Free Remortgage Calculator UK

Current Monthly

New Monthly

Monthly Savings

Total Savings (incl. fees)

For most homeowners, the mortgage is their single largest monthly commitment. Yet thousands of people stay locked into outdated or expensive deals, often without realising they could be saving money. When a fixed-rate period ends or interest rates rise, repayments can increase sharply, quietly draining thousands of pounds over the lifetime of the loan. The truth is, remortgaging at the right time can significantly reduce costs, shorten your repayment term, or even release equity for other financial goals. That’s where the FinCalc Remortgage Calculator comes in.

This easy-to-use, independent tool is designed to show you instantly how much you could save by switching mortgages. By entering your current balance, interest rate, and term alongside potential new deal details, you’ll see a clear comparison of monthly repayments and long-term costs. No spreadsheets, no guesswork, just accurate, transparent numbers. Whether you’re aiming to cut your bills, unlock cash for home improvements, or simply make sure you’re not overpaying, the calculator gives you clarity before you speak to a bank or broker.

What is a Remortgage Calculator?

A Remortgage Calculator is a financial tool that helps homeowners work out whether switching to a new mortgage deal could save them money. Instead of sticking with your current lender’s standard variable rate (SVR), which is usually much higher than fixed or tracker deals, the calculator allows you to compare what you’re paying now with what you could be paying if you switched.

Here’s how it works. You enter the details of your current mortgage, the balance outstanding, the interest rate you’re paying, and the remaining term. Then you add the details of a potential new mortgage deal, such as the interest rate and term length. The calculator will instantly show:

- Your current monthly repayments.

- What your repayments would be under the new deal.

- How much could you save each month?

- The difference in total repayment costs over the life of the loan.

For example, imagine you have £200,000 left on your mortgage with 20 years remaining at 6% interest. Your monthly repayment might be around £1,432. If you remortgaged to a 4.5% deal, your monthly payment could drop to about £1,265. That’s a saving of around £167 each month, or more than £2,000 a year. Over the full term, the savings could be tens of thousands of pounds.

The value of a Remortgage Calculator is that it makes the decision simple and clear. Instead of guessing whether switching is worthwhile, you get transparent numbers that show the impact on your finances instantly. This empowers you to make better choices, negotiate confidently with lenders, and avoid overpaying on one of life’s biggest expenses. Use the FinCalc Interest Rate Comparison Calculator to compare rates side-by-side before you switch.

Why Remortgage Planning Matters?

