Best Mortgage Repayment Calculator UK

Loan Amount

Monthly Payment

Total Repayment

Total Interest

Taking out a mortgage is often the single biggest financial decision most people will make in their lifetime. Yet many buyers dive into the property market without truly understanding what their repayments will look like month after month, or how much interest they’ll pay over the lifetime of the loan. Without this knowledge, it’s easy to overcommit financially and end up with years of stress.

The FinCalc Mortgage Repayment Calculator takes away that uncertainty by giving you instant, accurate figures. Simply enter your property price, deposit, interest rate, and mortgage term, and the tool shows your monthly repayments, total interest, and the full cost of your mortgage. No guesswork, no confusing formulas, just clear numbers that make sense. Whether you’re a first-time buyer, a family upgrading to a bigger home, or an investor planning your next purchase, this calculator helps you see the bigger picture and make smarter choices.

What is a Mortgage Repayment Calculator?

A Mortgage Repayment Calculator is a simple but powerful tool that helps you understand the true cost of borrowing when buying a property. Instead of guessing what your monthly repayments might be, the calculator does the maths instantly and shows you exactly how much you’ll owe each month, how much interest you’ll pay, and the overall cost of the mortgage across its lifetime. When you apply for a mortgage, lenders don’t just give you a lump sum; they spread repayments across 20, 25, or even 35 years, depending on the term you choose. The interest rate applied makes a huge difference to your total repayments, and even small changes can add up to tens of thousands of pounds over time. A Repayment Calculator takes these factors, the loan amount, term length, and interest rate, and converts them into clear numbers that you can use to plan. Want to check your borrowing ceiling alongside repayments? Use the FinCalc Mortgage Affordability Calculator for a lender-style estimate.

For example, imagine buying a £200,000 property with a 10% deposit (£20,000). That means you’ll need a mortgage of £180,000. Over a 25-year term at an interest rate of 5%, the calculator would show repayments of around £1,055 per month. Over the full 25 years, you’d end up repaying over £316,000 in total, meaning more than £136,000 of that figure is interest alone. Seeing this breakdown up front helps you prepare properly and avoid surprises later. The real value of the Mortgage Calculator is clarity. It empowers you to compare different scenarios: What happens if you save for a bigger deposit? How do your repayments change with a shorter term? What impact does a higher or lower interest rate have? These insights let you budget effectively and make smarter choices before committing to such a major financial responsibility.

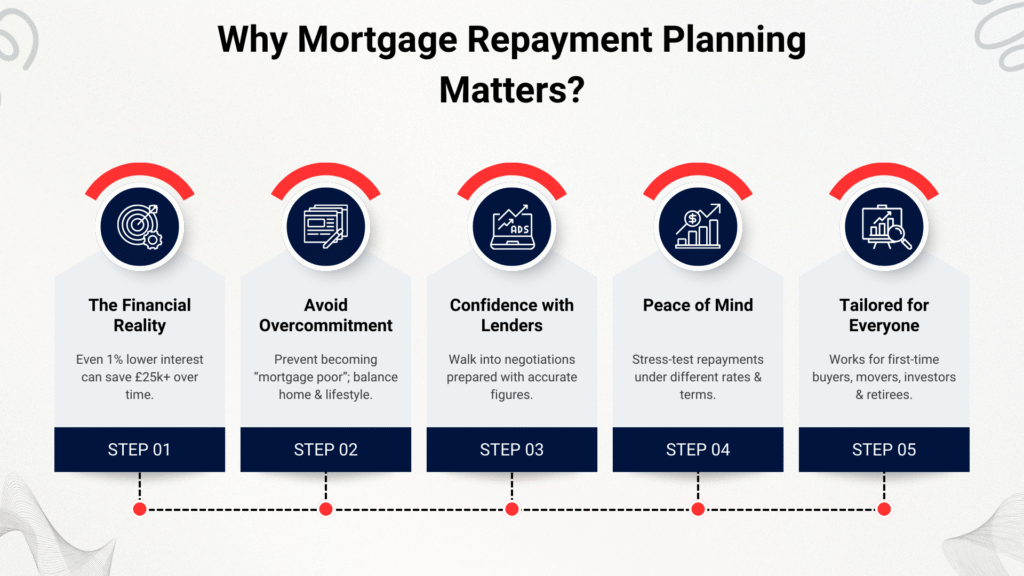

Why Mortgage Repayment Planning Matters?

