The Best Buy to Let Mortgage Calculator UK

Loan Amount

Monthly Mortgage

Net Monthly Cashflow

Rental Yield

Investing in property can be both exciting and intimidating. Buy-to-let has become one of the most popular ways to generate steady rental income while building long-term wealth, but the financial side is rarely straightforward. Mortgage repayments, interest rates, deposit requirements, and rental yield all need to be factored in before you can confidently decide if a property is worth it. For new landlords, these numbers often feel overwhelming, while seasoned investors know that miscalculations can quickly erode profit margins.

That’s exactly why the FinCalc Buy to Let Mortgage Calculator was created: to bring clarity to property investment. By entering a few key details such as property price, deposit, mortgage term, interest rate, and expected rental income, you get an instant, transparent breakdown of your monthly repayments, total mortgage cost, and how your rental income compares against your loan.

What is a Buy to Let Mortgage Calculator?

A Buy to Let Mortgage Calculator is a specialist financial tool designed for property investors who plan to purchase homes to rent out. Unlike a standard mortgage calculator, which only shows repayments for residential buyers, a buy-to-let version considers both the cost of the mortgage and the potential rental income the property generates. This dual perspective is vital for landlords because profitability depends not just on covering mortgage repayments but also on ensuring the rent provides a return on investment.

Here’s how it works: you input details such as property price, deposit amount, mortgage term, and interest rate. For buy-to-let scenarios, you also add expected monthly rent. The calculator then instantly shows you:

- Your monthly mortgage repayments.

- The total interest payable over the loan term.

- The overall repayment cost.

- Your gross rental yield (how rental income compares with property value).

- Whether your rental income comfortably covers the mortgage (the critical test for lenders).

For example, imagine a £200,000 property with a 25% deposit (£50,000) and a £150,000 mortgage at 5% interest over 25 years. The calculator shows monthly repayments of around £877. If your expected rent is £1,000, you’ll cover repayments and leave a margin for maintenance, insurance, and profit. Without this clarity, many investors risk overestimating returns and underestimating costs.

The value of the Buy to Let Mortgage Calculator lies in its ability to make complex property finance decisions simple. Instead of juggling spreadsheets or relying on rough estimates, you get a clear breakdown of how an investment will perform financially. This helps you answer the big questions: Can I afford this mortgage? Will the rent cover my costs? Is this property truly profitable? In short, a Mortgage Calculator is more than just a repayment tool; it’s a decision-making ally for investors. It allows you to test scenarios, stress-test against interest rate changes, and approach property investing with confidence and transparency.

Why Buy to Let Mortgage Planning Matters?

Buying a property to rent out isn’t just about choosing the right location or finding reliable tenants; it’s about making sure the numbers add up. A buy-to-let mortgage is very different from a standard residential loan. Landlords face stricter criteria, larger deposit requirements, and often higher interest rates. Without careful planning, what looks like a profitable investment on paper can quickly turn into a financial burden. This is why using a Buy to Let Mortgage Calculator and planning repayments upfront is essential.

The Financial Commitment

A buy-to-let mortgage usually requires a deposit of at least 20–25% and is often interest-only. That means you’ll only pay the interest each month, with the loan balance due at the end of the term. While this keeps monthly costs lower, it makes long-term planning even more important. If you don’t calculate repayments accurately, you may overcommit and end up with a property that drains cash instead of generating profit.

Avoiding Profit Erosion

Landlords often underestimate ongoing costs such as property maintenance, insurance, letting agent fees, and potential void periods (times when the property is empty). If you only focus on rental income and ignore these factors, your profit margin can shrink quickly. The Buy to Let Mortgage Calculator helps avoid this by showing you whether your rental income comfortably covers repayments and leaves enough margin for other costs.

Meeting Lender Requirements

Lenders don’t just look at your personal income; they assess whether the property itself is self-sustaining. Most require the rent to cover at least 125–145% of the mortgage repayment. Before applying, estimate what you can realistically borrow using the Mortgage Affordability Calculator to align rent coverage with lender stress tests. For example, if your repayment is £800/month, lenders want rent of at least £1,000–£1,160. Planning with a calculator ensures you meet these thresholds and improves your chances of mortgage approval.

Dealing with Market Changes

Interest rates fluctuate, property prices shift, and rental markets evolve. A property that looks profitable today might be less so tomorrow if rates rise or rents fall. The Buy to Let Mortgage Calculator allows you to stress-test different scenarios. By adjusting rates or deposits, you can see how changes affect your repayments and profits, giving you resilience against market uncertainty.

