NHS Pension Contribution – What You Pay

When you check your NHS payslip, one of the biggest deductions you’ll notice is for the Pension Scheme. While it can feel like a large chunk of your earnings is disappearing, these contributions are an investment in your future financial security. Understanding how NHS pension deductions work, how the tier contribution rates are applied, and how tools like the pension calculator can help is essential for every NHS employee.

This guide explains everything you need to know about what you pay, how much is deducted from your salary, and what benefits you receive in return.

What Is an NHS Pension Deduction?

An NHS pension deduction is the amount of money taken directly from your salary each month to fund your Pension Scheme membership. This deduction appears clearly on your payslip and is based on your pensionable pay, which may differ slightly from your total gross salary.

The pension deduction ensures that:

- You contribute a fair percentage of your earnings.

- You build up pension benefits that will support you in retirement.

- The government and NHS also contribute to your pension pot.

How Pension Contribution Tiers Work

NHS pension contributions are not the same for everyone—they depend on your salary band, known as tier contribution rates.

For example:

- Lower earners may pay around 5% of their pensionable pay.

- Middle-income staff contribute between 7%–9%.

- Higher earners could contribute up to 12.5%.

- These tiered rates are designed to keep the pension scheme fair and sustainable. As your salary increases, your pension deduction will also rise accordingly.

Using an NHS Pension Calculator

One of the easiest ways to understand your deductions is by using an pension calculator.

These tools allow you to:

- Enter your salary details.

- See exactly how much you’ll pay in contributions.

- Estimate your future pension benefits.

For example, if your annual pensionable pay is £35,000, the calculator will instantly show your monthly contribution based on the tier you fall into. This makes financial planning much easier for NHS staff.

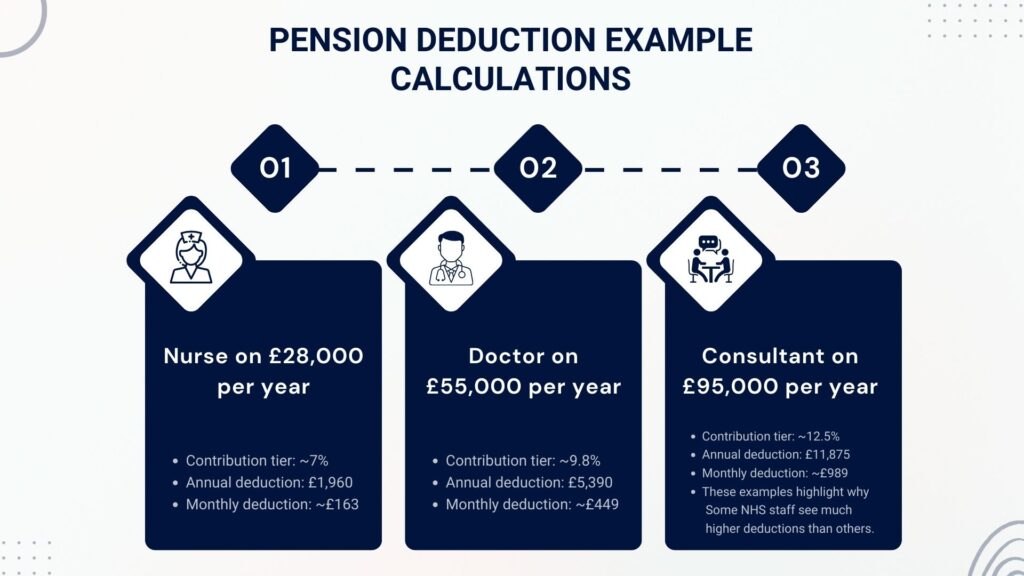

Pension Deduction Example Calculations

Let’s break down how deductions work in practice.

- Nurse on £28,000 per year

- Contribution tier: ~7%

- Annual deduction: £1,960

- Monthly deduction: ~£163

- Contribution tier: ~7%

- Doctor on £55,000 per year

- Contribution tier: ~9.8%

- Annual deduction: £5,390

- Monthly deduction: ~£449

- Contribution tier: ~9.8%

- Consultant on £95,000 per year

- Contribution tier: ~12.5%

- Annual deduction: £11,875

- Monthly deduction: ~£989

- These examples highlight why some NHS staff see much higher deductions than others.

- Contribution tier: ~12.5%

Impact on Take-Home Pay

Because pension deductions come straight from your salary, they reduce your monthly take-home pay. However, there are two important things to remember:

- Tax Relief – Contributions reduce your taxable income, meaning you pay less tax overall.

- Employer Contributions – The NHS also pays into your pension, adding significant value beyond your deductions.

While you may see money leaving your payslip each month, the long-term return is far greater.

Benefits of Paying Pension Contributions

Despite the short-term reduction in take-home pay, contributing to the NHS pension scheme has several benefits:

- Secure retirement income – Guaranteed pension payments for life.

- Employer contributions – The NHS adds to your pension, increasing its value.

- Ill health & family protection – Benefits in case of ill health, retirement, or death in service.

- Tax efficiency – Pension contributions lower your taxable income.

Tips for Managing NHS Pension Deductions

To make sure you’re not caught off guard by deductions, follow these tips:

- Check your payslip regularly to confirm deductions are accurate.

- Use the pension calculator to forecast future changes.

- Understand tier changes – If your salary rises, expect higher contribution rates.

- Plan your budget with deductions in mind, especially if you rely on overtime pay.

Conclusion:

The NHS pension deduction might seem like a significant reduction from your monthly salary, but it’s one of the most valuable benefits of working in the NHS. With tiered contribution rates, tax relief, and generous employer contributions, the scheme offers long-term financial stability. By using tools like the NHS pension calculator and understanding how tier contribution rates apply to your pay, you can manage your finances more effectively and make informed decisions about your future.

Frequently Asked Questions:

How much do NHS employees pay into the pension scheme?

NHS pension contributions depend on your salary tier. Lower earners typically pay around 5%, mid-range earners contribute 7%–9%, and higher earners may pay up to 12.5% of their pensionable pay.

What is pensionable pay in the NHS?

Pensionable pay is the portion of your salary used to calculate NHS pension contributions. It usually includes basic salary and some regular payments but may exclude certain overtime or one-off bonuses, which is why it can differ from total gross pay

Why are NHS pension deductions so high?

NHS pension deductions can appear high because the scheme is a defined benefit pension, offering guaranteed income for life. Higher earners pay more due to tiered contribution rates, but the NHS also makes significant employer contributions, adding substantial long-term value.

Can I reduce my NHS pension contribution?

You cannot reduce your contribution rate unless your salary changes to a lower tier. However, you can opt out of the NHS Pension Scheme, though this means losing employer contributions and long-term retirement benefits, which most financial advisers discourage.

How can I calculate my NHS pension deduction accurately?

You can use an NHS Pension Calculator to calculate your monthly and annual pension contributions. By entering your pensionable salary, the calculator shows your exact deduction, tax relief impact, and how it affects your take-home pay.