The Most Accurate Interest Only Mortgage Calculator Uk

Loan Amount

Monthly Interest

Total Interest Paid

Final Repayment (Loan)

Mortgages can feel complicated enough, but few create as much confusion as the interest-only mortgage. Unlike traditional repayment mortgages, where every monthly payment reduces both the loan balance and interest, interest-only deals cover just the interest. That means your monthly payments are far lower, but the full loan amount still has to be repaid at the end of the term. For many borrowers, this structure can look affordable in the short term but risky in the long run. This is where the FinCalc Interest Only Mortgage Calculator becomes essential. Instead of relying on rough estimates or complex financial tables, our tool shows you exactly what an interest-only mortgage looks like in practice.

By entering your loan amount, term length, and interest rate, you’ll instantly see your monthly cost, the total interest payable, and the lump sum owed at the end. Whether you’re a first-time buyer tempted by lower monthly costs, an investor planning a rental strategy, or a homeowner weighing affordability against long-term responsibility, the Mortgage Calculator gives you the clarity you need. With it, you can plan smarter, reduce uncertainty, and make decisions with confidence.

What is an Interest-Only Mortgage Calculator?

An interest-only mortgage Calculator is a tool designed to show you the real cost and structure of an interest-only loan. Unlike standard repayment mortgages, where your monthly payment gradually reduces both the balance and the interest, interest-only mortgages only cover the interest charges. That means your loan balance doesn’t shrink over time; it stays the same until the end of the term. At that point, the full loan amount (also called the “balloon payment”) becomes due in one lump sum.

The calculator takes away the guesswork by giving you a clear picture of:

- Monthly interest-only repayments – how much you’ll pay each month without reducing the loan balance.

- Total interest paid over the term – the cumulative cost of servicing the loan.

- Final lump sum owed – the original mortgage amount still due at the end.

- Comparison with repayment mortgages – so you can see the difference in long-term costs.

For example, let’s say you borrow £200,000 at 4% interest for 25 years. With an interest-only mortgage, your monthly payment would be just ~£667. That feels manageable, but by the end of the term, you’ll still owe the full £200,000. On the other hand, a repayment mortgage at the same rate might cost ~£1,055 per month, but after 25 years, the loan is completely cleared.

This is why the Interest Only Mortgage Calculator is so valuable. It highlights the trade-off between short-term affordability and long-term responsibility. Investors may find interest-only useful for managing cash flow on rental properties, while homeowners may prefer repayment mortgages for peace of mind. The calculator shows both sides so you can make an informed decision. In short, the Mortgage Calculator isn’t just about numbers; it’s about clarity. It helps you understand how interest-only structures really work, what risks you need to plan for, and whether it’s the right choice for your financial future.

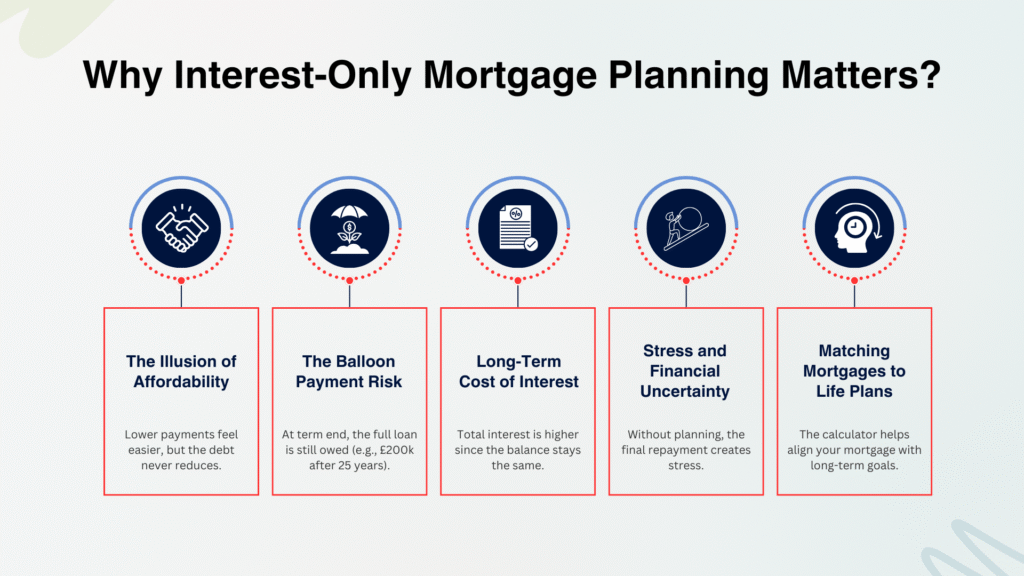

Why Interest-Only Mortgage Planning Matters?