Peace of Mind for Long-Term Investors

Property investment is usually a long game. You’re committing for 10, 20, or even 25 years, and success depends on planning. Having a clear picture of repayments, yields, and affordability means you can focus on growing your portfolio instead of worrying about unexpected costs.

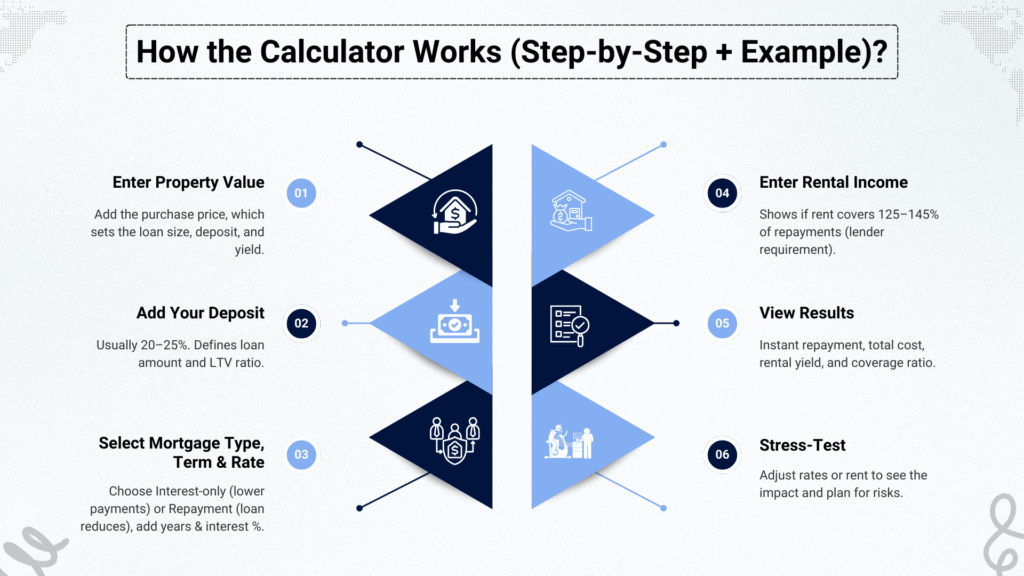

How the Calculator Works (Step-by-Step + Example)?

The Buy to Let Mortgage Calculator is designed to replicate the way lenders and investors assess affordability, repayments, and profitability. Instead of juggling spreadsheets or relying on guesswork, you can see everything clearly in just a few steps.

Step 1: Enter the property value.

Start with the purchase price of the property you want to buy. This is the base figure that determines the loan size, deposit requirement, and future yield.

Step 2: Add your deposit.

Most buy-to-let mortgages require a 20–25% deposit. The calculator subtracts this deposit from the property price to show the loan amount. This also defines the loan-to-value (LTV) ratio, which directly impacts interest rates. Not sure if your deposit meets lender thresholds? Check your ratio with the Loan to Value (LTV) Calculator to see how your LTV affects rates and approval.

Step 3: Select mortgage type, term, and interest rate

Buy-to-let mortgages often come in two types:

- Interest-only (common for landlords, lower monthly payments, but balance remains).

- Repayment (paying both principal + interest, balance reduces over time).

- Choose your loan term (e.g., 20–25 years) and interest rate to see how your repayments look under each setup.

Use the Interest Only Mortgage Calculator to compare lower monthly costs against capital-repayment options before you choose a mortgage type.

Step 4: expected rental income

Unlike residential mortgages, rental income plays a critical role. Lenders usually want the rent to cover 125–145% of monthly repayments. The calculator factors this in, showing whether your projected rent covers repayments comfortably.

Step 5: View instant results.

The calculator instantly provides:

- Monthly mortgage repayment.

- Total interest payable over the term (if repayment).

- Total mortgage cost.

- Gross rental yield (% of annual rent vs property value).

- Coverage ratio (rent ÷ repayment) to check lender stress tests.

Step 6: Stress-test your plan

Change interest rates or rents to test resilience. For example, if the rate rises from 5% to 6%, monthly repayments increase significantly. The calculator lets you see these changes instantly, so you can plan buffers. Stress-test different rates and terms with the Mortgage Repayment Calculator to see how monthly payments shift if interest rates rise.

