risks you’re not prepared for. That’s why using the Fixed vs Variable Mortgage Calculator is so valuable. It lets you see the trade-offs clearly before you commit.

Fixed vs Variable: Two Very Different Journeys

A fixed-rate mortgage offers peace of mind by keeping payments stable, regardless of market shifts. This predictability makes budgeting easier, especially for families or first-time buyers who need stability. Variable-rate mortgages, meanwhile, can start cheaper and save you money if rates remain low, but they can also increase your payments dramatically if interest rates rise. Planning helps you weigh stability against potential savings.

The Cost of Guesswork

Many borrowers pick a mortgage type based on headline rates without considering long-term implications. For example, a variable mortgage that starts at 3.9% may look appealing compared to a fixed 4.5%. But if rates rise by 2%, your payments could suddenly be hundreds more each month. The Fixed vs Variable Calculator shows you this risk upfront, helping you avoid costly surprises.

Matching Your Mortgage to Your Life Plans

Your mortgage isn’t just a financial product; it’s part of your life plan. If you’re planning a family, approaching retirement, or investing in property, your needs are different. A young professional with flexible income may accept the risk of a variable mortgage, while a retiree might prioritise stability. Planning ensures the mortgage you choose fits your circumstances, not just the market conditions.

Emotional Peace of Mind

Money isn’t just numbers; it’s emotional. Unexpected rate hikes on a variable mortgage can create stress and uncertainty, while a fixed deal can feel like a safety net. Conversely, some homeowners regret fixing too high when rates fall. The Fixed vs Variable Mortgage Calculator takes the emotion out of it by showing you the numbers clearly, so you make decisions with confidence, not fear.

Preparing for Market Changes

Interest rates are influenced by the economy, inflation, and government policy. They can rise suddenly, as many homeowners experienced recently. Planning with a calculator means you’re not caught off guard. You can see “what if” scenarios, what happens if rates rise by 1%, 2%, or more, and plan accordingly. Model base-rate moves in detail with the Tracker Mortgage Calculator.

How the Calculator Works Step-by-Step and Example

The Fixed vs Variable Mortgage Calculator is designed to simplify one of the toughest mortgage decisions homeowners face. Putting the two options side by side helps you understand the cost of stability versus the potential reward and risk of flexibility. Here’s how the tool works in practice.

Step 1 – Enter Your Loan Amount

Start with the total mortgage you’re taking out or the balance you’re refinancing. This forms the foundation for the calculation.

Step 2 – Add Fixed Rate Option

Input the fixed interest rate offered by your lender. The calculator uses this to show your monthly repayments and the total cost of the loan over the chosen term.

Step 3 – Add Variable Rate Option

Enter the starting interest rate for the variable mortgage. Because variable deals can change, you can also adjust for potential increases (or decreases) to model “what if” scenarios.

Step 4 – Choose Term Length

Select the repayment period, 20, 25, or 30 years are common. The calculator uses this term to show how long you’ll be repaying and how much interest you’ll pay overall.

Step 5 – See Side-by-Side Results

The Fixed vs Variable Mortgage Calculator instantly generates a comparison, including:

- Monthly repayment for both fixed and variable.

- Total interest payable across the loan term.

- Impact of rate changes on variable repayments.

- A clear summary of which option is cheaper or safer in the long run.

Step 6 – Test Scenarios

The real power of the calculator lies in testing different conditions. You can ask

- What if interest rates rise by 1%, 2%, or more?

- How much could I save if I lock in a fixed rate now?

- Would a variable mortgage still be cheaper if rates stay flat for 5 years?

This flexibility helps you see the risks and rewards with clarity.

Worked Example

Let’s imagine you’re choosing between two options on a £250,000 mortgage over 25 years:

- Fixed Mortgage at 4.8%

- Monthly payment: ~£1,430

- Total interest over 25 years: ~£179,000

- Variable Mortgage at 3.9%

- Starting monthly payment: ~£1,295

- If rates stay flat: Total interest ~£152,000

- If rates rise by 1% after 3 years: Monthly payment jumps to ~£1,435, total interest ~£171,000

In this scenario, the variable looks attractive at first but carries a risk of ending up almost as costly as the fixed option. The Fixed vs Variable Mortgage Calculator makes this trade-off visible in seconds.If you expect to switch later, compare today’s choice with a future deal in the FinCalc Remortgage Calculator.

