The Best Credit Card Repayment Calculator UK

Monthly Payment

Total Interest Paid

Total Paid

Time to Payoff

Credit card debt can feel like quicksand. You make the minimum payment each month, but the balance barely moves. Interest keeps piling up, and suddenly what felt like a small expense turns into years of repayment. For millions of people, this is the everyday reality of relying on credit cards. That’s exactly why we built the FinCalc Credit Card Repayment Calculator. Instead of guessing how long it will take to clear your balance, you can see the exact timeline, interest cost, and total repayment required ,all in seconds. It’s simple, accurate, and designed for people who want to take control of their finances without wading through spreadsheets or financial jargon. This isn’t about complicated formulas. It’s about clarity. You’ll instantly understand the difference between sticking to the minimum versus committing to a fixed repayment strategy. For example, a £5,000 balance at 20% APR might take more than 15 years to clear with minimum payments. But if you commit to £250 a month, you could be debt-free in under two years. That’s the kind of insight that can transform your financial future.

Take the case of Mark, a young professional juggling two credit cards. He thought paying £100 per card each month was enough. But when he ran the numbers, the Credit Card Repayment Calculator showed he would pay over £7,000 in interest over the next decade. By increasing his payments by just £50 per card, he cut that timeline in half and saved thousands. One quick calculation changed his entire approach. That’s the power of FinCalc: giving you the numbers upfront so you can make better decisions today. No gimmicks, no fine print, no sales pitch ,just pure financial clarity. Your debt doesn’t need to control you. In less than a minute, you can see your repayment path clearly, test different strategies, and choose the one that gets you debt-free faster. Whether you’re carrying a small balance or dealing with multiple cards, the calculator gives you the knowledge you need to take back control.

What is a Credit Card Repayment Calculator?

A credit card can be both a convenience and a trap. It gives you instant access to purchases today, but if you only make the minimum payment, the debt can quietly snowball for years. That’s why understanding how long it takes to clear your balance ,and how much it will really cost ,is essential. A Credit Card Repayment Calculator is designed to give you that clarity.

Put simply, it’s a tool that shows you exactly how long it will take to pay off your credit card balance based on your current repayment habits. Instead of leaving you in the dark, it calculates repayment timelines, total interest, and the true cost of carrying debt. You enter a few details ,your card balance, the annual percentage rate (APR), and your monthly payment ,and the calculator does the heavy lifting for you.

Unlike a generic loan calculator, which often assumes fixed amounts or doesn’t account for compounding interest, a Credit Card Repayment Calculator is built specifically for revolving debt. It recognizes how credit cards work: high APRs, minimum payments, and compounding charges that can stretch a “small” debt into a decades-long burden.

Here’s what makes it so useful:

- Clarity: It turns vague numbers into a clear repayment timeline.

- Control: You can adjust payments to see how faster repayments save thousands in interest.

- Motivation: Seeing how an extra £50 a month shortens your debt by years is a powerful incentive.

Take a simple example. Imagine you owe £3,000 on a card with 19% APR. If you stick to minimum payments, you could be repaying that balance for over a decade and pay thousands extra in interest. But if you commit to paying £200 a month, the calculator will show you that you can be debt-free in just 18 months, with far less interest paid. This tool isn’t just for people in deep debt. It’s just as valuable if you’re carrying a small balance and want to plan smartly, avoid surprises, or test how quickly you could pay it off by increasing your repayments. Whether you’re managing one card or several, the Credit Card Repayment Calculator gives you a realistic snapshot of your repayment journey.

Why Use a Credit Card Repayment Calculator?

Most people assume they’ll “get around to” paying off their credit cards eventually. The minimum payment is small, so the debt feels manageable. But here’s the reality: relying on minimum payments can lock you into debt for years, sometimes decades, while interest quietly drains thousands from your pocket.The problem is, without clear numbers, it’s impossible to see just how long repayment will actually take. That’s why the Credit Card Repayment Calculator is such a powerful tool. Instead of guessing or hoping, it gives you the truth, in black and white.

