The Best Equity Loan Calculator UK

Equity Loan Amount

Your Mortgage

Monthly Mortgage

Total Mortgage Repayment

Buying your first home is exciting, but it often comes with one big question: how can I actually afford it? For many first-time buyers, the government’s Help to Buy Equity Loan scheme has been a lifeline, making it possible to get onto the property ladder with a smaller deposit and more manageable monthly repayments. But while the scheme sounds simple, the reality can feel overwhelming. How much can you borrow? How will the equity loan affect your mortgage? What happens when you sell or when interest kicks in after the interest-free period?. Sense-check your borrowing power first with the FinCalc Mortgage Affordability Calculator to set a realistic price range.

That’s where the FinCalc Help to Buy Equity Loan Calculator comes in. With just a few inputs, it shows you exactly how much of your property can be covered by the equity loan, what your mortgage will look like, and what repayments you can expect in the future. No confusing maths, no hidden surprises, just clear, easy-to-read results tailored for first-time buyers. Whether you’re exploring new-build options outside the city or trying to stretch your budget in London with a 40% equity loan, this tool gives you the clarity to make smarter decisions.

What is a Help to Buy Equity Loan Calculator?

A Help to Buy Equity Loan Calculator is a financial tool designed to help first-time buyers understand how the government’s Help to Buy scheme affects their mortgage. Instead of trying to work out percentages and repayments with complicated formulas, the calculator does the hard work instantly, giving you clear numbers that make sense for your situation. Here’s how it works: under the Help to Buy scheme, the government lends you up to 20% of the property’s value (40% in London). You then contribute at least a 5% deposit, and the rest is covered by a mortgage. The calculator shows how these three pieces, your deposit, the government’s loan, and your mortgage, fit together.

For example, if you’re buying a £250,000 new-build home with a 5% deposit (£12,500) and take a 20% equity loan (£50,000), the calculator will show that your mortgage needs to cover the remaining £187,500. It also projects monthly repayments, interest after the 5-year interest-free period, and what you’d owe back if the property’s value increases. This matters because the Help to Buy loan isn’t a fixed amount you pay back; it’s a percentage of your property’s value. So if your £250,000 home grows to £300,000, your 20% loan repayment rises from £50,000 to £60,000. The calculator highlights this so you’re not caught off guard later.

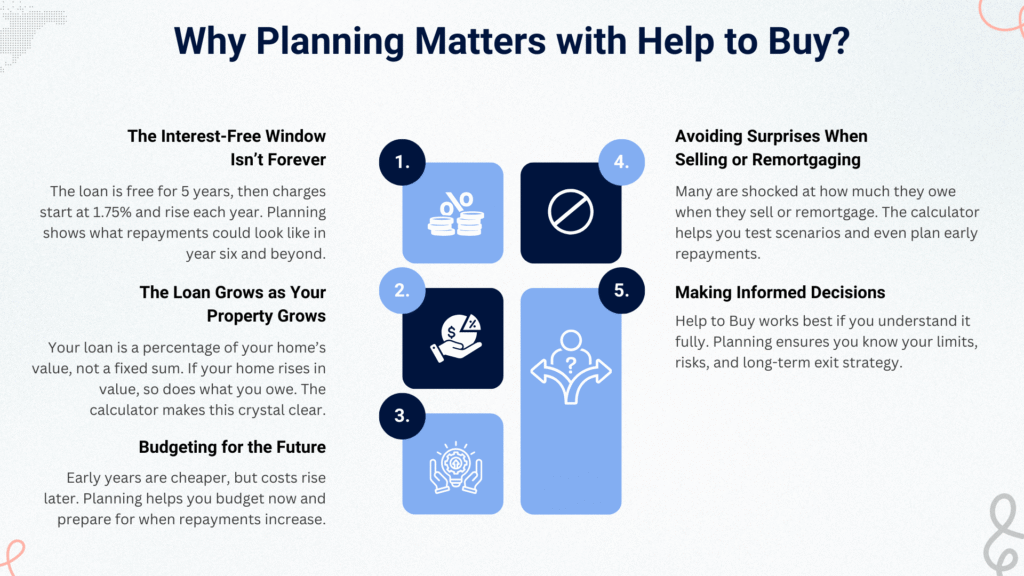

Why Planning Matters with Help to Buy?

The government’s Help to Buy scheme has opened doors for thousands of first-time buyers who might otherwise struggle to afford a home. By reducing the size of the mortgage you need and keeping repayments lower in the early years, it can feel like the perfect solution. But as with any financial product, there’s more beneath the surface. Without proper planning, the very scheme designed to help you could create financial challenges down the road. This is why using a Help to Buy Equity Loan Calculator is so important; it takes a scheme that can feel complex and turns it into a clear picture of what your financial future looks like.