At first glance, an interest-only mortgage looks appealing. The monthly payments are often hundreds of pounds lower than a traditional repayment mortgage, making homeownership feel more affordable. But what many borrowers overlook is what happens at the end of the term: the loan balance doesn’t go away. You still owe the full amount, and without careful planning, that final repayment can come as a shock. This is why using the Interest Only Mortgage Calculator and planning is so important.

1. The Illusion of Affordability

Interest-only mortgages reduce your immediate costs, which can be attractive to first-time buyers, families juggling expenses, or investors seeking higher rental yields. But this affordability is temporary. Without a repayment strategy in place, the debt remains unchanged for decades. The calculator reveals how much interest you’ll pay and reminds you that the principal must still be repaid.

2. The Balloon Payment Risk

At the end of the term, you’ll owe the full original loan. For example, on a £200,000 mortgage, you’ll still owe £200,000 after 25 years of interest-only payments. Many borrowers underestimate this risk. The calculator makes it crystal clear by showing the lump sum due, so you can plan to save, invest, or refinance in time.

3. Long-Term Cost of Interest

Because you never reduce the balance, you end up paying more interest over the life of the loan. Using the calculator, you’ll see how, even though monthly payments are lower, the total interest paid may be much higher compared to a repayment mortgage. This helps you balance short-term relief with long-term cost.

4. Stress and Financial Uncertainty

Unplanned interest-only borrowing can lead to serious stress. Homeowners may panic as the end of the term approaches without a strategy in place. The Interest Only Mortgage Calculator takes away this uncertainty by spelling out the numbers clearly, reducing anxiety and encouraging smarter financial choices.

5. Matching Mortgages to Life Plans

Not everyone’s goals are the same. An investor might plan to sell or refinance before the end of the term, while a family may want the security of full repayment. Planning with the calculator ensures your mortgage type fits your lifestyle, income, and long-term ambitions.

How the Calculator Works (Step-by-Step + Example)?

The Interest Only Mortgage Calculator is designed to simplify one of the most misunderstood mortgage structures. Many borrowers are drawn to the lower monthly payments of interest-only loans but underestimate the long-term financial impact. This tool breaks the process into clear steps, helping you see the real costs and responsibilities of your mortgage.

Step 1 – Enter Your Loan Amount

Start with the total amount you’re borrowing or the balance remaining on your mortgage. This figure forms the foundation of the calculation.

Step 2 – Input the Interest Rate

Add your mortgage’s annual interest rate. Since interest-only mortgages don’t reduce the principal, the rate is applied to the full balance for the entire term.

Step 3 – Select the Loan Term

Choose the number of years your mortgage will run. Terms typically range from 10 to 30 years. The calculator uses this to show how long you’ll be making payments.

Step 4 – View Your Monthly Interest-Only Payment

The calculator instantly shows your monthly payment, which is simply the interest on the loan. Unlike repayment mortgages, this doesn’t reduce the balance.

Step 5 – See Total Interest Payable

One of the most eye-opening features is the total interest cost over the life of the loan. Because the balance never decreases, the total interest can be much higher than you’d expect.

Step 6 – Understand the Balloon Payment

At the end of the term, the calculator shows the lump sum (the original loan) that still needs to be repaid. This “balloon payment” is a critical factor in deciding whether an interest-only mortgage fits your plans.

Worked Example:

Imagine a £250,000 mortgage at 4% interest over 25 years:

Interest-Only Mortgage:

- Monthly payment: ~£833 (interest only).

- Total interest over 25 years: ~£250,000.

- Balance owed at end of term: £250,000 (balloon payment).

Repayment Mortgage (same terms):

- Monthly payment: ~£1,320.

- Total interest over 25 years: ~£145,000.

- Balance owed at end of term: £0.

This shows the trade-off clearly: interest-only lowers monthly costs but results in far higher long-term costs and a large balance still due.

Benefits of Using FinCalc’s Interest-Only Mortgage Calculator

Interest-only mortgages can look appealing at first glance because of their lower monthly payments. But without a clear understanding of the long-term costs and risks, it’s easy to make a decision that becomes stressful later. The FinCalc Interest Only Mortgage Calculator provides clarity, independence, and transparency, giving you the insights you need before committing to this type of mortgage.

1. Clear View of True Costs

Most people only see the short-term advantage of lower monthly repayments. The calculator goes further, showing you the total interest you’ll pay over the term and the balloon payment still owed at the end. This removes illusions and ensures you know the real commitment upfront.

