The Most Accurate Tracker Mortgage Calculator UK

Monthly Payment

Total Payment

Total Interest

Tracker Rate

Choosing the right mortgage is one of the most important financial decisions any homeowner will make. For many, tracker mortgages seem appealing because they follow the Bank of England’s base rate, often starting lower than fixed deals and offering the potential for big savings if interest rates fall. But there’s also a risk: if rates go up, so do your monthly repayments. That unpredictability leaves many homeowners unsure whether a tracker mortgage is truly the right choice. The FinCalc Tracker Mortgage Calculator takes away the guesswork.

By entering your loan balance, mortgage term, and the tracker margin (for example, base rate +1%), you can instantly see how rate changes affect your monthly repayments and the total cost of your mortgage. Want to know the difference if rates rise by 1%? Or how much you’ll save if they fall back down? The calculator models it for you in seconds. Whether you’re a first-time buyer, a family looking to remortgage, or simply curious about the risks and rewards of a tracker mortgage, this tool provides the clarity you need.

What is a Tracker Mortgage Calculator?

A Tracker Mortgage Calculator is a tool that helps homeowners understand how their repayments change when interest rates move. Unlike fixed-rate mortgages, which lock your payments for a set period, tracker mortgages follow the Bank of England base rate plus a set margin. This means your monthly payments can rise or fall depending on wider economic conditions. For many people, that uncertainty makes planning difficult, but the calculator solves this by modelling different rate scenarios instantly. Here’s how it works. You enter your mortgage details, the loan balance, the repayment term, and the tracker margin (for example, base rate +1%). The Mortgage Calculator then shows you your monthly repayments at the current rate, but also allows you to test how those repayments would change if the base rate increases or decreases. This gives you a full picture of both risk and reward.

For example, suppose you have a £200,000 mortgage over 25 years at a tracker rate of base +1%. If the base rate is 2%, your rate becomes 3%, and your monthly repayment might be around £948. If the base rate rises to 4%, your rate becomes 5%, and your repayment jumps to about £1,170, an increase of over £220 per month. On the other hand, if the base rate drops to 1%, your repayment could fall closer to £850, saving you more than £1,100 a year.

This kind of modelling is what makes the calculator so valuable. Instead of being caught off guard by changes in the economy, you can plan and stress-test your finances. It helps you decide whether a tracker mortgage fits your lifestyle, tolerance for risk, and long-term goals. In short, the Tracker Mortgage Calculator is more than a repayment tool; it’s a planning companion. It shows you not just what you’ll pay today, but how your payments might shift tomorrow, giving you the foresight to make confident, informed mortgage decisions. Compare tracker vs fixed scenarios side by side with the Interest Rate Comparison Calculator before you choose a product.

Why Tracker Mortgage Planning Matters?

Tracker mortgages can feel like both an opportunity and a gamble. On one hand, they often start with lower interest rates than fixed-rate mortgages, which can mean immediate savings. On the other hand, they are tied directly to the Bank of England’s base rate, so any change in that rate affects your monthly repayments. Without proper planning, homeowners can find themselves struggling with sudden increases in costs or missing out on potential savings when rates fall. That’s why tracker mortgage planning is so critical.

Managing Uncertainty

The biggest difference between tracker and fixed mortgages is predictability. With a fixed mortgage, you know exactly what you’ll pay each month for the duration of the term. With a tracker, your payments fluctuate. For example, if your repayment is £950 one month, it could be £1,100 the next if the base rate rises. This unpredictability means households need to stress-test their budgets to ensure they can cope with rate changes. The Tracker Mortgage Calculator makes this easy by showing exactly how much payments could change at different interest levels. Stress-test payments against rate rises with the FinCalc Mortgage Affordability Calculator to check your buffer.

Avoiding Costly Surprises

Consider a family with a £200,000 mortgage at base +1%. If the base rate rises from 2% to 4%, their repayments could increase by over £200 per month. Without planning, that extra cost can destabilise household budgets and lead to financial stress. Running the numbers ahead of time means you’ll know if you can realistically afford the risk of a tracker mortgage.