The Interest-Free Window Isn’t Forever

One of the most attractive parts of Help to Buy is that the equity loan is interest-free for the first five years. After that, charges begin at 1.75% and increase annually with inflation plus 1%. For many buyers, this is where costs suddenly start to rise. Planning ensures you know exactly what repayments might look like in year six and beyond.

The Loan Grows as Your Property Grows

Unlike a standard mortgage, the Help to Buy loan is tied to the property’s value, not a fixed figure. If your home increases in value, so does the amount you owe the government. For example, if you borrowed 20% on a £200,000 home (£40,000) and later sell when it’s worth £250,000, you’ll need to repay £50,000. Planning with a calculator makes this crystal clear, helping you prepare for future equity growth.

Budgeting for the Future

The early years of homeownership are often the most financially demanding, with moving costs, furniture, and bills stacking up. The scheme eases this burden initially, but homeowners must budget for the moment when repayments rise. The Help to Buy Equity Loan Calculator helps you project your finances not just for today, but for the next decade.

Avoiding Surprises When Selling or Remortgaging

Many buyers are caught off guard when they sell their home or remortgage, only to discover the government is entitled to a larger share than they expected. By planning, you avoid unpleasant shocks, and you can even model scenarios where you repay part of the equity loan early. Model your year-five switch with the FinCalc Remortgage Calculator to compare deals and fee-adjusted savings.

Making Informed Decisions

The scheme is an opportunity, but only if you understand how it works for you. Planning ensures you know whether it’s the right move, how much you can truly afford, and what exit strategy makes sense long term.

How the Calculator Works Step-by-Step + Example

The Help to Buy Equity Loan Calculator is built to take the complexity out of government-backed home buying and give you an instant, easy-to-read breakdown of your numbers. Instead of juggling percentages, mortgage estimates, and interest calculations, you get a clear step-by-step view of what your financial picture looks like, today and in the future.

Here’s how it works:

Step 1 – Enter Your Property Price

Start by typing in the value of the home you want to buy. This sets the baseline for every other calculation.

Step 2 – Add Your Deposit

Input how much you’ve saved. The minimum is typically 5% of the property price, but you can enter more to see how a larger deposit reduces your borrowing. Plan your deposit precisely with the House Deposit Calculator to see how 5%, 10% or 20% changes your numbers.

Step 3 – Select Your Equity Loan Percentage

Choose whether you want the standard 20% equity loan available across England or the 40% loan offered in London. The calculator instantly shows how much of the property this covers.

Step 4 – Input Mortgage Details

Enter your preferred mortgage term (e.g., 25 years) and the interest rate you expect from a lender. This gives you a realistic picture of monthly repayments. Break down monthly and lifetime costs with the Mortgage Repayment Calculator for your chosen rate and term.

Step 5 – View Your Results

The calculator breaks everything down into:

- Deposit (your contribution)

- Equity loan (government’s share)

- Mortgage (the remainder you borrow from a bank)

It also projects: - Monthly mortgage repayments

- Equity loan repayment amounts if the property increases in value.

Interest charges after the 5-year interest-free period

Example Calculation

Imagine buying a home worth £250,000:

- Deposit: £12,500 (5%)

- Equity Loan: £50,000 (20%)

- Mortgage: £187,500 (75%)

In this case, you only need a mortgage for 75% of the property value, which often unlocks better interest rates compared to a 95% mortgage. The calculator then shows what your monthly repayments would look like today, plus what happens if your home increases in value over time.

The goal is simple: the Help to Buy Equity Loan Calculator turns a complex government scheme into an easy, visual plan, so you can shop for homes with confidence and prepare for the future with clarity.

The Help to Buy scheme is one of the most powerful tools available for first-time buyers in England, but its complexity often creates confusion. How much will you really owe? How does your deposit affect affordability? What happens after the five-year interest-free period? These aren’t questions you should leave to guesswork. That’s exactly why the FinCalc Help to Buy Equity Loan Calculator is designed to put clarity and control in your hands. Here are the key benefits:

- Instant Clarity on Your Borrowing Breakdown

With just a few details, you can see exactly how your property price is divided between your deposit, the government’s equity loan, and your mortgage. No more rough estimates, just precise, easy-to-read numbers. - Accurate Projections Beyond Year Five

The first five years of the equity loan are interest-free, but after that, fees start to apply. FinCalc’s calculator shows how much those costs might look like, helping you budget for the future instead of being blindsided. - Test Multiple Scenarios in Seconds