Worked Example 1, Standard repayment

- Property price: £250,000

- Deposit: 25% (£62,500)

- Mortgage: £187,500

- Term: 25 years, rate: 5% repayment

Results:

- Monthly repayment: ~£1,100

- Total interest: ~£143,000

- Total repaid: ~£330,000

- Rent assumed: £1,250 → Coverage ratio = 114% (below lender threshold, risky).

Worked Example 2, Interest-only

Same property, but with interest-only:

- Monthly repayment: ~£781

- Total repaid during term: ~£234,000 (interest only, balance remains).

- Rent assumed: £1,250 → Coverage ratio = 160% (comfortably above threshold).

This example shows how interest-only mortgages can boost short-term cash flow but leave the principal outstanding at the end.

Benefits of Using FinCalc’s Buy-to-Let Mortgage Calculator

Property investment isn’t just about buying bricks and mortar; it’s about making sure the numbers work. Many landlords rush in with optimism, only to find that repayments and costs eat away at their rental profits. The FinCalc Buy to Let Mortgage Calculator removes the uncertainty, giving you clarity and control from the start. Here’s why using it can transform your investment decisions.

1. Transparent Results You Can Trust

Unlike bank calculators that often hide the full cost, FinCalc lays everything out clearly: monthly repayments, total interest, gross rental yield, and repayment coverage ratio. This transparency means you’ll never be caught off guard.

2. Speed and Accuracy

Manual spreadsheets are time-consuming and error-prone. Bank tools often oversimplify. FinCalc gives accurate, lender-style figures in seconds, so you can compare properties quickly and make confident choices.

3. Flexibility for Every Scenario

Whether you’re exploring an interest-only mortgage, testing shorter vs. longer terms, or stress-testing higher rates, the calculator adapts. You can adjust deposits, terms, rates, and rental income instantly to see how each decision impacts repayments and profitability.

4. Independence and Unbiased Guidance

Most bank calculators are designed to steer you toward their own mortgage products. FinCalc is different. Our Buy to Let Mortgage Calculator is independent, no sales agenda, no hidden bias, just data you can rely on.

5. Smarter Investment Planning

With clear figures, you’ll know whether your rental income comfortably covers repayments and leaves room for profit. This empowers you to negotiate better with lenders, avoid risky deals, and focus only on properties that make sense financially.

6. Designed for All Types of Landlords

- First-time landlords can avoid common mistakes by seeing true costs upfront.

- Portfolio investors can test multiple properties and compare yields.

- Retirement planners can model income streams from buy-to-let.

- Hands-off landlords can build confidence without needing complex spreadsheets.

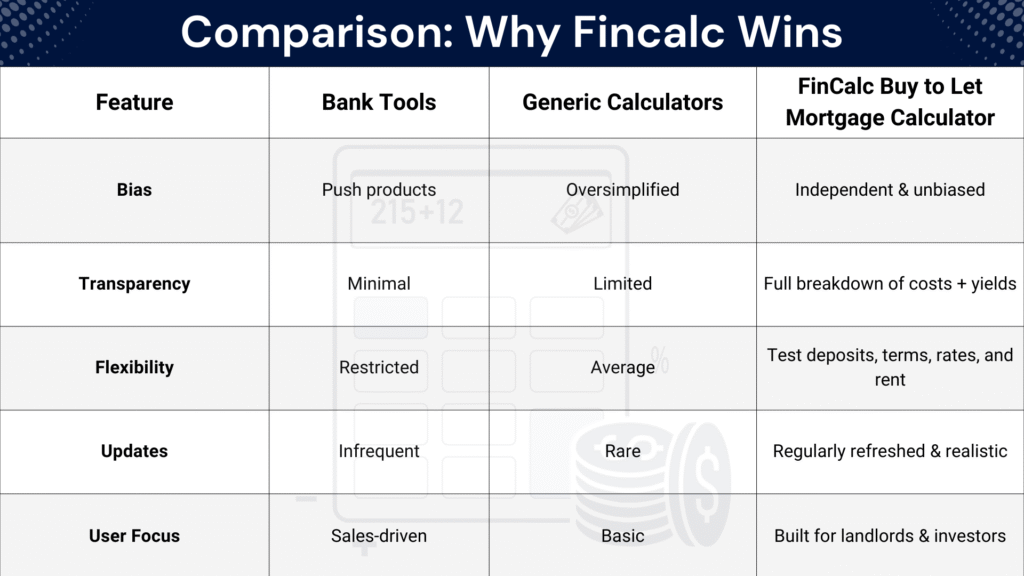

Comparison: Why FinCalc Wins

Real-Life Use Cases

Every landlord’s journey looks different, but one thing is universal: the need to get the numbers right. The Buy to Let Mortgage Calculator is built to support all types of investors, from first-time landlords dipping their toes into property to experienced portfolio builders. Here are some real-world style examples of how people use it to plan smarter.