Taking out a mortgage isn’t just about securing a property; it’s about committing to decades of regular repayments. For most people, this becomes the single largest financial responsibility of their lifetime. That’s why repayment planning is so critical. Without a clear understanding of how much you’ll pay month after month, and how interest impacts the total, you risk financial stress, wasted opportunities, or even falling into debt. A Mortgage Repayment Calculator ensures you go in with your eyes open.

The Financial Reality

Mortgages stretch across 20, 25, or even 35 years. Over such long periods, even small differences in interest rates or loan terms can translate into tens of thousands of pounds. For instance, on a £180,000 mortgage, reducing the rate by just 1% could save more than £25,000 over the lifetime of the loan. Without proper planning, many borrowers don’t realise the true cost until they’ve already committed.

Avoiding the Trap of Overcommitment

A big house may look tempting, but borrowing beyond your comfort zone can leave you “mortgage poor”, where most of your income goes toward repayments, leaving little for savings, emergencies, or everyday living. By using the Repayment Calculator, you can see exactly how much your loan will cost each month, helping you strike the right balance between your dream home and financial stability.

Confidence with Lenders

When you know your repayment figures, you’re in a stronger position to speak with banks, brokers, or estate agents. You’ll avoid nasty surprises, be less likely to overestimate your budget, and feel more confident when negotiating rates or terms. In fact, many buyers who use a calculator first find that their estimates closely align with lender affordability checks, making the process smoother and less intimidating.

Peace of Mind in Uncertain Times

Interest rates fluctuate, and the housing market can change quickly. Planning your repayments helps you stress-test your budget under different scenarios. What if rates rise by 1%? What if you extend the term by five years? A Mortgage Repayment Calculator lets you run these scenarios in minutes, giving you peace of mind that you’re prepared for whatever happens. Stress-test different rate scenarios with the FinCalc Interest Rate Comparison Calculator before you fix or track.

Tailored for Every Buyer

Repayment planning isn’t just for first-time buyers. Families upgrading, investors testing buy-to-let returns, and retirees downsizing with smaller mortgages all need to know how their repayments will fit into their financial plans. With a calculator, you can tailor results to your unique situation instead of relying on generic estimates.

How the Calculator Works (Step-by-Step + Examples)

The Mortgage Repayment Calculator mirrors the way lenders translate a loan into monthly payments, total interest, and overall cost, so you can see the full picture before you commit. Here’s the workflow and what each input changes.

Step 1: Enter the property value

This is the agreed purchase price. It anchors everything else, from the size of the mortgage to your loan-to-value (LTV).

Step 2: Add your deposit.

The calculator subtracts your cash deposit from the property value to find the loan amount (principal). A larger deposit lowers LTV, which often unlocks better rates and lowers repayments.

Step 3: Choose the mortgage term.

Pick the length of the loan (e.g., 20, 25, 30 or 35 years). Longer terms reduce the monthly payment but increase total interest paid. The calculator lets you compare terms side-by-side.

Step 4: Set the interest rate

Enter an assumed annual rate (fixed or variable). The tool converts this to a monthly rate and applies the standard amortisation formula to compute your repayment.

Step 5: Review the results instantly.

You’ll see:

• Monthly repayment (your fixed payment each month)

• Total interest over the term

• Total cost of the mortgage (principal + interest)

• LTV band (useful for rate expectations)

Optional overpayment view to see how small extras cut time and interest. See how your LTV band affects rates—run your numbers through the FinCalc Loan to Value Calculator UK.

Step 6: Stress-test your plan

Nudge the rate up or down (±0.5% or ±1%) to see how sensitive your budget is. This is exactly how prudent lenders and savvy buyers avoid nasty surprises.

