The Best Compound Interest Calculator UK

Final Balance

Total Contributions

Total Interest Earned

Tax Paid

Saving money is important, but the real game-changer is understanding how compound interest works. Unlike simple interest, which only pays on your original deposit, compound interest lets your money grow on both the amount you put in and the interest it has already earned, creating a snowball effect over time. The problem? Most people underestimate how powerful compounding can be because the maths seems complicated. That’s why we built the FinCalc Compound Interest Calculator.

In just seconds, it shows you exactly how your savings or investments can grow based on your starting balance, regular contributions, interest rate, compounding frequency, and time. Whether you’re saving for a home, retirement, or building long-term wealth, this tool gives you instant clarity and motivation. No jargon, no guesswork, just accurate numbers you can trust.

What is a Compound Interest Calculator?

At its simplest, a compound interest calculator is a tool that shows you how your money can grow when interest is added not just to your original deposit but also to the interest you’ve already earned. This concept, earning “interest on interest”, is what makes compounding one of the most powerful forces in personal finance. Most people understand saving at a basic level: you put money aside, and it earns some interest. But what they often miss is how dramatically compounding changes the outcome over time. With simple interest, £10,000 at 5% would grow to £20,000 after 20 years. With compound interest, that same £10,000 could grow to more than £26,500, without you adding a penny. The difference is significant, and that’s without considering additional contributions.

The Compound Interest Calculator takes the mystery out of these numbers. By entering your starting balance, contribution amount, interest rate, compounding frequency (monthly, quarterly, annually, or even daily), and time frame, you can instantly see how much your savings will be worth in the future. The tool doesn’t just give you a final balance; it breaks the result down, showing your total contributions, the interest earned, and the combined total. This makes it easy to understand how much of your final sum comes from your effort versus the power of compounding. Another advantage of using a compound interest calculator is flexibility. You can test different scenarios to see how small changes impact your results. For example:

- What if you save £200 instead of £150 each month?

- What if your money compounds monthly instead of annually?

- What if you extend your timeline from 10 years to 20 years?

Each adjustment can make a dramatic difference, and the calculator shows you those outcomes instantly.

In short, a Compound Interest Calculator turns a complex financial formula into something visual and practical. It helps savers, investors, students, and retirees alike understand how money grows over time and how to make smarter decisions about saving and investing.

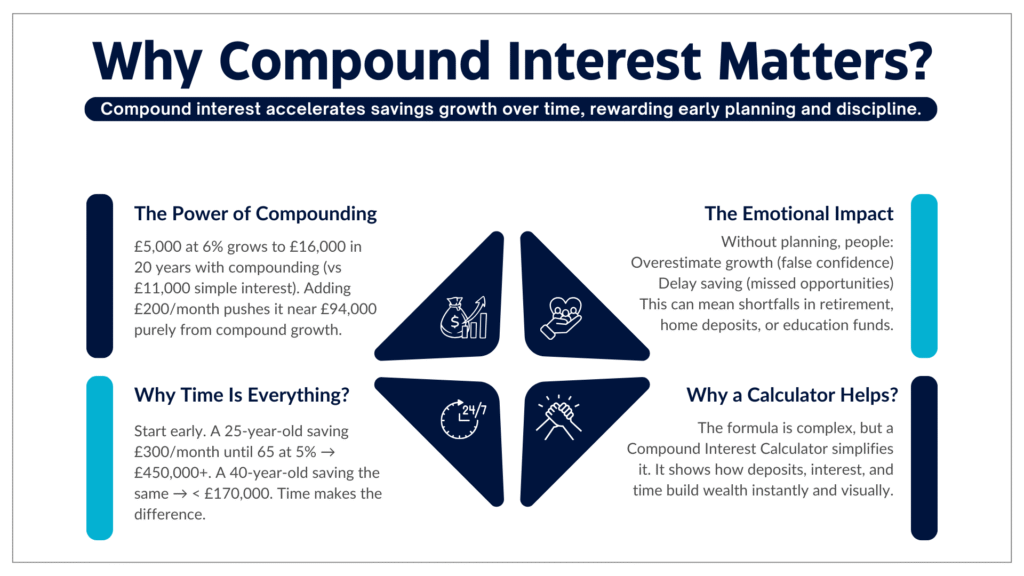

Why Compound Interest Matters?

Compound interest isn’t just a financial term you learned at school, i t’s the quiet force that determines whether your savings crawl forward or accelerate into real wealth. It matters because it magnifies both discipline and time, rewarding those who plan and penalising those who delay.