Taking Advantage of Falling Rates

The flip side is opportunity. When rates fall, tracker mortgage holders often enjoy lower repayments than those locked into fixed deals. If the base rate drops by 1%, that same family could save over £100 a month compared to their fixed-rate counterparts. Planning allows homeowners to see not just the risks, but also the potential rewards of choosing a tracker mortgage.

Aligning with Your Lifestyle

Not every borrower has the same tolerance for financial uncertainty. Some prefer predictability, while others are willing to take on a bit of risk for potential savings. Using the Tracker Mortgage Calculator helps you decide whether your income stability, lifestyle, and long-term financial goals make a tracker mortgage the right fit.

The Emotional Side

Mortgages aren’t just numbers; they affect peace of mind. The unpredictability of tracker rates can cause anxiety if you’re not prepared. Knowing exactly how repayments change at different rate levels reduces that stress. Planning means confidence, not worry, when the Bank of England announces changes.

How the Calculator Works Step-by-Step + Example

The Tracker Mortgage Calculator is designed to give you a clear, realistic picture of how your repayments could change when interest rates move. It takes what might seem like complex financial maths and breaks it down into simple steps you can follow. Here’s exactly how it works:

Step 1: Enter your mortgage details

Start by entering the outstanding mortgage balance, the repayment term (in years), and your tracker rate margin (for example, base rate +1%). This creates the baseline for your calculation.

Step 2: Add current base rate.

Enter the current Bank of England base rate. The calculator combines this with your tracker margin to show your actual interest rate.

Step 3: Model rate changes

Adjust the base rate up or down to see how changes affect your monthly repayments. For example, if the base rate increases by 1%, the calculator shows the extra cost immediately.

Step 4: Review repayment results

You’ll see:

- Your current monthly repayment at today’s rate.

- Repayment changes if the base rate rises or falls.

- Total interest payable across the mortgage term under each scenario.

Step 5: Stress-test affordability

The calculator allows you to test multiple “what if” scenarios. For example, what happens if the base rate goes up by 2%? Can your budget handle the increase? Planning with these stress tests ensures you’re prepared for future changes. If you decide to switch later, estimate savings and break-even with the FinCalc Remortgage Calculator.

Worked Example

Imagine you have a £200,000 mortgage over 25 years at base rate +1%.

- Base rate at 2% → Your tracker rate is 3%. Monthly repayment = around £948.

- Base rate rises to 4% → Tracker rate is 5%. Repayment = around £1,170. That’s an increase of £222 per month.

- Base rate falls to 1% → Tracker rate is 2%. Repayment = around £848. That’s a saving of £100 per month.

This simple example shows both the risk (higher payments) and the reward (savings) that come with tracker mortgages.

Benefits of Using FinCalc’s Tracker Mortgage Calculator

Tracker mortgages can be a great option, but they also carry risk. The unpredictability of interest rates means that you need clarity before making decisions. The FinCalc Tracker Mortgage Calculator was built to provide exactly that clarity, giving you insights that most bank or generic calculators don’t. Here are the key benefits of using it.

- Transparent Results, Not Guesswork

Many tools give only a basic repayment figure. FinCalc goes further. It shows:

- Monthly repayments at different base rate levels.

- How much will your payments rise if rates increase?

- How much do you save if rates drop?

- Total interest payable over the life of the loan.

This transparency means you can plan for the best- and worst-case scenarios.

- Stress-Testing Your Budget

One of the biggest challenges with tracker mortgages is uncertainty. By modelling rate rises of 0.5%, 1%, or even 2%, the calculator helps you see whether your budget can handle potential increases. It’s like a financial “safety drill” before committing.

- Flexibility to Test Multiple Scenarios

Do you want to compare a 20-year term with a 25-year term? Or see how repayments shift with a higher tracker margin (e.g., base +2%)? The Tracker Mortgage Calculator allows you to test these variations in seconds, so you know exactly how different deals compare.

- Independent and Unbiased

Bank calculators are often designed to make their own mortgage products look attractive. FinCalc is different. Our calculator is independent, meaning the numbers you see are unbiased and built purely for your benefit.

- Saves Time and Cuts Stress

Instead of running endless calculations in a spreadsheet, you get instant results. The tool breaks down complex maths into clear, actionable figures, so you don’t waste hours trying to work it out yourself.

- Suitable for Every Type of Homeowner

- First-time buyers can test affordability before committing.