The Problem Without a Calculator

Without a repayment calculator, you’re flying blind. You might think you’re making progress, but in reality, your monthly payments could be covering little more than interest. For example, paying £100 toward a £5,000 balance at 20% APR feels like progress, but in reality, only £20–30 of that payment may reduce the principal. The rest is swallowed by interest. At that pace, your debt could follow you for 15 years or more. And the mental cost is just as heavy. The stress of carrying “invisible debt”, the kind that never seems to shrink, can weigh on your confidence, your financial goals, and even your sleep.

The Solution With a Calculator

FinCalc’s Credit Card Repayment Calculator turns a vague financial burden into a clear repayment plan. With a few simple inputs, you’ll instantly see:

- Exactly how long will it take to clear your balance?

- How much of your hard-earned money will go toward interest?

- How different payment strategies speed up your debt-free date.

For example, if you increase your monthly repayment from £150 to £200, you won’t just save £50 on the balance. You might cut years off your repayment timeline and save thousands in interest charges. Seeing that difference on-screen is often the motivation people need to take action.

The Emotional Advantage

It’s not just about numbers , it’s about peace of mind. Imagine walking into the new year already knowing you’ll be debt-free in 18 months, not 10 years. Or planning a major purchase with the confidence that your credit card balance will be gone by the time you need extra borrowing power. That kind of clarity removes uncertainty and stress, replacing them with control and confidence.

More Than Just Repayment Math

Another reason to use the calculator is flexibility. It’s not just a one-time tool; it’s a strategy planner. You can:

- Test “what if” scenarios (What if I add £50 more each month? What if I get a balance transfer deal at 0% APR?).

- Compare multiple cards side by side.

- Decide whether to consolidate debt or accelerate repayment.

Instead of treating your credit card like a black box, the calculator opens it up and shows you how to beat the system.

Avoiding the Minimum Payment Trap

Credit card companies often highlight how “affordable” minimum payments are, but what they don’t tell you is that sticking to those payments often doubles or triples your repayment timeline. The Credit Card Repayment Calculator exposes this trap instantly, showing you how much faster you’ll be debt-free by making even slightly higher payments.

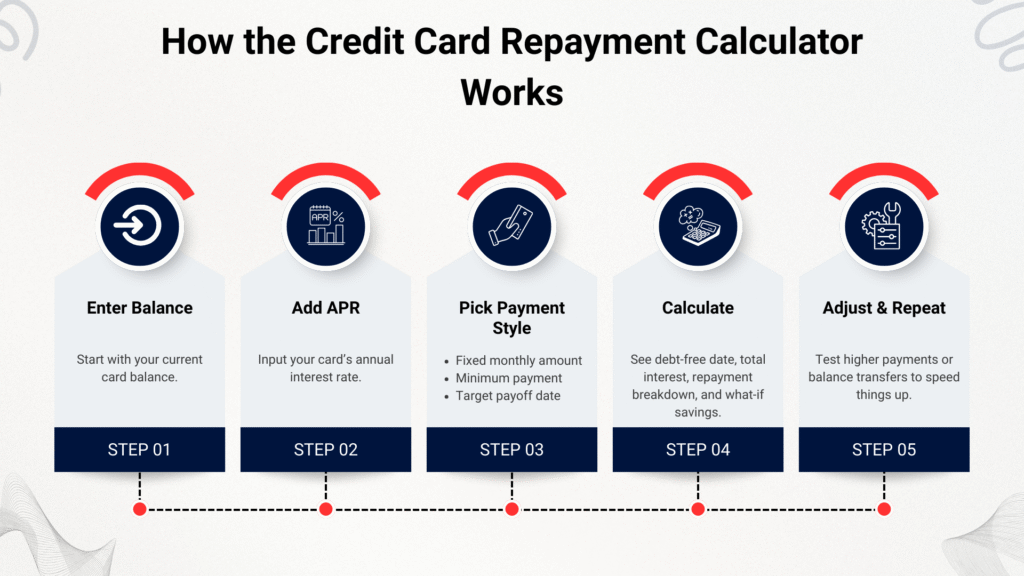

How the Credit Card Repayment Calculator Works

You don’t need spreadsheets or guesswork. In a few inputs, FinCalc’s Credit Card Repayment Calculator shows exactly how long payoff will take, how much interest you’ll pay, and what to change to get debt-free faster.

