NHS Pay Calculator Comparison: Gov.uk vs Online Tools in 2025

Understanding your NHS salary can be complicated, especially with different pay bands, overtime, and pension contributions. This is where an NHS pay calculator comparison becomes useful. By evaluating different calculators, NHS staff can quickly estimate their take-home pay, deductions, and overall earnings.

With multiple tools available online, knowing which calculator is accurate and reliable is essential. From official government tools to private online calculators, each has its strengths and limitations. This guide explores how NHS pay calculators work, the differences between gov.uk vs private calculator comparison, and helps you determine which tool best fits your needs.

What Is an NHS Pay Calculator?

An NHS pay calculator is an online tool designed to help healthcare staff estimate their salary, deductions, and take-home pay based on their pay band, hours worked, and any additional allowances. These calculators simplify the complex structure of NHS salaries, making it easier for staff to understand what they can expect to earn each month. Start with the official NHS Pay Calculator to understand your salary by band and allowances.

By using an NHS pay calculator, employees can:

- Check standard salary against pay bands

- Calculate overtime and unsocial hours payments

- Estimate pension contributions

- Compare different pay scenarios for budgeting

When performing an NHS pay calculator comparison, it becomes clear that some tools offer more detailed features, while others focus on quick, simple calculations. Choosing the right calculator ensures accurate results and helps staff plan their finances effectively.

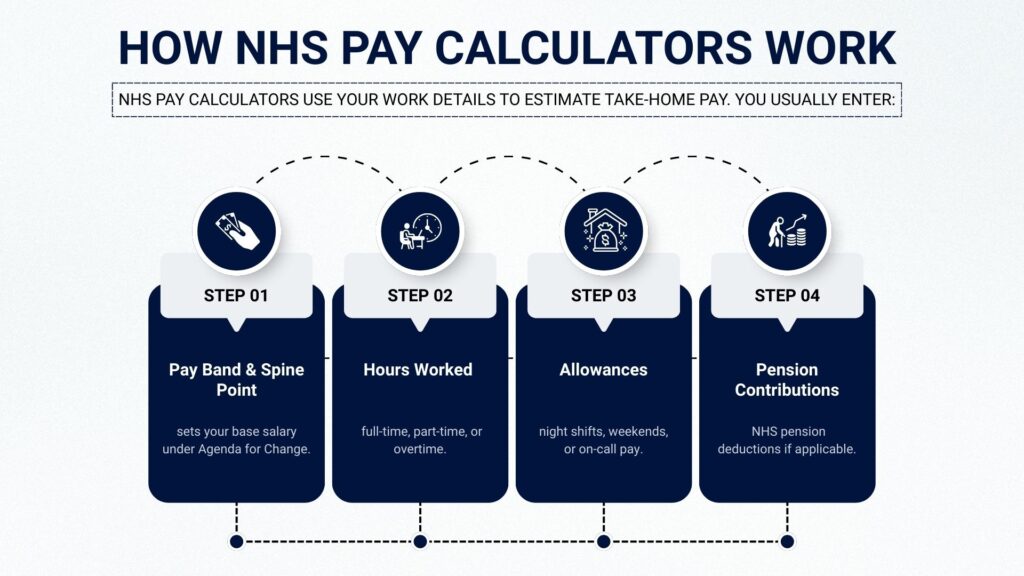

How NHS Pay Calculators Work

NHS pay calculators are designed to take your salary details and other work-related information to generate an accurate estimate of your take-home pay. Most calculators require you to input:

- Pay Band and Spine Point – Determines your base salary according to the Agenda for Change pay structure.

- Hours Worked: Full-time, part-time, or overtime hours affect your total earnings.

- Allowances: Unsocial hours, weekend, night shifts, and on-call pay can be included.

- Pension Contributions: Optional deduction based on your NHS pension scheme.

Performing an NHS pay calculator comparison helps staff understand which tools include additional features like holiday pay, bonuses, or on-call earnings, making it easier to choose the most comprehensive and accurate calculator.

Gov.uk vs Private Calculator: Key Differences

When performing an NHS pay calculator comparison, it’s important to understand the differences between official government tools and private calculators. Both have their advantages, but they serve slightly different purposes.

1. Accuracy and Reliability

- Gov.uk Calculator – Maintained by the government, it is highly accurate for standard pay, tax, and National Insurance deductions. For detailed NI breakdowns, try the NI Contributions Calculator alongside your salary estimates.

- Private Calculators – May include extra features like allowances, overtime, and on-call pay, but the accuracy depends on how frequently the tool is updated.

2. Features and Flexibility

- Gov.uk – Focuses on basic salary and statutory deductions. It is straightforward but may not include unsocial hours or bonuses.