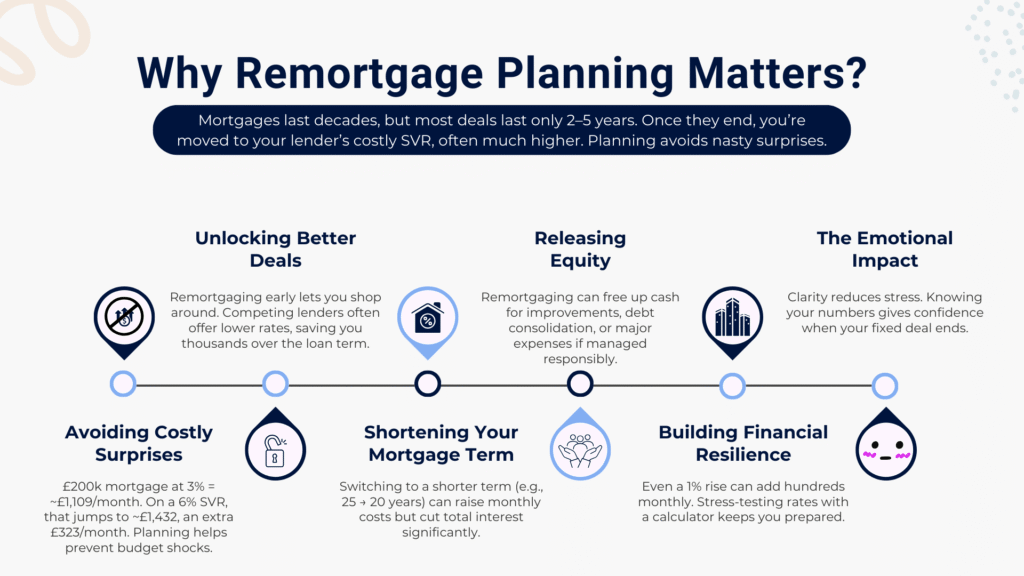

For most people, a mortgage is the single largest financial commitment they will ever make. But while property ownership is long-term, mortgage deals are not. Fixed-rate and discounted mortgage products typically last only 2–5 years, after which borrowers are automatically moved onto their lender’s Standard Variable Rate (SVR). These SVRs are usually much higher, meaning your monthly repayments can increase dramatically if you don’t plan. This is why remortgage planning isn’t just useful, it’s essential.

Avoiding Costly Surprises

A homeowner with £200,000 left on a 20-year mortgage at 3% interest would pay around £1,109 per month. But if their deal ended and they rolled onto an SVR of 6%, repayments could jump to about £1,432. That’s an extra £323 every month, nearly £4,000 a year. Without planning, this sudden increase can put enormous strain on household budgets.

Unlocking Better Deals

By planning your remortgage early, you can shop around for better rates rather than being forced to accept your lender’s default. Lenders compete for remortgage business, often offering lower rates to attract borrowers. The Remortgage Calculator makes it easy to see how switching from one deal to another could save thousands over the lifetime of the loan.

Shortening Your Mortgage Term

Remortgaging isn’t just about cutting monthly costs. Some homeowners use the opportunity to shorten their loan term, for example, from 25 years to 20. While monthly repayments may rise slightly, the total interest paid over time can drop significantly. The calculator lets you model these scenarios and decide whether long-term savings outweigh short-term sacrifices.

Releasing Equity

Many homeowners remortgage to release some of the equity built up in their property. This could be used for home improvements, consolidating debts, or funding major life events. Proper planning ensures you release equity responsibly, balancing today’s needs with tomorrow’s repayment commitments.

Building Financial Resilience

Interest rates can fluctuate over time. Without planning, a rise of even 1% on a large mortgage could mean hundreds of pounds extra each month. The Remortgage Calculator allows you to stress-test different rates so you can prepare your budget and avoid nasty surprises. Stress-test repayments at higher rates with the FinCalc Mortgage Repayment Calculator, so a 1%–2% move never blindsides your budget.

The Emotional Impact

Financial uncertainty causes stress. Knowing your repayments in advance and planning for them gives peace of mind. With clear numbers in front of you, you can make confident decisions instead of worrying about what might happen when your fixed term ends.

How the Calculator Works (Step-by-Step + Examples)

The Remortgage Calculator mirrors how lenders (and savvy homeowners) compare your current deal with a potential new one. Follow these steps to get lender-like clarity in minutes.

Step 1: Enter your current mortgage details

Input your outstanding balance, remaining term (years/months), current interest rate, and repayment type (repayment or interest-only). If you know your current monthly payment, add it for a quick sense-check.

Step 2: Add the new deal assumptions

Select a proposed interest rate, new term (keep the same or shorten), and product type (fixed, tracker, etc.). If it’s a fixed deal, note the fixed period (e.g., 2 or 5 years) so you can compare savings over that window.

Step 3: Include fees (so the math is honest)

Add product/arrangement fees, valuation/legal costs, and any ERC (early repayment charge) if you’re switching before your fix ends. Choose whether to pay fees upfront or add them to the loan; the calculator reflects both.

Step 4: Choose the comparison mode.

- Monthly savings view: compares today’s payment vs the new one.

- Total-cost view: compares lifetime interest and fee-adjusted savings.

- Fixed-period view: shows savings during the new fixed term (e.g., 24 or 60 months).