Step 1: Enter your balance.

Use today’s statement balance (or the balance you plan to tackle). If you’re carrying multiple cards, start with one, then repeat or sum results.

Step 2: Add your APR.

Enter the card’s annual percentage rate. The calculator converts this to a monthly rate and applies compounding the same way your issuer does.

Step 3: Choose your payment style.

- Fixed monthly amount (e.g., £200): most useful for building a plan.

- Minimum payment mode (e.g., 2% of balance or £25, whichever is higher): reveals how long repayment drags when you only pay the minimum.

- Target payoff date (optional): tell the tool your desired debt-free date; it returns the monthly payment required to hit it.

Seeing how minimums stretch the timeline? Run your balance through the Credit Card Minimum Payment Calculator to compare payoff time and total interest side-by-side.

Step 4: Calculate.

You’ll see:

- Months to payoff / debt-free date

- Total interest across the journey

- Amortisation view (how each payment splits between interest and principal)

- What-if suggestions (e.g., +£25/mo, +£50/mo) with the time and interest saved

Step 5, Iterate.

Nudge the payment up or test a balance-transfer APR. The calculator updates instantly, so you can lock a plan that fits your cash flow. If you’re weighing a single fixed-rate payoff loan, price the new monthly and lifetime cost with the Debt Consolidation Calculator before you switch.

Benefits of Using FinCalc’s Credit Card Repayment Calculator

Carrying credit card debt isn’t just about owing mone; it’s about the stress of not knowing when, or if, you’ll ever be free of it. Most people pay month after month without realising how much of their payment disappears into interest. That’s where the Credit Card Repayment Calculator changes the game. Instead of living in uncertainty, you get clear answers in seconds.

1. See the Full Picture

Credit card statements often show a “minimum payment” and maybe a small box estimating time to repay, but they rarely tell the whole story. Our calculator lays out your complete repayment path, balance, interest, and timeline, so you see exactly what you’re up against.

2. Test Different Payment Strategies

Ever wondered what would happen if you added just £50 to your monthly repayment? Or if you cut out a small expense to free up £100? With the calculator, you don’t have to wonder; you can see the difference instantly. Small changes today often mean years saved tomorrow. To decide where the extra ££ goes, map it with the Debt Snowball Calculator for quick wins or the Debt Avalanche Calculator for minimum interest paid.

3. Protect Yourself from the Minimum Payment Trap

Credit card companies highlight the affordability of minimum payments, but what they don’t tell you is that it locks you into debt for years. The calculator reveals how destructive that approach is and motivates you to pay more than the minimum.

4. Motivation to Pay Off Faster

Debt repayment often feels endless because progress is invisible. By showing you how close you are to being debt-free, and how much faster you’ll get there with slightly higher payments, the calculator keeps you motivated to stick to your plan.

5. No Credit Checks, No Strings Attached

FinCalc doesn’t require your personal details, doesn’t touch your credit file, and isn’t tied to lenders trying to sell you consolidation loans. It’s fast, private, and designed purely for your clarity.