Benefits of Using FinCalc’s Fixed vs Variable Mortgage Calculator

Choosing between a fixed-rate and a variable-rate mortgage is one of the most important financial decisions a homeowner can make. Yet too often, people rely on gut feeling, lender sales pitches, or incomplete comparisons. The FinCalc Fixed vs Variable Mortgage Calculator changes that by giving you clarity, independence, and confidence. Here’s why it stands out.

- Instant Side-by-Side Comparisons

Instead of trying to crunch numbers yourself or relying on vague lender examples, the calculator gives you an instant, clear comparison. You’ll see monthly repayments, total interest payable, and the impact of rate changes, all in one place.

- Transparency You Can Trust

Lenders often showcase their best numbers but gloss over the risks. FinCalc is completely independent, and the Fixed vs Variable Mortgage Calculator provides an unbiased breakdown. You see the strengths and weaknesses of both mortgage types with no hidden agenda.

- Test Real-World Scenarios

What if rates rise by 2%? What if they stay flat for five years? What happens if you make a lump sum payment halfway through your term? The calculator allows you to run these scenarios in seconds, giving you insight into both the risks and opportunities.

- Saves Time and Reduces Stress

Mortgage comparisons can feel overwhelming, especially when every lender uses different assumptions. Instead of juggling spreadsheets or second-guessing figures, the calculator gives you accurate results quickly. That means less stress and more confidence in your decision.

- Flexibility for Every Homeowner

Whether you’re a first-time buyer craving predictability, a family managing rising costs, or an investor balancing risk and return, the calculator adapts to your needs. It helps you find the option that matches your lifestyle, budget, and financial goals.

- Motivation to Make Smarter Choices

When you can see in black and white how much a fixed deal protects you from uncertainty, or how much a variable deal could save if rates stay low, it’s easier to make decisions with confidence. The calculator turns complex trade-offs into simple, motivating insights.

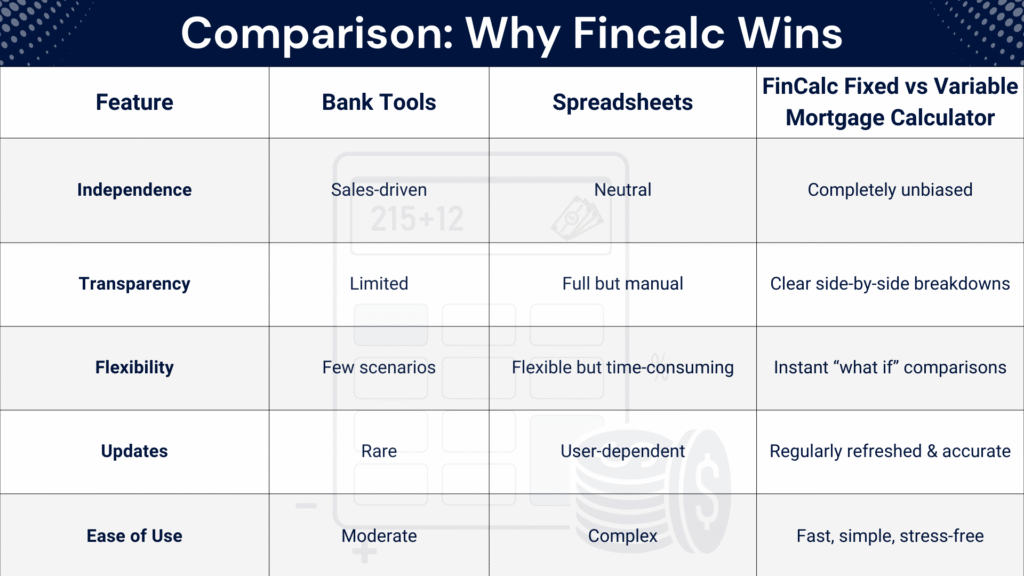

Comparison: Why FinCalc Wins

Feature | Bank Tools | Spreadsheets | FinCalc Fixed vs Variable Mortgage Calculator |

Independence | Sales-driven | Neutral | Completely unbiased |

Transparency | Limited | Full but manual | Clear side-by-side breakdowns |

Flexibility | Few scenarios | Flexible but time-consuming | Instant “what if” comparisons |

Updates | Rare | User-dependent | Regularly refreshed & accurate |

Ease of Use | Moderate | Complex | Fast, simple, stress-free |

Real-Life Use Cases

The decision between fixed and variable mortgages isn’t abstract; it’s deeply personal. Every borrower has unique circumstances, risk tolerance, and financial goals. The Fixed vs Variable Mortgage Calculator makes these decisions clearer by modelling real-life scenarios. Here are some examples of how different people benefit from using the tool.