The Power of Compounding

Let’s take a simple example. Imagine you invest £5,000 at a 6% annual return:

- With simple interest, you’d have £11,000 after 20 years.

- With compound interest, you’d have more than £16,000.

Now imagine adding just £200 per month alongside your initial deposit. After 20 years, you wouldn’t just have your £53,000 of contributions, you’d have closer to £94,000. The difference comes entirely from compound growth.

Why Time Is Everything?

The earlier you start, the more compounding works in your favour. A 25-year-old saving £300 a month until age 65 at 5% could end up with over £450,000. A 40-year-old saving the same amount for 25 years? Less than £170,000. The only difference is time. This is why financial experts call compounding the “eighth wonder of the world.”

The Emotional Impact

Without planning, many people underestimate how much they need to save or how much they could be earning. This often leads to two problems:

- False confidence: assuming savings will grow faster than they will.

- Missed opportunities: starting late and losing decades of potential growth.

That gap can translate into retirement shortfalls, delayed home ownership, or missed education funding for children. Knowing the true power of compounding can relieve stress and give you confidence that you’re doing enough for your future.

Why a Calculator Helps?

Compound interest is powerful, but the formula can be intimidating:

A = P × (1 + r/n)^(nt).

Most people don’t want to do that maths. The Compound Interest Calculator takes this complexity away. It shows you exactly how contributions, interest, frequency, and time interact. More importantly, it makes the outcomes visual and immediate, so you can see how today’s decisions impact tomorrow’s wealth.

How the Calculator Works (Step-by-Step + Example)

Compound interest is a powerful concept, but the formula behind it can feel intimidating. That’s why the FinCalc Compound Interest Calculator was designed to turn complex maths into a simple, step-by-step process. All you need to do is enter a few details, and the calculator does the heavy lifting. Here’s how it works:

Step 1: Enter Your Starting Balance

This is the amount you already have saved or invested. It could be £0 if you’re starting from scratch, or a lump sum you’ve already built.

Step 2: Add Your Regular Contributions

Decide how much you’ll save or invest regularly, such as monthly or yearly. These contributions are often the biggest driver of growth, especially when combined with compounding. If you save on a schedule, the Regular Monthly Savings Calculator models recurring deposits precisely and shows how cadence changes the final balance.

Step 3: Choose the Interest (Growth) Rate

Enter the expected annual return rate. For example, 2–3% for cash savings, or 5–7% for long-term investments. The calculator uses this to project your future balance.

Step 4: Select the Compounding Frequency

This detail matters more than many people realise. Compounding can happen annually, quarterly, monthly, or even daily. The more frequently interest is compounded, the faster your money grows.

Step 5: Pick Your Time Horizon

Enter how many years you plan to save. Whether it’s a short-term goal like a holiday fund or long-term retirement savings, the calculator projects how your balance builds over that period.

Step 6: View Instant Results

In seconds, the calculator shows you:

- Your total contributions (how much you’ve put in).

- The total interest earned (thanks to compounding).

- Your final balance at the end of the chosen timeframe.

This breakdown makes it clear how much of your wealth comes from you versus from compounding.

Worked Example: £5,000 Starting Balance + £200 Monthly Contribution

Let’s imagine you start with £5,000 and add £200 each month for 25 years at an annual growth rate of 6%, compounded monthly.

- Total contributions: £65,000 (£5,000 initial + £200 × 300 months).

- Interest earned: ~£87,000.

- Final balance: ~£152,000.

Now compare that with annual compounding instead of monthly: your final balance would be closer to £145,000. The extra £7,000 comes purely from the frequency of compounding, proof of how small details make a big difference.

Why This Matters?

The Compound Interest Calculator shows the hidden drivers of growth. It makes it easy to test scenarios like:

- Increasing contributions by £50 a month.

- Extending the timeline by 5 years.

- Changing compounding from annual to monthly.

These quick tests reveal how small adjustments today can add tens of thousands tomorrow.

Benefits of Using FinCalc’s Compound Interest Calculator:

When it comes to financial planning, clarity is everything. Most people know compound interest is powerful, but very few actually run the numbers for themselves. That’s where the FinCalc Compound Interest Calculator stands out; it turns complex maths into simple, actionable insights you can trust. Here’s why it’s different:

1. Transparency You Can Trust

Many calculators give you a single figure and leave you wondering how it was calculated. FinCalc goes further, breaking down:

- Your starting balance

- Total contributions

- Total interest earned

- Final balance

This makes it clear exactly how your money grows over time.