Step 7: Iterate scenarios

Change deposit, term, or rate to find your comfort zone. The Mortgage Repayment Calculator is built for rapid “what-ifs,” not one-shot answers.

Worked Example A, Classic first-time buyer

Property price £250,000; deposit 10% (£25,000) → loan £225,000

Term 25 years, rate 5.00%

• Monthly repayment: £1,315.33

• Total interest: £169,598.28

• Total repaid: £394,598.28

Sensitivity:

At 4.00% the payment would be £1,187.63 and interest £131,289.87. At 6.00% the payment would be £1,449.68 and interest £209,903.45. A 1% rate rise adds ~£134/month and ~£40k more interest over the life of the loan; a 1% drop saves ~£128/month and ~£38k interest. That’s why stress-testing matters.

Worked Example B, Overpayment impact (same loan)

Keep the setup above (loan £225,000, 25 years, 5.00%) and add a £100/month overpayment:

• New time to clear: ~262 months (~21.8 years) , you finish 38 months (~3.17 years) early

• New total interest: £144,613.85

• Interest saved vs no overpayment: ~£24,984.43

Small, steady overpayments are one of the most efficient ways to de-risk your mortgage and cut years off the term.

Worked Example C, Different term, same loan

Loan £225,000 at 5.00%:

• 20-year term: monthly £1,486–1,490 (approx), far less interest overall

• 30-year term: monthly ~£1,207–1,210, but significantly more total interest

Shorter terms turbo-charge interest savings; longer terms prioritise monthly affordability. The calculator makes this trade-off visible in seconds.

Benefits of Using FinCalc’s Mortgage Repayment Calculator

A mortgage is more than just a loan; it’s a long-term financial commitment that can shape your future for decades. That’s why clarity and transparency matter. The FinCalc Mortgage Repayment Calculator was built to take the uncertainty out of property finance and give buyers, families, and investors the tools to make smarter choices. Here’s why it stands out.

1. Instant Transparency

Instead of vague estimates, the calculator shows a clear breakdown:

- Monthly repayment.

- Total interest over the mortgage term.

- Full repayment cost (principal + interest).

- Loan-to-value (LTV) ratio.

This means you’ll know exactly where your money is going.

2. Speed and Accuracy

Manually calculating repayments takes time and leaves plenty of room for error. Bank tools often round figures or oversimplify. With FinCalc’s Mortgage Repayment Calculator, you get accurate results in seconds, mirroring how lenders actually calculate repayments.

3. Flexibility to Explore Scenarios

The tool isn’t limited to one answer. You can test different:

- Deposit amounts.

- Interest rates.

- Loan terms (20, 25, 30+ years).

- Overpayment options.

This flexibility helps you prepare for different scenarios, from stress-testing against rate hikes to exploring how small overpayments save thousands in interest.

4. Independent and Unbiased

Bank calculators often push their own mortgage products. FinCalc is independent; it has no hidden agenda, just numbers. That independence means you can trust the results to be transparent and focused solely on helping you plan.

5. Confidence in Negotiations

Walking into a bank or estate agent with repayment figures in hand puts you in control. When you know your numbers, you won’t be pressured into deals that stretch you too far. The Mortgage Repayment Calculator gives you negotiating power.

6. Peace of Mind for Every Buyer Type

- First-time buyers can see how much they’ll really pay.

- Families upgrading can test affordability before committing.

- Investors can check rental yields against mortgage costs.

- Retirees downsizing can balance comfort and affordability.

The tool adapts to every situation.