Want to know how a larger deposit changes your mortgage repayments? Or how a £300,000 property compares to a £250,000 property? With the calculator, you can adjust numbers instantly and see the impact right away. - See the Real Impact of Property Growth

Because the equity loan is based on a percentage of your home’s value, repayments rise if your property increases in price. The calculator shows what you’d owe back at different property values, preparing you for both best-case and realistic growth scenarios. - Tailored for First-Time Buyers

Unlike generic mortgage calculators, this tool is built specifically for the Help to Buy scheme. It’s simple, jargon-free, and focused on the things that matter most to first-time buyers: affordability, repayments, and long-term planning. - Independent and Unbiased

FinCalc isn’t tied to a bank, broker, or developer. That means no hidden sales agenda, no adverts for products you don’t need, just pure numbers you can trust to guide your decisions. - Easy to Share and Plan Together

Buying your first home often involves family support, a partner, or advice from friends. The calculator gives you results that are easy to share, whether you’re showing them to parents, mortgage advisors, or co-buyers.

Real-Life Use Cases

Numbers are powerful, but it’s the stories behind them that show just how valuable the Help to Buy Equity Loan Calculator can be. Here are some real-life style scenarios where the tool made the difference between confusion and clarity.

Emma – The Solo First-Time Buyer in Manchester

Emma, a 27-year-old marketing executive, wanted to buy a £220,000 new-build flat. With £12,000 saved for a deposit, she wasn’t sure if it was enough. Using the calculator, she saw how the 20% Help to Buy loan would reduce her mortgage to £164,000, making her monthly payments affordable. The tool also showed her what repayments could look like after year five when interest charges begin, helping her plan her budget more realistically.

James & Sarah – A Young Couple in Birmingham

James and Sarah were renting while saving for their first home. With a combined deposit of £15,000, they were looking at properties around £250,000. Using the calculator, they realised that with a 20% equity loan, their mortgage would only cover £185,000, putting them in a lower loan-to-value bracket and unlocking better interest rates. They used this insight to confidently approach lenders and secure a deal they could manage long term.

Priya – A London Buyer Using the 40% Loan

London prices felt out of reach for Priya, a software engineer, even with a £30,000 deposit. Looking at £400,000 properties, she thought she’d never manage. With FinCalc’s tool, she tested the 40% Help to Buy equity loan available in London. Suddenly, her required mortgage dropped to £210,000 instead of £370,000. The calculator also showed her future repayment scenarios if her flat’s value increased, making her aware of how much the government’s share would grow.

Ahmed & Fatima – Family Planning Ahead

Ahmed and Fatima, with two children, were moving from renting into a £300,000 home. They used the calculator not just to see monthly repayments, but also to model property growth. If their home rose to £360,000 in 10 years, their 20% equity loan repayment would climb from £60,000 to £72,000. Knowing this early helped them plan for partial repayment before year six, reducing future costs.

Tom – Selling After 8 Years

Tom bought a £200,000 property with Help to Buy and later sold it for £250,000. Using the calculator, he modelled the government’s repayment share and saw he’d need to return £50,000 instead of the original £40,000 borrowed. This clarity prevented surprises and helped him plan his next deposit.

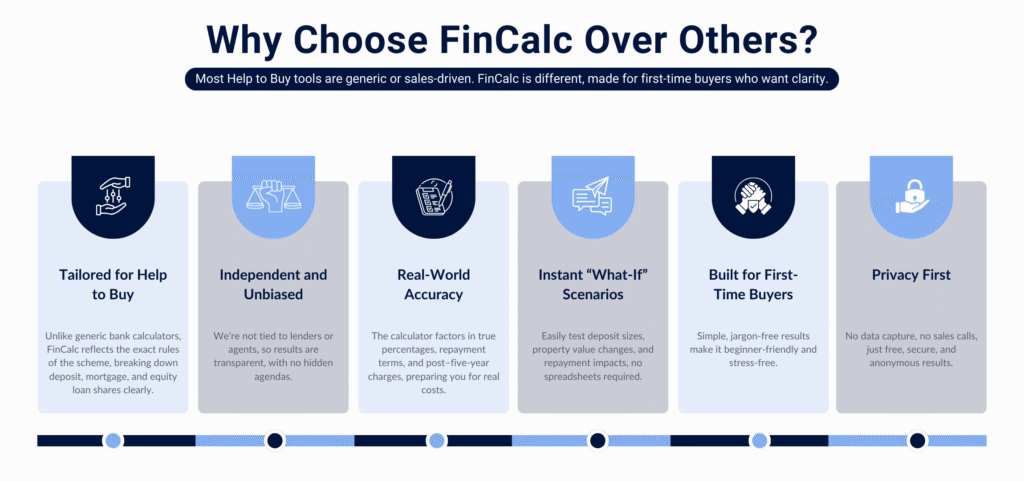

Why Choose FinCalc Over Others?