2. Compare Interest-Only vs Repayment Mortgages

The calculator doesn’t just give you one figure; it allows you to compare interest-only mortgages with traditional repayment options. Seeing the difference side by side makes it easier to weigh affordability today against financial freedom tomorrow.

3. Test Real-World Scenarios

What if interest rates rise by 2%? What if you extend your mortgage term? The Interest Only Mortgage Calculator lets you model multiple scenarios instantly, so you can understand how different changes affect your monthly payments, total interest, and long-term obligations.

4. Independent and Transparent Results

Unlike bank calculators that may push you toward their own products, FinCalc is independent. The results you see are unbiased and designed to help you make smarter decisions, not sell you a mortgage.

5. Easy to Use, No Jargon

Spreadsheets and complex mortgage formulas can be overwhelming. The FinCalc tool simplifies everything. With a few quick inputs, you’ll get instant, easy-to-read results, no financial expertise required.

6. Helps Plan for the Balloon Payment

One of the biggest risks of interest-only mortgages is the lump sum owed at the end. The calculator highlights this clearly, encouraging you to plan for repayment strategies in advance, whether through savings, investments, or refinancing.

Real-Life Use Cases

Every borrower comes to a mortgage with different goals, risks, and financial situations. An interest-only mortgage might make sense for some, but not for others. The Interest Only Mortgage Calculator helps bring clarity to these scenarios by showing the true numbers behind the choice. Here are some real-life examples where the tool proves invaluable.

1. First-Time Buyer Tempted by Lower Payments

Emma, 27, was excited to buy her first flat but worried about monthly affordability. A repayment mortgage seemed out of reach at £950/month, but an interest-only option lowered her payments to £650. Using the calculator, she saw that after 25 years she’d still owe the full £180,000 loan. That insight helped her plan a repayment strategy alongside her interest-only deal, avoiding a nasty shock later.

2. Family Managing Tight Budgets

The Patel family, with two children and rising household costs, considered interest-only payments to free up cash flow. The calculator showed them their monthly savings compared to a repayment mortgage, but also highlighted that they’d owe £250,000 at the end of the term. With this information, they decided to combine short-term savings with a long-term investment plan to cover the balloon payment.

3. Investor Maximising Rental Returns

James, a property investor, used the Interest Only Mortgage Calculator to model cash flow for his rental portfolio. By sticking with interest-only, his monthly payments stayed low, leaving more profit from rental income. However, the calculator also revealed the interest cost over time, helping him decide which properties to sell before the term ended to clear balances strategically.

4. Retiree Downsizing for Flexibility

Linda, 62, downsized into a smaller home and wanted lower monthly costs. She considered an interest-only mortgage to keep cash free during her semi-retirement. The calculator showed her the balloon payment due at the end. Since she planned to sell the property later anyway, she felt confident using the interest-only option without fear of being caught off guard.

5. Professional Planning to Refinance Later

David, 35, an IT consultant, expected his income to rise significantly in the next 10 years. He used the calculator to see the difference between interest-only and repayment mortgages. The lower monthly payments freed up cash in the short term, and the tool showed him exactly what he’d owe later. Knowing he could refinance or overpay once his income grew, he confidently chose interest-only as a temporary strategy.

Understanding the Numbers:

Mortgages aren’t just about monthly affordability; they’re about the total financial picture. Interest-only mortgages can look appealing because of the lower payments, but the long-term costs are often misunderstood. The Interest Only Mortgage Calculator helps break these numbers into clear insights so you can see the full story behind your loan.

How Interest-Only Payments Work?

With an interest-only mortgage, your monthly payment covers only the interest on the loan. The principal (the amount borrowed) stays the same throughout the term. That means even after 10, 20, or 25 years of payments, you still owe the original balance as a lump sum.

For example, on a £200,000 mortgage at 4% interest:

- Interest-only: ~£667/month. After 25 years, you’ve paid ~£200,000 in interest, but you still owe the full £200,000 balance.

- Repayment mortgage: ~£1,055/month. After 25 years, you’ve paid ~£116,000 in interest and cleared the loan completely.

The Balloon Payment Reality

The biggest risk of interest-only mortgages is the balloon payment at the end of the term. Borrowers often underestimate how large this obligation is. The calculator shows you exactly how much you’ll owe, the full original loan, so you can plan whether to save, invest, sell the property, or refinance.

The Long-Term Interest Cost

Because the principal never reduces, you often pay more in total interest on an interest-only mortgage compared to a repayment mortgage. The Interest Only Mortgage Calculator highlights this, helping you weigh short-term affordability against long-term expense.