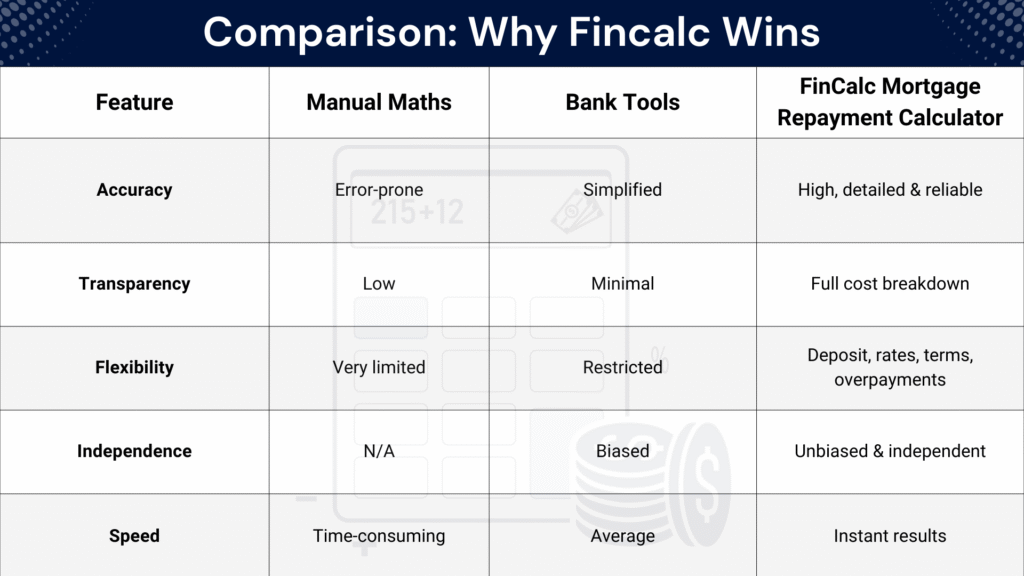

Comparison: Why FinCalc Wins

Real-Life Use Cases

A tool is only as valuable as the difference it makes in real life. The Mortgage Repayment Calculator has been designed to help people at every stage of their property journey, from first-time buyers to investors and retirees. Here are some scenarios that show how it works in action.

1. The First-Time Buyer Gaining Confidence

Emma, 26, wanted to buy her first flat but felt overwhelmed by the unknowns. With a £28,000 deposit and a modest income, she worried about stretching herself too far. By entering her details into the Repayment Calculator, she saw her monthly repayment would be around £890 for a £180,000 mortgage at 5% over 25 years. Seeing the breakdown gave her the confidence to focus on properties within her budget, instead of wasting time on homes she couldn’t afford.

2. The Family Upgrading to a Bigger Home

James and Laura already owned a two-bedroom house but needed more space for their growing family. They had built up equity and saved a £50,000 deposit. Using the calculator, they tested scenarios: a 25-year mortgage versus a 30-year one. On £250,000 borrowing at 4.5%, repayments were £1,390/month over 25 years or £1,265/month over 30 years. The tool showed them how extending the term lowered monthly costs but added more interest overall. With this insight, they chose the shorter term and a repayment plan they felt comfortable with.

3. The Couple Comparing Interest Rates

Amir and Sofia were nervous about rising interest rates. With a mortgage of £200,000, they wanted to see how even a small change would affect their repayments. Using the Mortgage Repayment Calculator, they compared:

- At 4% → £1,056/month

- At 5% → £1,170/month

- At 6% → £1,289/month

The difference was eye-opening; a 2% rise added more than £230/month. This motivated them to lock in a fixed-rate deal, ensuring stability for the next five years.

4. The Investor Testing Rental Yield

Mark, 40, was exploring buy-to-let investments. He wanted to know if rental income would comfortably cover mortgage repayments. By entering a £300,000 property with a £75,000 deposit and borrowing £225,000 at 5% over 25 years, the calculator showed a repayment of ~£1,315/month. Since local rental values averaged £1,800/month, Mark could see the property would generate a healthy surplus after covering the mortgage. The tool became part of his investment due diligence.

5. The Retiree Downsizing Smartly

Rachel, 61, planned to downsize after her children moved out. She wanted a smaller property but wasn’t sure how repayments would look with her reduced retirement income. With £40,000 saved as a deposit, she tested a £160,000 mortgage over 15 years at 4.5%. The calculator showed repayments of ~£1,225/month. While higher than expected, it was manageable within her pension plan. Testing alternatives helped her adjust her property search to stay financially comfortable.