1. The First-Time Landlord Finding Confidence

Emily, 29, had saved £55,000 and wanted to buy her first rental property worth £220,000. She wasn’t sure if the rental income would cover repayments. Using the Buy to Let Mortgage Calculator, she saw that with a £165,000 mortgage at 5% interest-only, repayments would be ~£688/month. With an expected rent of £950, the calculator showed a coverage ratio of 138%. This reassured her that she could afford the mortgage comfortably, even after allowing for maintenance and letting fees.

2. The Growing Portfolio Investor

David already owned three properties and was considering a fourth worth £300,000. He wanted to compare repayment vs interest-only mortgages. The calculator revealed that:

- Repayment mortgage at 5% over 25 years = ~£1,750/month.

- Interest-only mortgage = ~£1,250/month.

With a projected rent of £1,700, the repayment model left almost no profit margin, whereas the interest-only option generated a positive cash flow. The insight helped David choose interest-only for this property while keeping repayment mortgages on others, balancing long-term strategy with short-term cash flow.

3. The Couple Planning Retirement Income

Sarah and Mike, both in their early 50s, wanted to buy a small flat to rent out as part of their retirement plan. They had £80,000 to put down as a deposit on a £250,000 property. With a £170,000 loan at 4.5%, repayments would be ~£850/month. The calculator showed that the expected rent of £1,200 per month provided sufficient coverage, plus a £350 profit margin. This gave them the confidence to proceed, knowing the property would supplement their pensions later.

4. The Investor Stress-Testing Rates

Mark, 42, worried about rising interest rates. He used the Buy to Let Mortgage Calculator to see how a £200,000 loan would look at different rates:

- 4% = £667/month (interest-only).

- 5% = £834/month.

- 6% = £1,000/month.

With rent at £1,200, he realised that while his investment was safe at 4–5%, higher rates would eat into profits quickly. This helped him decide to fix his mortgage for 5 years to protect cash flow.

5. The Retiree Downsizing with a Buy-to-Let

Rachel, 62, sold her large family home and wanted to invest part of the proceeds into a rental flat. She tested a £150,000 buy-to-let mortgage with a 25% deposit on a property valued at £200,000. With rent at £850 and repayments at ~£625 (interest-only, 5%), the calculator showed a healthy 136% coverage ratio. The numbers gave her peace of mind that she could rely on this rental for a steady income in retirement.

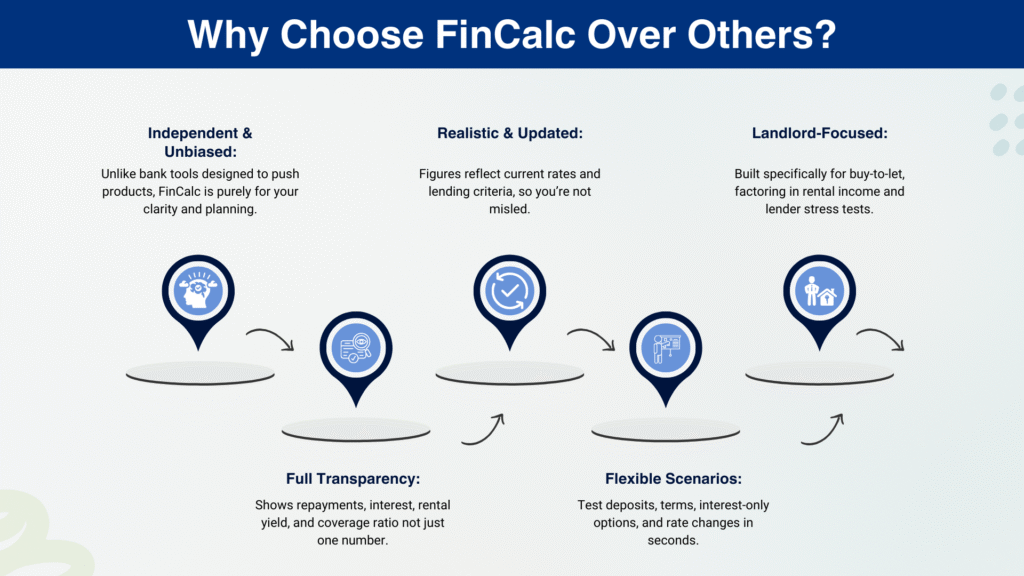

Why Choose FinCalc Over Others?