Impact of Rate Changes

If your interest rate rises, your monthly payments increase immediately, and since the balance never falls, those higher payments continue until the term ends. For example, on a £200,000 loan:

- At 4%: £667/month.

- At 6%: £1,000/month.

That’s a 50% increase in payments, with the balance still due at the end.

Why Numbers Matter for Planning?

Without seeing these figures clearly, many people are tempted by the illusion of affordability. The calculator turns percentages into actual pounds, helping you understand the reality of an interest-only mortgage before you commit.

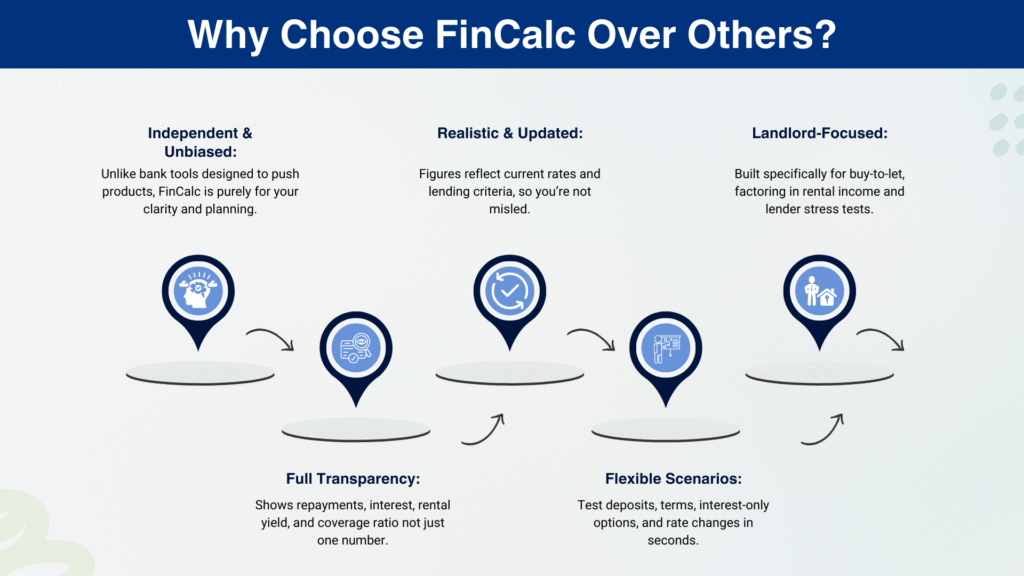

Why Choose FinCalc Over Others?

There are plenty of online mortgage calculators, but not all are created equal. Many lender tools are designed to push their own products, while spreadsheets and DIY calculations can feel overwhelming. The FinCalc Interest Only Mortgage Calculator was built with one clear goal: to give borrowers transparent, unbiased, and easy-to-understand insights into one of the most complex mortgage types.

1. Independent and Unbiased

Most bank calculators are tied to sales, nudging you toward products they want you to choose. FinCalc is completely independent. The Interest Only Mortgage Calculator shows you the numbers exactly as they are, with no hidden agendas.

2. Clarity on Balloon Payments

Other calculators often focus only on monthly payments. FinCalc goes further by showing you the balloon payment still owed at the end of the term. This is one of the biggest risks of interest-only mortgages, and understanding it upfront is essential for proper planning.

3. Side-by-Side Comparisons

While many tools calculate only one type of mortgage, the FinCalc tool allows you to compare interest-only against repayment mortgages. Seeing the monthly difference, total interest, and long-term costs side by side gives you a much clearer picture.

4. Flexibility to Test Scenarios

The calculator lets you adjust loan amounts, terms, and rates instantly, so you can see how different scenarios impact your payments and obligations. Whether rates rise, terms shorten, or you plan to refinance, the results update in seconds.

5. Simple and User-Friendly

You don’t need a financial background to use the tool. With just three quick inputs, you’ll have all the information you need, from monthly payments to long-term totals. No jargon, no complicated spreadsheets, just clarity.