2. Speed and Simplicity

Forget wrestling with spreadsheets or memorising formulas. With the Compound Interest Calculator, you enter a few details and get results instantly. It’s quick enough for casual savers yet accurate enough for serious investors.

3. Flexibility to Test Scenarios

Want to see what happens if you increase your monthly contribution by £50? Or if your interest rate improves by 1%? The calculator lets you test endless “what if” scenarios in seconds, helping you make smarter financial choices.

4. Independent and Unbiased

Unlike bank calculators that try to steer you toward their products, FinCalc is independent and free to use. There’s no upselling, no hidden agenda, just accurate projections tailored to you.

5. Motivation Through Visibility

Numbers on a page aren’t always inspiring, but watching your balance grow in real time can be. Seeing how your £100 monthly savings turn into tens of thousands over time makes it easier to stay motivated and consistent.

6. Always Updated with Realistic Assumptions

Financial environments change, and outdated calculators can mislead you. FinCalc is updated regularly, ensuring your projections reflect realistic interest assumptions and compounding methods.

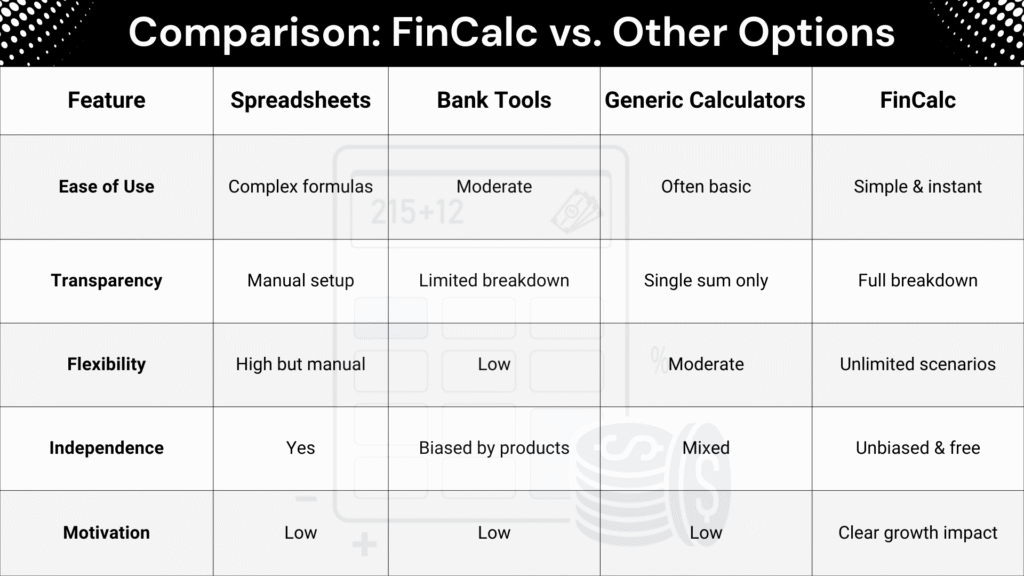

Comparison: FinCalc vs. Other Options

Real-Life Use Cases (Stories)

Numbers are useful, but stories bring them to life. Here are five examples of how different people used the FinCalc Compound Interest Calculator to plan smarter and achieve financial clarity.

1. The Student Investor

Alex, a 22-year-old student, had just £1,000 saved and wondered if it was even worth investing. Using the calculator, he saw that contributing just £100 a month at 6% growth could build over £115,000 by age 50. What seemed like “pocket change” turned into a long-term wealth strategy. The calculator showed him that starting small and early mattered more than waiting for a big income.

2. The Family Saving for Education

Priya and Mark wanted to save for their daughter’s university costs. They entered £5,000 as a starting balance, with £250 monthly contributions at a 4% growth rate for 15 years. The calculator projected nearly £60,000 by the time their daughter turned 18. That clarity gave them confidence that their savings would cover tuition and living costs without debt.

3. The Professional Planning Retirement

David, 40, worried about whether he was contributing enough to his retirement fund. He entered his £60,000 pension balance, £500 monthly contributions, and 6% annual growth for 25 years. The results? Over £400,000 by retirement age. By testing scenarios, he realised increasing contributions by just £100 monthly could add nearly £100,000 more. The calculator gave him the clarity to adjust before it was too late.