FinCalc vs Other Options: A Reality Check

Feature | FinCalc (Repayment Calculator) | Bank Statement “estimates” | Generic Loan Calculator |

Transparency | Shows full timeline, interest, and payoff date | Often hides total interest | Ignores compounding, oversimplified |

Flexibility | Test scenarios: add payments, change APR, set target date | Fixed assumptions only | Designed for loans, not credit cards |

Accuracy | Built for revolving credit, mirrors card math | Often limited or vague | Doesn’t reflect credit card minimum rules |

Privacy | 100% free, no login, no credit check | Tied to your account | Often requires sign-up |

The Real Advantage

FinCalc’s Credit Card Repayment Calculator isn’t just a number-cruncher; it’s a decision-making tool. It helps you avoid costly mistakes, plan with confidence, and finally see a finish line to your credit card debt. Instead of reacting to your balance, you take charge of it.

Real-Life Use Cases of the Credit Card Repayment Calculator

Numbers matter, but stories make those numbers real. Here’s how different people use the Credit Card Repayment Calculator to take control of their debt and plan smarter.

1. The Young Professional

Emma just started her first job after university. Between moving expenses and a few impulse buys, her credit card balance hit £2,800 at 19% APR. She was paying £75 a month and assumed she’d be clear in a couple of years. When she entered her details into the calculator, reality hit: at that pace, she’d be in debt for nearly 5 years, with over £1,200 in interest. By adjusting her payment to £150 a month, the calculator showed she could be debt-free in under 20 months and save more than £700 in interest. One quick calculation gave her the motivation to double her payments.

2. The Family Managing Christmas Debt

James and Laura used their cards to cover Christmas shopping, ending up with £5,500 spread across two cards at an average APR of 20%. They were making minimum payments, which felt manageable at around £160 a month. The calculator revealed the hidden trap: it would take over 16 years to pay it all off, with nearly £9,000 in interest. Shocked, they tested different repayment strategies. By committing to £350 a month, they cut their timeline to 2.5 years and reduced interest to under £1,700. The calculator turned stress into a plan.

3. The Graduate with Student Loans

Liam had a small card balance of £1,200 at 18% APR. Between rent, bills, and student loan payments, he was only putting £50 toward it. The calculator showed he’d take more than 3 years to clear such a small debt, paying nearly £400 extra in interest. By reworking his budget and raising his card payment to £100, his debt-free date dropped to 13 months, with interest of less than £120. Seeing the numbers gave him clarity and control at a time when finances felt overwhelming.

4. The Small Business Owner

Maria ran a design studio and used her personal credit card to cover business supplies when cash flow was tight. The balance grew to £7,000 at 21% APR. Her bank offered her a “special repayment plan,” but she wanted to check the numbers herself. Using the Credit Card Repayment Calculator, she discovered that sticking to £200 a month would keep her in debt for more than 5 years. By testing scenarios, she realised that paying £350 a month would clear the balance in under 2 years, saving her almost £3,000 in interest. The calculator empowered her to negotiate confidently with her bank.

5. The Upgrade Enthusiast

Daniel loves the latest gadgets and often uses his card to fund upgrades. His £4,000 balance at 20% APR didn’t seem alarming until he used the calculator. He saw that paying only £120 a month would take 5 years and cost £2,300 in interest. By adjusting to £220 monthly, his payoff time dropped to 22 months, and his interest bill shrank by more than half. The tool gave him a clear picture and the push to change his habits.

Understanding the Numbers Behind Credit Card Repayments

Most people know that credit card debt “comes with interest,” but few understand just how much those numbers can snowball. That’s why the Credit Card Repayment Calculator isn’t just about showing a balance and payoff time; it’s about revealing the mechanics behind the scenes.

Annual Percentage Rate (APR)

APR is the yearly cost of borrowing on your credit card, expressed as a percentage. But what many people don’t realise is that it isn’t charged once a year, it’s applied monthly, and sometimes even daily. A card with 20% APR doesn’t mean you pay 20% once a year. It means your balance is hit with around 1.67% every month, compounding if you don’t pay it off. That’s why balances that seem manageable can quickly spiral.