- Families can model how higher rates affect monthly budgets.

- Investors can calculate risks for buy-to-let tracker mortgages.

Retirees can plan for stability while weighing potential savings.

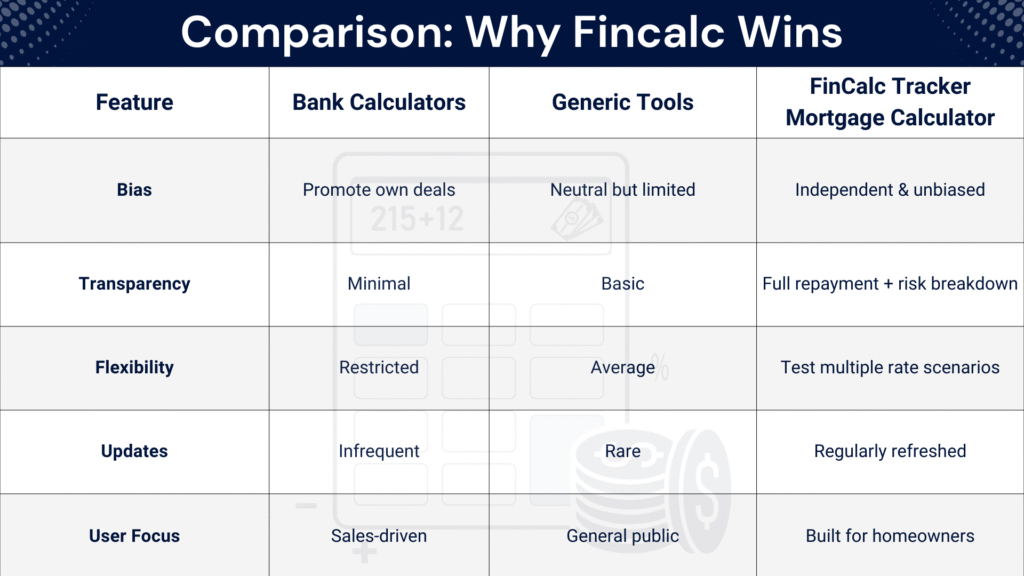

Comparison: Why FinCalc Wins

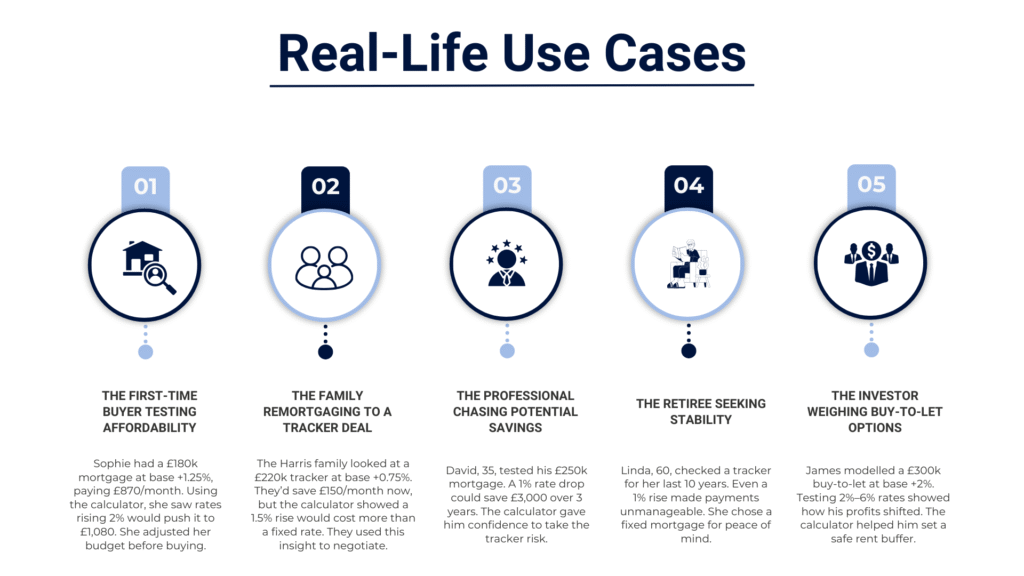

Real-Life Use Cases

The best way to understand the value of the Tracker Mortgage Calculator is to see how it helps real people. From first-time buyers to retirees, every homeowner faces different challenges when it comes to interest rates. Here are some scenarios where the calculator makes all the difference.