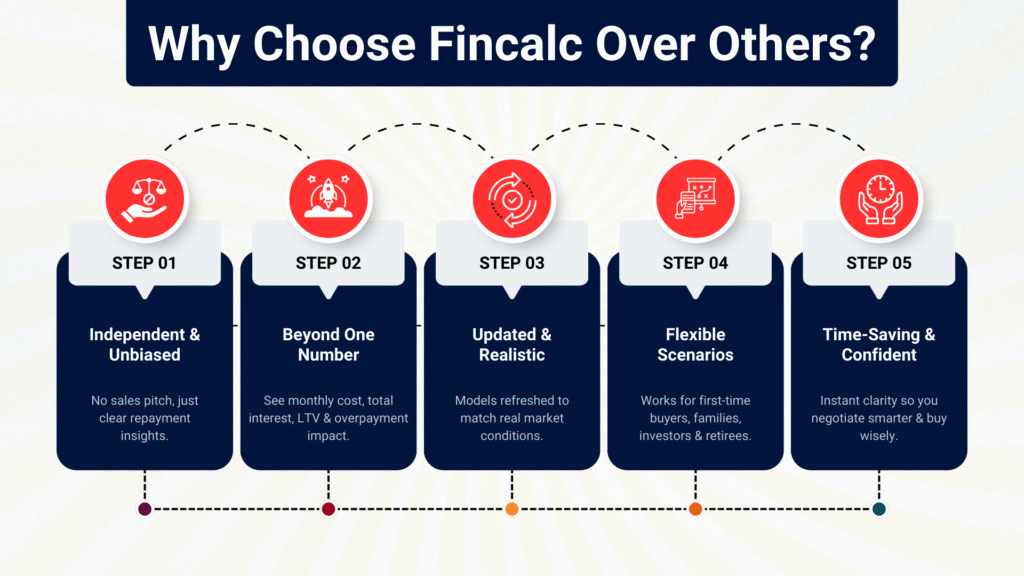

Why Choose FinCalc Over Others?

When it comes to calculating mortgage repayments, there are plenty of tools online. Banks provide their own calculators, brokers have basic widgets, and comparison sites offer rough estimates. But here’s the problem: most of these tools are limited, biased, or outdated. The FinCalc Mortgage Repayment Calculator is designed differently; it puts your interests first, giving you clarity, independence, and precision.

1. Independent and Unbiased

Bank calculators exist to sell products. They often show overly optimistic figures or push you toward their own mortgage deals. FinCalc is completely independent. Our Mortgage Repayment Calculator is designed only to give you clear, accurate insights into your repayments, with no hidden agenda.

2. More Than a Single Number

Many calculators give you a monthly repayment figure and stop there. FinCalc goes deeper. You’ll see:

- Monthly repayment amount.

- Total interest payable.

- Full repayment cost (loan + interest).

- Loan-to-value (LTV) ratio.

- Overpayment scenarios.

This transparency means you get the whole picture, not just a headline number.

3. Updated and Realistic

Mortgage rates and lending criteria change quickly. Generic calculators are rarely updated, which makes their results misleading. FinCalc refreshes its models to reflect current conditions, ensuring your repayment estimates are as realistic as possible.

4. Flexible for Any Scenario

Whether you’re a first-time buyer, a family upgrading, an investor, or a retiree downsizing, the tool adapts. You can change terms, deposits, interest rates, and even test overpayments. Instead of one-size-fits-all, you get results tailored to your situation

5. Saves Time and Builds Confidence

Manually calculating mortgage repayments is time-consuming and error-prone. Relying on vague estimates leaves you uncertain. With the Mortgage Repayment Calculator, you get instant clarity. That confidence means you can walk into lender meetings prepared, negotiate smarter, and focus your property search on homes you can actually afford.