The Trap of Minimum Payments

Credit card companies make minimum payments look appealing, usually 2–3% of your balance or a flat £25. But here’s the catch: minimums are designed to keep you paying interest for as long as possible. If you owe £5,000 at 20% APR and stick to minimums, your repayment can drag on for more than 15 years, with thousands of pounds wasted in interest. The Credit Card Repayment Calculator exposes this trap instantly, showing you how dangerous the

The Power of Compounding

Compounding interest is why credit card debt feels like it never shrinks. Every month, interest is added to your balance, and then interest is charged on that new balance, too. The longer you carry debt, the more the compounding effect stacks against you. Without a clear picture, you can pay for years without making real progress. The calculator breaks this cycle by showing how much of your payment goes toward interest versus principal, so you see where your money is really going.

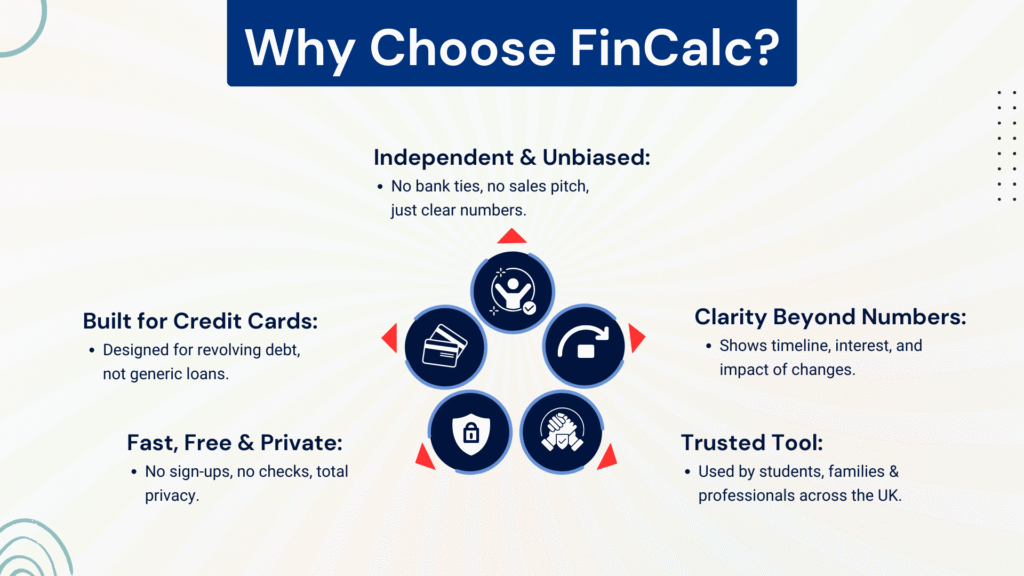

Why Choose FinCalc Over Others?

Not all repayment calculators are created equal. Some are hidden behind bank websites, others are generic loan tools that don’t reflect the way credit cards really work. Many give you a number without explaining what it means. FinCalc is different. We built our Credit Card Repayment Calculator to put clarity, control, and confidence back in your hands.

Independent and Unbiased

Most bank calculators are designed with one goal: to push you toward their loan products. FinCalc isn’t tied to lenders or hidden sales funnels. Our results are independent and transparent; he numbers you see are there to help you, not to sell you something.

Built for Credit Cards, Not Just Loans

A personal loan is fixed. A credit card is revolving, with minimum payments and compounding interest that make repayment far more complex. Generic loan calculators often underestimate how long repayment will take. FinCalc’s calculator is designed specifically for credit cards, so the results mirror reality. If you’re considering a fixed-term loan to clear the card, sanity-check rate + fees with the APR Loan Calculator before you commit.

Clear Explanations, Not Just Numbers

Seeing “72 months to repay” doesn’t help unless you understand why. FinCalc goes further: it shows your repayment timeline, total interest, and how small changes impact your outcome. We translate financial jargon into clear insights anyone can act on.

Fast, Free, and Private

Our calculator is completely free to use. No logins, no credit checks, no hidden strings. You can test as many scenarios as you like in total privacy. Your data stays yours.