4. The Couple Testing Saving vs. Investing

Emma and James debated whether to keep £20,000 in a savings account or invest it. The calculator compared 2% growth (cash) vs. 6% growth (investments) over 20 years. The difference was staggering: £29,700 vs. £64,000. Seeing the numbers side-by-side helped them make an informed choice, turning a difficult decision into a confident plan. Comparing cash vs. investing? Use the Investment Return Calculator to contrast expected outcomes at different annual returns before you commit.

5. The Retiree Managing Withdrawals

Margaret, 65, had £150,000 saved and wanted to see how long it would last if she withdrew £1,200 monthly. Entering the figures at 4% annual growth showed her money could last 14 years. By lowering her withdrawals to £1,000 monthly, she extended it to nearly 20 years. The Compound Interest Calculator helped her make realistic, stress-free retirement decisions.

Understanding the Numbers (Educational Section)

Compound interest may sound complicated, but at its core, it’s just a formula that makes your money work harder over time. The challenge is that many people don’t grasp the impact of frequency, contributions, or time horizons. The Compound Interest Calculator makes these numbers easy to understand by turning the maths into real-life projections.

The Formula

The standard formula for compound interest is:

A = P × (1 + r/n)^(nt)

Where:

- A = future value of investment

- P = starting principal (initial amount)

- r = annual interest rate

- n = number of times interest compounds per year

- t = time in years

On paper, this looks intimidating, but the calculator handles it instantly, showing results without the headache.

Why Compounding Frequency Matters?

Interest can be compounded annually, quarterly, monthly, or even daily. The more often it’s compounded, the faster your balance grows.

Example: £10,000 at 5% for 20 years →

- Annually compounded = ~£26,500

- Monthly compounded = ~£27,100

- Daily compounded = ~£27,180

That extra £600+ comes purely from frequency. The Compound Interest Calculator lets you test each option side by side.

The Role of Contributions

Adding regular savings supercharges compound growth. Imagine starting with £0 but saving £200/month for 20 years at 5%:

- Total contributions = £48,000

- Final balance = ~£81,000

- Interest earned = ~£33,000

Here, compounding more than doubled the impact of your savings.

The Power of Time

Time is the most powerful ingredient. The earlier you start, the more dramatic the results. Example: £5,000 at 6% →

- After 10 years = ~£9,000

- After 20 years = ~£16,000

- After 30 years = ~£29,000

The biggest growth happens later, proving why starting early is critical.

Adjusting for Inflation

It’s also important to consider inflation, which reduces your money’s purchasing power. At 2% inflation, £100,000 in 20 years is worth closer to £67,000 in today’s terms. The calculator helps you test scenarios with and without inflation so you can plan realistically. To see real purchasing power, run the same scenario in the Inflation Impact on Savings Calculator and compare nominal vs. inflation-adjusted results.

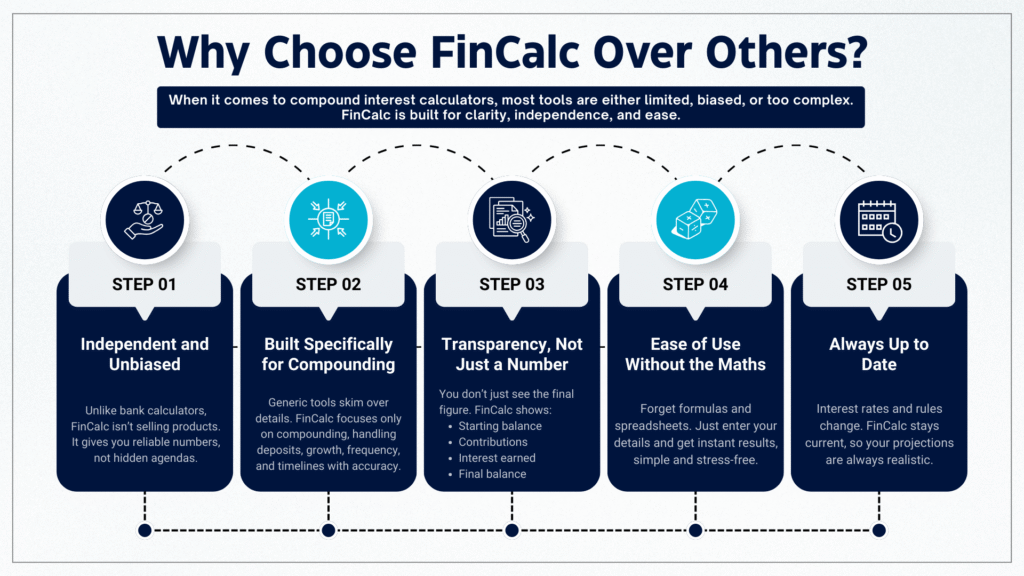

Why Choose FinCalc Over Others?