Step 5: Review the results

You’ll see:

- New monthly payment and monthly saving/extra vs your current deal

- Break-even point (months to recover fees from savings)

- Total interest under each scenario and fee-adjusted net savings

- Optional: same-payment strategy (keep paying your old amount to shorten the term dramatically)

Check your current LTV and potential rate tier with the FinCalc Loan to Value Calculator UK before you lock a deal.

Step 6, Stress-test (don’t skip this)

Nudge the new rate ±0.5% or ±1% to see if the savings still hold. This protects you from wishful thinking and mirrors lender stress-testing.

Step 7: Iterate “what-ifs”

Shorten the term to accelerate the payoff, or keep the term and bank the monthly savings. Test adding fees to the loan vs paying upfront. Re-run with and without ERCs. The Remortgage Calculator is built for rapid scenario planning.

Worked Example A, Classic rate-cut with fees

- Balance: £200,000 | Remaining term: 20 years (240 months)

- Current rate: 6.49% → Monthly ~£1,489.97

- New rate: 4.49% (same term) → Monthly ~£1,264.22

- Monthly savings ≈ £225.75

- Add fees: £999 product + £600 legals/valuation = £1,599 total

- Break-even ≈ 7 months (£1,599 / £225.75)

- Lifetime interest (same 20-yr term):

- Stay put ≈ £157,593

Remortgage ≈ £103,413 - Headline interest saved ≈ £54,180 (before fees)

Why it matters: Even after fees, the savings stack up fast, both monthly and over the life of the loan.

Worked Example B: Keep the old payment, finish years earlier.

Using the same example, choose the same-payment strategy: keep paying ~£1,489.97 after remortgaging at 4.49%.

- The new term falls to ~187 months (~15.6 years) instead of 20 years.

- Total interest ≈ £78,332 (vs £103,413 on the same 20-yr new deal)

- Extra interest saved ≈ £25,081 just by holding your payment steady.

Takeaway: A lower rate doesn’t only mean cheaper months, it can mean fewer years if you maintain your old payment.

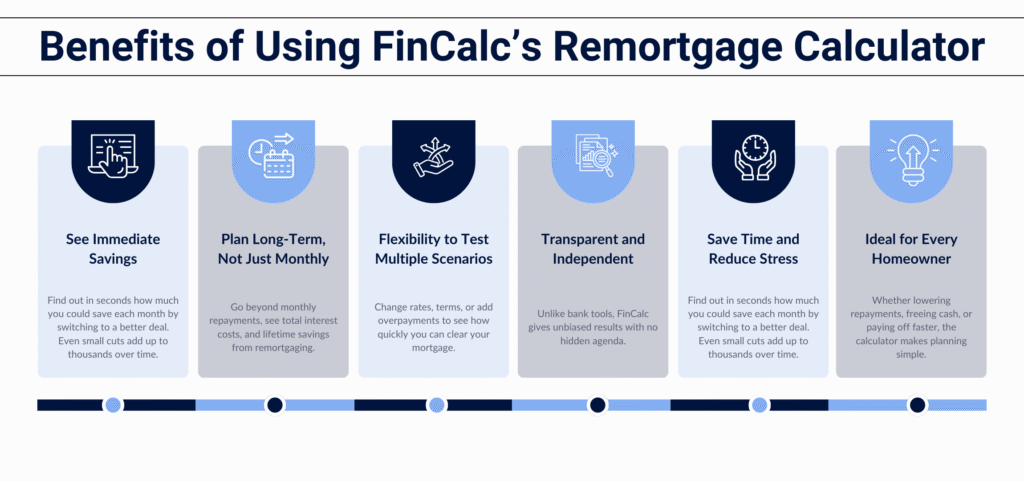

Benefits of Using FinCalc’s Remortgage Calculator

Remortgaging can be one of the smartest financial moves a homeowner makes, but only if you have clear numbers to guide your decision. Many people delay switching because the process feels complicated, or they rely solely on advice from lenders who may not have their best interests at heart. The FinCalc Remortgage Calculator removes the confusion by giving you instant, transparent insights. Here are the key benefits.