First-Time Buyer Choosing Security

Emily, 28, is buying her first flat with a £180,000 mortgage. The appeal of a variable mortgage with a 3.9% starting rate tempted her, but she worried about rising interest rates. Using the calculator, she compared this against a 4.5% fixed mortgage. The results showed that while the variable rate saved her £60/month initially, even a 1% increase would make her payments higher than the fixed deal. Seeing the numbers gave Emily peace of mind to lock in the fixed option for stability.

Family Planning for Predictability

The Johnsons, a family with two children, recently upgraded to a £300,000 home. With childcare and school costs, they valued consistency. The calculator revealed that a fixed 5% rate meant predictable payments of ~£1,750/month, while a variable rate starting at 4.2% could save them £150 monthly if rates stayed low, but would cost £200 more if rates rose 1.5%. Prioritising peace of mind, they chose fixed, confident in their decision, thanks to the calculator.

Professional Balancing Flexibility and Risk

David, a 35-year-old IT contractor with irregular income, liked the idea of a variable mortgage since he could afford higher payments if rates rose. The calculator showed him that even if the rate increased by 2% after five years, the variable loan still costs less than the fixed deal overall. With this clarity, David felt comfortable accepting the risk, knowing he was making an informed choice.

Retiree Seeking Peace of Mind

Linda, 60, downsized into a smaller home with a £120,000 mortgage. On a fixed retirement income, unpredictable payments worried her. The calculator compared a 4.8% fixed rate with a 3.7% variable. Although the variable saved money short-term, even a small rate rise would have stretched her budget. The tool made the risks clear, helping Linda secure the fixed option for stress-free retirement.

Investor Weighing Risk vs Return

James, a property investor with several rental homes, needed to choose mortgages that balanced risk with potential returns. By running each property through the calculator, he compared fixed stability against variable flexibility. For high-yield rentals, variable rates made sense; for lower-yield ones, fixed gave him cost certainty. The Fixed vs Variable Mortgage Calculator allowed him to diversify his strategy with confidence.

Understanding the Numbers

Mortgages are long-term commitments, and the difference between fixed and variable rates isn’t just about today’s payment; it’s about how much you’ll spend over decades. The Fixed vs Variable Mortgage Calculator helps you break down these numbers into clear, practical insights, so you know exactly what you’re signing up for.

How Fixed Rates Work

With a fixed-rate mortgage, your interest rate is locked in for a set period, usually two, five, or ten years. That means your monthly payments stay the same during that term, no matter what happens to market rates. For example, a £200,000 mortgage at 4.5% fixed for 5 years would have consistent payments of ~£1,111/month. Even if the Bank of England raises rates, your payments won’t change until your fixed term ends.

The Long-Term Cost of Each

The key difference often lies in total interest. Using the calculator, you can compare:

- Fixed at 4.5% for 25 years: Total interest ~£133,000.

- Variable at 3.9% for 25 years (rates stable): Total interest ~£117,000.

- Variable at 3.9% with a 2% rise in year 5: Total interest ~£145,000.

This shows how much of a gamble variable rates can be, savings if rates stay low, but higher costs if they rise.

How Variable Rates Work?

Variable mortgages, such as trackers, follow the market. If the base rate rises, so do your payments; if it falls, you pay less. On the same £200,000 loan, a 3.9% variable rate might start at ~£1,045/month. But if rates rise by 2%, your payments could jump to ~£1,265/month. This flexibility is the main risk and potential reward.

Why Timing Matters?

The calculator also shows how timing changes the picture. If rates rise early in your term, the long-term impact is much larger than if they rise later. By modelling scenarios, you can see how sensitive your loan is to changes in the first five years versus the last five.