The First-Time Buyer Testing Affordability

Sophie was buying her first home with a £180,000 mortgage. At base +1.25%, her repayments looked manageable at £870 per month. But she worried about future rate hikes. Using the Tracker Mortgage Calculator, she tested what would happen if the base rate rose by 2%. The result: her repayments could jump to £1,080. Knowing this in advance, Sophie adjusted her budget and created a safety buffer before committing.

The Family Remortgaging to a Tracker Deal

The Harris family were coming off a 5-year fixed deal and was tempted by a lower tracker rate at base +0.75%. Their balance was £220,000, and the calculator showed they’d save £150 a month at current rates. However, it also revealed that if the base rate rose by 1.5%, they’d actually end up paying more than with a fixed rate. Armed with this insight, they negotiated a better deal with their lender.

The Professional Chasing Potential Savings

David, a 35-year-old accountant, believed rates might fall in the next few years. With a £250,000 mortgage, he used the calculator to see how much he could save if the base rate dropped by 1%. The tool showed he could save over £3,000 across three years compared to sticking with a fixed rate. This gave him the confidence to take the calculated risk.

The Retiree Seeking Stability

Linda, age 60, had 10 years left on her mortgage. She considered a tracker because it started lower than fixed rates, but she was concerned about budgeting on a fixed retirement income. The Mortgage Calculator allowed her to test repayments under different rate increases. When she saw that even a 1% rise would stretch her budget too far, she wisely chose to stick with a fixed product for peace of mind.

The Investor Weighing Buy-to-Let Options

James, a landlord with a buy-to-let mortgage, used the calculator to model repayments on a £300,000 property at base +2%. He tested scenarios from 2% to 6% base rates and saw how his profit margins shifted under each. This helped him decide how much rent buffer he needed to cover rising costs, ensuring his investment strategy stayed profitable.

Understanding the Numbers

The real challenge with tracker mortgages isn’t the concept, it’s the numbers. Because repayments move with the Bank of England’s base rate, it can be hard to predict what you’ll actually pay. The Tracker Mortgage Calculator makes these calculations simple, breaking down the mechanics so you can see how rate shifts affect your mortgage in both the short and long term.

Tracker Rate = Base Rate + Margin

Every tracker mortgage has two parts:

- The base rate (set by the Bank of England).

- The margin (the extra percentage your lender adds).

For example, if the base rate is 2% and your tracker margin is +1.5%, your actual mortgage rate is 3.5%.

How Small Changes Impact Repayments

Even a small movement in the base rate can have a significant effect on monthly payments:

- £200,000 mortgage over 25 years at 3.5% → ~£1,001/month.

- Base rate rises by 1% (rate = 4.5%) → ~£1,111/month.

- Base rate rises by 2% (rate = 5.5%) → ~£1,226/month.

That’s a jump of £225/month from just a 2% increase, or £2,700 a year.

The Cumulative Effect of Interest

Tracker mortgages don’t just affect monthly payments; they also change how much you’ll pay over the full loan term.

- At 3.5% on £200,000 over 25 years, the total interest is about £100,000.

- At 5.5%, the total interest climbs to £166,000.

This £66,000 difference shows why rate movements matter so much.

Planning for the Best and Worst Scenarios

The Tracker Mortgage Calculator lets you test multiple outcomes:

- Best case: if rates drop, you enjoy cheaper monthly repayments and long-term savings.

- Worst case: if rates rise sharply, you know in advance whether your budget can handle the extra cost.

Short-Term vs Long-Term Outlook

- Short term: A tracker may save you hundreds if rates remain stable or fall.

- Long term: Even small, gradual increases can add up to tens of thousands over decades.

The calculator helps you balance these perspectives, showing how today’s choice affects tomorrow’s finances.

Why Choose FinCalc Over Others?

When it comes to mortgages, most lenders and comparison sites provide calculators. But here’s the catch: bank calculators are designed to sell their own products, while generic tools often oversimplify tracker mortgages. That leaves borrowers with half the story and half the confidence they need to make the right choice. The FinCalc Tracker Mortgage Calculator is built differently: it’s independent, transparent, and designed to show you the full picture.

