NHS Payslip Explained: Terms, Deductions & More

Getting your NHS payslip and not understanding half of what’s on it? You’re not alone. Whether you’re a new NHS starter or a long-serving healthcare worker, decoding your payslip can feel like trying to read medical Latin. Between confusing NHS tax codes, unexpected deductions, and pension contributions you didn’t know were mandatory, it’s no wonder many NHS staff are left wondering if they’ve been paid correctly.

In this guide, we’ll walk you through the NHS payslip explained in plain English. We’ll break down each section, from gross pay to student loan deductions, and help you understand what your payslip is telling you. By the end, you’ll not only know what every line means, but you’ll also be able to spot mistakes, challenge over-deductions, and feel fully in control of your monthly earnings.

What’s on an NHS Payslip?

An NHS payslip calculator might look like a jumble of acronyms, codes, and numbers at first glance, but each part tells a story about your earnings, taxes, and entitlements. Here’s a breakdown of the key components you’ll typically see:

1. Personal Details & Employment Info

At the top, you’ll find your name, employee number, and usually your job title or department. This section also shows your pay period (e.g., April 2025) and your tax reference number, which links to your employer for HMRC purposes.

2. NHS Tax Code

One of the most critical lines is your tax code. This little code determines how much Income Tax you’ll pay. Most NHS staff in 2025 will see codes like 1257L (the standard) or BR (basic rate, often used for second jobs). If your tax code is incorrect, you could be overpaying or underpaying your taxes.

3. Gross Pay

This is your total salary before any deductions. It includes your base pay, overtime, unsocial hours payments, bonuses, and any shift enhancements. Don’t confuse this with take-home pay; it’s what you’ve earned before HMRC steps in.

4. Deductions Section

This section shows what’s been taken out of your gross pay. Expect to see things like:

- National Insurance (NI) contributions

- Income Tax

- NHS Pension contributions

- Student Loan deductions if applicable

- Other items like union fees or season ticket loans

Each deduction should be listed clearly with the amount taken and the cumulative amount for the year.

5. Net Pay

This is the golden number: what you take home after all deductions. It’s what lands in your bank account on payday.

Common Deductions: Tax, NI, Student Loans & More

When you see a lower net pay than expected, it’s usually not a mistake; it’s deductions doing their job. NHS payslips include a few core deductions that apply to most staff, and it’s crucial to understand what each one means and why it’s taken out of your gross pay.