- Private Calculators – Often allow for input of overtime, weekend shifts, and additional pay, giving a more detailed estimate of NHS pay.

3. User Experience

- Gov.uk – Simple interface, easy to navigate, ideal for quick calculations.

- Private Calculators – Some offer more interactive features and breakdowns, which can help plan finances and understand take-home pay in detail.

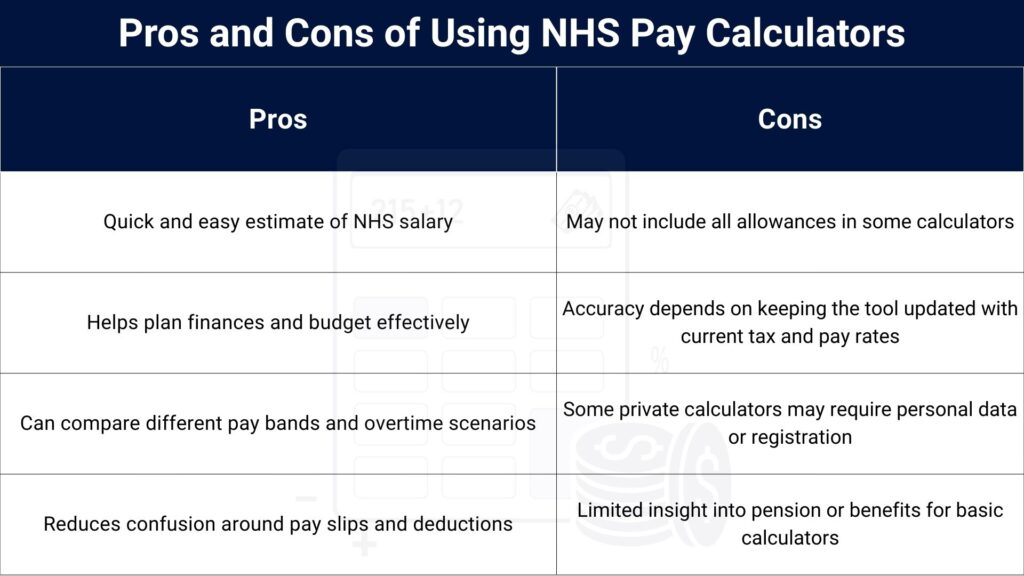

Pros and Cons of Using NHS Pay Calculators

NHS Pay Calculator Comparison: Which Tool Is Better?

Choosing the right tool depends on your needs and the level of detail you want. When conducting an NHS pay calculator comparison, there are two main options:

1. Gov.uk Calculator

- Pros: Highly accurate for basic salary, tax, and National Insurance. Maintained by the government, so reliable and up-to-date.

- Cons: Limited features; does not include unsocial hours, overtime, or on-call pay.

2. Private Calculators

- Pros: Detailed breakdowns including overtime, weekend shifts, night shifts, on-call pay, and allowances. Ideal for staff who want a comprehensive estimate.

- Cons: Accuracy depends on how frequently the tool is updated; some require registration or personal data.

How Accurate Are NHS Pay Calculators?

Accuracy is a key concern when performing an NHS pay calculator comparison. While most calculators provide a reliable estimate, their precision depends on several factors:

- Input Accuracy

The results are only as accurate as the data entered. Pay band, spine point, contracted hours, and allowances must be correct. - Updates and Maintenance

Calculators must be regularly updated to reflect the latest tax rates, National Insurance contributions, and NHS pay scales. Gov.uk tools are typically more accurate for basic pay, while private calculators may vary in reliability. - Inclusion of Allowances

Tools that account for overtime, night shifts, weekend rates, and on-call pay offer a more precise estimate. Basic calculators without these inputs may understate take-home pay.

Tips for Choosing the Right Calculator

When performing an NHS pay calculator comparison, selecting the right tool can save time and provide accurate results. Here are some key tips:

- Ensure the calculator is updated with the latest NHS pay bands, tax rates, and National Insurance contributions.

- A simple, intuitive interface helps avoid mistakes and makes calculations faster.

- Verify that private calculators do not require unnecessary personal data and that your information is protected.

Conclusion:

An NHS pay calculator comparison is a useful way for staff to estimate their salary, understand deductions, and plan their finances. While Gov.uk calculators provide official, reliable figures for standard pay and tax, private calculators offer detailed insights including overtime, weekend rates, and on-call allowances.

Choosing the right tool depends on your needs: if you want simplicity and accuracy, Gov.uk is ideal; if you need a comprehensive breakdown of all potential earnings, a trusted private calculator may be better. By comparing different options, NHS staff can make informed decisions and better manage their take-home pay.