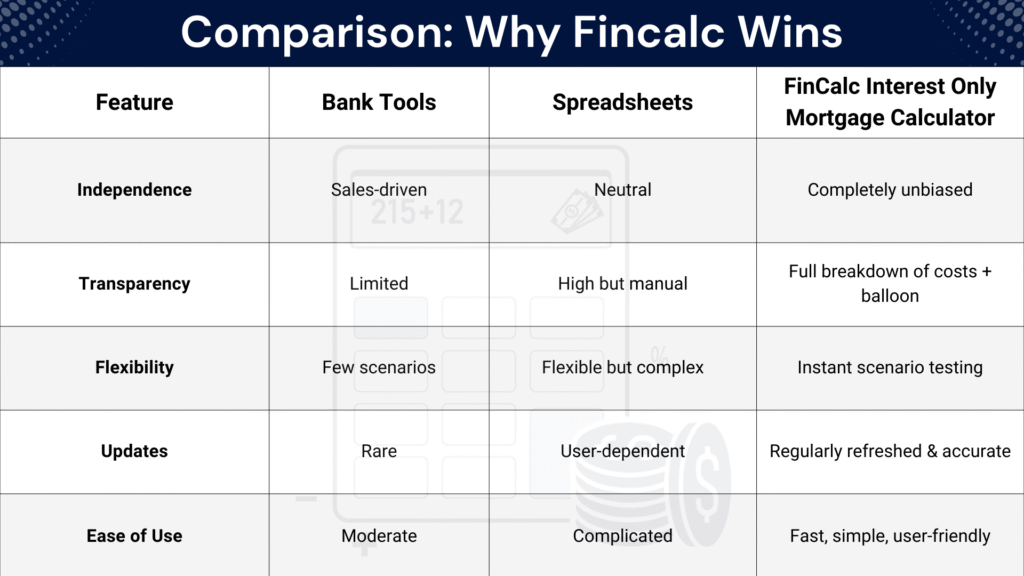

Comparison: Why FinCalc Wins

Feature | Bank Tools | Spreadsheets | FinCalc Interest Only Mortgage Calculator |

Independence | Sales-driven | Neutral | Unbiased & transparent |

Balloon Payment Visibility | Rare | Possible but manual | Always shown clearly |

Comparison (Repayment vs Interest-Only) | Limited | Manual | Built-in side-by-side |

Flexibility | Low | High but complex | High & easy to use |

Ease of Use | Moderate | Complicated | Fast, simple, intuitive |

Conclusion:

Interest-only mortgages can seem attractive because of their lower monthly payments, but without proper planning, they can become a financial trap. While this type of loan may offer short-term breathing room, the reality is that you’ll still owe the full balance at the end of the term. Many borrowers underestimate this balloon payment and the total interest costs, only to face stress and financial strain later.

The FinCalc Interest Only Mortgage Calculator removes that uncertainty. By clearly showing your monthly interest-only payments, the total interest paid, and the lump sum due at the end, it gives you the clarity to plan. Whether you’re a first-time buyer tempted by affordability, an investor looking to maximise cash flow, or a homeowner weighing long-term options, this tool ensures you see the full picture before committing. With knowledge comes confidence. The Interest Only Calculator empowers you to make smarter, more responsible choices, balancing short-term affordability with long-term responsibility.

FAQs:

What is an interest-only mortgage?

It’s a type of mortgage where you only pay the interest each month. The original loan balance (principal) is not reduced and must be repaid at the end of the term.

How does the Interest Only Mortgage Calculator work?

You enter your loan amount, interest rate, and term. The calculator shows your monthly interest-only payments, total interest cost, and the balloon payment due at the end.

Do I pay off the loan with an interest-only mortgage?

No. Your monthly payments only cover the interest. The full loan balance remains outstanding until the term ends.

What happens at the end of an interest-only mortgage?

You’ll still owe the original loan amount, which must be repaid in full. Borrowers typically refinance, sell the property, or use savings/investments.

Is an interest-only mortgage cheaper than a repayment?

It’s cheaper monthly but more expensive long term. You’ll pay more interest overall and still owe the principal at the end.

Can I switch from interest-only to repayment later?

Yes. Many lenders allow a switch, often at remortgage points. The calculator helps you compare how payments and total costs change.

Is an interest-only mortgage good for buy-to-let?

Many landlords use them to keep monthly costs low and maximise rental income. However, they need a strategy to repay the balance later.

Does the calculator show the total interest paid?

Yes. It highlights monthly interest, the cumulative cost over the term, and the final balance owed.

What risks are there with interest-only mortgages?

The biggest risk is not having a repayment plan for the loan balance. Rising interest rates can also increase monthly costs significantly.

Why should I use FinCalc’s Interest-Only Mortgage Calculator?

Because it’s independent, transparent, and easy to use. It gives you unbiased results with clear comparisons to repayment mortgages.

Can first-time buyers use the calculator?

Yes. It’s ideal for first-time buyers who want to see how affordable interest-only looks compared to repayment, and what risks to plan for.

How often should I check my mortgage using the calculator?

Any time you’re considering a new mortgage, refinancing, or when rates change. Regular use ensures your plan stays on track.