Balancing Risk and Stability

Numbers don’t lie; fixed mortgages cost more in stability premiums, while variable mortgages expose you to risks that could add tens of thousands in interest. The Fixed vs Variable Mortgage Calculator puts these outcomes side by side, so you can balance predictability against potential savings with confidence.

Why Choose FinCalc Over Others?

When comparing mortgage types, you’ll find no shortage of online tools from banks, brokers, and financial sites. But most of these calculators are limited in scope, tied to sales pitches, or too complicated for the average borrower. The FinCalc Fixed vs Variable Mortgage Calculator was built differently, with clarity, independence, and user-friendliness at its core.

Independent and Unbiased

Bank calculators often highlight their own mortgage products, nudging you toward deals that serve their interests. FinCalc doesn’t sell mortgages. The Fixed vs Variable Calculator is unbiased, showing you the numbers exactly as they are, so you can make decisions without pressure.

Side-by-Side Transparency

Most calculators give you one figure at a time. FinCalc lays fixed and variable options side by side, showing:

- Monthly repayments.

- Total interest payable.

- The impact of interest rate rises on variable loans.

This transparency means you’re not left guessing or digging through fine print.

Flexibility to Model Real Scenarios

Lender tools often assume flat rates that never change, an unrealistic view of the market. With FinCalc, you can model “what if” scenarios: What if interest rates rise 1% in three years? What if they stay flat for a decade? This flexibility gives you a realistic picture of both risk and reward.

Regularly Updated for Accuracy

Many online calculators are left outdated, using assumptions that no longer match current interest rate environments. FinCalc is regularly updated to reflect today’s market conditions, giving you accurate results every time.

Easy to Use, No Jargon

Spreadsheets and technical mortgage tables can overwhelm anyone without a finance background. FinCalc simplifies the process. Clear inputs, instant results, and straightforward comparisons mean you don’t need to be a mathematician to understand your mortgage choices.

Conclusion

Choosing between a fixed-rate and a variable-rate mortgage is one of the biggest financial decisions you’ll ever make. It affects not only your monthly payments but also your long-term stability, risk exposure, and total interest costs. For many borrowers, the challenge lies in balancing peace of mind with the potential for savings, and that’s rarely an easy choice to make without the right insights.

The FinCalc Fixed vs Variable Mortgage Calculator takes the uncertainty out of this decision. By giving you side-by-side comparisons, real-world scenarios, and clear breakdowns of costs, it empowers you to make choices based on facts, not guesswork. Whether you’re a first-time buyer seeking stability, a family managing monthly budgets, or an investor balancing risk and return, this tool provides the clarity you need to act with confidence. With the Fixed vs Variable Calculator, you’re not just choosing a mortgage, you’re choosing financial control and peace of mind.

FAQs

What’s the difference between a fixed and variable mortgage?

A fixed-rate mortgage keeps your interest and monthly payments the same for a set period. A variable-rate mortgage changes with market rates, meaning payments can go up or down.

How does the Fixed vs Variable Mortgage Calculator work?

You enter your loan amount, fixed rate, variable rate, and term. The calculator then shows you side-by-side repayments, total interest, and how rate changes affect costs.

Which mortgage type is safer?

Fixed mortgages offer stability and predictable budgeting, while variable mortgages carry more risk but may save money if rates remain low.

Can I switch from fixed to variable later?

Yes, often when your fixed term ends or by remortgaging. The calculator helps you compare the cost of switching before making a decision.

Does a variable mortgage always save money?

Not necessarily. While they can start cheaper, rising interest rates may make them more expensive than fixed deals over time.

Does the calculator show total interest paid?

Yes, it provides not only monthly repayments but also the total interest cost of fixed and variable options, so you see the full picture.

Can I test future interest rate rises?

Yes. The calculator allows “what if” scenarios so you can see how payments change if rates rise by 1%, 2%, or more.

Is a fixed mortgage better for first-time buyers?

Many first-time buyers prefer fixed rates for stability, but the calculator helps weigh the cost difference against variable options.

What if interest rates fall after I fix my mortgage?

You won’t benefit from lower payments, but you’ll still enjoy the peace of mind of predictable monthly costs.

Why use FinCalc’s Fixed vs Variable Mortgage Calculator?

Because it’s independent, transparent, and easy to use. It gives unbiased comparisons with no hidden sales agenda, unlike many lender tools.