- Independent and Unbiased

Bank calculators almost always tilt in their favour, showing repayment figures that look appealing but without exploring risks if rates rise. FinCalc is independent, meaning the numbers you see are accurate, unbiased, and purely for your benefit.

- Full Transparency

Instead of giving you a single repayment figure, FinCalc reveals:

- How repayments change as the base rate moves.

How total interest costs shift across different scenarios.

Side-by-side comparisons of multiple base rate outcomes.

This detail ensures you’re never blindsided by rate changes.

- Flexible Scenario Testing

Tracker mortgages are unpredictable, so flexibility matters. With the Tracker Mortgage Calculator, you can test different margins, terms, and base rate movements. Want to know what happens if rates rise by 2%? Or how a 5-year term compares with a 25-year term? The calculator lets you test it all.

- Updated and Realistic

Markets change fast, and outdated calculators can give misleading results. FinCalc’s tracker tool is regularly updated to reflect realistic assumptions, keeping your calculations relevant to current conditions.

- Designed for Homeowners, Not Lenders

Many calculators assume you’re a finance expert. FinCalc keeps things simple: just enter your numbers, and it provides lender-style clarity in plain English. It’s built for real people who need confidence, not jargon.

Comparison: Why FinCalc Wins

Feature | Bank Calculators | Generic Tools | FinCalc Tracker Mortgage Calculator |

Bias | Promote own deals | Neutral but limited | Independent & unbiased |

Transparency | Minimal | Basic | Full repayment + risk breakdown |

Flexibility | Restricted | Average | Test multiple rate scenarios |

Updates | Infrequent | Rare | Regularly refreshed |

User Focus | Sales-driven | General public | Built for homeowners |

Conclusion

Tracker mortgages can be a smart option, offering flexibility and potential savings when interest rates fall. But they also come with uncertainty, since your repayments rise or fall alongside the Bank of England base rate. For many homeowners, that unpredictability makes it difficult to plan with confidence. The FinCalc Tracker Mortgage Calculator removes the guesswork.

By entering just a few details, you can instantly see how rate changes affect your monthly repayments and long-term costs. Whether you’re testing how a 1% increase impacts your budget or exploring the savings from lower rates, the calculator provides clear, unbiased insights in seconds. Instead of relying on vague estimates or biased bank tools, you get transparent numbers that help you make smarter financial decisions. From first-time buyers to seasoned homeowners and investors, the calculator adapts to every scenario. Explore more mortgage tools, guides, and calculators at FinCalc.

FAQs

What is a tracker mortgage?

A tracker mortgage follows the Bank of England’s base rate plus a margin set by your lender, so your repayments rise or fall when the base rate changes.

How does the Tracker Mortgage Calculator work?

You enter your mortgage balance, term, and tracker margin. The calculator shows how your repayments and total costs change as interest rates move.

How do tracker mortgages differ from fixed-rate mortgages?

Fixed mortgages lock in your payments for a set period. Tracker mortgages move with the base rate, which means they can be cheaper when rates fall, but riskier if they rise.

What happens if the base rate increases?

Your monthly repayments go up in line with the rise. The calculator lets you model different rate increases so you can prepare in advance.

Can I save money with a tracker mortgage?

Yes, if rates fall or remain low, tracker mortgages can cost less than fixed deals. The calculator helps you see the potential savings.

Is the Tracker Mortgage Calculator accurate?

It uses lender-style formulas to give realistic repayment estimates. Actual figures may vary slightly depending on fees or lender terms.

Can I use the calculator for remortgaging?

Yes. Whether you’re switching from fixed to tracker or comparing deals, the tool works for remortgage scenarios as well as new loans.

Do all tracker mortgages follow the Bank of England base rate?

Most do, but some track other reference rates. Always check the lender’s terms before committing.

Is a tracker mortgage right for first-time buyers?

It depends on your risk tolerance. The calculator helps first-time buyers test affordability if rates rise, reducing the chance of financial surprises.

Can I switch from tracker to fixed later?

Yes, many lenders allow you to remortgage or switch products. The calculator helps you see if staying on the tracker is worth it compared to fixing.