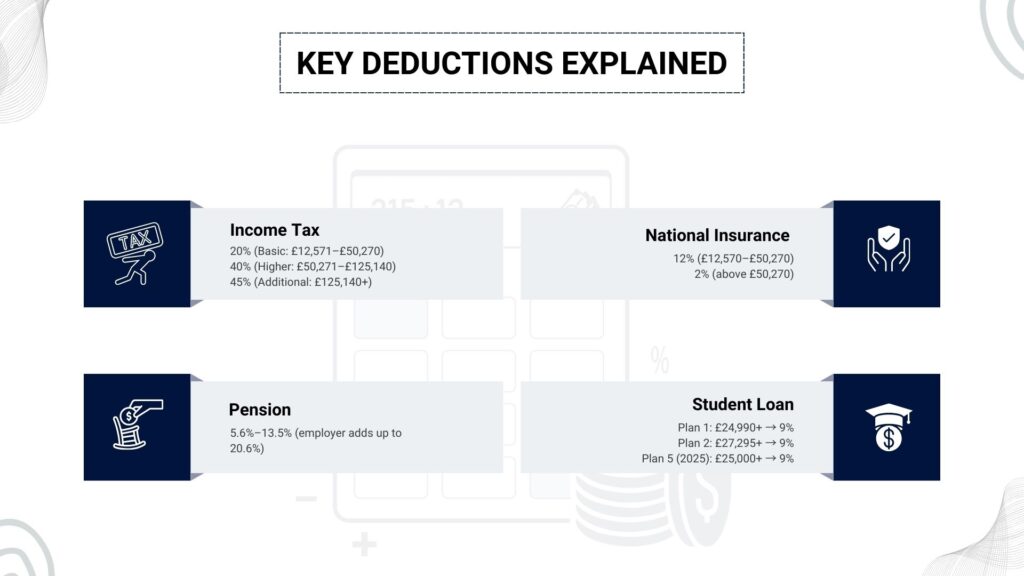

1. Income Tax

This is the most obvious one. Based on your NHS tax code, HMRC deducts a portion of your income depending on how much you earn. The standard personal allowance in 2025 is £12,570, meaning you won’t pay tax on the first £12,570 of your annual salary. Everything above that is taxed at:

- 20% (Basic Rate) for earnings between £12,571–£50,270

- 40% (Higher Rate) for earnings over £50,271

- 45% (Additional Rate) for income above £125,140

If your tax code is wrong (say, you’ve got multiple jobs), you could be taxed too much, or not enough.

2. National Insurance (NI)

NI contributions help fund state benefits like the NHS itself, state pensions, and maternity leave. For most NHS employees, Class 1 NI applies:

- 12% on earnings between £12,570 and £50,270

- 2% on earnings above £50,270

This deduction is automatic, and you don’t have to file anything for it; just keep an eye on the amounts deducted.

3. NHS Pension Contributions

If you’re in the NHS Pension Scheme (which is optional, but highly recommended), you’ll contribute a percentage of your gross pay. Rates vary based on your earnings:

- Entry level: ~5.6%

- Higher bands: up to ~13.5%

These deductions help fund your retirement, and the employer contributes a hefty chunk too, up to 20.6% in some cases. Your payslip will show the monthly deduction and year-to-date contributions.

4. Student Loan Deduction

If you’ve taken out a student loan, you may see “Student Loan” listed on your payslip. The amount and threshold depend on your repayment plan:

- Plan 1: Earnings over £24,990 (9% deduction)

- Plan 2: Earnings over £27,295 (9% deduction)

- Plan 5 (new in 2025): Earnings over £25,000 (9% deduction)

Important: Student loan deductions are based on gross pay before tax, not your net salary.

Conclusion

Understanding your NHS payslip doesn’t have to be a guessing game. Once you break down the components, from your NHS tax code and National Insurance to pension contributions and student loan deductions,it all begins to make sense. Whether you’re just starting in the NHS or looking to get a clearer picture of your pay structure, a clear grasp of your payslip can give you better financial control and peace of mind.

Remember your payslip is more than just a summary of hours worked, it’s a window into how your pay is calculated and why your net take-home may differ from your gross salary. If you ever feel uncertain or notice something off, don’t hesitate to raise it with payroll or use an NHS pay calculator to double-check your expected pay. Knowledge is power, especially when it comes to your paycheck.

Frequently Asked Questions:

What information is shown on an NHS payslip?

An NHS payslip shows your personal details, tax code, gross pay, itemised deductions (such as income tax, National Insurance, NHS pension, and student loan), and your final net pay. It also includes year-to-date totals to help you track earnings and deductions across the tax year.

What does gross pay mean on an NHS payslip?

Gross pay is your total earnings before any deductions are taken. It includes your basic salary, overtime, unsocial hours payments, shift enhancements, and any additional allowances.

Why is my NHS net pay lower than my gross pay?

Your net pay is lower because deductions are taken for income tax, National Insurance, NHS pension contributions, and sometimes student loan repayments or other agreed deductions. These are mandatory and calculated automatically based on your tax code and earnings.

How do I know if my NHS payslip deductions are correct?

You can check your deductions by reviewing your tax code, comparing pension contribution rates to your salary band, and ensuring student loan deductions match your repayment plan. Using an NHS pay or payslip calculator can also help verify whether the amounts look accurate.

What should I do if there is a mistake on my NHS payslip?

If you notice an error on your NHS payslip, contact your payroll or HR department as soon as possible. For tax code issues, you may also need to contact HMRC to correct the problem and prevent over- or under-deductions.