There are plenty of mortgage calculators online, but most are designed for residential buyers, not landlords. Others are created by banks with the hidden goal of selling their own products. Generic tools often give rough estimates without factoring in rental income, yields, or coverage ratios. The FinCalc Buy to Let Mortgage Calculator is different; it’s built for landlords, fully transparent, and independent.

1. Independent and Unbiased

Bank calculators typically nudge you toward their mortgages, sometimes showing “optimistic” results to make their offers look more appealing. FinCalc is completely independent. Our calculator is designed solely to give you clarity and confidence, not to sell you a deal.

2. Full Transparency

Most calculators stop at monthly repayments. FinCalc goes further by showing:

- Monthly mortgage repayment.

- Total interest cost.

- Coverage ratio (rent ÷ repayment).

- Gross rental yield.

- Impact of term length and deposit size.

This level of detail ensures you see the whole picture, not just part of it.

3. Updated and Realistic

Interest rates and lending criteria change constantly. Many tools are outdated, leading to misleading results. The Buy to Let Mortgage Calculator is refreshed regularly, meaning your figures mirror real-world conditions.

4. Flexibility for All Investors

Whether you’re testing an interest-only mortgage, comparing different deposits, or stress-testing higher rates, the calculator adapts. You can experiment with multiple scenarios in seconds, giving you flexibility that most calculators simply don’t provide.

5. Built for Landlords, Not Homeowners

Residential calculators don’t factor in rental income or lender stress tests. FinCalc does. By modelling rental coverage ratios and yields, it gives landlords exactly the data lenders will check, helping you avoid surprises.

Conclusion:

Investing in property can be highly rewarding, but only when the numbers add up. Too many landlords dive in without a clear understanding of mortgage repayments, rental yield, or coverage ratios, only to discover later that their profits are thinner than expected. That’s where the FinCalc Buy to Let Mortgage Calculator makes all the difference.

By combining property price, deposit, loan term, interest rate, and rental income, the calculator instantly shows you monthly repayments, total loan costs, yield, and whether your rent comfortably covers the mortgage. This level of transparency means you can plan realistically, stress-test different scenarios, and avoid common pitfalls that catch many new and experienced landlords off guard. Whether you’re buying your first rental property, adding to a growing portfolio, or planning a buy-to-let as part of your retirement income, FinCalc gives you clarity and confidence every step of the way.

FAQs:

What is a Buy to Let Mortgage Calculator?

It’s a tool that helps landlords work out monthly repayments, total loan costs, rental yield, and coverage ratios for buy-to-let properties.

How is it different from a standard mortgage calculator?

Unlike residential calculators, it factors in rental income and stress-test coverage, critical for landlords and lender approval.

What deposit do I need for a buy-to-let mortgage?

Most lenders require at least 20–25% of the property price, though some may ask for more depending on your profile.

Does it show rental yield as well as repayments?

Yes. The Buy to Let Mortgage Calculator shows both monthly costs and gross rental yield, helping you check profitability.

Can I use it for interest-only mortgages?

Absolutely. Many buy-to-let loans are interest-only, and the calculator can model both repayment and interest-only structures.

How accurate are the results?

They provide realistic estimates that mirror lender calculations, though final figures may vary based on lender criteria and fees.

What is a coverage ratio, and why does it matter?

It’s the ratio of rent to repayments, usually 125–145%. Lenders require this margin to ensure the rent comfortably covers the mortgage.

Does the calculator work for multiple properties?

Yes. You can test scenarios for as many properties as you like, comparing yields and costs side by side.

Can I use it if I’m a first-time landlord?

Of course. It’s designed to be beginner-friendly, helping new investors avoid common mistakes and overestimating profits.

Do interest rates make a big difference to buy-to-let?

Yes. Even a 1% rise in rates can add hundreds to monthly repayments, which is why stress-testing with the calculator is vital.

Does the tool include fees like insurance or maintenance?

No, it focuses on mortgage costs, but you should always budget separately for fees, maintenance, and potential void periods.

Why use FinCalc’s Buy to Let Mortgage Calculator?

Because it’s independent, transparent, and built for landlords, giving you detailed results without the bias of bank calculators.