When it comes to calculating compound interest, there are plenty of options out there. You could use a bank’s built-in calculator, a generic app, or even try to build your own spreadsheet. The problem? Most of these tools are either too limited, too biased, or too complicated. That’s why the FinCalc Compound Interest Calculator was built with clarity, independence, and simplicity in mind.

Independent and Unbiased

Unlike bank calculators, FinCalc doesn’t try to push you into choosing one savings account or investment product. Our calculator is completely independent, designed to give you numbers you can trust, not sales pitches you didn’t ask for.

Built Specifically for Compounding

Generic financial calculators often lump together different tools, but few go deep on compounding. The Compound Interest Calculator is built specifically to handle deposits, growth rates, frequencies, and timelines with precision. It’s not a “catch-all” tool; it’s focused, detailed, and accurate.

Transparency, Not Just a Number

Many calculators spit out a lump sum and call it a day. FinCalc shows you the full breakdown:

- Starting balance

- Total contributions

- Interest earned

- Final balance

That level of detail makes it easy to understand how your wealth grows.

Ease of Use Without the Maths

Yes, spreadsheets can calculate compound interest perfectly if you know the formulas. But not everyone has the time or skill to manage complex spreadsheets. FinCalc makes it simple: a few inputs and you’re done. No formulas, no stress.

Always Up to Date

Interest environments change, and outdated tools can give misleading projections. FinCalc’s calculator is updated with current rules and methods, ensuring your results are relevant and realistic.

Comparison at a Glance

Feature | Bank Tools | Spreadsheets | Generic Apps | FinCalc |

Ease of Use | Moderate | Complex | Variable | Simple, instant |

Transparency | Low | Manual setup | Limited | Full breakdown |

Independence | Biased | Yes | Mixed | Unbiased |

Flexibility | Low | High | Medium | Unlimited scenarios |

Motivation | Low | Low | Low | Clear growth impact |

Conclusion

Compound interest is one of the most powerful forces in finance, but only if you understand how to make it work for you. Too many savers underestimate its impact or avoid running the numbers because the maths seems complicated. That’s exactly why we built the FinCalc Compound Interest Calculator. In just a few seconds, it shows you how your savings or investments grow over time, breaking down contributions, compounding, and total growth.

Whether you’re building an emergency fund, planning for retirement, or comparing investment options, this calculator gives you clarity and confidence. No jargon, no hidden agendas, just accurate numbers you can trust.For more calculators, projections, and plain-English guides across money topics, start at FinCalc.

FAQs

What is compound interest?

Compound interest is when you earn interest on both your original deposit and the interest that’s already been added. Over time, this creates a “snowball effect” that grows your money faster than simple interest.

How does a Compound Interest Calculator work?

The calculator uses your starting balance, contributions, interest rate, compounding frequency, and time horizon to project growth. It shows the total contributions, interest earned, and final balance.

What’s the difference between simple and compound interest?

Simple interest only applies to your original deposit. Compound interest grows on both your deposit and past interest, making it much more powerful over longer periods.

How often is interest compounded?

It can be compounded annually, quarterly, monthly, or even daily. The more frequent the compounding, the faster your money grows.

How much difference does frequency make?

A £10,000 balance at 5% over 20 years grows to about £26,500 with annual compounding but over £27,100 with monthly compounding. The calculator lets you compare these differences instantly.

Can I use the calculator for investments?

Yes. The Compound Interest Calculator works for both savings accounts and long-term investments. Just enter your expected growth rate to test different scenarios.

Does the calculator account for inflation?

It shows nominal growth by default, but you can adjust interest rates to factor in inflation. This helps you see both the “real” and “headline” value of your savings.

What interest rate should I enter?

Use 2–3% for cash savings and 5–7% for long-term investments. Running multiple scenarios helps you plan for the best, worst, and realistic cases.

Can I test different saving goals?

Absolutely. You can project how long it takes to reach a target like £20,000, or see how much you’ll have after a set number of years.