- See Immediate Savings

Instead of guessing, you’ll know in seconds how much you could save each month by switching to a new deal. Whether it’s £50 or £500, the calculator gives you a clear picture of the financial impact.

- Plan Long-Term, Not Just Monthly

Some calculators stop at monthly payments. FinCalc goes further, showing you the total interest you’ll pay over the life of the loan, as well as the savings you’ll make if you remortgage. This ensures you understand both the short-term and the long-term benefits.

- Flexibility to Test Multiple Scenarios

You can test different interest rates, loan terms, and repayment strategies. Want to see how shortening your term affects interest? Or how keeping the same payment reduces years off your mortgage? The calculator makes this simple.

- Transparent and Independent

Bank calculators often present results in a way that favours their own products. FinCalc is independent. Our Remortgage Calculator has no hidden agenda, just unbiased, easy-to-understand results you can trust.

- Save Time and Reduce Stress

No more spreadsheets, no more trawling through rate tables, and no more confusing mortgage maths. In under a minute, you’ll have the key numbers you need to make an informed decision.

- Ideal for Every Homeowner

Families worried about rising repayments can see savings clearly. First-time remortgagers can gain confidence before speaking to lenders. Retirees can test strategies to lower repayments and free up cash flow. Ambitious homeowners can explore how to shorten terms and pay off the mortgage faster.

Comparison: Why FinCalc Wins

Real-Life Use Cases

Numbers tell part of the story, but real-life situations show just how powerful the Remortgage Calculator can be. Homeowners across all stages of life use it to make smarter choices, reduce stress, and unlock savings. Here are some practical examples.

The Family Facing Higher Bills

When the Johnsons’ 2-year fixed deal ended, their lender moved them onto a 6% SVR. Their monthly repayment on a £220,000 balance jumped by almost £300 overnight. Unsure what to do, they used the Remortgage Calculator to compare their current deal with a 4.5% remortgage offer. The results showed they could save £280 a month, nearly £3,400 a year. That clarity gave them the confidence to switch quickly, easing pressure on their household budget.

The First-Time Remortgager Seeking Clarity

Amira bought her first home three years ago with a fixed-rate mortgage. When her deal was due to expire, she had no idea what remortgaging involved. By entering her balance, term, and current interest rate into the calculator, she instantly saw the difference between staying put and switching. The transparency reassured her and gave her the confidence to approach brokers, knowing what to expect.

The Retiree Managing Cash Flow

Alan, 62, had 12 years left on his mortgage and was struggling with rising repayments. By using the calculator, he explored switching to a lower rate and extending the term slightly. While this meant paying more interest overall, it cut his monthly bills by £250, giving him the breathing room he needed in retirement. The tool helped him balance short-term affordability with long-term planning.

The Ambitious Homeowner Shortening Their Term

Sophie, 35, had a stable income and wanted to become mortgage-free sooner. She used the Remortgage Calculator to test a 15-year term instead of her existing 220-year term. The results showed that while her repayments would rise by £180 per month, she would save over £40,000 in interest and finish 5 years earlier. That insight empowered her to commit confidently to a more aggressive repayment plan.

Understanding the Numbers

Mortgages can seem complicated, but they all boil down to a few core numbers: the loan balance, the interest rate, the term, and the total repayment. The Remortgage Calculator brings these together in a clear, transparent way so you can see exactly how switching affects your finances.

Principal vs Interest

Every repayment has two parts: the principal (the loan amount you’re paying back) and the interest (the lender’s charge for borrowing). At higher rates, a larger chunk of your monthly payment goes toward interest. By remortgaging to a lower rate, more of your payment goes toward reducing the balance, meaning you pay your mortgage off faster.