Trusted by Everyday People

From graduates tackling their first credit card bill to families managing multiple cards, FinCalc has become a trusted resource for people across the UK. It’s simple enough for anyone to use, but accurate enough to guide real financial decisions.

Conclusion

Credit card debt has a way of sneaking up on you. A few purchases here, a missed payment there, and suddenly the balance looks overwhelming. The statements keep arriving, the minimum payments feel endless, and the finish line seems further away each month. For many people, it’s not just the financial weight of the debt that hurts; it’s the uncertainty. How long will this take to pay off? How much interest am I really throwing away? Will I ever get ahead? That’s exactly why FinCalc created the Credit Card Repayment Calculator. It isn’t just another online tool; it’s a lifeline of clarity. Instead of vague guesses or confusing fine print, you get direct answers in seconds. With just a few simple inputs, you can see your entire repayment journey: how many months it will take, how much you’ll spend in interest, and how small changes to your payments can save you years of stress.

The power of this calculator isn’t in the math itself; it’s in what the math gives you: control. When you know your numbers, you’re no longer trapped by them. You can make better choices, whether that means increasing your monthly payments, budgeting smarter, consolidating debt, or even setting a clear goal to be debt-free by a specific date. Imagine the difference between two people: one who keeps paying the minimums, hoping the balance shrinks one day, and another who uses the calculator, sees the reality, and takes action. The first person stays stuck for a decade, paying thousands in extra interest. The second person gets debt-free in a fraction of the time, with money left over for savings, travel, or simply peace of mind. FinCalc was built for real people, not financial experts. It’s for the graduate trying to clear their first card, the family managing holiday debt, the small business owner separating personal from business expenses, and anyone else who wants to escape the trap of revolving credit.

Frequently Asked Questions (FAQ)

What is a Credit Card Repayment Calculator?

A Credit Card Repayment Calculator is a tool that shows you how long it will take to clear your credit card balance and how much interest you’ll pay. By entering your balance, APR, and monthly payment, the calculator gives you a clear timeline to becoming debt-free. Instead of guessing or relying on vague bank statements, you see the actual payoff period and total cost. It’s the easiest way to understand the impact of your repayment choices and plan smarter.

How accurate is the calculator?

The FinCalc Credit Card Repayment Calculator uses the same formulas that banks and card issuers apply, including monthly interest compounding. While exact figures may vary slightly depending on your lender’s policies (daily vs monthly compounding, fees), the results are highly accurate and realistic. This makes it a reliable way to forecast your debt-free date and total interest costs before you make financial decisions.

Can I use the calculator for multiple credit cards?

Yes. If you carry balances on more than one card, you can run the calculator for each card individually and then add up the timelines or total interest. Many users also use the tool alongside debt repayment strategies like the “debt snowball” (tackling the smallest balance first) or the “debt avalanche” (tackling the highest APR first). Either way, the calculator helps you map out which approach saves more money and time.

Does the calculator show total interest paid?

Absolutely. One of the most powerful features of the Credit Card Repayment Calculator is that it doesn’t just show how long repayment takes; it shows how much of your money goes toward interest versus the actual debt. This makes it easy to see why sticking to minimum payments is costly and how small increases in your monthly payment can save thousands over the life of the debt.

Can I calculate repayments if I only pay the minimum?

Yes. The calculator can estimate repayment timelines based on paying only the minimum (usually 2–3% of your balance or a flat £25). This reveals how dangerous minimum payments are , often stretching repayment across 10–20 years with huge interest costs. Many people use this feature to see why paying more each month makes such a difference.

Does the Credit Card Repayment Calculator affect my credit score?

No. Using the calculator has no impact on your credit score. It’s a free, private tool that doesn’t require logins, personal details, or credit checks. You can run as many scenarios as you want without leaving any trace on your credit report. It’s simply a way to understand your debt and repayment options in a safe, risk-free way.