When you search online for tools to understand Help to Buy, you’ll find plenty of mortgage calculators and bank widgets. The problem? Most are either too generic, too complicated, or designed to push you toward specific financial products. The FinCalc Help to Buy Equity Loan Calculator is different. It’s built for first-time buyers who need clarity, not sales tactics.

- Tailored for Help to Buy, Not Generic Mortgages

Most bank calculators are “one-size-fits-all” and don’t reflect the unique rules of the Help to Buy equity loan scheme. FinCalc is designed specifically for this purpose, breaking down deposit, mortgage, and government equity loan shares in a way that matches the official scheme. - Independent and Unbiased

FinCalc isn’t tied to a lender, estate agent, or developer. That means no hidden agendas, no pushing you toward a product, and no skewed results. You get pure, transparent numbers to help you make your own decisions. - Real-World Accuracy

We’ve built the calculator to reflect the actual percentages, repayment terms, and post–five-year interest charges that come with the scheme. Unlike oversimplified tools, FinCalc prepares you for the real costs, not just the first few years of ownership. - Instant “What-If” Scenarios

Wondering how a 10% deposit instead of 5% changes your repayments? Or what happens if your £250,000 home increases to £300,000 before you sell? FinCalc lets you adjust figures in seconds, giving you answers immediately. No spreadsheets, no manual maths. - Built for First-Time Buyers

Buying your first home is stressful enough without jargon. FinCalc is beginner-friendly, with clear explanations alongside your results. Whether you’re 23 and buying solo, or a couple planning a future together, the calculator makes sense from the very first click. - Privacy First and Always Free

Unlike some tools that capture your data to connect you with brokers, FinCalc doesn’t ask for personal details. It’s free, secure, and anonymous, because planning your first home should be stress-free.

Conclusion

Buying your first home can feel overwhelming, but with the right tools, it doesn’t have to be. The government’s Help to Buy scheme was created to make homeownership more accessible, yet many first-time buyers struggle to understand how the numbers really work. That’s where the Help to Buy Equity Loan Calculator changes everything. Breaking down your property price into deposit, equity loan, and mortgage gives you instant clarity on what you’ll pay today and what you may owe tomorrow.

From monthly repayments to the effect of property value increases and post–five-year interest charges, the calculator shows you the bigger picture so you can plan smarter. Unlike generic mortgage tools, FinCalc is built specifically for first-time buyers using Help to Buy. It’s transparent, independent, and designed to give you confidence instead of confusion. Whether you’re exploring your options in Manchester, Birmingham, or London, this calculator helps you move forward with peace of mind.

FAQs

What is the Help to Buy equity loan scheme?

It’s a government-backed scheme for first-time buyers, offering up to 20% of a property’s value (40% in London) as an equity loan to make mortgages more affordable.

How does the Help to Buy Equity Loan Calculator work?

You enter the property price, your deposit, and loan percentage. The calculator shows how much comes from your deposit, the government’s loan, and your mortgage.

Who is eligible for Help to Buy?

Only first-time buyers purchasing new-build homes in England are eligible. The property must fall within regional price caps.

Do I still need a deposit with Help to Buy?

Yes, you’ll need at least a 5% deposit. The government equity loan reduces the mortgage you need to borrow, but doesn’t replace your deposit.

Is the Help to Buy loan interest-free?

Yes, it’s interest-free for the first five years. From year six onwards, interest charges begin at 1.75% and increase each year with inflation plus 1%.

Can I repay the equity loan early?

Yes, you can repay it in full or in part. Repayments are based on the property’s current value, not the original purchase price.

What happens when I sell my home?

You’ll need to repay the government’s share of the property’s value at the time of sale. If the home has increased in value, the repayment amount will be higher.

Does the calculator show repayments after the interest-free period?

Yes, the Help to Buy Equity Loan Calculator projects future repayments, including interest charges after year five, so you can budget ahead.

Is this calculator only for London buyers?

No. It works for all eligible buyers in England. You can choose either the 20% equity loan (standard) or 40% for London.

Will using the calculator affect my credit score?

No. The calculator is completely anonymous and doesn’t involve credit checks. It’s purely an educational and planning tool.