Impact of Interest Rates

Interest rates have the biggest influence on repayment costs. For example:

- Balance: £200,000 | Term: 20 years

- At 6% interest: monthly payment ≈ £1,432

- At 4.5% interest: monthly payment ≈ £1,265

That’s a saving of £167 every month, or just over £2,000 per year. Over the full term, the total saving is more than £40,000 in interest.

The Role of Term Length

Changing your term also has a dramatic effect:

- £200,000 over 25 years at 4.5% → monthly payment ≈ £1,111, total interest ≈ £133,000

- £200,000 over 15 years at 4.5% → monthly payment ≈ £1,530, total interest ≈ £76,000

Extending your term lowers monthly costs but increases total interest. Shortening the term raises monthly payments but slashes long-term interest. The Remortgage Calculator makes these trade-offs visible in seconds.

Fees and Break-Even Point

Most remortgage deals come with arrangement or legal fees. The calculator lets you add these costs so you see the true savings. For example, if you save £150 per month but the new deal has £900 in fees, you’ll break even after six months. From then on, the savings are genuine.

Equity Release Scenarios

Many homeowners use remortgaging to release equity. The calculator shows how adding to your balance (borrowing more) affects repayments. For example, borrowing an extra £20,000 at 4.5% may only increase monthly repayments by around £127, but you’ll see the true cost over the full term, allowing you to weigh the decision carefully.

Stress-Testing Your Mortgage

The calculator also helps you stress-test “what if” scenarios. What if rates rise by 1%? What if you extend your term? By seeing how your repayments change under different conditions, you can prepare your finances for the unexpected.

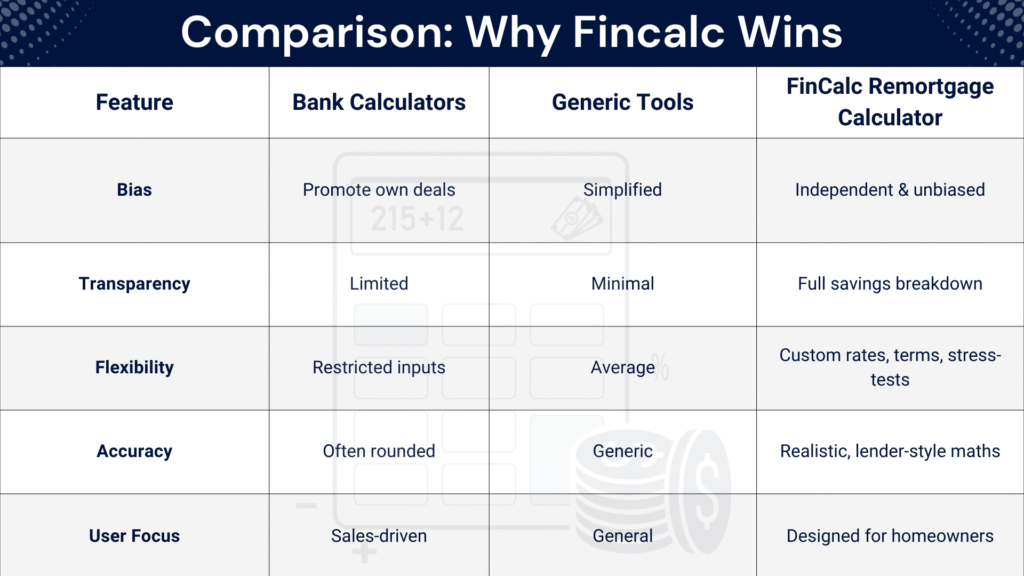

Why Choose FinCalc Over Others?

When it comes to comparing mortgage deals, there’s no shortage of tools online. Banks provide their own calculators, brokers have basic widgets, and comparison sites often give oversimplified results. But here’s the issue: most of them are either biased, outdated, or too limited to give you the full picture. The FinCalc Remortgage Calculator is different; it’s designed for homeowners who want clarity, independence, and confidence before making such an important financial decision.