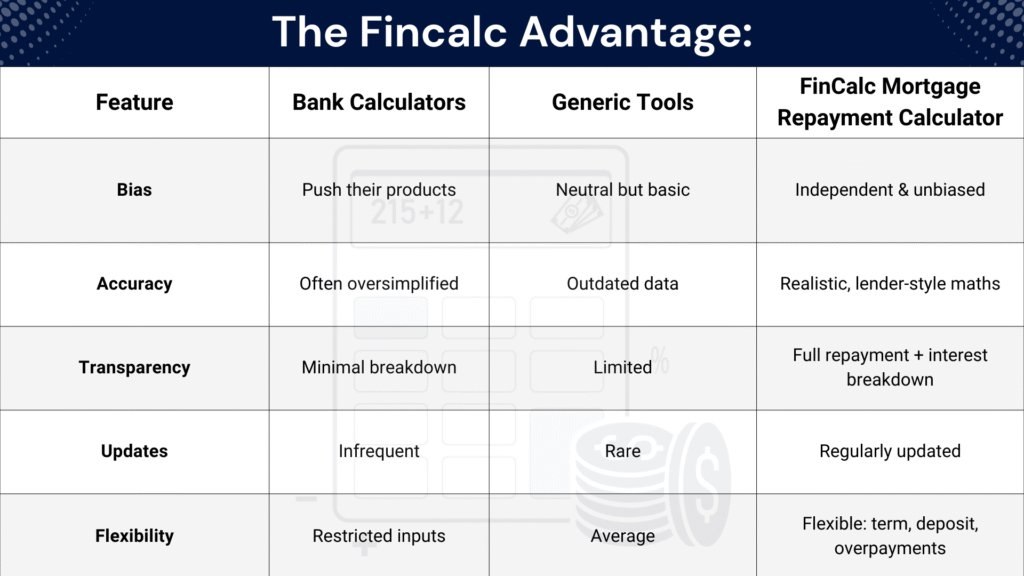

The FinCalc Advantage:

Conclusion:

A mortgage isn’t just about securing a property; it’s about managing one of the biggest financial responsibilities of your life. Without a clear understanding of repayments, interest, and total costs, it’s easy to overcommit or underestimate the true burden of a loan. That’s where the FinCalc Mortgage Repayment Calculator makes all the difference.

By combining your property price, deposit, loan term, and interest rate, the tool instantly shows your monthly repayments, the total interest payable, and the full lifetime cost of your mortgage. Instead of vague estimates or biased bank figures, you get transparent, independent results that help you plan with confidence. For more mortgage tools—repayments, affordability, LTV, and deposits—start at FinCalc.

FAQs:

What is a Mortgage Repayment Calculator?

It’s a tool that shows your monthly repayments, total interest, and full cost of a mortgage based on loan amount, term, deposit, and interest rate.

How accurate is the Mortgage Repayment Calculator?

It provides strong estimates that closely reflect lender calculations. Final figures may vary slightly depending on lender fees and individual circumstances.

What information do I need to use it?

You’ll need the property price, deposit amount, mortgage term, and an assumed interest rate. These inputs generate your repayment plan instantly.

Can it show both monthly and total costs?

Yes. The Mortgage Repayment Calculator displays your monthly payment and the total amount you’ll repay across the life of the loan.

Do interest rates affect repayments?

Absolutely. Even a 1% increase in rates can add £100+ to monthly repayments and tens of thousands in extra interest.

Can I compare different mortgage terms?

Yes. You can test terms like 20, 25, or 30 years to see how shorter or longer loans affect monthly affordability and overall costs.

What is loan-to-value (LTV)?

It’s the percentage of the property’s value you borrow. A bigger deposit reduces LTV, often unlocking lower interest rates and cheaper repayments.

Does it work for joint mortgages?

Yes. Couples or joint applicants can enter combined deposits and loan terms to estimate repayments on shared borrowing.

Can I test overpayments with the calculator?

Yes. By adding regular overpayments, the calculator shows how much faster you can clear your loan and how much interest you’ll save.

Why use FinCalc’s Mortgage Repayment Calculator instead of a bank’s?

Bank tools are often limited or biased. FinCalc is independent, transparent, and gives you a full breakdown of costs without pushing products.

Does a credit score affect repayments shown?

The calculator focuses on numbers. However, in practice, your credit score may affect the rate a lender offers, which changes repayments.

Can the calculator help me choose between fixed and variable rates?

Yes. You can model both by adjusting the interest rate and comparing results to see how changes would affect monthly payments.