Independent and Unbiased

Bank calculators are built to promote their own products, which means they rarely give you a fair comparison. FinCalc is completely independent. Our calculator has one goal: to show you accurate, transparent numbers so you can make the decision that’s best for you, not your lender.

Full Transparency

Most calculators stop at monthly repayments. FinCalc goes much deeper by showing: Monthly repayments under your new deal. Total interest over the lifetime of the loan.The break-even point once fees are included.Savings over fixed periods (e.g., 2-year or 5-year fixes).Impact of different term lengths. This level of detail means you don’t just see if you’re saving money, you see exactly how, where, and when.

Updated and Realistic

The mortgage market changes rapidly. Interest rates can move in weeks, and outdated calculators quickly become misleading. The Remortgage Calculator is regularly updated with realistic assumptions, so your results reflect current market conditions.

Flexibility for Every Homeowner

Whether you’re remortgaging to lower repayments, shorten your term, or release equity, the calculator adapts. You can model multiple “what if” scenarios: How much would I save if I switched today? What if interest rates rise by 1%? What happens if I keep paying my old amount at a lower rate? This flexibility gives you control over your options before you ever speak to a bank.

Designed for Real People

FinCalc isn’t a generic calculator thrown together for marketing purposes. It’s designed for everyday homeowners who need clear, practical insights. You don’t need to be a financial expert, just enter your details, and you’ll get lender-style clarity in seconds.

Comparison: Why FinCalc Wins

Feature | Bank Calculators | Generic Tools | FinCalc Remortgage Calculator |

Bias | Push their own deals | Neutral but basic | Independent & unbiased |

Transparency | Limited | Minimal | Full savings breakdown |

Flexibility | Restricted | Average | Custom rates, terms, equity options |

Accuracy | Often rounded | Oversimplified | Realistic, fee-aware results |

User Focus | Sales-driven | General public | Built for homeowners |

Conclusion

For many households, the mortgage is the single biggest monthly expense, yet too often, people stay on the wrong deal and pay far more than they need to. When fixed terms end or interest rates rise, repayments can climb sharply, eating into savings and adding unnecessary stress. The good news is that with the right planning, those costs can be reduced significantly. The FinCalc Remortgage Calculator makes this process simple, fast, and transparent.

By entering just a few details about your current loan and a potential new deal, you’ll instantly see your new repayments, long-term savings, and the impact of fees. Instead of guessing or relying solely on your lender’s advice, you’ll have unbiased numbers at your fingertips. Whether your goal is to cut monthly bills, release equity, shorten your term, or avoid overpaying, the calculator gives you the clarity you need to take control of your mortgage.For more remortgage tools, guides, and calculators, start at FinCalc.

FAQs

What is a Remortgage Calculator?

It’s a tool that compares your current mortgage with potential new deals, showing how much you could save in monthly repayments and total costs.

How does the Remortgage Calculator work?

You enter your current loan balance, term, and rate, then test new rates or terms. The calculator instantly shows monthly savings, interest reductions, and break-even points.

When should I consider remortgaging?

Typically, when your fixed or discounted deal ends, when interest rates rise, or when you want to release equity or reduce repayments.

Can the calculator show long-term savings as well as monthly?

Yes. It reveals both short-term monthly changes and lifetime savings across the full mortgage term.

Do I need exact figures to use it?

Approximate balances and terms work, but more accurate details give you more precise results.

Does it include fees like arrangement or legal costs?

Yes, you can add fees to see the true savings and calculate how long it takes to break even.

Can it be used for buy-to-let remortgages?

Yes. While designed for homeowners, it also works for buy-to-let scenarios by comparing repayments and terms.

How accurate are the results?

The calculator mirrors lender-style calculations. Actual offers may differ slightly due to fees, credit profile, and lender policies.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Will using the calculator affect my credit score?

No. It’s a planning tool only. Your credit score is only affected when you make a formal mortgage application.

Can I use it to shorten my mortgage term?

Yes. The tool shows how higher repayments or a shorter term reduce total interest and help you become mortgage-free faster.